Crypto Market Intelligence March 2023

by André Dragosch, Head of Research

Key Takeaways

- Cryptoassets posted another high performance in March as Bitcoin’s market cap surpassed 500 bn USD again

- The recent banking stress has induced a flight to cryptoassets, in particular Bitcoin

- Positive on-chain fundamentals were also largely supportive of the latest price increase across cryptoassets, while US regulatory uncertainty has increased significantly

Chart of the month

Cryptoasset Performance

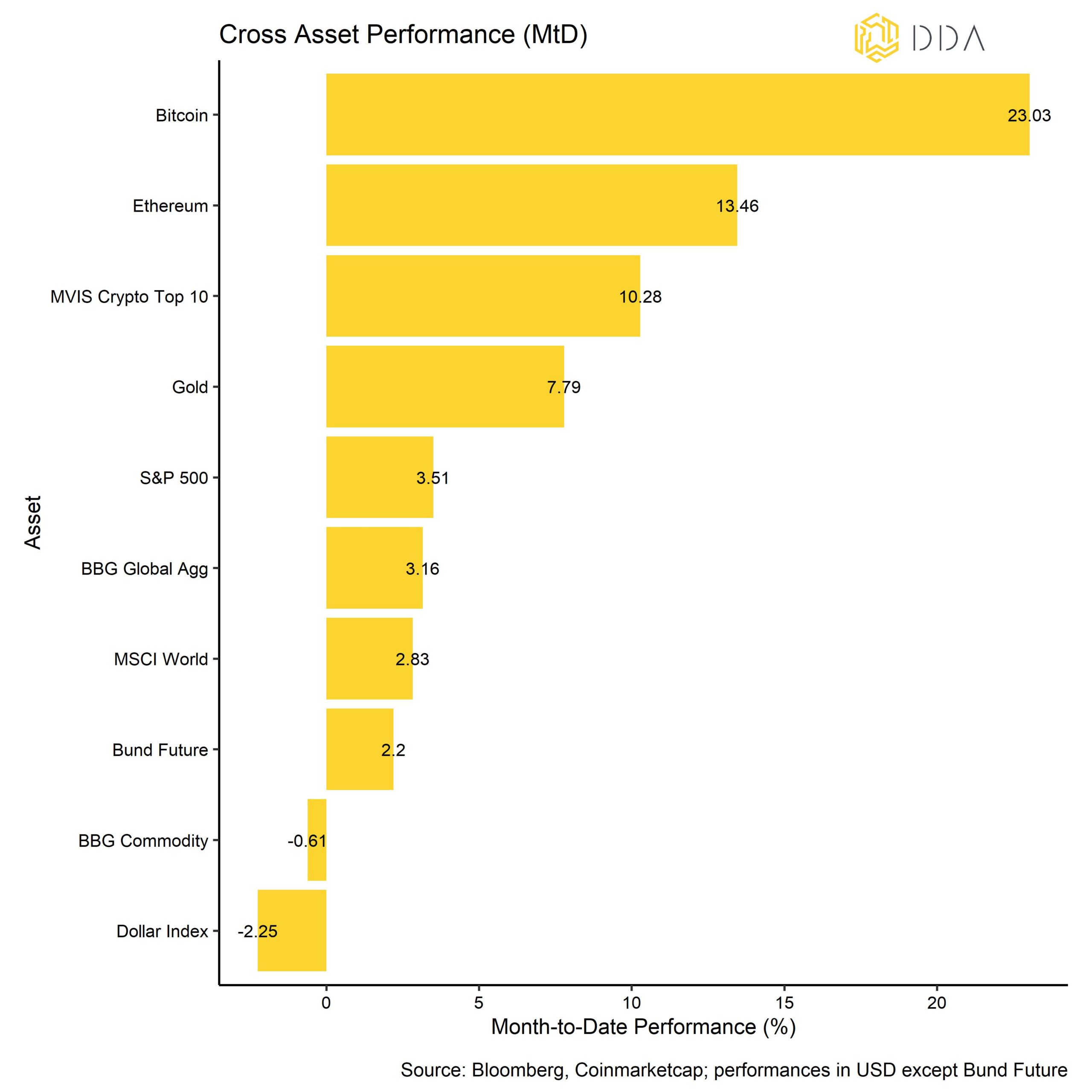

Cryptoassets posted another high performance in March as Bitcoin’s market cap surpassed 500 bn USD again. The major coins outperformed any other major asset class by a very wide margin in last month. The main reason was that cryptoassets were speculating on a potential return of loose monetary policy by the Fed following the latest stress in the traditional banking sector. There was generally also a perceived “flight-to-safety” into cryptoassets.

