by André Dragosch, Head of Research

Key Takeaways

- February: Cryptoasset prices torn between positive on-chain fundamentals and longer than anticipated tightening in US monetary policy

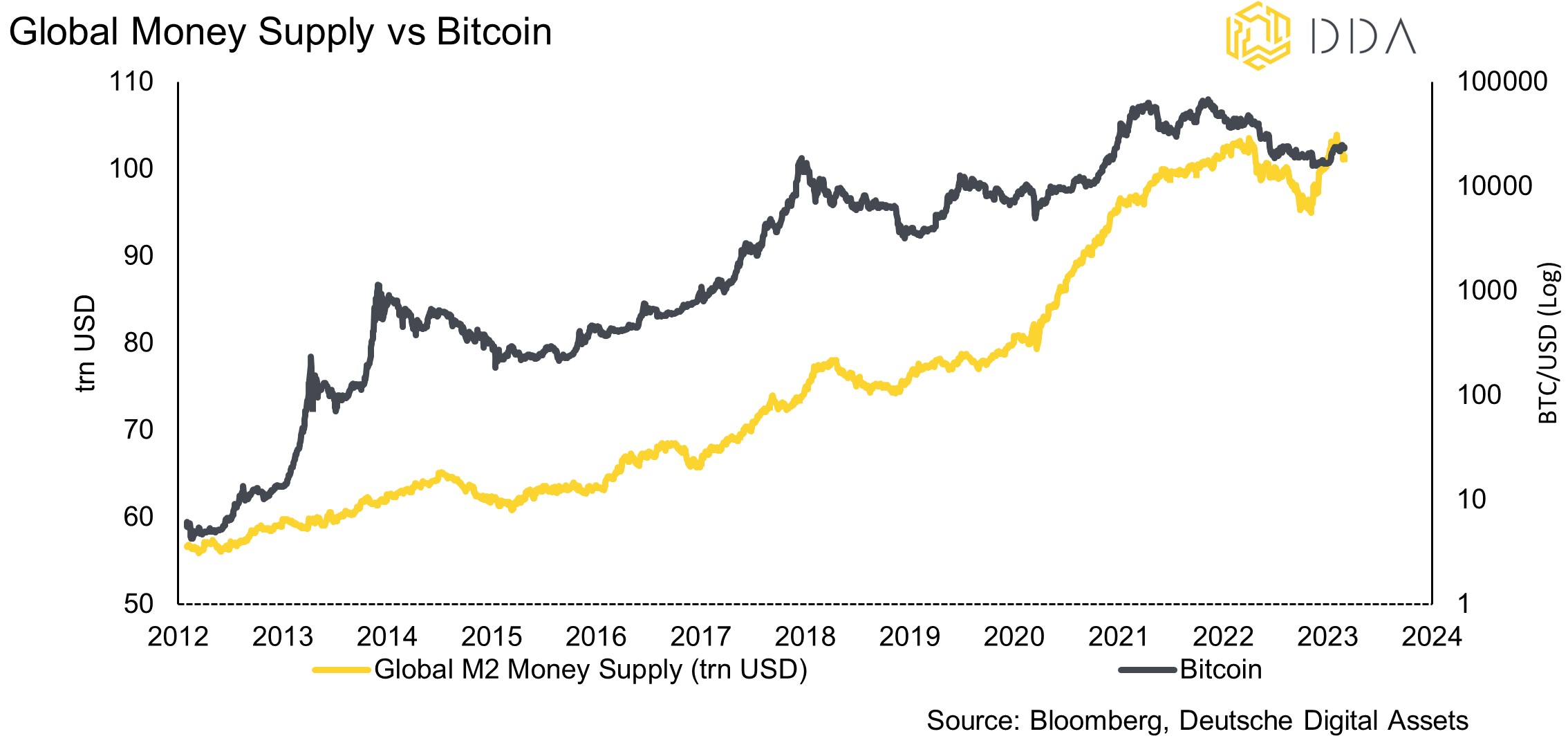

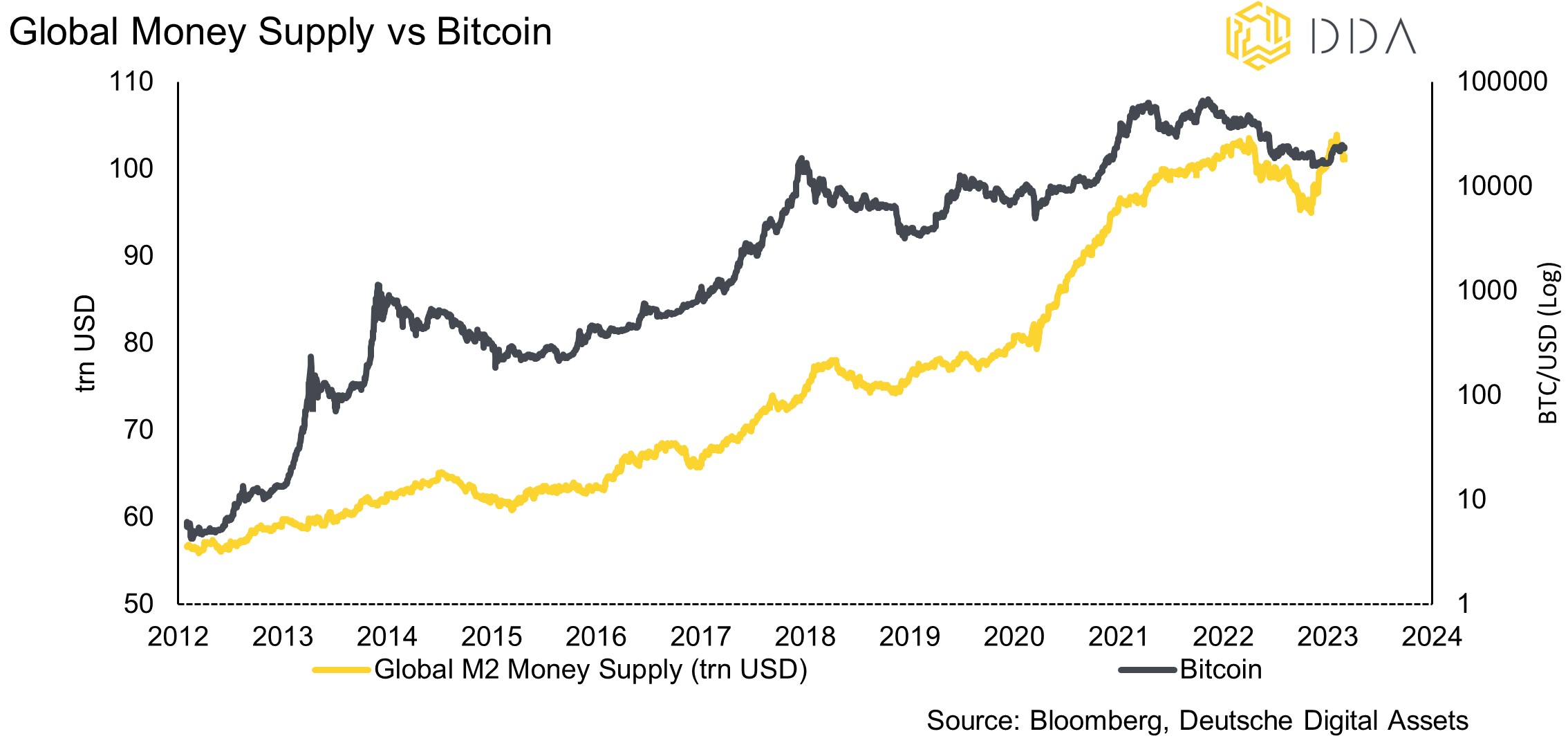

- While the tightening in US and EU monetary policy should weigh on liquidity, the recent Chinese Re-Opening and quantitative easing seems to have supported a rise in global liquidity

- Many on-chain indicators imply that we might be at the cusp of a new bull market including higher market profitability, higher network activity and an influx of new investors

