by André Dragosch, Head of Research

Key Takeaways

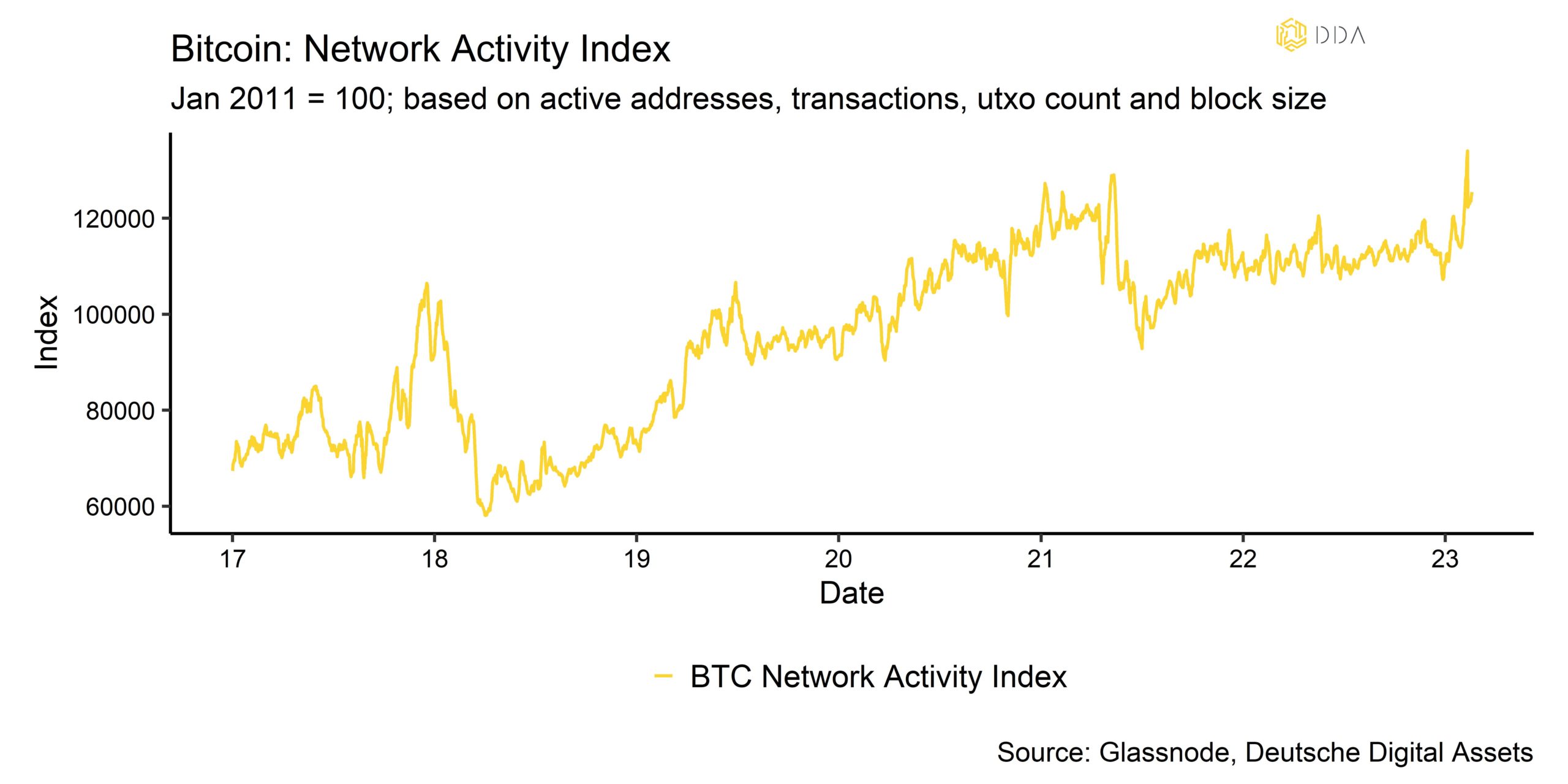

- Cryptoassets managed to de-couple from traditional financial markets, supported by a significant increase in network activity due to so-called “inscriptions” on the Bitcoin blockchain

- Our in-house Crypto Sentiment Index has reversed some its declines compared to last week and is still in positive territory

- While on-chain fundamentals have significantly improved, the outlook for US monetary policy still remains uncertain with an US economy that is still too strong for the Fed to consider reversing QT