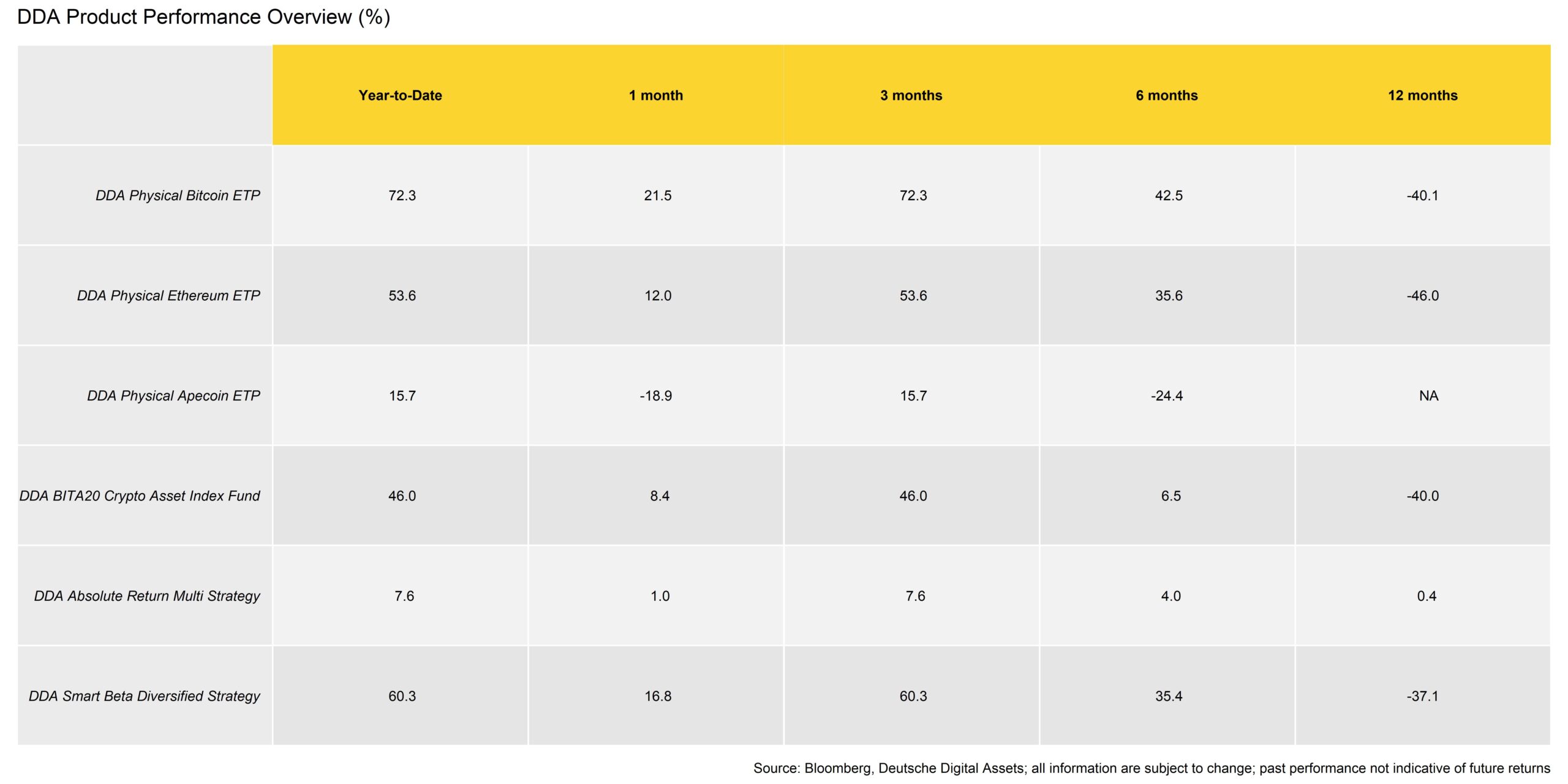

Likewise, our own DDA products also reflect this positive performance development quite well in March:

A notable exception to the overall very positive performance in March, was shown by the DDA Physical Apecoin ETP which is due to the fact that there was an unlock of 4% additional Apecoin tokens to the circulating supply. A token unlock might be prompted by the need to grow the project and finance development and market liquidity.