Chart of the month

Cryptoasset Performance

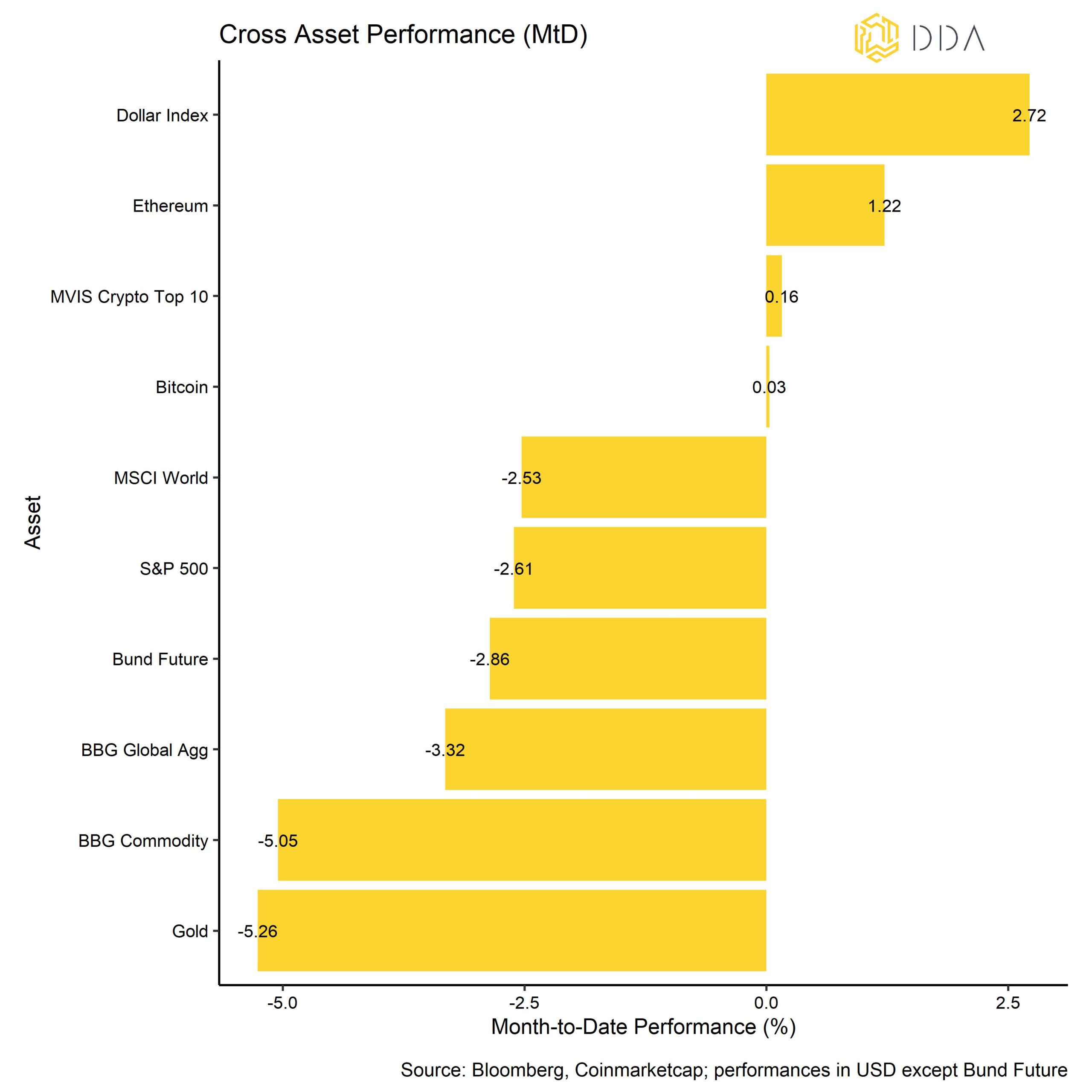

Cryptoasset prices were mostly flat during February, as the market has been torn between positive on-chain fundamentals and the outlook for a longer than anticipated tightening of the Federal Reserve. The Dollar was the best-performing asset class due to an increase in US interest rates that significantly weighed on traditional financial assets such as stocks or bonds. Gold was also significantly under pressure due to the repricing of Fed rate hike expectations.

