Performance in Focus: DDA Crypto Select 10 ETP – Rebalance Recap

By Dominik Poiger, Chief Product Officer, DDA

Key Takeaways

- Index and product rebalanced at 17:00 CET, 30 August 2024

- Bitcoin Cash (“BCH”) removed from the index, TRON (“TRX”) was added

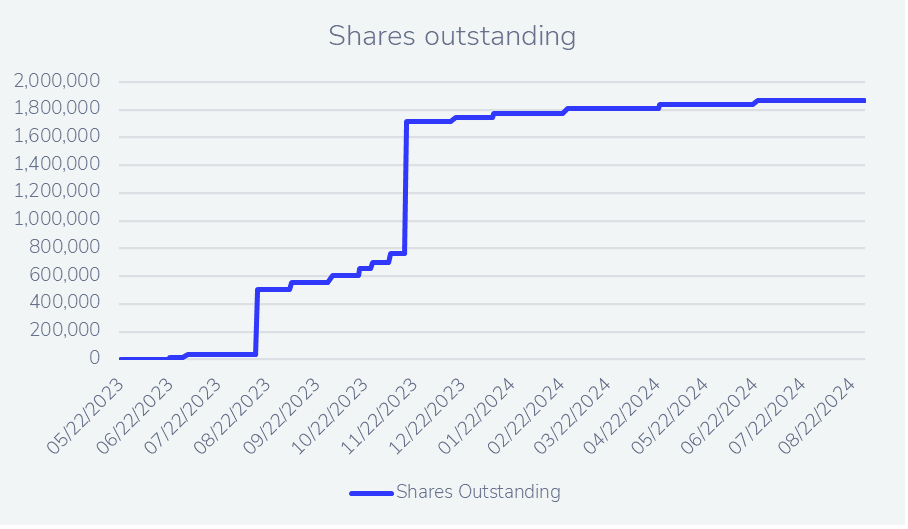

- AuM shrank from USD 26.7M to USD 22.3M but shares outstanding remained constant

- Diversification into altcoins makes sense but bitcoin should be the core holding

The DDA Crypto Select 10 ETP went through its fourth rebalancing since DDA incepted and listed the product on Deutsche Börse Xetra on 22 June 2023. The index provider MarketVector released its quarterly review of digital assets indices on 27 August 2024, including the MarketVector Digital Assets Max 10 VWAP Close Index (“MVDAMV”), the underlying index for the DDA Crypto Select 10 ETP.

According to the index methodology, the index was then rebalanced to its new target composition at the end of 30 August 2024. Find out more about the index and index methodology here:

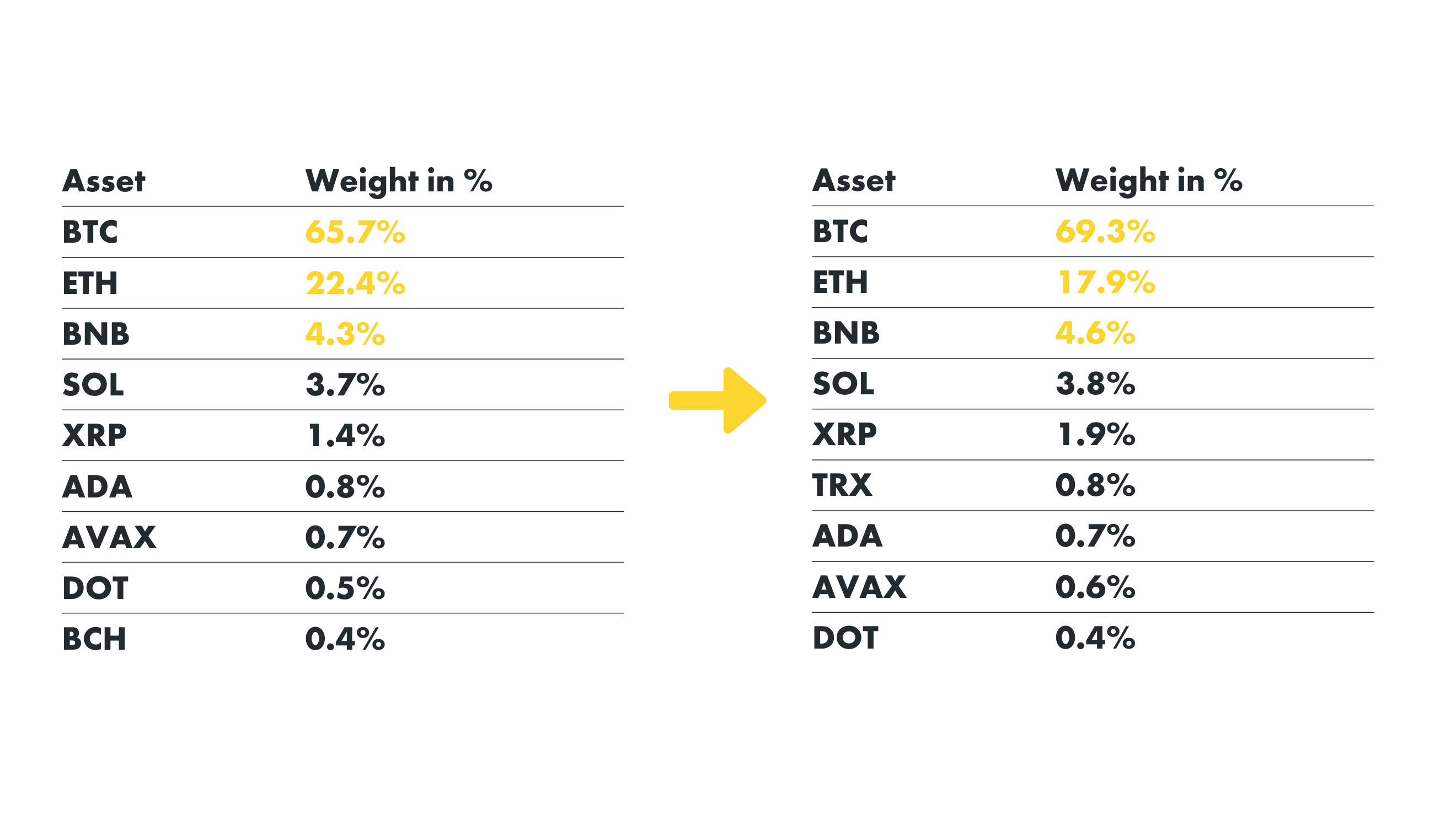

New Allocation as of 30 August 2024

Source: DDA, MarketVector, data as of 30 August 2024

Tron (“TRX”) Added to the index, Bitcoin Cash (“BCH”) Removed

The index showed little turnover with Bitcoin Cash being removed from the index while Tron was added to the index.

TRX was added at a 0.82% weight.

Bitcoin Cash has been underperforming and has been – according to the index rules – removed from the index. Consequently, the index is still only composed of 9 assets. This is due to the fact that the index universe is driven by the MarketVector Digital Assets 10 Index, which also includes coins that do not qualify for ETP underlyings on Deutsche Börse Xetra (The Open Network (“TON”) is currently not eligible on Deutsche Börse Xetra).

BoJ Rate Hike Scares Traders; Bitcoin Supply Overhang still Looming

August was another month of consolidation for the crypto market, albeit with a lot of nervousness. The BOJ’s surprise rate hike led to an unwinding of carry trades, which weighed on overall risk at the start of the month. The markets then yo-yoed, with expectations of a September rate cut by the FED and the aggressiveness with which it will lower rates in the months ahead, on the one hand, and fears of a much harder economic landing than had been widely anticipated until now, on the other. With US equity indices particularly high, the risks of turbulence are high. For the time being, there is no particular stress on the credit market, but the situation could flare up very quickly. It should be noted that, after months of consolidation, this sharp fall at the start of the month could well be the final capitulation for the crypto markets. We note that Bitcoin is less and less sensitive locally to global growth, and more and more to the dollar, which has depreciated sharply, and historically these are favorable conditions for Bitcoin. In addition, the fears caused by demand shocks such as the repayment of Mt.Gox victims or the sale of Bitcoins held by the US authorities are fading, which is another sign that we may be approaching the end of the correction period we have been experiencing for some months.

At the same time, the US elections are looming with two rigorously antagonistic programs. Donald Trump, as well as officially supporting cryptos, is proposing a highly inflationary program that would de facto support Bitcoin, especially now that ETFS are available to asset managers. In contrast, Kamala Harris’s program is much more deflationary and would automatically be less supportive of the crypto market. However, given the massive indebtedness of developed countries in general, and the government difficulties in countries such as France, favourable environments for crypto should multiply in the coming months and years.