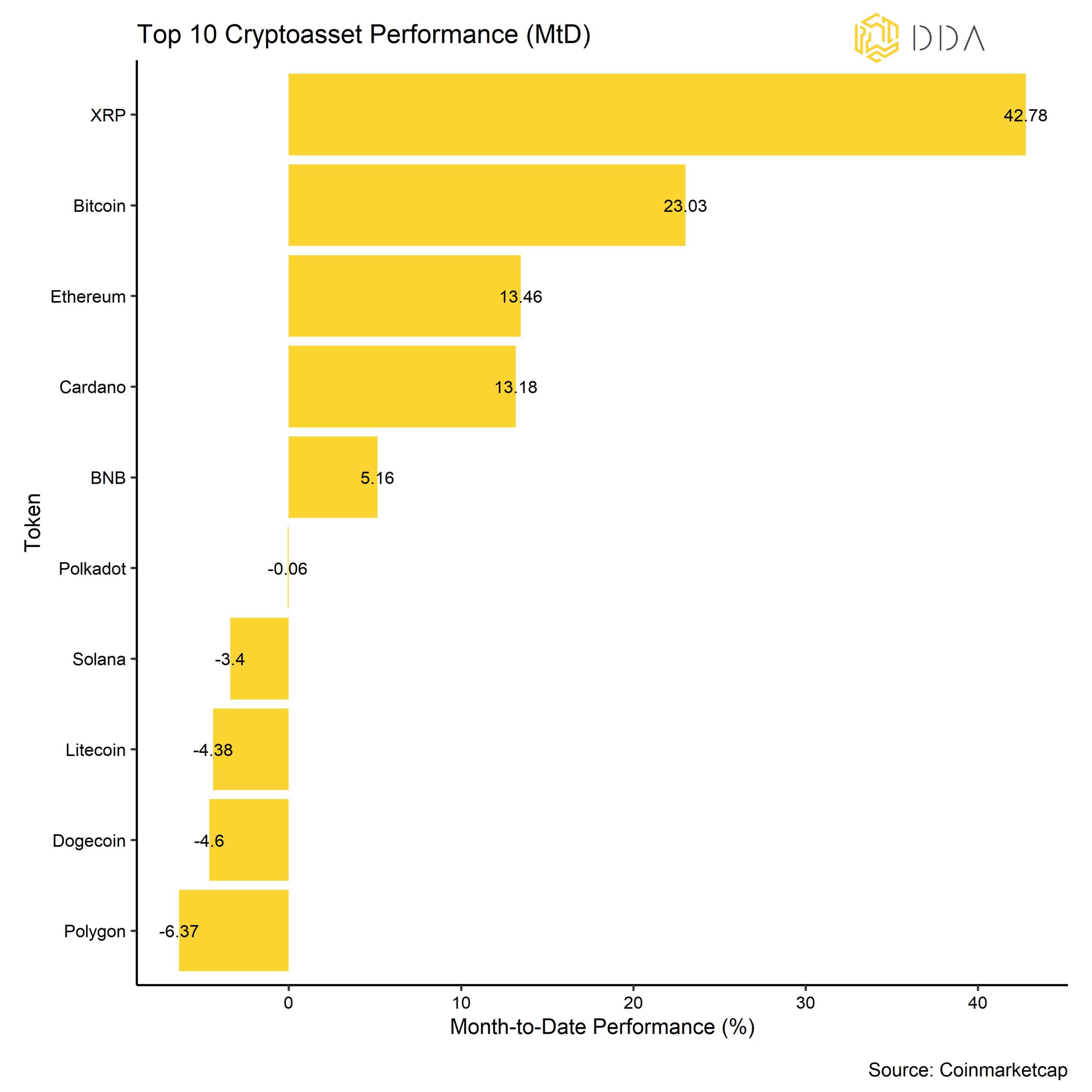

In general, among the top 10 major cryptoassets, XRP, Bitcoin, and Ethereum have been the main outperformers. Apart from the overall “flight-to-safety”, XRP was further supported by rumours that Ripple might reach a positive outcome in its trial against the SEC.

However, overall Altcoin outperformance has stayed very low throughout the month with only 15% of our tracked set of altcoins outperforming Bitcoin on a 1-month basis. At the same time, crypto dispersion has also remained relatively low in March, implying that cryptoasset performances were mostly driven by systematic factors rather than coin-specific factors.

Bottom Line: Cryptoassets posted another high performance in March as Bitcoin’s market cap surpassed 500 bn USD again. This was mostly driven by the stress in the traditional banking system that induced a flight to cryptoassets, in particular Bitcoin.

Macro & Markets Commentary

Probably the most cataclysmic event for cryptoasset and traditional financial markets was the collapse of Silicon Valley Bank (henceforth SVB) on March 8, 2023. A combination of bad risk management and deposit flight had ultimately led to the insolvency of the bank which was later taken into FDIC receivership.

One of the main reasons why SVB collapsed was the fact that a major part of its bond portfolio and duration risk was held in “held-to-maturity” (henceforth HTM) accounts that allowed SVB to book these bonds at face value instead of mark-to-market and abandon standard risk management practices such hedging duration risks of these bonds. These issues surfaced when deposit flight and liquidity strains forced the bank to sell these HTM bonds at a significant loss due to higher interest rates.