Chart of the week

Cryptoasset Performance

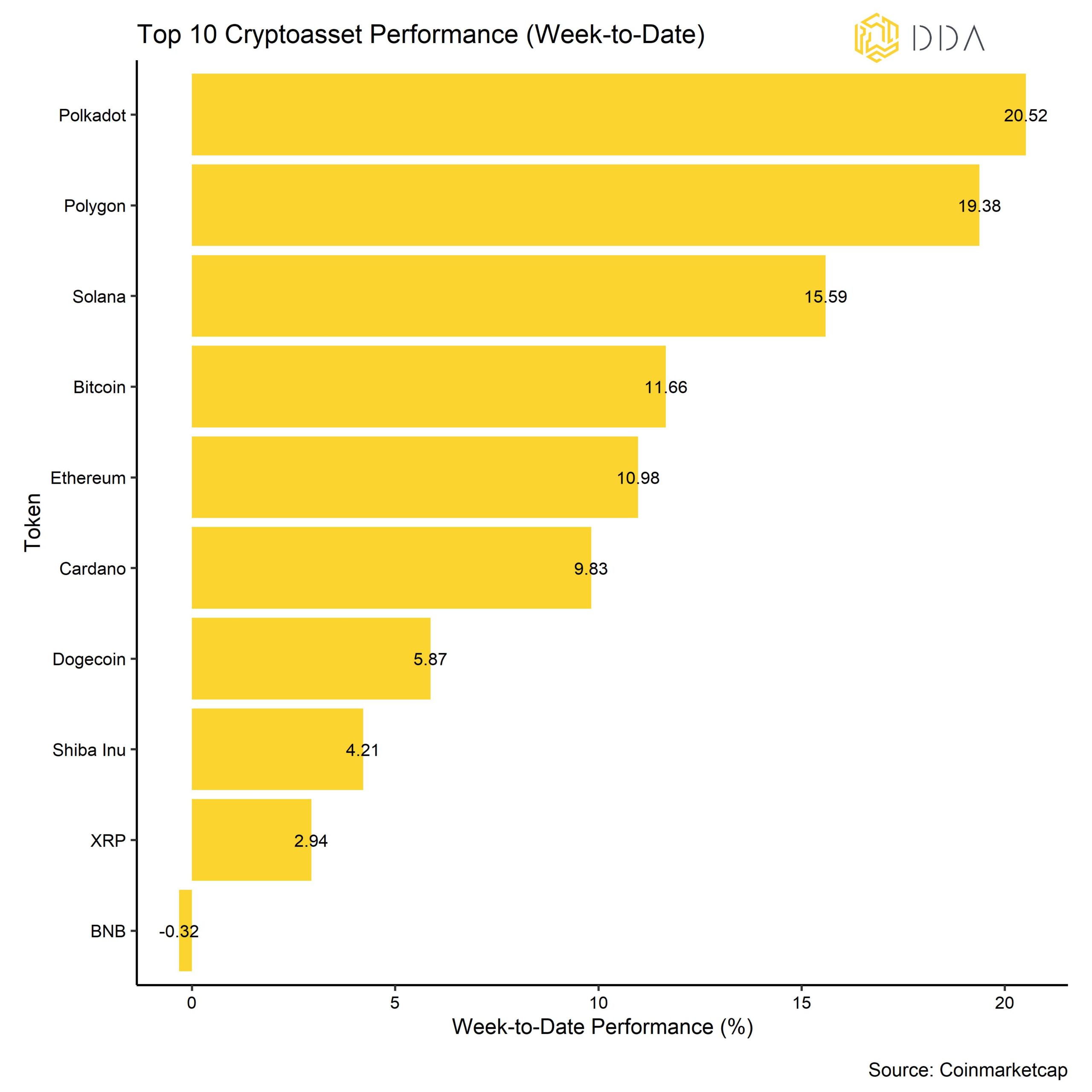

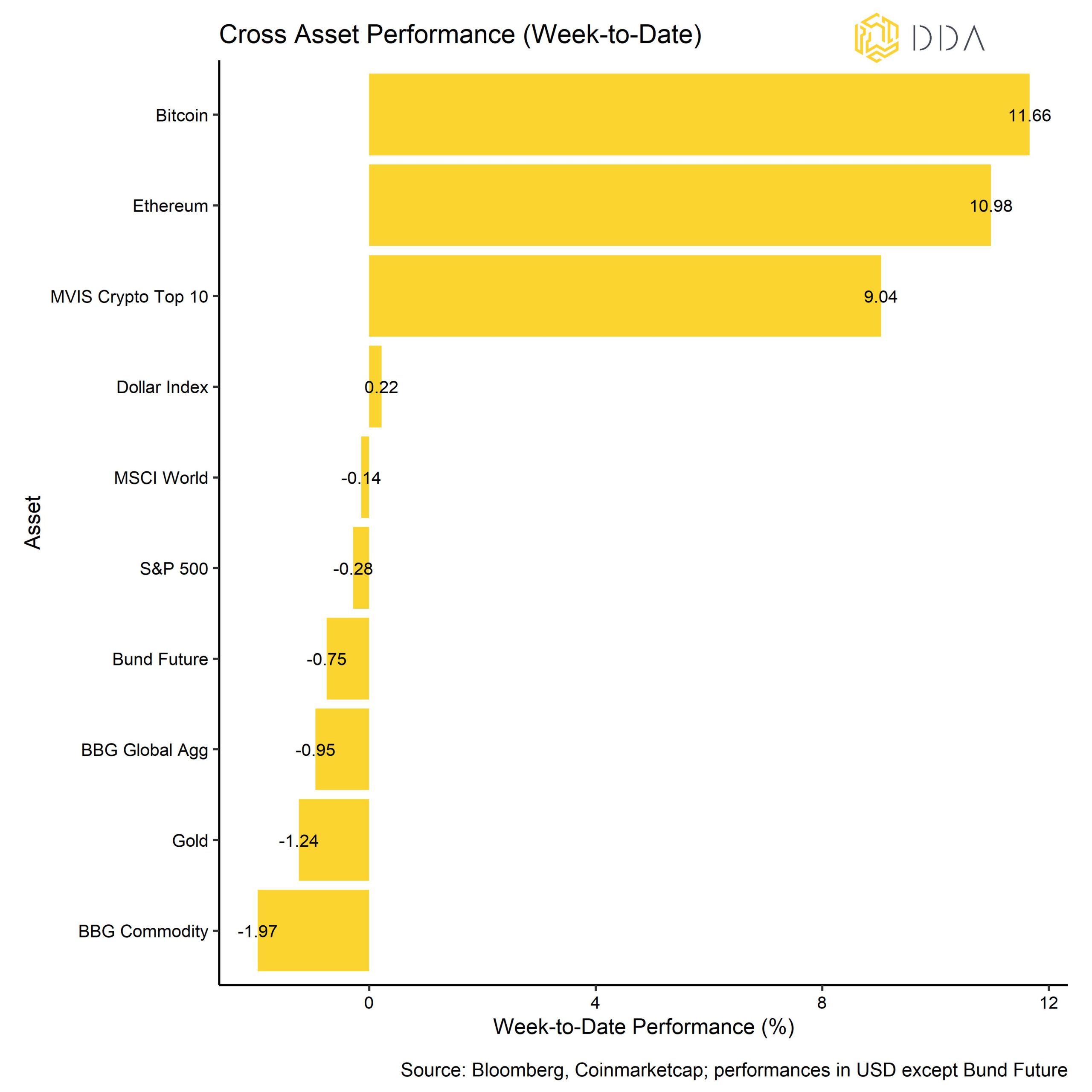

Last week, cryptoasset performances were mostly positive, supported by a significant increase in network activity due to so-called “inscriptions” on the Bitcoin blockchain.

Cryptoassets were able to de-couple from the negative performance in traditional financial markets that were negatively affected by a repricing in Fed rate hike expectations due to fairly solid US economic data releases and renewed hawkish Fed speak.

Among the major cryptoassets, Polkadot, Polygon, and Solana were the relative outperformers. BNB tokens was a rare exception among the top 10 since the uncertainty surrounding the SEC’s crackdown on “staking-as-a-service” providers has increased regulatory uncertainty for crypto exchanges with large staking volumes. Moreover, the SEC issued a Wells notice to Paxos, the issuer of Binance USD (BUSD), ordering the company to stop minting BUSD stablecoin token. This has also put pressure on Binance’s BNB token although BUSD is not issued by Binance directly. The biggest global crypto exchange Binance, who issues the BNB exchange tokens, is also the 4th largest provider of staking services for Ethereum globally based on their total value that has been staked their platform.

Sentiment

Our in-house Crypto Sentiment Index has reversed some its declines compared to last week and is still in positive territory. 12 out of 15 indicators are still above their short-term trend.

Compared to last week, we saw major reversals in BTC futures basis rate, in the Crypto Fear & Greed Index as well as in the performance of Bitcoin itself.

The Crypto Fear & Greed Index increased from “Neutral” into “Greed” territory. However, sentiment measured on Bitcoin Twitter remained bearish throughout last week.