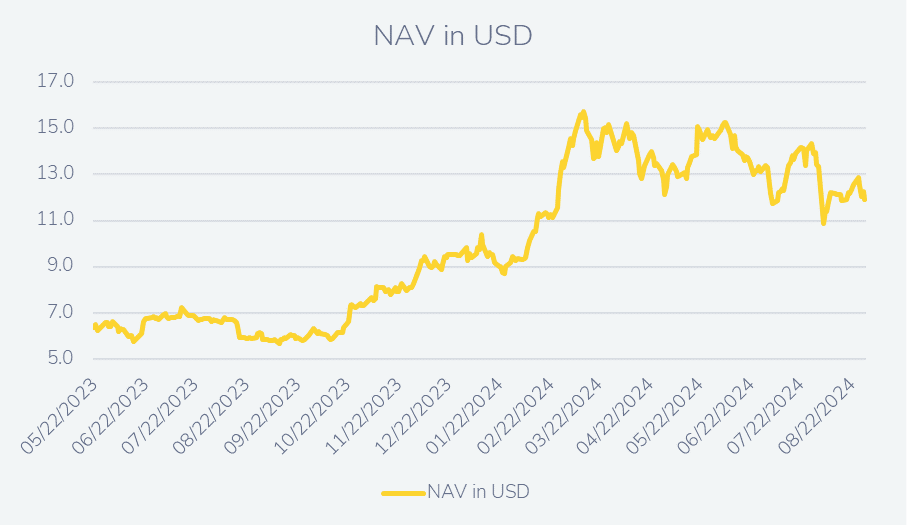

Performance of DDA Crypto Select 10 ETP

| 1M | 3M | 1Y | 3Y | YTD | Since Inception* | |

| DDA Crypto Select 10 ETP | -14.6% | -17.9% | 94.6% | n/a | 25.7% | 86.6% |

The top performing coin (as over the last observation period) was Ripple (“XRP”) with +7.6%.

| Top 3 | Performance in % since last rebalancing (or inception) |

| XRP | 7.6% |

| BNB | -9.8% |

| BTC | -12.6% |

| Bottom 3 | Performance in % since last rebalancing (or inception) |

| DOT | -38.9% |

| AVAX | -36.1% |

| TRX | -33.9% |

There is no Second Best? The Advantages and Disadvantages of Portfolio Diversification

When investing into cryptocurrencies, it is important to consider that diversification – as in traditional capital markets – delivers a net benefit to investors. However, there are very few crypto assets that have managed to outperform Bitcoin over the course of various market cycles: So far, only Ripple (XRP), Dogecoin (DOGE), and Ethereum (ETH) managed to outperform Bitcoin (BTC) over two market cycles, i.e. managed to make two new highs in relative terms (denominated in Bitcoin).

In one of our previous research articles (DDA Crypto Espresso – Cryptoassets: There is no second best? The advantages and disadvantages of portfolio diversification), we have studied the alpha (outperformance vs bitcoin), beta (sensitivity of a token vs bitcoin) and the theta (time trend measured in days) of various cryptocurrencies.

The results were the following:

- most Altcoins are high beta and negative theta derivatives of Bitcoin (BTC)

- Binance Coin (BNB), Solana (SOL), Polygon (MATIC), and TRON (TRX) that exhibit a positive theta relative to Bitcoin (BTC)

- Altcoins do have a place in a diversified portfolio of crypto assets but Bitcoin (BTC) should be a core holding of the passive portfolio itself

When investing in cryptocurrencies, it is therefore of utmost importance to consider the design of the concept. While other basket ETPs artificially cap the exposure to bitcoin, the DDA Crypto Select 10 ETP was specifically designed with the above-mentioned analysis in mind: Bitcoin needs to be the core holding of a passive portfolio; altcoins do have a place in a portfolio, but their weight should not be artificially inflated.

About DDA Crypto Select 10 ETP

| Product name | DDA Crypto Select 10 ETP |

| Ticker Xetra / Bloomberg | SLCT GY / SLCT |

| ISIN / WKN | DE000A3G3ZD0 / A3G3ZD |

| TER | 1.69% |

| Base Currency | USD |

| Trading Currency | EUR |

| Underlying | MarketVector™ Digital Assets Max 10 VWAP Close Index (“MVDAMV”) |

| Product Structure | Physically replicating |

| Rebalancing Frequency | Quarterly |

| Index Provider | MarketVector |

| Domicile | Liechtenstein |

| Issuer | DDA ETP AG |

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.

Important Notices

This article represents solely a non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129(Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG).

Risk Considerations

The price of an investment in a DDA ETP may go up or down and the investor may not get back the amount invested.

The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of deciding to invest in the securities.

The prospectus of each ETP product is available at https://deutschedigitalassets.com/products/etp/