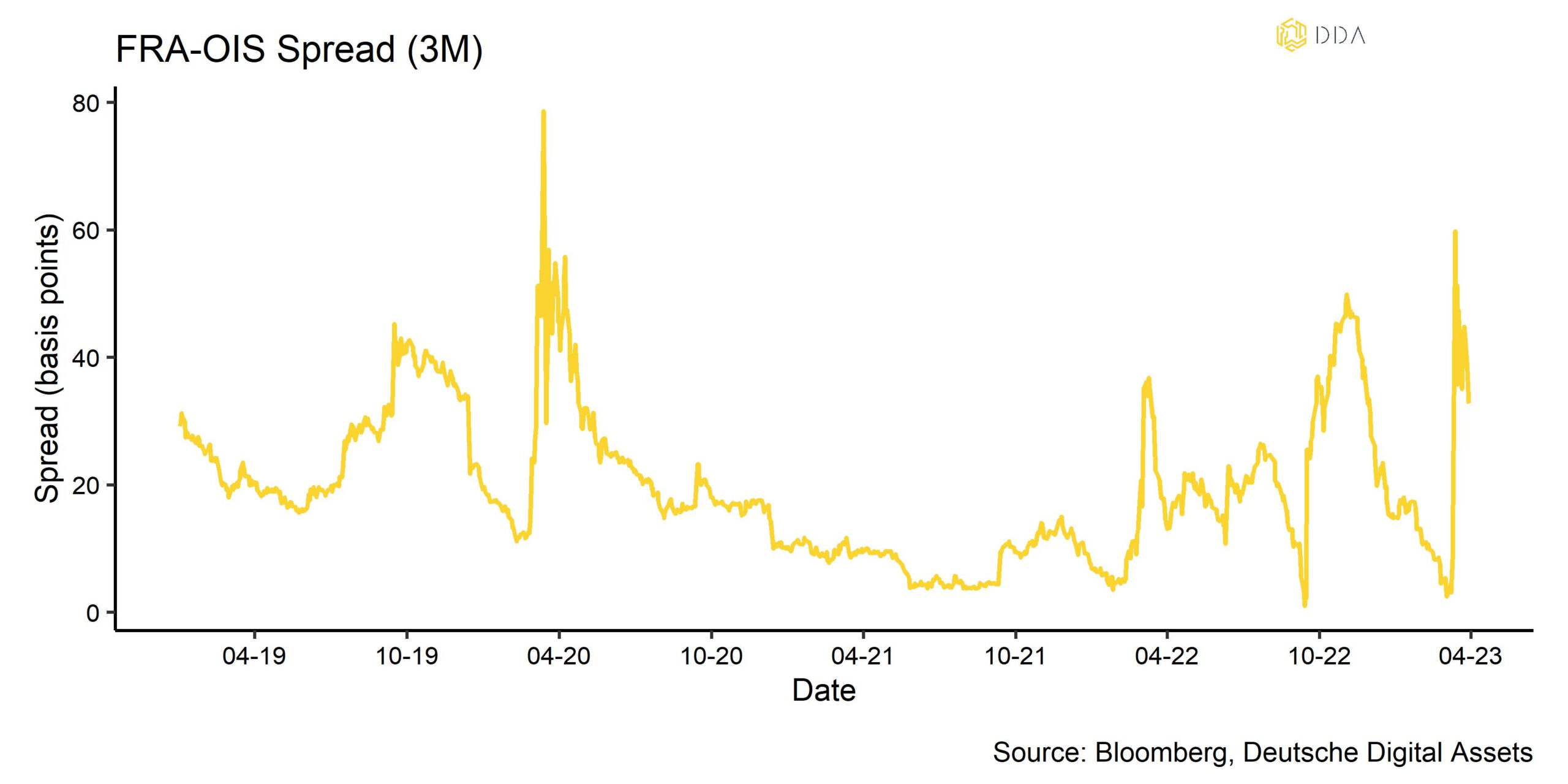

The collapse had led to a general increase of uncertainty surrounding the solvency of US regional banks that later led to financial market contagion at other US financial institutions. Interbank funding stress and liquidity issues were amongst others visible in the 3-months FRA-OIS (forward rate agreement minus overnight index swap) Spread that spiked to the highest level since the Covid crisis in March 2020:

This is mostly a reflection of increasing counterparty risk within the banking sector.

The Fed was quick to calm market uncertainty by providing additional liquidity in terms of a new funding facility called “Bank Term Funding Program” (BTFP) and via the primary discount window. The BTFP allows banks to borrow reserves by providing eligible bonds as collateral at par value (!), i.e. way above their current market value.

The primary discount window is usually only used in times of significant liquidity issues as these loans are more expensive than the standard Fed funds provided via open market operations, so an increased usage is a sign of significant interbank funding stress.