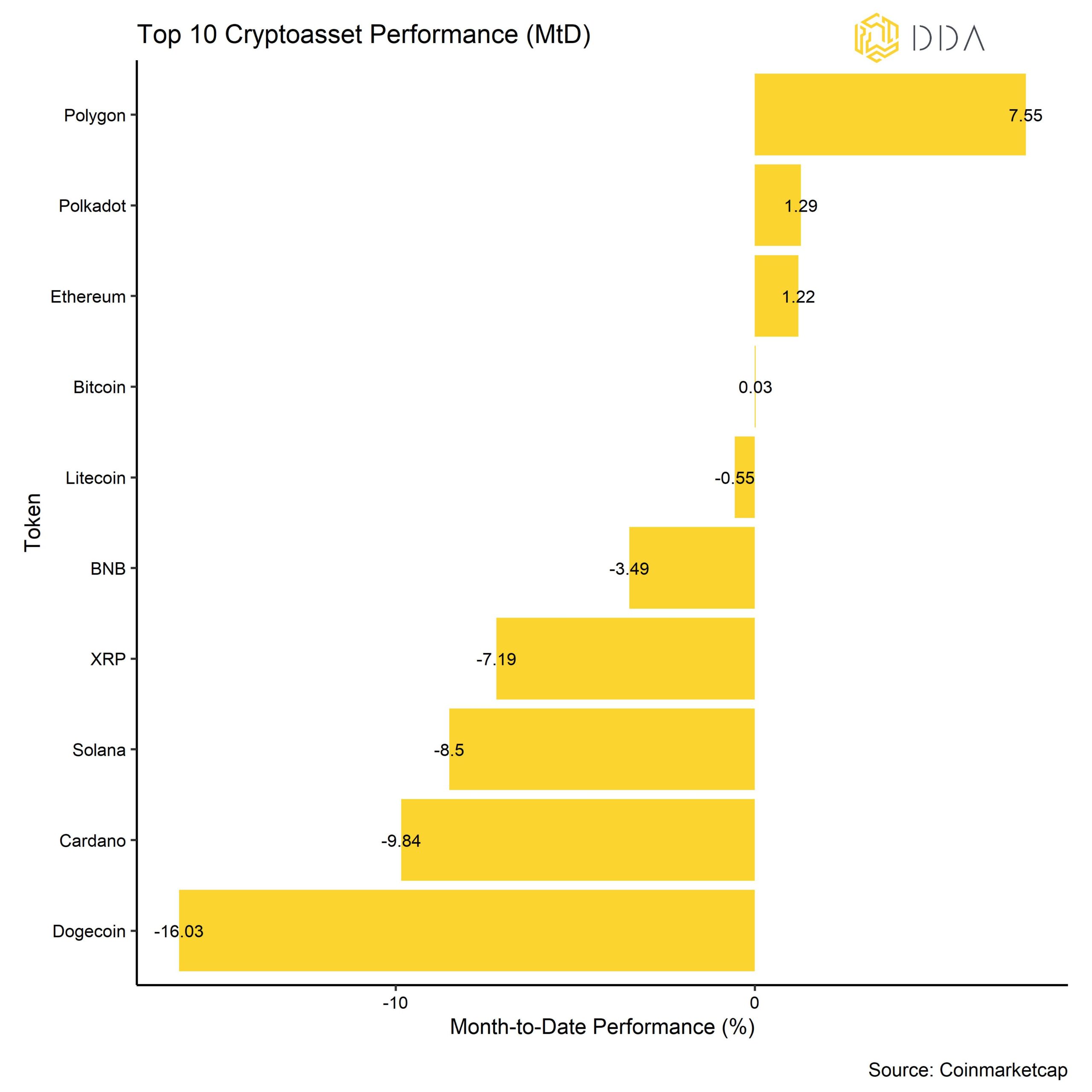

Among the top 10 major cryptoassets, Polygon, Polkadot, and Ethereum have been the main outperformers. Altcoin outperformance has recently increased and was briefly above 50% for our tracked set of altcoins on a 1-month basis. At the same time, crypto dispersion has been constantly falling, implying that cryptoasset performances were mostly driven by systematic factors rather than coin-specific factors. Bottom Line:Cryptoasset prices were mostly flat during February, as the market has been torn between positive on-chain fundamentals and the outlook for a longer than anticipated tightening of the Federal Reserve.

Macro & Markets Commentary

After the Fed delivered a 25 basis points rate hike as expected, it essentially failed to push back against recent loosening of financial conditions priced by financial markets and appeared to be content with the overall tightening in financial conditions since last year. This has led to a general appreciation of prices across all asset classes at the beginning of the month.

However, during February, we have received an array of hard and soft data releases from the US that were mostly above consensus expectations. For instance, the ISM Services Index, University of Michigan Consumer Sentiment, Empire Manufacturing Index and US Retail Sales all surprised positively to the upside which supported the view of a potential “soft landing” of the US economy. In this context, a soft landing implies a mild recession of the US economy with only mild impact on corporate earnings growth. In consequence, economic surprise indices such as the one by Citi increased to the highest reading since April 2022.

