Grayscale’s Bitcoin Trust NAV Discount Narrows: Is a Spot Bitcoin ETF on the Horizon?

DDA Crypto Market Pulse, October 16, 2023

by André Dragosch, Head of Research

Key Takeaways

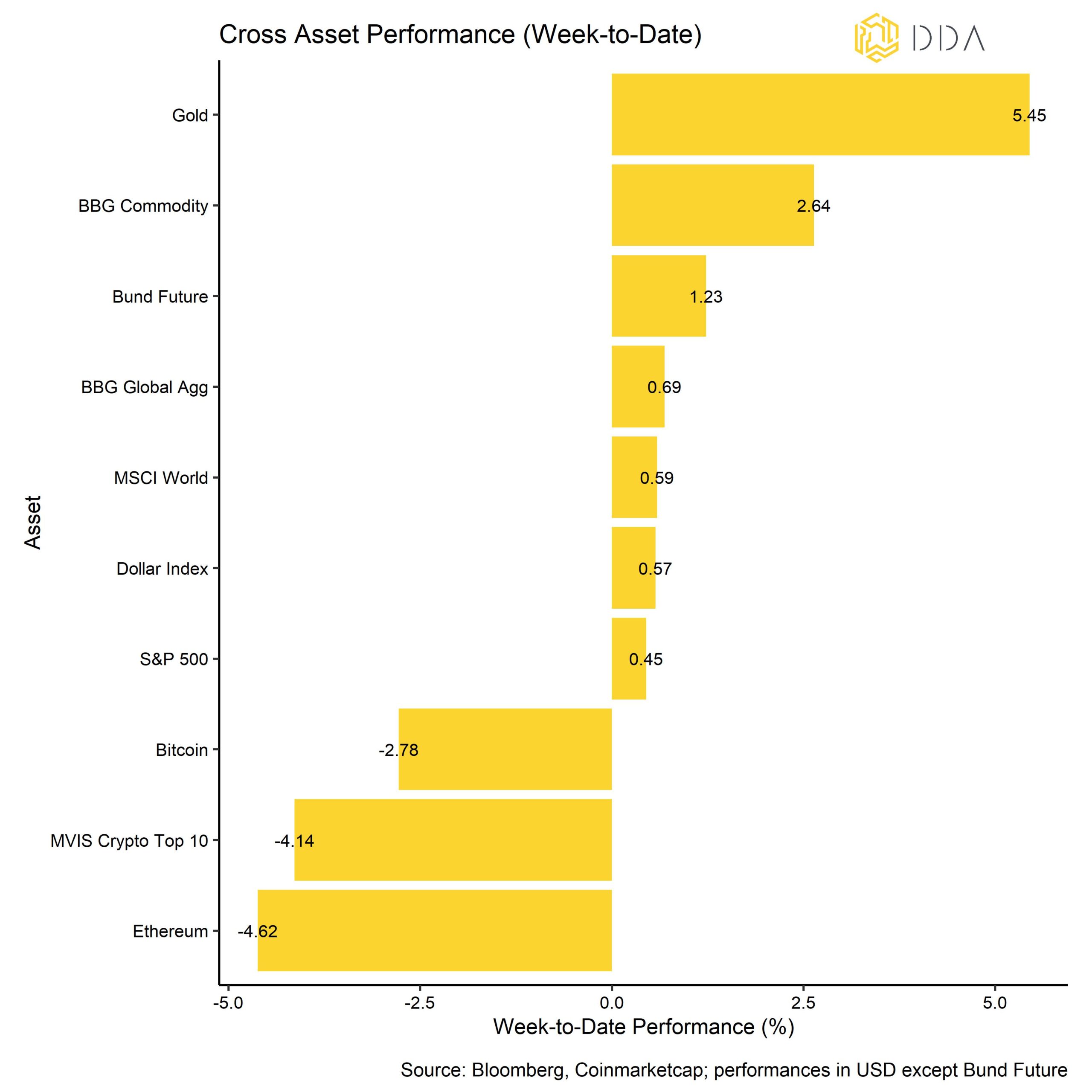

- Last week, crypto assets underperformed and Ethereum continued to underperform Bitcoin

- Our in-house Crypto Sentiment Index has decreased again compared to last week and remains slightly bearish