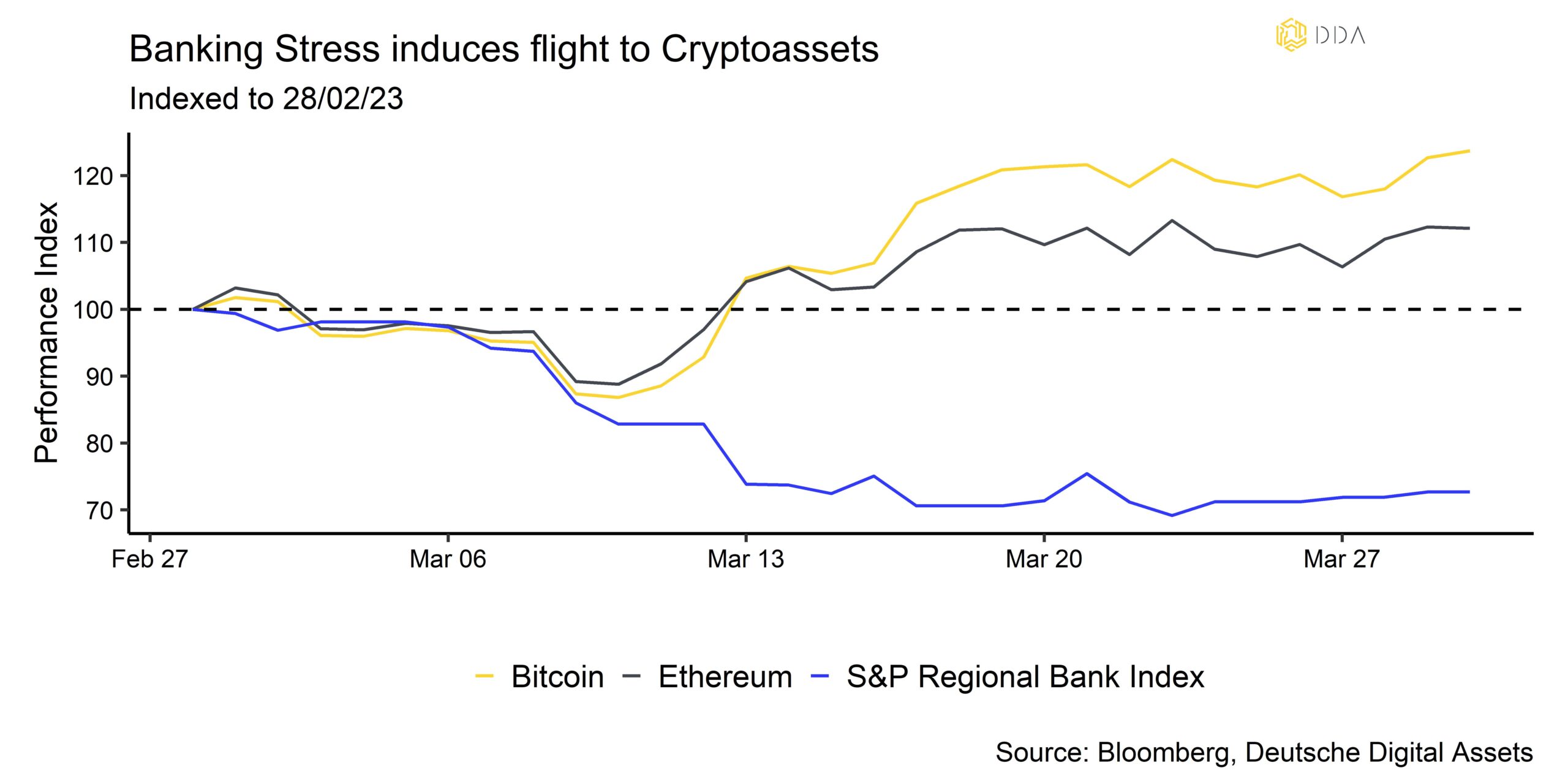

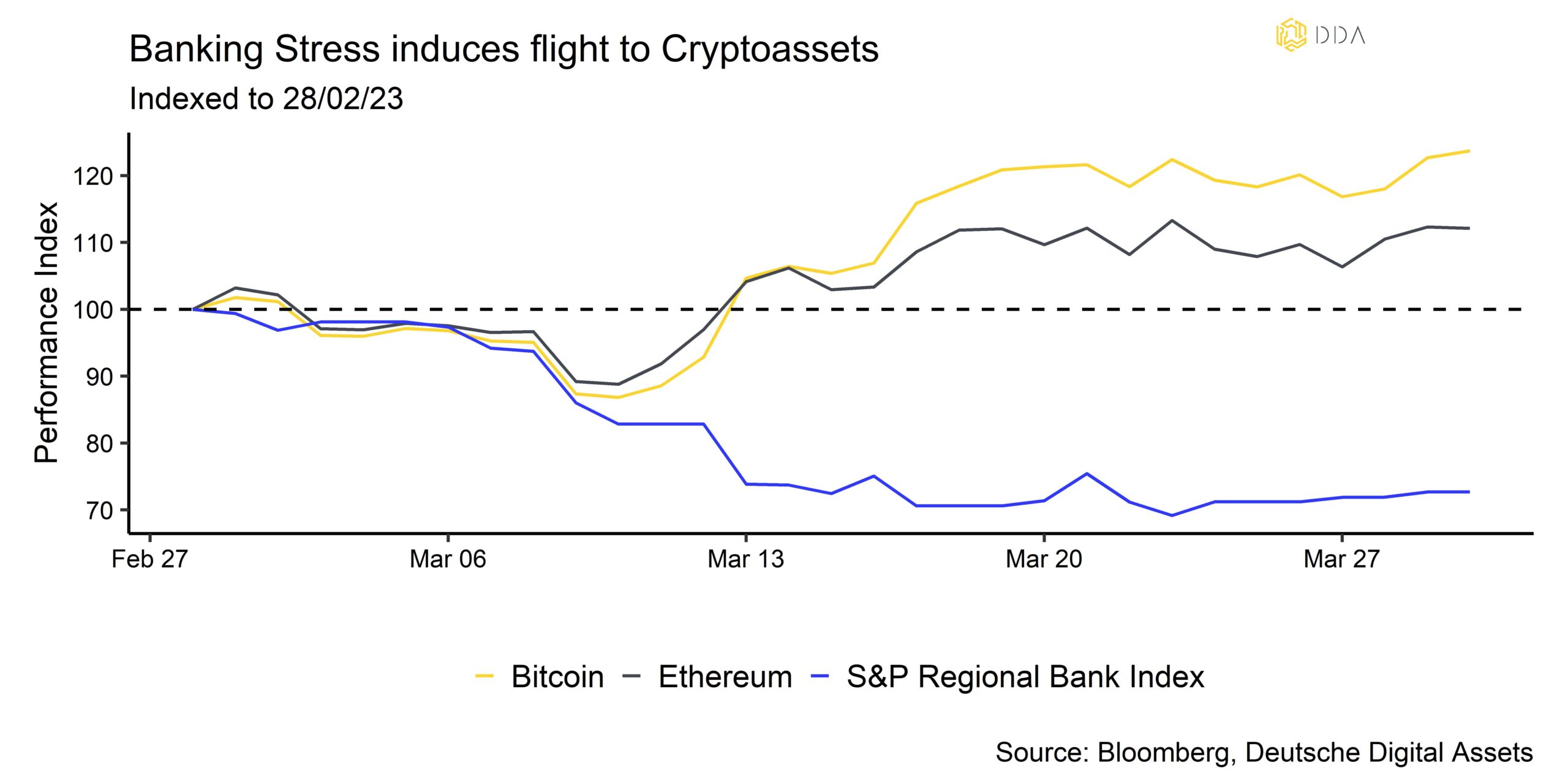

The good news for investors is that Bitcoin and other cryptoassets have significantly appreciated following these events in what some experts even described as a “flight-to-safety” into cryptoassets:

We think that the initial positive reaction by cryptoasset markets was justified for the following reasons:

