Download the Full Report in PDF

by André Dragosch, Head of Research

Key Takeaways

- November was a rather hard month for cryptoassets due to the collapse of one of the biggest crypto exchanges FTX

- Our in-house indicator of monetary policy has eased significantly lately as the market has begun to price in a more moderate stance of US monetary policy – this should be a macro tailwind for cryptoassets going forward

- The probability of a Bitcoin bottom has increased lately based on the random forest model, but the overall probability remains relatively low. Potential miner capitulation might put further downside pressure on prices in the short term

Chart of the Month

Performance Review

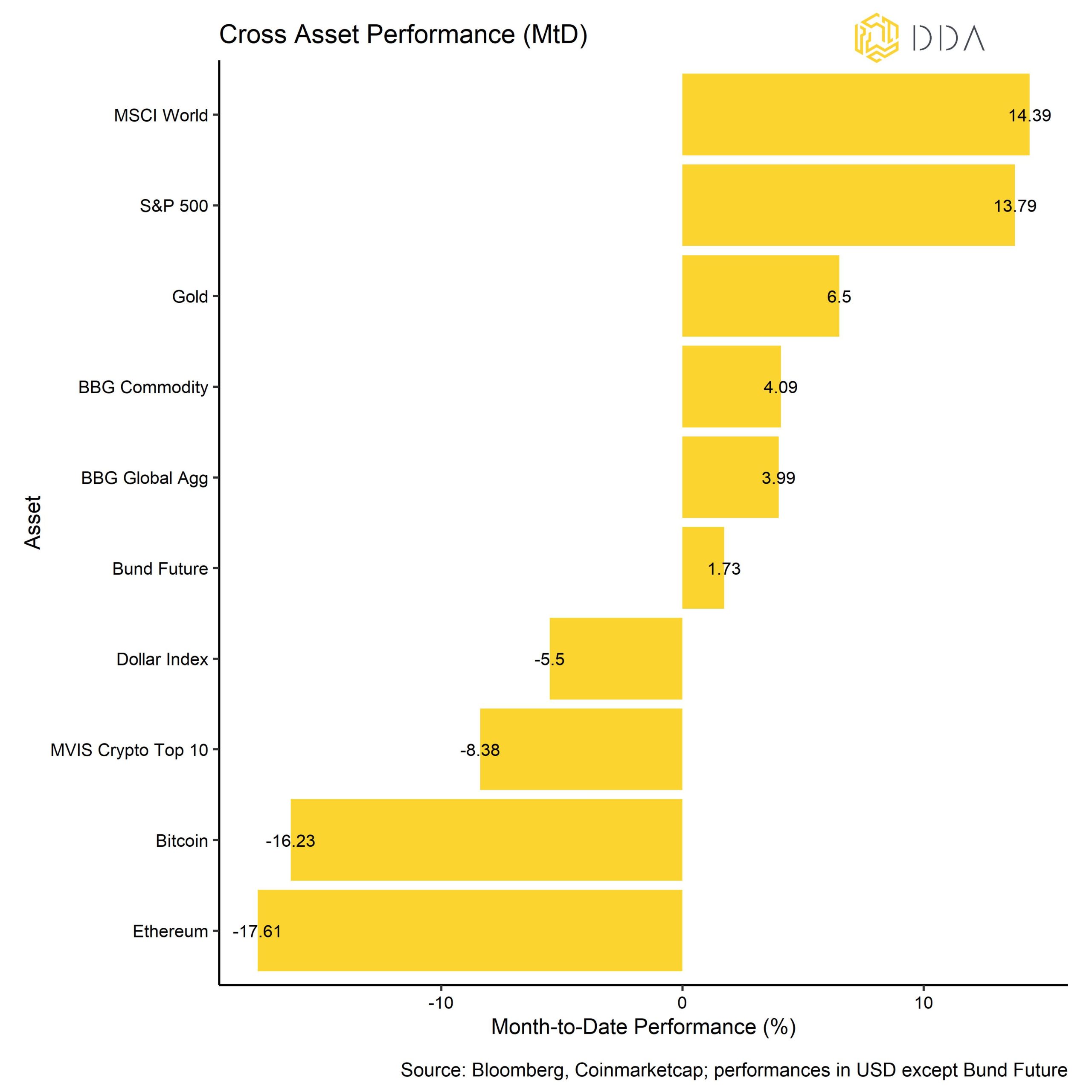

November was a rather hard month for cryptoassets. There was a significant increase in volatility compared to the October lull on account of the collapse of the major crypto exchange FTX in early November.

We covered the backgrounds and consequences of FTX’s collapse in greater detail here and here.

In short, FTX went from the 4th biggest crypto exchange on the globe to bankruptcy in a matter of a single week. Likewise, the founder and CEO of FTX Sam Bankman-Fried watched his multi-billion Dollar fortune evaporate within days.

Life can happen fast, especially in the crypto markets. A colleague of mine said after the week of the FTX collapse: “There are decades where nothing happens; and there are weeks where decades happen.”

Fortunately, we at Deutsche Digital Assets had no company exposure to FTX or BlockFi and we managed to navigate out of this environment without financial losses.