Despite this, we remain in the US recession camp for the time being on account of the following reasons:

- We have seen one of the most significant inversions of the US Treasury yield curve – yield curve inversions are historically one of the most reliable forward-looking US recession indicators

- Other forward-looking indicators are also signaling a US recession such as the ISM Manufacturing New Orders Index or the Leading Economic Indicator published by the Conference Board

- Based on a variety of surveys, US credit conditions are seen very unfavorable and are likely still going to feed through the economy

- the housing market downturn inflicted by the spike in mortgage rates still needs to feed through to construction employment figures which are usually a precursor to total employment data; housing affordability is already the worst ever according to estimations by Goldman Sachs

- labor market data such as non-farm payroll employment figures are lagging economic indicators and are subject to revisions. More forward-looking employment indicators such as layoff announcement still signal a significant increase in unemployment in the coming months; this is also corroborated by the recent increase in Google search queries of “filing for unemployment”.

A key point to make here is the observation that expectations for the Fed rate hiking path have recently increased on account of these improvements in economic data. Thus, it implies that the market expects Fed tightening to continue for longer than previously anticipated. More specifically, the so-called “Terminal Rate”, ie the Fed Funds Rate at which the market expects the Fed hiking cycle to peak, has been repriced up by more than 50 Bps to around 5.40% in September 2023 on account of recent economic data surprises.

However, this also implies that the negative effects on the economy will prevail. Thus, there is some element of reflexivity in this latest market reaction – no recession now may just mean a deeper recession later on account of continued monetary policy tightening and a further rise in yields.

Another major talking point is the Chinese Re-Opening. In fact, recent data releases from China were mostly above consensus and also support the view of an ongoing reacceleration of growth in China. We have seen further confirmation this morning, with the Caixin Manufacturing PMI rising to the highest level since April 2012. Moreover, recent credit data released for January imply a very significant pick-up in lending activity in China. Usually, the Chinese credit cycle leads global industrial activity and commodity prices by around 6 months. So, the recent uptick in Chinese credit data is likely going to support the Re-Opening narrative for most of this year which should be net positive for risk assets and cryptoassets in general. However, January and February are usually quite volatile data releases due to the Chinese New Year festivities which is why one should wait for confirmation in the coming releases. High-frequency data such as travel activity within China also point to a sharp reversal of Covid-restrictions. Moreover, we have seen a significant pick-up in liquidity injections by the People’s Bank of China (PBoC) which should also support the ongoing Chinese recovery.

In this context it is interesting to note that global liquidity measures have been increasing since late last year already. This happened despite the ongoing monetary tightening efforts by the Fed and the ECB. The current quantitative easing in China should also support this development further.

So far, the Chinese Re-Opening has led to an increase in cyclical commodities such as copper and global inflation expectations which could complicate the overall assessment of the effects on cryptoasset markets. Nonetheless, we expect a US recession to play out only later than previously expected which would be consistent with significant Fed easing of monetary policy down the road. In combination, with a reacceleration in Chinese growth, this could lead to a pronounced weakness of the US Dollar which should ultimately be a boon for cryptoassets.

Bottom Line: Forbearance is not acquittance: Despite recent positive data surprises in the US, we remain in the US recession camp for the time being on account of a variety of reasons including the inversion of the yield curve and other signals from forward-looking leading indicators. This would be consistent with significant Fed easing down the road. In combination with an ongoing reacceleration of Chinese growth momentum, this could ultimately lead to a pronounced Dollar weakness which should be a boon for cryptoassets.

On-Chain Analytics

Last month positive cryptoasset performance continued in February as well but the reasons behind the outperformance appear to be more nuanced this month. While January saw lots of evidence for institutional buying interest in cryptoassets as we have previously lined out, February rather saw an overall increase in network activity which was mostly driven by renewed retail interest.

In the case of Bitcoin, this was mostly due to the increase of so-called “inscriptions” which represent non-fungible tokens (NFTs) on the Bitcoin blockchain. Data files that have been inscribed onto the Bitcoin blockchain range from simple images, to audio files and even video games.

These Inscriptions, which differ from NFTs discovered on other chains, are best characterized as digital artifacts. NFTs are typically found on Ethereum or Solana and are one-of-a-kind tokens that carry a reference pointer to the target file, which is typically a file hosted elsewhere, like a picture file. Cloud servers, IPFS, and file-storage blocks are just a few examples of the hosting services available; each has its own counterparty risk trade-offs and is exclusive to each NFT coin. On the other hand, inscriptions are relatively distinctive in that they really contain the raw file data, recorded straight into the Bitcoin network.

The Bitcoin community is still in disarray and there are still fundamental discussions surrounding this non-monetary use case of the Bitcoin blockchain.