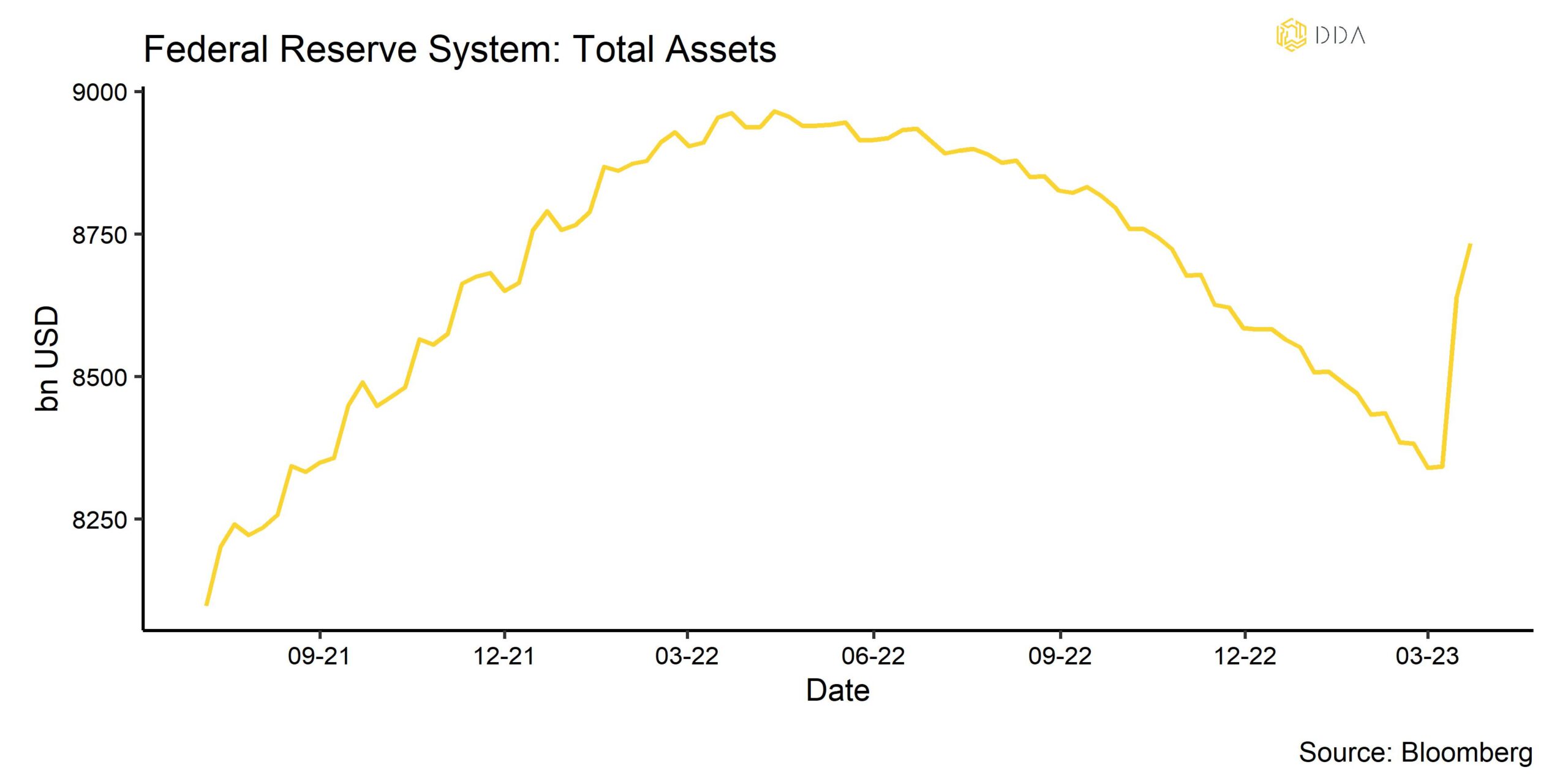

- The Fed has already expanded its assets again, reversing almost 2/3 of the tightening that has been done since mid-2022 (see chart below); bank reserves have also increased significantly which represents a de facto increase of liquidity in the banking system

- The fact that the Fed has already provided liquidity due to the stress in the banking sector implies that the classical “Fed Put” is still alive and well and that Quantitative Tightening has reached its limits, which makes a short-term return to outright easy monetary policy and interest rate reductions very likely.

- The fact that commercial banks already show first cracks despite still high inflation (6% in the US), implies that inflation will remain structurally higher in the next cycle which is net positive for scarce cryptoassets such as Bitcoin (cf. also our inflation deep dive on that topic).

- Cryptoassets and in particular Bitcoin are regarded as alternatives to the banking and monetary system as they represent unconfiscatable assets without counterparty risk – a flight into these assets makes sense given the counterparty risks associated with traditional banking deposits that are not fully backed.

Thus, the recent events in the banking sector might turn out to be a catalyst for a longer-term change in monetary policy which could provide a significant tailwind for cryptoassets going forward.

In fact, our in-house macro factor model implies that both monetary policy expectations and Eurozone Risk expectations are currently among the most dominant macro factors w/ respect to Bitcoin (see chart in the appendix).

This means that further loosening in monetary policy expectations and/or an increase in Eurozone sovereign risks will lead to a further appreciation of cryptoassets, and in particular Bitcoin.

Concerning monetary policy, this is also quite likely given the fact the recent banking stress is bound to tighten lending standards even further resulting in a further slowdown in credit growth. This is likely going to severe the upcoming US recession with the associated increase in unemployment. The Fed will then likely be forced (politically) to loosen monetary policy again. We have elaborated on the reasons why we think that the US is likely going to experience a recession in our last CMI report (see here).

Meanwhile real-time indicators of US CPI inflation such as the one published by Truflation are already signalling a US CPI inflation slightly above 4% (vs 6% government reported). This downtrend in inflation is expected to be amplified by a more pronounced US recession going forward.

Financial markets have already repriced the US Terminal Rate (expected peak in the Fed Funds Rate) downwards significantly coming from 5.6% in November 2023 before the SVB collapse to only 4.9% expected in May 2023. The market already expects around 50 bps in cuts until January 2024.

Nonetheless, despite the recent stress in the banking system, the Fed has delivered an additional hike in March of 25 bps but has changed its forward guidance significantly from “The Committee anticipates that ongoing increases in the target range will be appropriate…” in January 2023 to “The Committee anticipates that some additional policy firming may be appropriate…” in March 2023. Some central bank watchers have interpreted this as an indication for a pause in the Fed hiking cycle.

While banking stress appears to be contained for now, commercial real estate prices and CMBS prices have emerged as the next “bogeyman” among investors. This could turn out to be another risk factor which might prolong the banking crisis, especially since smaller US banks are generally overextended in terms of loans to this sector.

Apart from that, an increase in perceived Eurozone sovereign risks is less certain. However, the recent financial contagion of European banking institutions such as Credit Suisse or Deutsche Bank have somewhat increased European sovereign risks as well as there is historically a close connection between banking stress and sovereign stress due to the associated high costs of bank bailouts.

Thus, Eurozone sovereign risks could continue to increase as well in case of a continuing stress in the European banking sector.