The collapse of FTX will certainly draw more regulatory scrutiny to the crypto markets although the collapse itself had more to do with traditional centralized control over assets than the decentralized nature of blockchains and decentralized control over assets. If anything, the collapse of FTX highlighted the need for more decentralization and genuine use of blockchain technology.

On a positive note, the collapse of FTX has so far led to an increased effort of more transparency among crypto exchanges such as the “Proof-of-Reserves” initiatives at Binance, Kraken or Gemini. They are certainly a step in the right direction although these data were already public information for on-chain analysts. What is still lacking are data about the liabilities of these reserves.

Regarding the overall market development, fears of financial contagion dominated market sentiment in November as the market was trying to single out companies that might have had significant exposure to or business with FTX or its parent company Alameda Research. Especially larger crypto lending companies like BlockFi (which also filed for bankruptcy later on), Nexo and Genesis came under market scrutiny.

In consequence, we marked a new cycle low in the price of Bitcoin on a closing price basis on the 21st of November.

Market sentiment managed to stabilize just recently with the announcement of a potential distressed assets fund by exchange behemoth Binance with a potential dry powder in the amount of 1 bn USD for distressed crypto companies, possibly even more.

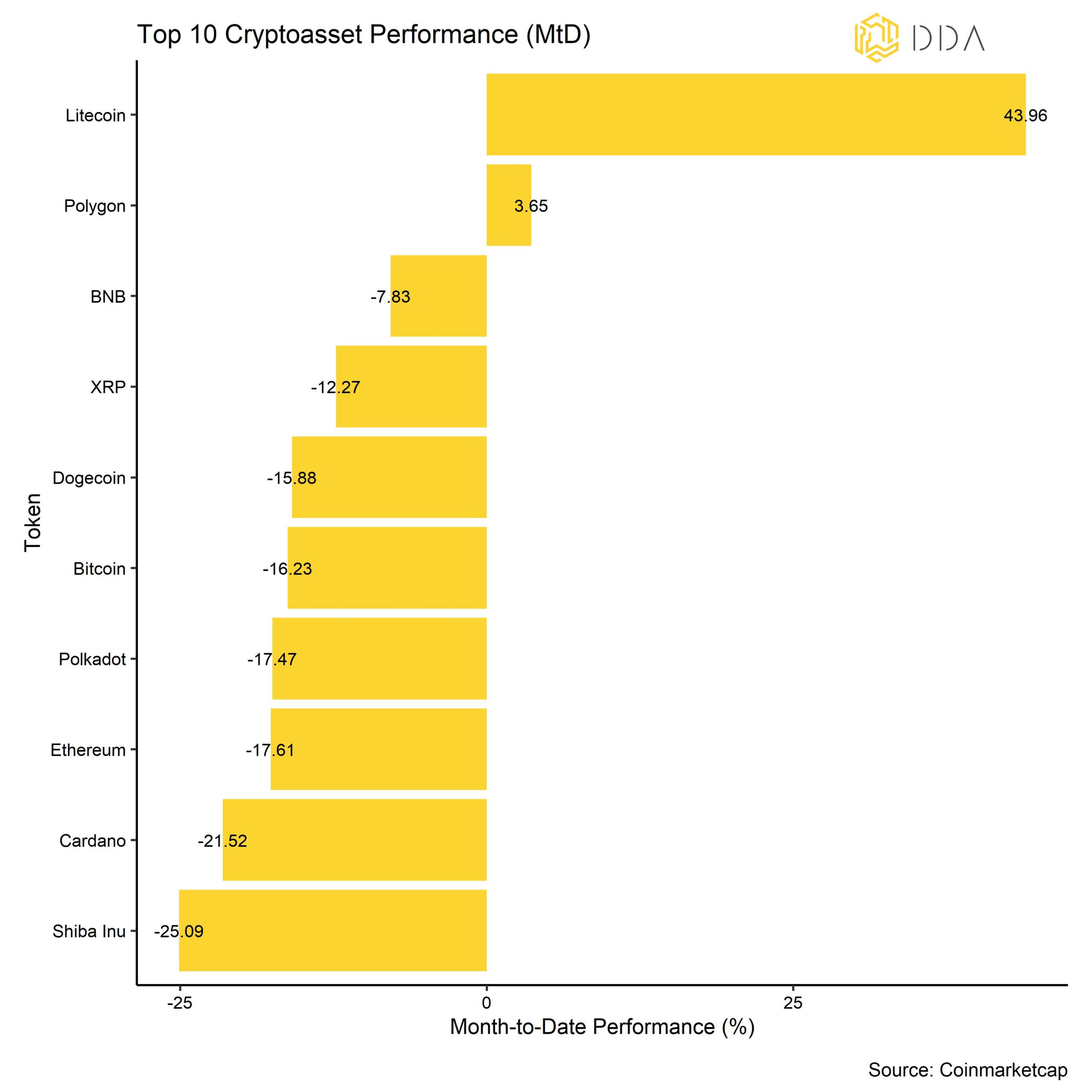

Among the top 10 major cryptoassets, Litecoin, Polygon and BNB have been the main outperformers. Litecoin tokens rallied due to the anticipated halvening in August 2023.

Overall risk appetite for altcoins was relatively high judging by our in-house Altseason Index (see Appendix). 50% of the major Altcoins tracked by the index managed to outperform Bitcoin over the month, despite the fallout caused by FTX.