Dispersion among cryptoassets continued to be high and dispersion has recently increased as well. At the same time, altcoins mostly underperformed Bitcoin on a 1-month and 3-months basis, although outperformance of some cryptoassets has recently started to pick up again. On a 1-month basis, only 35% of tracked altcoins have outperformed Bitcoin. Altcoin outperformance is usually a sign of increased risk appetite and low altcoin outperformance is still indicative of a rather cautious market sentiment.

Flows

Last week, cryptoassets saw further fund outflows, although there was a significant pick-up in inflows on Friday.

In aggregate, we saw net fund outflows in the amount of -55.0 mn USD. All types of products experienced net outflows. Fund outflows were mostly concentrated in BTC-based products (-29.6 mn USD) and Basket & Thematics products (-12.7 mn USD). Altcoin-based products such as ETH-funds saw net outflows of -11.8 mn USD while other Altcoins saw net outflows of -0.9 mn USD, in aggregate.

In this context, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – has stabilized again which signals that institutional demand has stabilized as well.

Compared to last week, the beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to decrease slightly, implying that hedge funds might have further decreased their directional exposure to cryptoassets during the last 20 days.

Bitcoin prices traded on Coinbase vis-à-vis those traded on Binance (Coinbase-Binance premium) were mostly flat throughout the week, although there was a slight uptick in premia during the middle of last week, which is indicative of neutral to positive buying interest from institutional investors vis-à-vis retail investors.

On-Chain

Probably the most interesting developments took place on-chain this week. In general, we saw an overall increase in network as shown in our Chart-of-the-Week which is a composite measure of network activity across a variety of blockchain metrics including the amount of active addressees, transactions, UTXOs and block size.

Most of this increase in network activity was largely due to an increase in transactions and block size, both of which were mainly influenced by the new emerging trend of so-called “inscriptions”.

Inscriptions allow users to store all kinds of data types in the Bitcoin blockchain including images, audio, video and plain text messages. These types of data types can also be transferred and are equivalent to non-fungible tokens (NFTs) known from other blockchains. This has been enabled by the Taproot soft fork upgrade that was already introduced in June 2021. However, the use of this feature has only picked up momentum in recent weeks when users started to inscribe a collection of images collectively known as “Taproot wizards”. Since then, more than 70000 inscriptions have already taken place most of which have been image files and text.

There are still important debates around this non-monetary use case of the Bitcoin blockchain, and the Bitcoin community is currently in disarray.

On the one hand, those who support this brand-new use-case category assert that Bitcoin should be used for any use-case desired as long as miners are compensated with a fee because it is a permissionless censorship-resistant system.

On the other side, those opposed to inscriptions assert that this may result in higher costs and longer settlement times for necessary financial operations, particularly for people living in developing nations. Also, this might pave the way for a hostile player to use the network as a means of attack by flooding it with unnecessary inscriptions.

The good news for investors is that this type of on-chain activity has increased overall network activity to new all-time highs. Higher network activity is usually correlated with higher prices as the value of the network grows with more network participation and utility.

In the short term, this certainly had a positive impact but it still remains to be seen how it will affect the overall network security and the community in the longer term.

Derivatives

In general, the reversal in cryptoasset sentiment has led to a sharp reversal in risk aversion in derivatives markets. Although implied volatilities on 1-month Bitcoin options have increased due to the reversal and increase in realized volatilities, other derivatives metrics imply that downside risks are being priced out. For instance, the 25-delta skew has clearly reversed and now signals that option traders value call options more than delta-equivalent put options. Bitcoin option traders remain firmly positioned in call options based on the relative open interest.

On the other hand, both Bitcoin perpetual funding rates and futures basis rate have recently increased significantly which implies that demand for long contracts relative to short contracts has recently picked up again. Funding rates have increased to the highest readings since the bull run phase in October 2021 which shows some pockets of short-term euphoria in the crypto derivatives market. Likewise, the Bitcoin 3-month futures basis rate has increased to the highest reading since April 2022. These are certainly indicators that signal a return of a positive market sentiment for Bitcoin.

Bottom Line

Cryptoassets managed to de-couple from traditional financial markets, supported by a significant increase in network activity due to so-called “inscriptions” on the Bitcoin blockchain. Our in-house Crypto Sentiment Index has reversed some its declines compared to last week and is still in positive territory. While on-chain fundamentals have significantly improved, the outlook for US monetary policy still remains uncertain with an US economy that is still too strong for the Fed to consider reversing QT.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.