What is even more is the fact that unrealized losses on the bond portfolio at the Federal Reserve itself might be higher than the paid in capital which might imply that the US central bank is already technically bankrupt (!) (see article here).

Although there is a clear technical distinction between bankruptcy and insolvency, the former not being so relevant for a central bank, this might imply a severe crisis of trust in the general banking system down the road. Investors should factor in this tail risk into their allocation decisions as well.

However, most Bitcoin price variations in the last 120 trading days cannot be explained by macro factors but rather coin-specific/non-macro factors (residual R^2 > 50%). This may be due to an increase in underlying network activity due to coin-specific developments such as inscriptions.

Bottom Line: The recent banking stress has induced a flight to cryptoassets. We think the initial positive reaction of cryptoassets to these developments was justified as a loosening in monetary policy has become more likely. This will provide a tailwind for Bitcoin and cryptoassets going forward. The resurfacing of Eurozone sovereign risks also appears to explain some variation in the price of Bitcoin lately. However, the majority of Bitcoin price variation cannot be explained by macro factors but rather coin-specific factors such as an increase in network activity.

On-Chain Analytics

Positive on-chain fundamentals were also largely supportive of the latest price increase across cryptoassets.

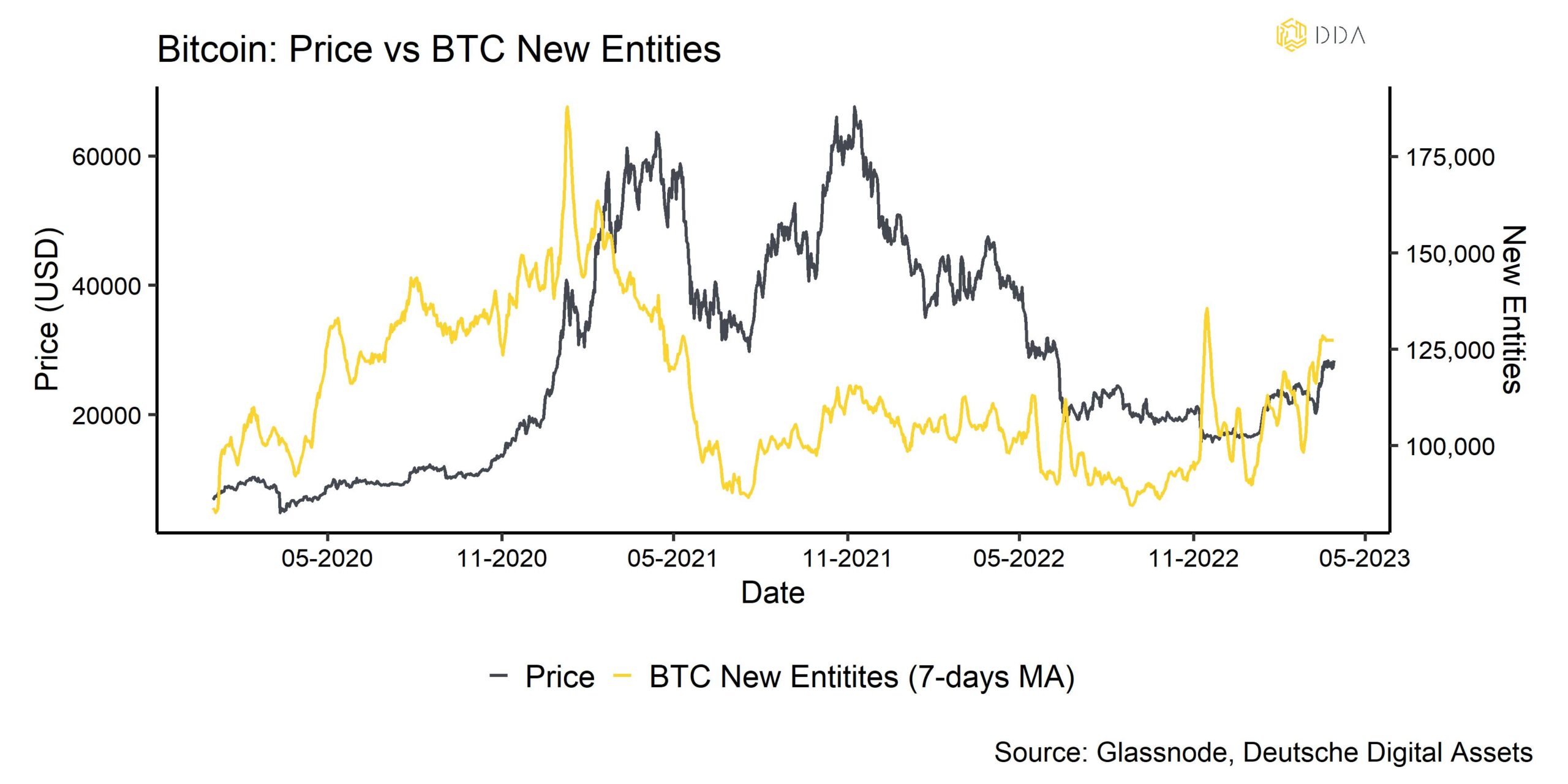

In general, there has been a continuous influx of new investors into Bitcoin lately, based on the number of new entities data provided by Glassnode:

The number of new entities represents the quantity of distinct entities that were seen for the first time during a native coin transaction in the network. Using sophisticated heuristics and Glassnode’s custom clustering algorithms, entities are calculated as groups of addresses that are under the control of the same network entity.

In other words, the recent price increase was also supported by an influx of new investors.