Our in-house Crypto Dispersion Index implies that cryptoasset performances were mainly driven by systematic factors in the last 30 days. A low reading of the Crypto Dispersion Index implies that average pairwise correlations between Altcoins and Bitcoin are high, meaning Bitcoin and Altcoin mostly trade in the same direction and are affected by the same factors.

Bottom Line: November was a rather hard month for cryptoassets due to the collapse of one of the biggest crypto exchanges FTX. The level of dispersion among cryptoassets was low but half of the Altcoins managed to outperform Bitcoin in the last month.

Macro & Markets Commentary

While cryptoasset markets were under immense pressure in consequence of the FTX collapse, traditional financial markets faired rather well. The main catalyst for a revival in risk appetite in November was the fact that US inflation data for October came in below consensus and implied that inflation numbers were finally rolling over. In consequence, US Treasury yields decreased and the Dollar sold off significantly as the market priced in a more moderate stance of US monetary policy. The decrease in yields and depreciation of the Dollar eased financial conditions and therefore helped global equities to rallye strongly in November.

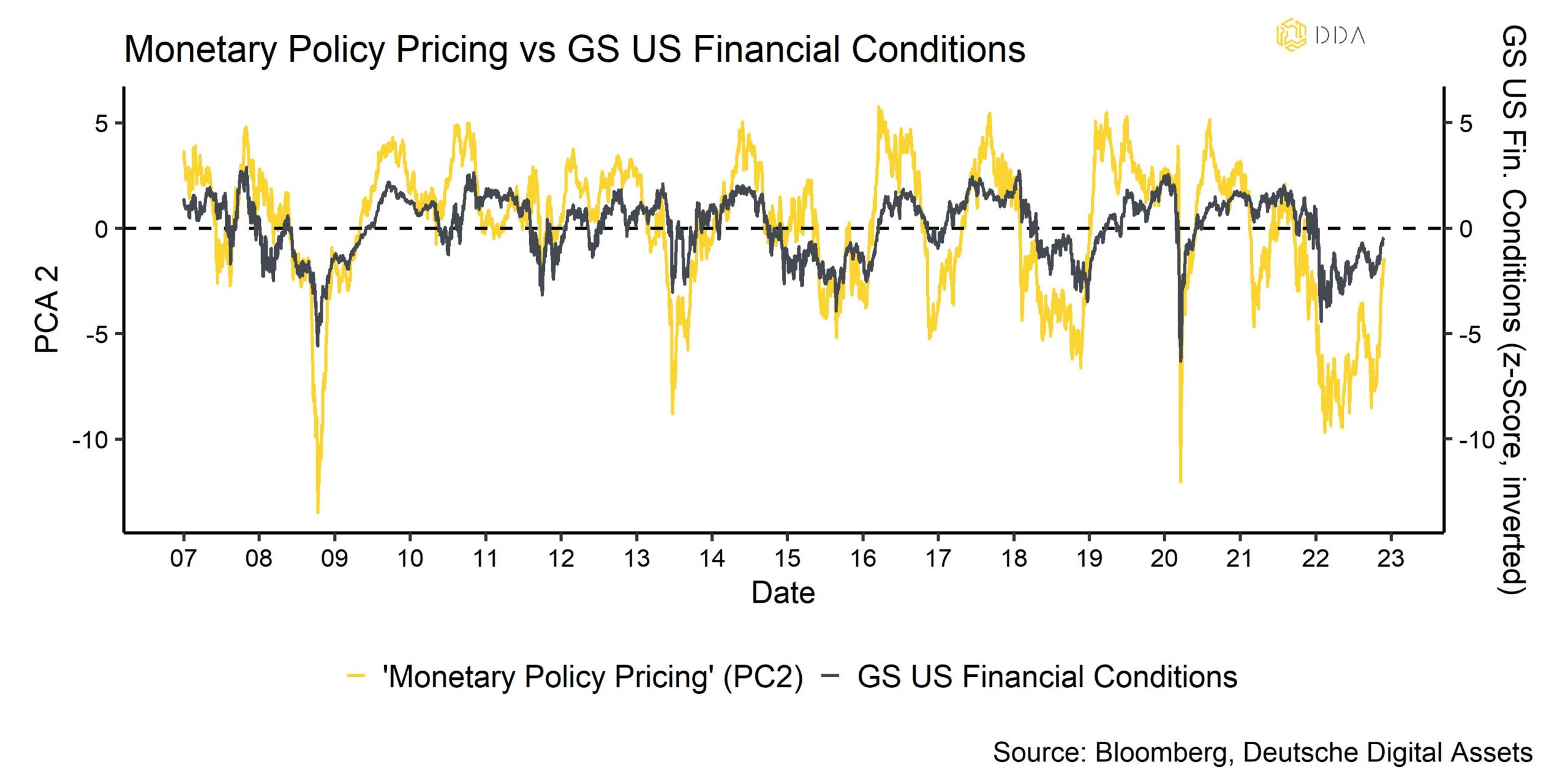

This is also evident in our in-house indicator of monetary policy pricing which increased from very low levels and, thus, indicates an easing in monetary policy as priced by the market.