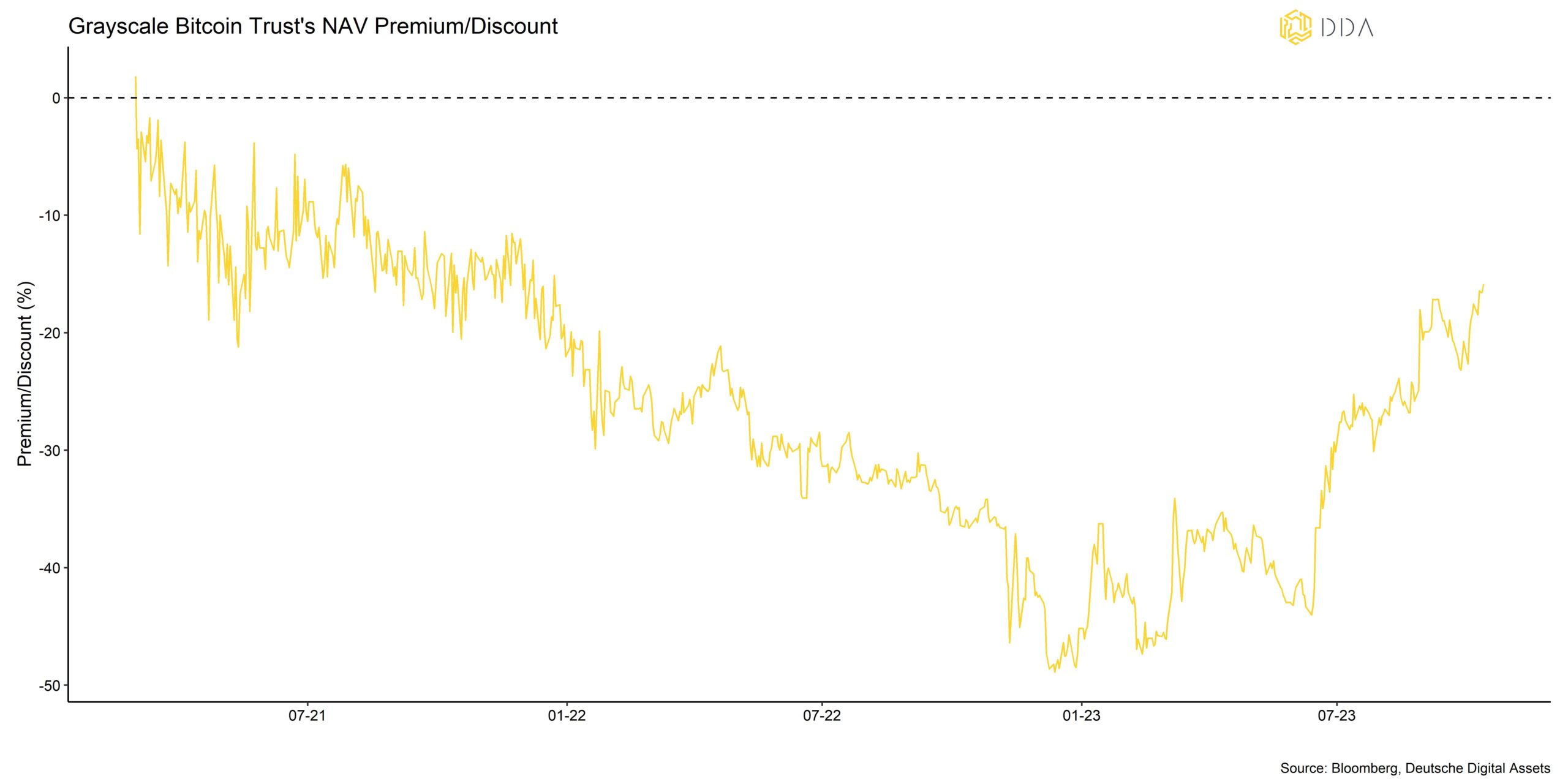

- Nevertheless, the discount to the NAV of Grayscale’s bitcoin trust has narrowed significantly on signs that its ETF application is more likely to be approved

Chart of the week

Cryptoasset Performance

Last week, crypto assets underperformed traditional assets. Below the surface, we saw a continued outperformance of Bitcoin vis-à-vis other altcoins which implies a continued decline in risk appetite. In particular, Binance’s exchange token is rumoured to exhibit signs of market manipulation which is weighing on overall risk appetite. Ethereum also continued to underperform Bitcoin due to variety of factors.

Nonetheless, we saw a continued narrowing of the NAV discount of the world’s biggest Bitcoin fund (Grayscale Bitcoin Trust) due to the fact that the SEC missed the deadline to appeal a DC Court ruling in favor of Grayscale. (Chart-of-the-Week).