Bitcoin network activity has generally stayed relatively high as the number of inscriptions is still increasing rapidly. At the time of writing (30/03/2023), we have already seen the following developments with respect to Bitcoin inscriptions (data by Glassnode):

- 643941 total number of inscriptions (7.5 GB total file size)

- 58% of inscriptions are image files, followed by text inscriptions (41%); rest audio, video and other data types

- Share of block size claimed by inscriptions has fluctuated between 20% and 60% of the total block size since mid-February 2023

In general, structurally higher block sizes and total sizes of all transactions per day have continued in March due to these developments. Transaction sizes (in bytes) have also reached a new all-time high on 23/03/2023. So, network activity in terms data transferred via the Bitcoin blockchain remains very high.

Meanwhile, Bitcoin hash rate has increased to new all-time highs which has curtailed any increase in valuation metrics related to the marginal cost of production. In general, overall Bitcoin valuations still appear to be relatively low, despite the recent increase in prices (see appendix of this report). It is interesting to note that cryptoasset prices have increased despite the fact that fund flows were very weak during the month of March, which represented one of the weakest net outflows ever from publicly-listed cryptoasset ETPs (see also the latest CMP report in the appendix). This was also accompanied by an increase in Bitcoin exchange balances which usually imply selling pressure. Besides, the Beta of global hedge funds remained negative throughout March, implying that hedge funds maintained a net short position to cryptoassets.

Thus, the market was able to absorb these high negative flows in March with even higher buying volume.

Smaller wallet cohorts (below 1 BTC wallet size) appear to be the main accumulators throughout the last month while there was also some larger accumulation activity by some very large wallets (100000+ BTC).

Similarly, Ethereum has seen a continuous increase in new addresses since January 2023 which have recently picked up even more. The same can be said for the total number of transfers on the Ethereum blockchain. Overall, there has been a significant increase in Gas usage (transaction fees) by protocols related to Bridges such as Polygon which has increased to the highest level since June 2022.

NFT volumes have also picked up from January onwards but recently subsided again. The increase in Stablecoin Gas usage in March was mostly related to the recent increase in risk aversion towards stablecoins and the collapse of SVB which held fiat deposits USDC. Other types of transactions (plain vanilla, ERC-20, DeFi) do not appear to have picked up significantly, yet.

One of the major foci of Ethereum investors is the upcoming Shanghai-Capella Upgrade (aka “Shapella”) which is scheduled to be activated on April 12, 2023. This upgrade will allow staked Ethereum to be withdrawn which was not yet implemented with The Merge hard fork in September 2022 that changed the protocol from Proof-of-Work to Proof-of-Stake.

Concerning Ethereum Proof-of-Stake, there has not been a significant increase in the number of new validators in March. To the contrary, there was a significant amount of “voluntary exits” of validators on March 16 which took the cumulative count of voluntary exits above 1000. A voluntary exit is an event where a validator opts to cease participating in consensus and enters the exit queue. These validators no longer propose or attest to blocks, but the ETH stake cannot yet be withdrawn. These validators will be first to withdraw their staked Ethereum with the upcoming upgrade.

At the time of writing, 17.950 mn ETH are currently staked, i.e. have been deposited to the ETH2 deposit contract. These represent approximately 14.9% of the current circulating supply of Ethereum.

Option traders currently do not price options ETH options expiring after the upgrade significantly higher than before the upgrade. For instance, weekly ETH options expiring on the 14th of April are currently trading at 57% implied volatility while options expiring a week earlier (7th of April) are priced at 54% implied volatility. So, ETH option traders do not appear to expect a significant pick-up in volatility after the upgrade. This is probably due to the fact that earlier staking withdrawal tests have so far shown to be successful.

Nonetheless, Ethereum has recently significantly underperformed Bitcoin, despite the fact that the current net supply growth of Ethereum is currently negative -1.5% p.a. versus +1.8% p.a. for Bitcoin.

This price action appears to be related to the increased regulatory uncertainty in the US regarding the potential classification into a security.

Consider the following events:

- The SEC has recently accused private individuals such as Lindsay Lohan of unlawful promotion of cryptoassets in the US

- The SEC has recently filed a lawsuit against Tron (TRX) founder Justin Sun, alleging market manipulation and fraud

- Coinbase has received a so-called “Wells Notice” from the SEC, cautioning of potential securities law violations

- The CFTC has sued Binance, alleging the exchange operated illegally in the US and violated rules designed to prevent illicit financial activity

In consequence, Binance has recently experienced significant outflows from its exchange again due to increased regulatory uncertainty.

It appears that “Operation Chokepoint 2.0” on the US crypto industry is well under way as some experts have warned in advance. In light of these developments, Ethereum founder Vitalik Buterin has recently emphasized that Ethereum is not a security.

This will set the US crypto industry back even further as many other jurisdictions such as Germany, UK or Hong Kong have simultaneously announced further steps to foster additional innovation and investments into their respective cryptoasset industries.

Due to the arbitrary and intransparent regulatory landscape, the US risks that cryptoasset companies might move off-shore to other more crypto-friendly jurisdictions such as Europe or the Middle East.

In any case, this is likely going to be a continuing risk factor for cryptoasset markets this year and implies that investors should overweight cryptoassets that are less likely to be deemed a security by US regulators such as Bitcoin vis-à-vis other cryptoassets.

That being said, we are entering a positive phase of the cycle as the upcoming Bitcoin halving (expected April 2024) already tends to become anticipated from a seasonality perspective. This should provide a continuous tailwind in the coming months.Bottom Line: Positive on-chain fundamentals were also largely supportive of the latest price increase across cryptoassets. This is true for both Bitcoin and Ethereum. The upcoming Shapella upgrade for Ethereum is unlikely to cause any significant increase in volatility based on option prices. Meanwhile, “Operation Chokepoint 2.0” is well under way which increases regulatory uncertainty in the US.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.