Based on our calculations, monetary policy also remains the dominant macro factor for Bitcoin. As we have outlined in our last Crypto Market Intelligence report in October 2022, we still think that a “Fed pivot”, i.e. a reversal of the tight monetary policy by the Fed remains the necessary macro condition for a sustained stabilization in Bitcoin and cryptoasset markets in general. We still think that the latest improvement in the macro environment is bound to be a tailwind for Bitcoin and cryptoassets in general, too. The collapse of FTX might have just superimposed the macro improvement of late, especially the sharp depreciation of the Dollar.

In fact, Bitcoin performs best historically in a weak Dollar environment and performs worst in strong Dollar environments.

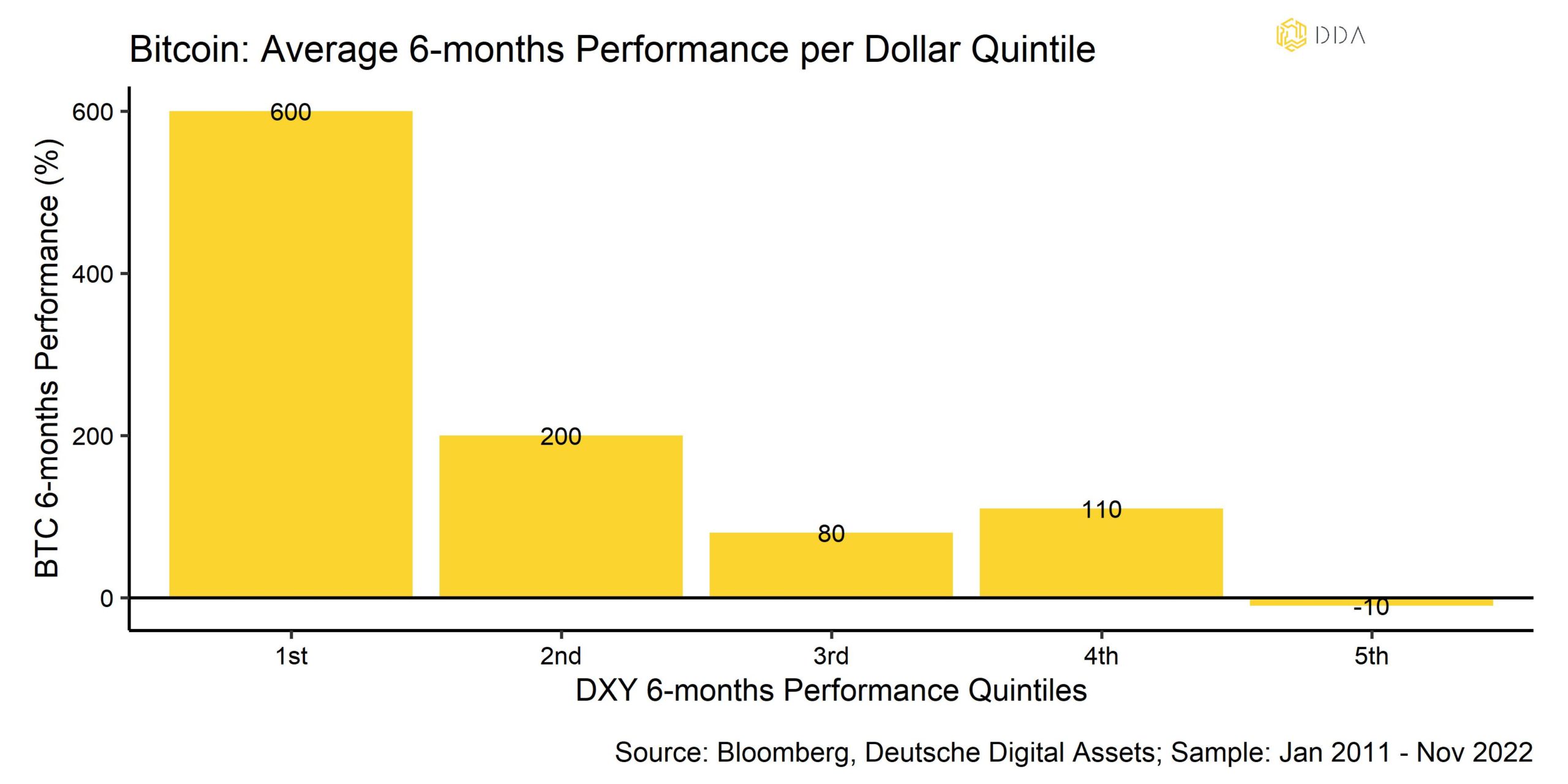

The following table highlights this empirical observation:

The table shows Bitcoin’s average 6-months performance based on different degrees of 6-months Dollar Index (DXY) performance. Quintiles divide the sample into 5 equally-sized sub-samples. The 1st quintile represents the sub-sample of 1/5 weakest Dollar performances (Dollar depreciations) and the 5th quintile represents the sub-sample of 1/5 strongest Dollar performances (Dollar appreciations).

On the one hand, Bitcoin performed +600% on average within 6 months in the bottom 1/5 of cases when the Dollar depreciated the most. On the other hand, Bitcoin performed -10% on average within 6 months in the top 1/5 of cases when the Dollar appreciated the most.

