Key Takeaways

- Index and product rebalanced at 17:00 CET, 30 November 2023

- Chainlink (“LINK”) and Avalanche (“AVAX”) joined the index, Bitcoin Cash (“BCH”) was removed

- AuM grew from USD 3.1M to USD 13.9M

- Diversification into altcoins makes sense but bitcoin should be the core holding

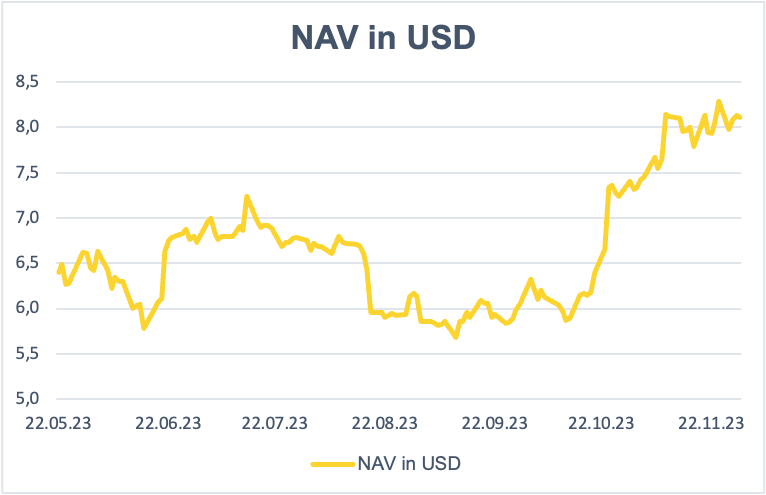

The DDA Crypto Select 10 ETP went through its second rebalancing since DDA incepted and listed the product on Deutsche Börse Xetra on 22 June 2023. The index provider MarketVector released its quarterly review of digital assets indices on 27 November 2023, including the MarketVector Digital Assets Max 10 VWAP Close Index (“MVDAMV”), the underlying index for the DDA Crypto Select 10 ETP.

According to the index methodology, the index was then rebalanced to its new target composition at the end of 30 November 2023. Find out more about the index and index methodology here.