District of Columbia Court of Appeals in Washington in August ruled that the SEC was wrong to reject Grayscale’s proposed bitcoin ETF. In consequence, the SEC will need to review Grayscale’s application to convert its Bitcoin trust into an ETF again which makes a potential ETF approval more likely.

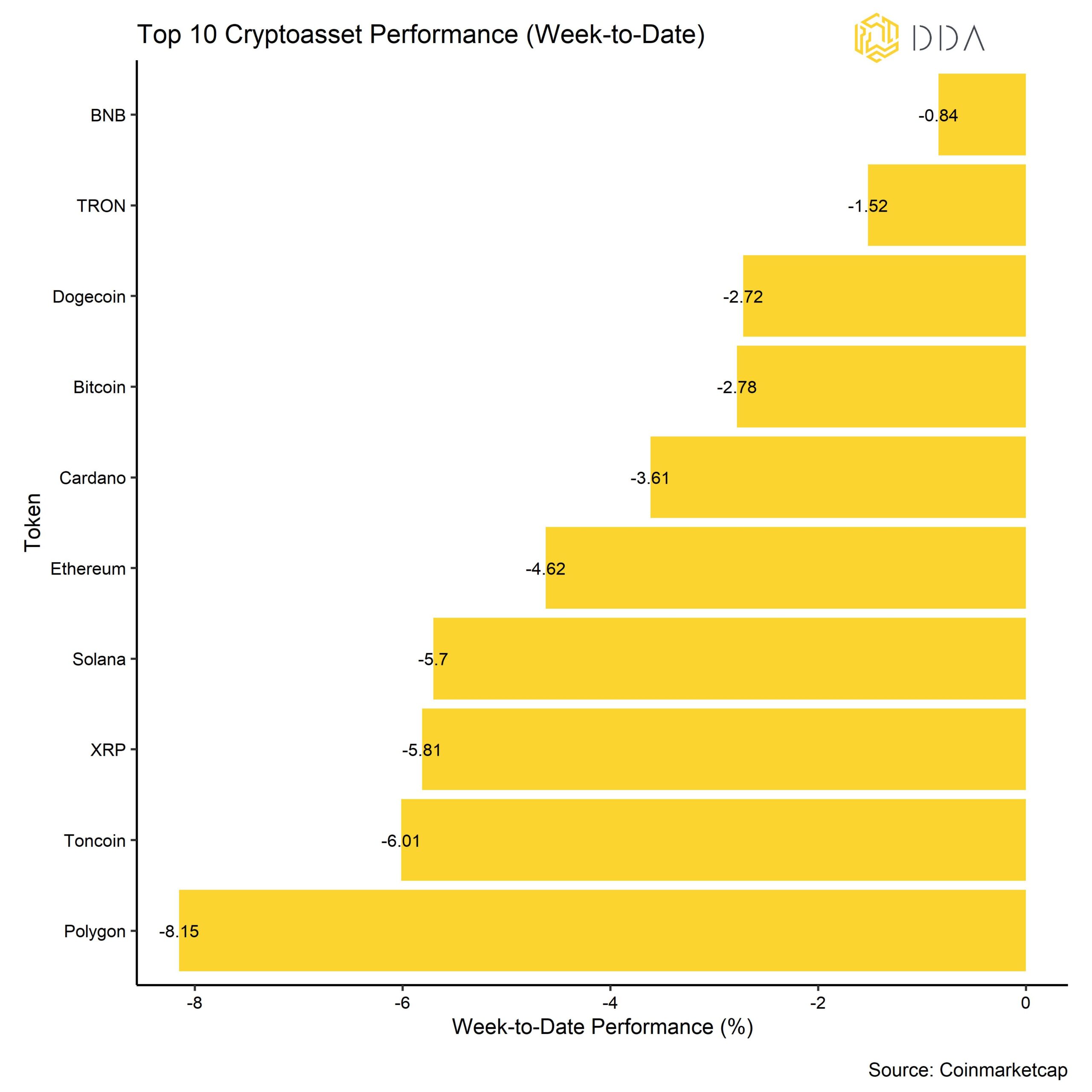

Among the top 10 crypto assets, BNB, TRON, Dogecoin were the relative outperformers.

As mentioned above, altcoin outperformance vis-à-vis Bitcoin has continued to be weak pointing to a decrease in risk appetite. Only 30% of our tracked altcoins managed to outperform Bitcoin on a weekly basis.