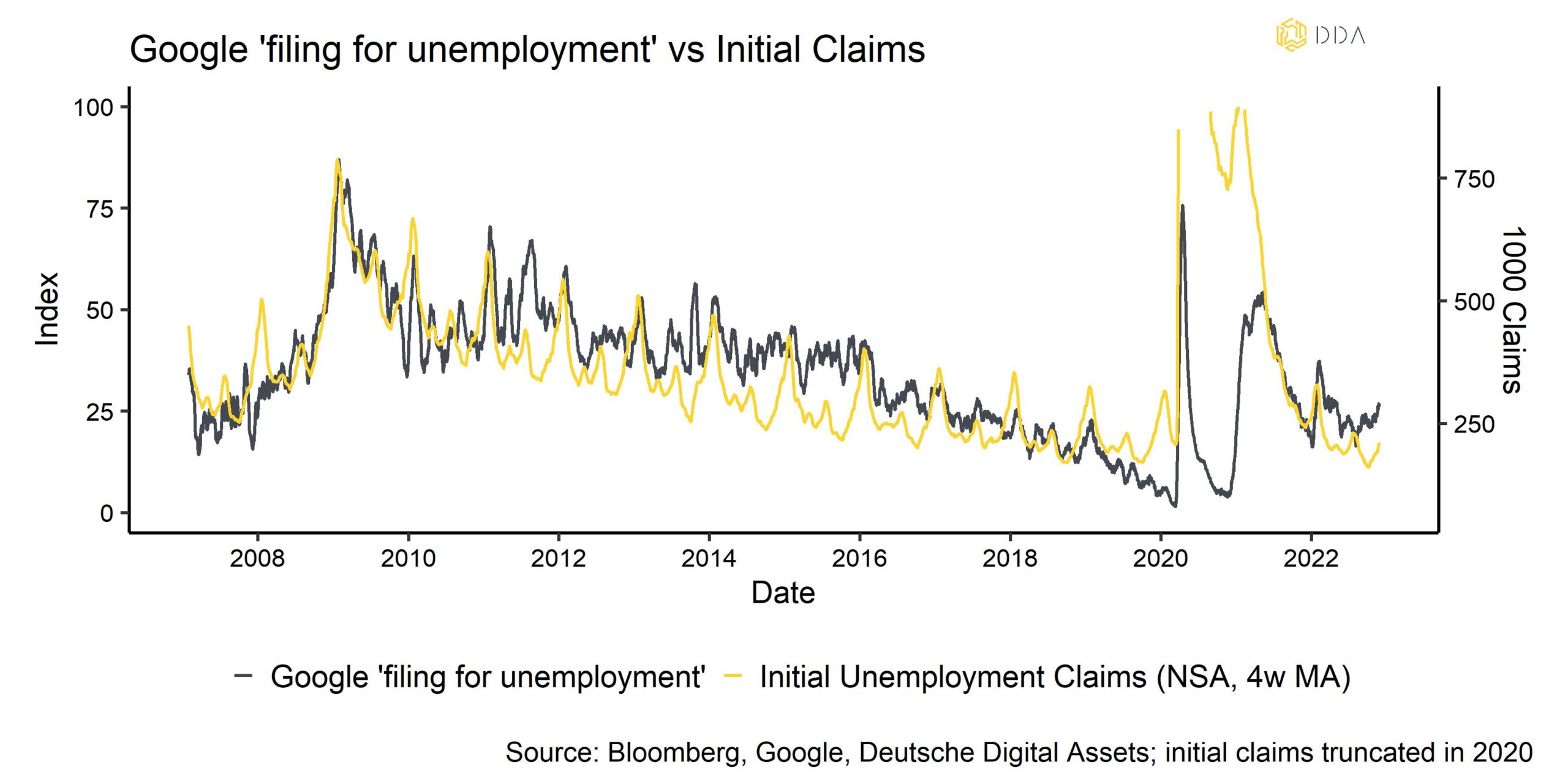

Nonetheless, although US inflation readings are likely to continue to come down in the coming months as supply chain indicators are easing and commodity prices have relaxed due to the current slowdown, it is still uncertain whether we will see a significant increase in unemployment in the short term. The reason investors are focusing on US employment is the fact that a weaker jobs market could pressure the Fed further to adopt a more moderate stance of monetary policy and therefore bring the market closer to the “Fed pivot”.

November has so far seen the biggest increase in layoff announcements year-to-date at big tech companies such as Amazon or Google, both of which have announced to cut around 10000 jobs each. It remains to be seen if these layoff announcements in aggregate show up in the November data already or rather in later releases.

Early leading indicators for unemployment claims such as Google search queries for “filing for unemployment” in the US have recently picked up but have not increased significantly, yet.

So, the risk for the market is that the upcoming release won’t confirm the expected slowdown in the US jobs market just yet. However, this is essentially a matter of timing at this point since most leading indicators are already clearly signaling a US recession with a high probability and therefore significant job losses are also very likely.

Bottom Line:

Our in-house indicator of monetary policy has eased significantly lately as the market has begun to price in a more moderate stance of US monetary policy – this should be a macro tailwind for cryptoassets going forward. The decrease in yields and depreciation of the Dollar should support Bitcoin as it performs best historically in a weak Dollar environment and performs worst in strong Dollar environments. In the short term, the risk for the market is that the upcoming US employment data release won’t confirm the expected slowdown in the US jobs market just yet.