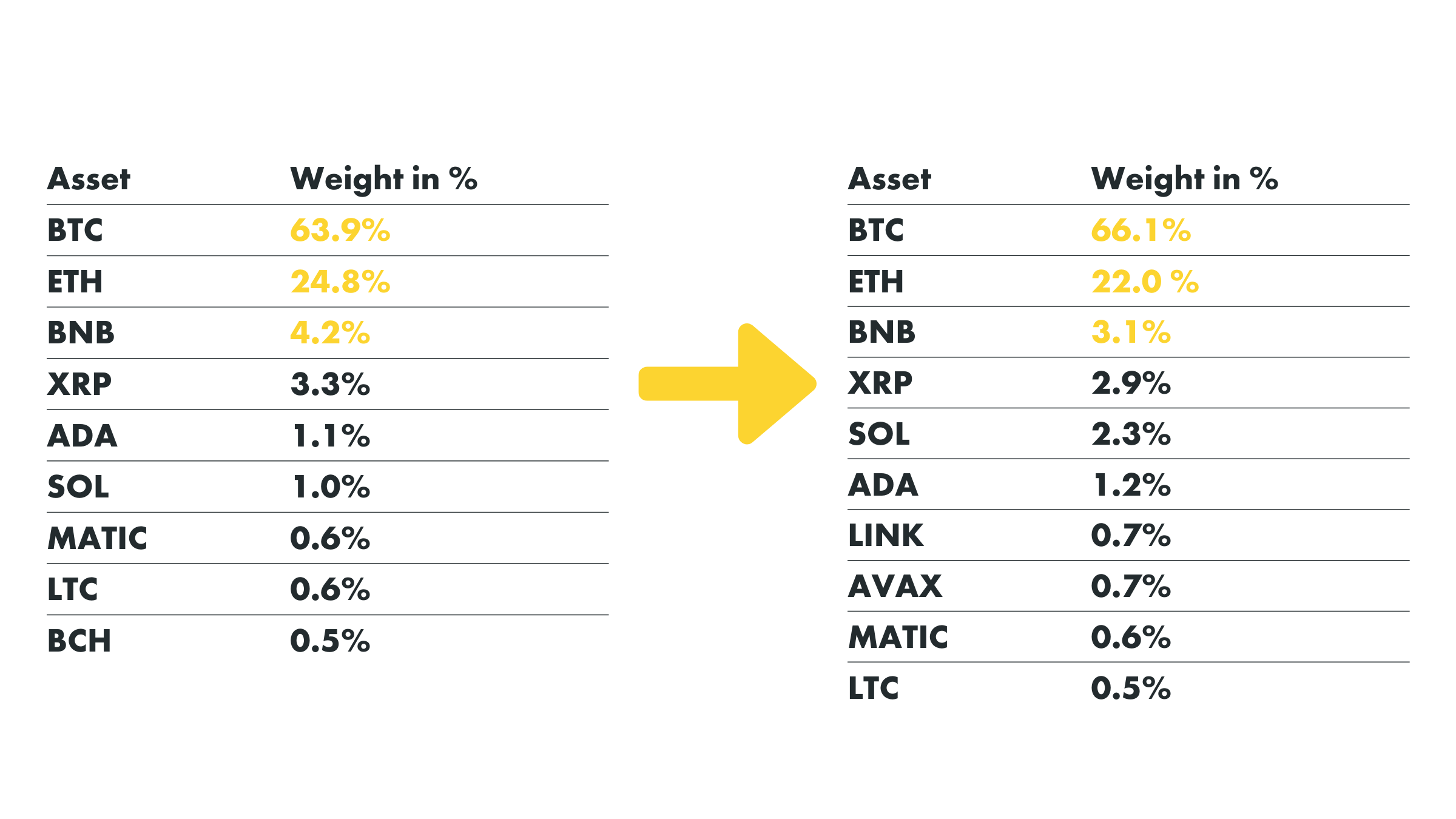

New Allocation as of 30 November 2023

Source: DDA, MarketVector, data as of 30 November 2023

While from August 2023 (last rebalancing) until November 2023, the index (and therefore the product) composed of 9 constituents, Chainlink (LINK) and Avalanche (AVAX) were added to the index and the product, while Bitcoin Cash (BCH) was removed during the November 2023 rebalancing.

Chainlink and Avalance Added to the Index, Bitcoin Cash Removed

After Bitcoin Cash was added only during the rebalancing in August, the coin was already removed as Chainlink and Avalance added the index.

Chainlink is a blockchain abstraction layer that enables universally connected smart contracts. Through a decentralized oracle network, Chainlink allows blockchains to securely interact with external data feeds, events and payment methods, providing the critical off-chain information needed by complex smart contracts to become the dominant form of digital agreement. Similar to Ethereum or Solana, the other new-joiner Avalanche is a layer one blockchain that functions as a platform for decentralized applications and custom blockchain networks.

Bitcoin Cash entered the index with a 0.5% weight (as of 31 August 2023) and is now substituted by LINK (0.72%) and AVAX (0.69%).

Positive AuM Growth Driven by Anchor Investor

The crypto market turned around significantly since the last rebalancing as the likelihood for a US spot Bitcoin ETF approval by the SEC has increased dramatically. Bitcoin, which has the largest weight in the index/product, jumped 38.7% since last rebalancing spilling over into altcoins. The DDA Crypto Select 10 ETP was able to gather significant inflows and increased its shares outstanding to 1,715,500 and AuM to USD 13.9M by 30 November 2023. This was due to the fact that a renowned German pension fund invested into DDA Crypto Select 10 ETP by the end of November (press release here).

Performance of DDA Crypto Select 10 ETP

| 1M | 3M | 1Y | 3Y | YTD | Since Inception* | |

| DDA Crypto Select 10 ETP | 10.8%% | 31.6% | n/a | n/a | n/a | 26.8% |

The top performing coin (as over the last observation period) was Solana (“SOL”) with +189.0%. In fact, no component of the index/product incurred negative performance since the last rebalancing in August 2023.

| Top 3 | Performance in % since last rebalancing (or inception) |

| SOL | 189.0% |

| ADA | 42.9% |

| BTC | 38.7% |

| Bottom 3 | Performance in % since last rebalancing (or inception) |

| BNB | 1.7% |

| BCH | 3.2% |

| LTC | 3.3% |

There is no Second Best? The Advantages and Disadvantages of Portfolio Diversification

When investing into cryptocurrencies, it is important to consider that diversification – as in traditional capital markets – delivers a net benefit to investors. However, there are very few crypto assets that have managed to outperform Bitcoin over the course of various market cycles: So far, only Ripple (XRP), Dogecoin (DOGE), and Ethereum (ETH) managed to outperform Bitcoin (BTC) over two market cycles, i.e. managed to make two new highs in relative terms (denominated in Bitcoin).

In one of our previous research articles (DDA Crypto Espresso – Cryptoassets: There is no second best? The advantages and disadvantages of portfolio diversification), we have studied the alpha (outperformance vs bitcoin), beta (sensitivity of a token vs bitcoin) and the theta (time trend measured in days) of various cryptocurrencies.

The results were the following:

- most Altcoins are high beta and negative theta derivatives of Bitcoin (BTC)

- Binance Coin (BNB), Solana (SOL), Polygon (MATIC), and TRON (TRX) that exhibit a positive theta relative to Bitcoin (BTC)

- Altcoins do have a place in a diversified portfolio of crypto assets but Bitcoin (BTC) should be a core holding of the passive portfolio itself

When investing in cryptocurrencies, it is therefore of utmost importance to consider the design of the concept. While other basket ETPs artificially cap the exposure to bitcoin, the DDA Crypto Select 10 ETP was specifically designed with the above-mentioned analysis in mind: Bitcoin needs to be the core holding of a passive portfolio; altcoins do have a place in a portfolio, but their weight should not be artificially inflated.

About DDA Crypto Select 10 ETP

| Product name | DDA Crypto Select 10 ETP |

| Ticker Xetra / Bloomberg | SLCT GY / SLCT |

| ISIN / WKN | DE000A3G3ZD0 / A3G3ZD |

| TER | 1.69% |

| Base Currency | USD |

| Trading Currency | EUR |

| Underlying | MarketVector™ Digital Assets Max 10 VWAP Close Index (“MVDAMV”) |

| Product Structure | Physically replicating |

| Rebalancing Frequency | Quarterly |

| Index Provider | MarketVector |

| Domicile | Liechtenstein |

| Issuer | DDA ETP AG |

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.

Important Notices

This article represents solely a non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129(Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG).

Risk Considerations

The price of an investment in a DDA ETP may go up or down and the investor may not get back the amount invested.

The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of deciding to invest in the securities.

The prospectus of each ETP product is available at https://deutschedigitalassets.com/products/etp/