Crypto Market Sentiment

Our in-house Crypto Sentiment Index has decreased somewhat and remains slightly bearish. At the moment, only 4 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals to the downside in the BTC Perpetual Funding Rate and BTC STH-SOPR.

The Crypto Fear & Greed Index also remains in “Neutral” territory as of this morning.

Performance dispersion among cryptoassets continues to be relatively high.

In general, high performance dispersion among cryptoassets implies that correlations among cryptoassets have decreased which means that cryptoassets are trading more on coin-specific factors.

At the same time, as mentioned above, altcoin outperformance has continued to be low with only 30% of altcoins outperforming Bitcoin on a weekly basis.

In general, low altcoin outperformance is a sign of low risk appetite within crypto asset markets.

Crypto Asset Flows

Last week saw minor net fund outflows from global crypto ETPs albeit with large divergences among crypto assets.

In aggregate, we saw net fund outflows in the amount of -2.9 mn USD (week ending Friday).

Most of these outflows focused on Ethereum funds (-15.1 mn USD) while other types of crypto assets experienced net fund inflows.

For instance, Bitcoin funds experienced net fund inflows in the amount of +5.5 mn USD last week.

Altcoin ex Ethereum based funds also experienced net fund inflows (+3.7 mn USD) while Thematic & basket crypto funds attracted net inflows to the tune of +3.1 mn last week.

The NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – narrowed significantly last week and is now around -16%. In other words, investors are assigning a slightly higher probability of around 84% that the Trust will be converted into a Spot Bitcoin ETF. Meanwhile, Bloomberg ETF analysts are assigning a probability of 90% that a spot Bitcoin ETF will eventually be approved by the SEC.

Furthermore, the beta of global crypto hedge funds to Bitcoin over the last 20 trading has further decreased, implying that global crypto hedge funds have reduced their market exposure to crypto assets.

On-Chain Activity

Overall, on-chain activity has continued to worsen over the last week.

For instance, active addresses on the Bitcoin blockchain have further continued to decrease and are now at their lowest level since May 2023. The same is true for new addresses on the Bitcoin blockchain. The number of addresses with non-zero balances moved sideways last week. Nonetheless, Bitcoin’s hash has increased to fresh all-time highs.

Furthermore, Ethereum continued to underperform Bitcoin for a variety of reasons. One of these centre around the (false) rumour that ETH whales, i.e. Ethereum investors with holdings in excess of 1000 ETH, have been distributing their holdings in large quantities. In fact, the % of supply held in wallets with more than 1000 ETH has declined considerably this year. But this is mostly associated with the fact that the % of ETH supply tied in smart contracts has increased concordantly.

In that sense, Ethereum’s underperformance might be more related to other factors such as the recent release of the BitVM paper by Robin Linus that suggests that “…any computable function can be verified on Bitcoin.” and the overall decline in risk appetite.

In the context of ETH staking, another interesting development is that the size of the ETH entry queue has declined considerably and suggests that the demand for staking is becoming saturated. This suggests that staking yields may have found their equilibrium at around ~3.45% p.a.

Meanwhile, BTC exchange balances have increased somewhat as exchange inflows have outweighed exchange outflows last week. In particular, Binance has seen a significant increase in BTC exchange balances last week.

In this context, Binance’s exchange token (BNB) is rumoured to exhibit signs of market manipulation which is weighing on overall risk appetite. Some on-chain analysts claim that Binance is actively supporting BNB via sales of other crypto assets in order to avoid mass liquidation of its token. If this rumour turned out to be true, it would be a significant downside risk for the overall market.

Cryptoasset Derivatives

Last week, open interest in the BTC futures and perpetual markets increased only slightly but remain at their highest levels since August 2023.

BTC options open interest increased only slightly. However, most of this increase was related to a relative surge in call options, so option traders have increased their upside exposure somewhat. In that context, BTC put-call open interest ratios have declined to their lowest levels year-to-date. So, there is relatively low demand for downside protection at the moment.

Nonetheless, BTC 1-month 25-delta option skew have decreased only slightly and remain at relatively high levels. This means that delta-equivalent put options are still more expensive than comparable call options. BTC Implied volatilities mostly went sideways last week and remain at very low levels.

Bottom Line

Last week, crypto assets underperformed and Ethereum continued to underperform Bitcoin.

Our in-house Crypto Sentiment Index has decreased again compared to last week and remains slightly bearish.

Nevertheless, the discount to the NAV of Grayscale’s bitcoin trust has narrowed significantly on signs that its ETF application is more likely to be approved.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.