On-Chain Analytics

A look at on-chain metrics reveals that there were significant disruptions in cryptoasset markets during the month of November.

The main observations are:

- The FTX collapse represents one of the biggest capitulation events in the history of Bitcoin with over 21 bn USD aggregate realized losses in November

- The market is still trading below cost-basis which is around ~20.2k USD for Bitcoin and ~1370 USD for Ethereum

- Our in-house “Crypto Sentiment Index” has crashed to the lowest levels since March 2020

- Our in-house “BTC Composite Valuation” metric has decreased to the bottom 20% of observations

- BTC Exchange balances have decreased significantly during November as mostly smaller investors and very large investors have use the lower prices to accumulate strongly

- The low prices are already pressuring Bitcoin miners to partially sell their reserves and switch off mining rigs which implies an increased probability of “miner capitulation”

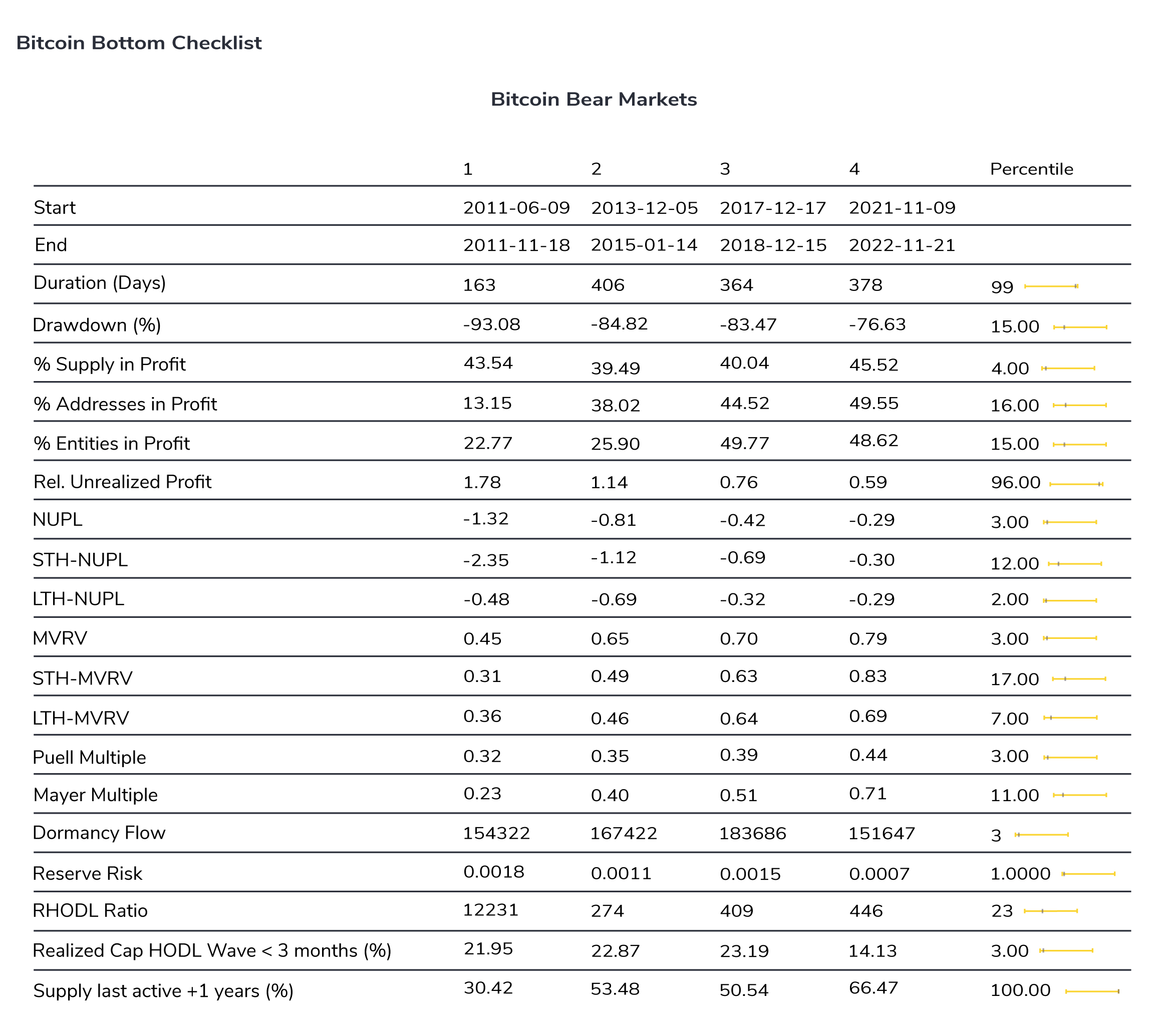

All the abovementioned observations imply that the probability of a cycle bottom has significantly increased in consequence of the FTX collapse as short-term investors have mostly exited the market and selling pressure appears to be exhausted. This can also be seen in the following “Bitcoin Bottom Checklist” where many indicators are already very low/high based on their historical percentiles.

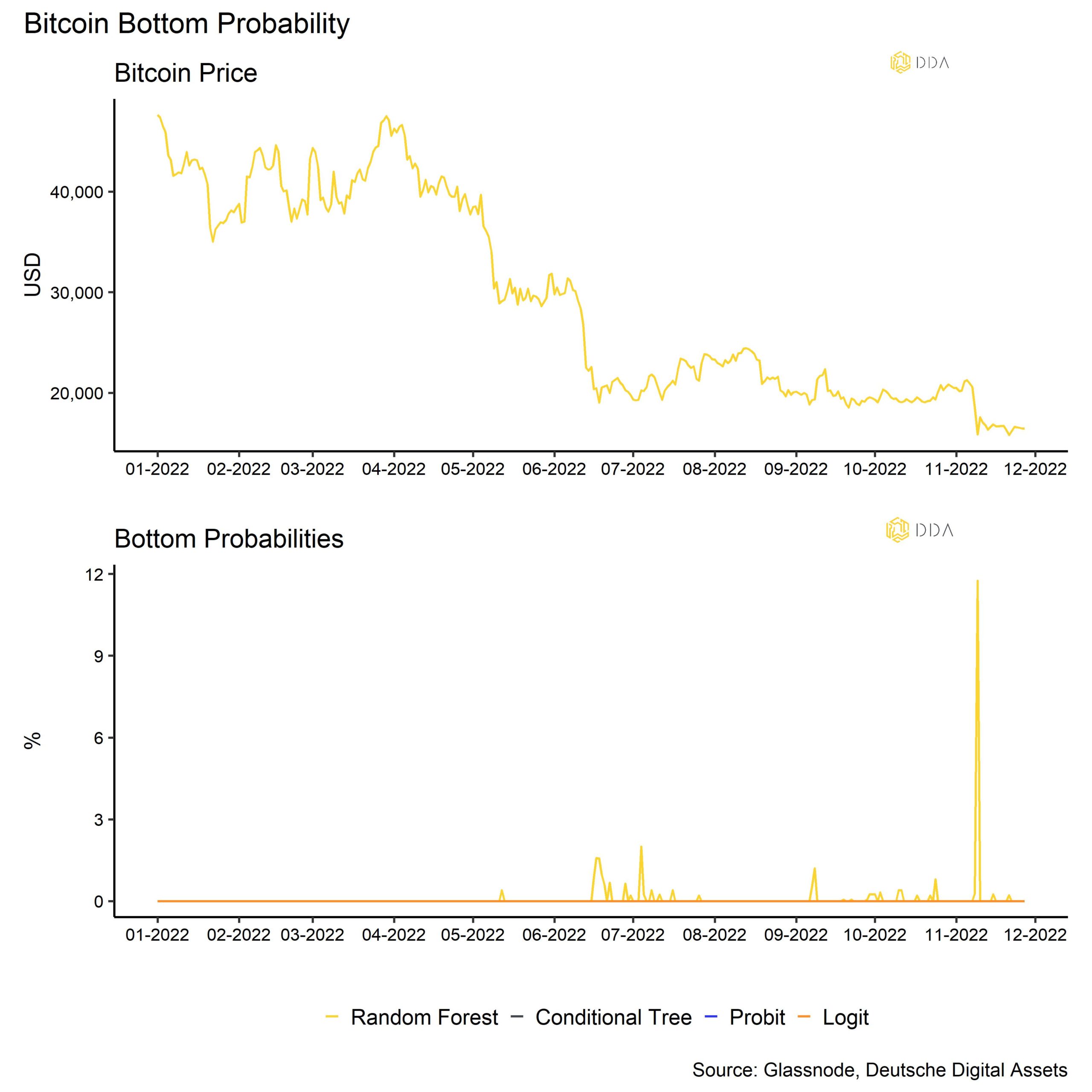

In fact, our in-house Bitcoin bottom probability has spiked on the very day FTX collapsed which is highlighted in our “Chart of the Month”. We have just recently released this new metric here.

We have combined several Bitcoin on-chain indicators in order to estimate the probability of a cycle bottom in the price of Bitcoin.

The key takeaway from this analysis is that, although the probability of a Bitcoin bottom has increased lately based on the random forest model, the overall probability remains relatively low. Please note that a probability of 12% does not mean that a bottom has not occurred, yet. It just means, statistically speaking, that it’s rather unlikely.

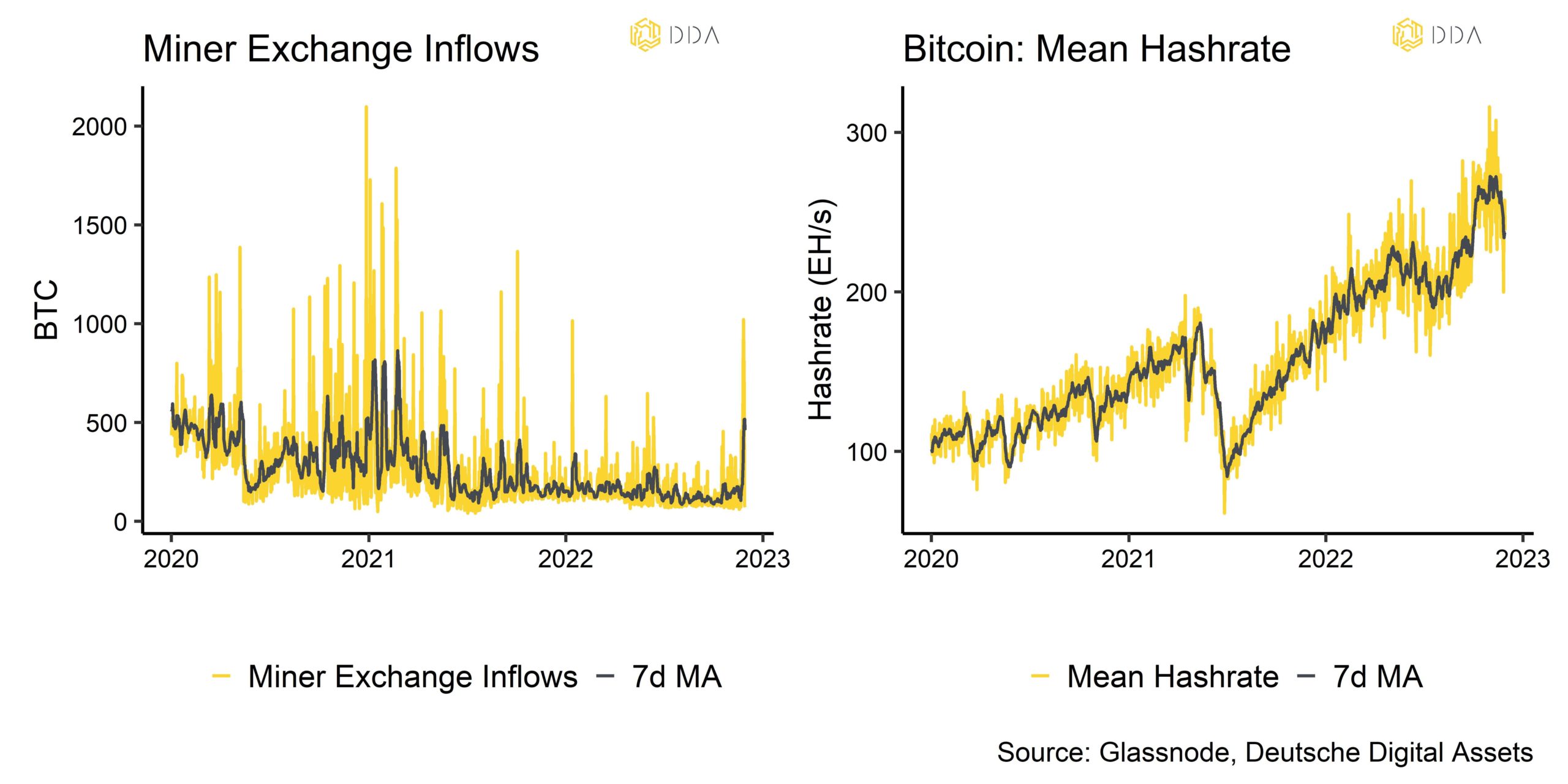

That being said, potential miner capitulation might put further downside pressure on prices in the short term. We have just recently observed a significant increase in Bitcoin miners’ balance transfers to exchanges that highlights increased selling activity by BTC miners. These transfers by miners have been the highest in 2022 so far.

In fact, Bitcoin miners are currently eating into their reserves and have also reduced their hash rate as some mining activity has become uneconomical to operate in face of these very low prices. All these observations imply an increased probability of a so-called “miner capitulation” which one usually observes during market bottoms. Current prices are trading below aggregate break-even prices for BTC miners which lies around 19.5k USD. So, the average BTC miner is currently operating at a loss.

In fact, Bitcoin miners are currently eating into their reserves and have also reduced their hash rate as some mining activity has become uneconomical to operate in face of these very low prices. All these observations imply an increased probability of a so-called “miner capitulation” which one usually observes during market bottoms. Current prices are trading below aggregate break-even prices for BTC miners which lies around 19.5k USD. So, the average BTC miner is currently operating at a loss.

Apart from this, the degree to which smaller investors have used these lower prices to accumulate coins is impressive. Our accumulation trend score, which weighs the increase in wallet balance by the respective size of the wallets, was particularly strong for wallet cohorts with balances between 0.01 BTC and 10 BTC as well as more than 100000 BTC. In the same vein, exchange balances have decreased strongly in November, which implies a significant amount of accumulation as these coins are transferred off exchanges into cold storage. From that point of view, the amount of illiquid supply has increased to a new alltime high which is usually a bullish signal. Only 12% of overall Bitcoin supply is currently held on exchange wallets.

Bottom Line: On-chain metrics reveal that there were significant disruptions in cryptoasset markets during the month of November. The probability of a Bitcoin bottom has increased lately based on the random forest model, but the overall probability remains relatively low. Potential miner capitulation might put further downside pressure on prices in the short term. However, the degree of accumulation especially by smaller wallet cohorts at these lower prices has been very strong.

Download the full report with appendix here.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Recent News and Articles

- Institutional Crypto Adoption: Why & How Institutions Are Going Crypto

- Crypto Portfolio Composition: How Different Portfolios Have Performed During the Recent Bull and Bear Markets

- How to Invest in Ethereum (ETH): A Guide for Professional Investors

- The Case for Actively Managed Investment Strategies in the Crypto Markets

- How to Invest in NFTs: A Guide for Professional Investors

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How accurate is the Bitcoin Stock-to_Flow Model?

Deutsche Digital Assets in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.