On the one hand, the proponents of this new type of use-case claim that Bitcoin, as a permissionless censorship-resistant protocol should be used for any use-case wanted as long as miners are rewarded with a fee.

On the other hand, opponents of inscriptions claim that this might increase fees and settlement times for essential monetary transactions, especially for individuals in developing countries. Besides, this could possibly open the door for a potential attack vector by a hostile player that could clog the network with unessential inscriptions.

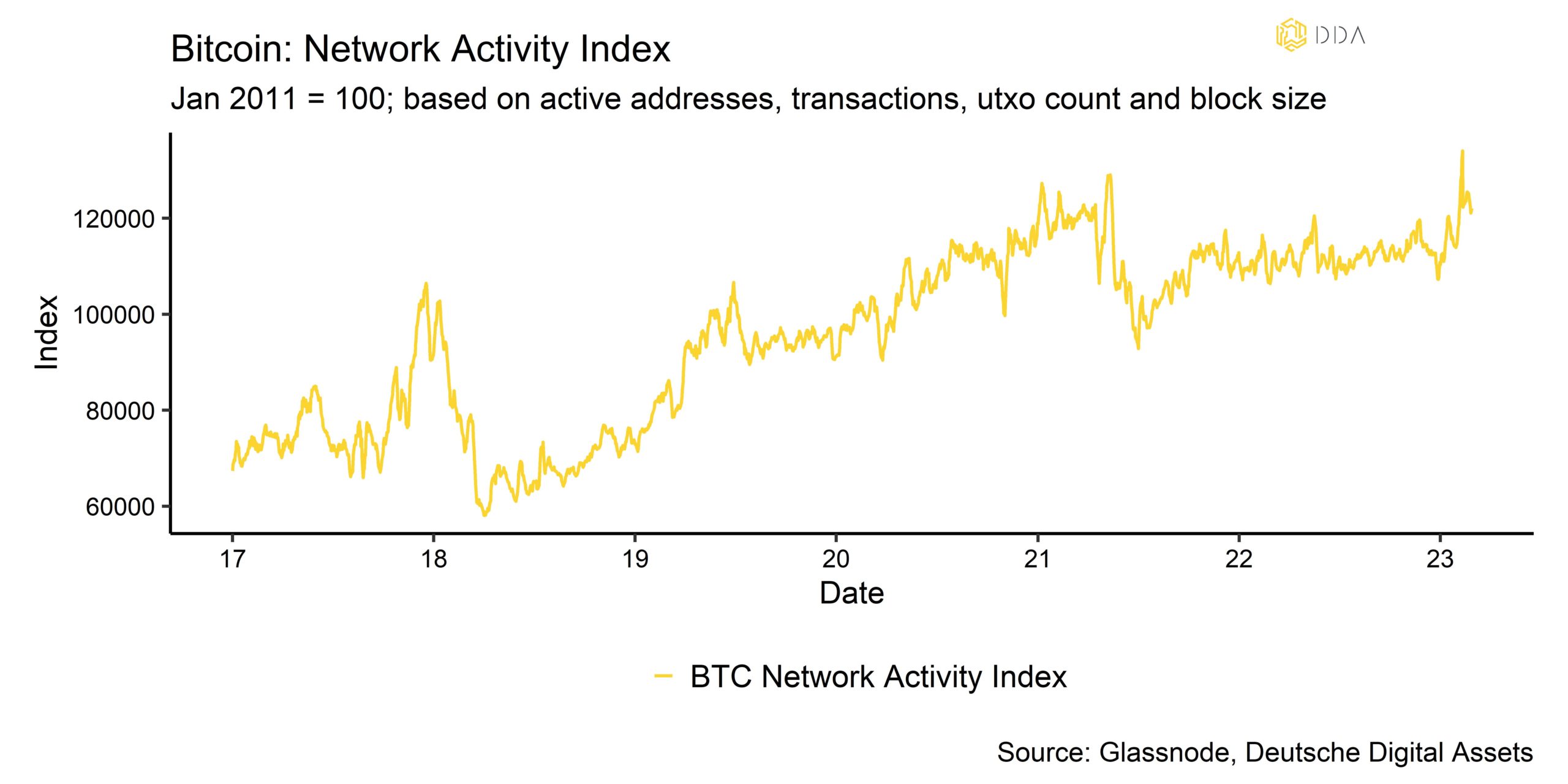

The good news for investors is that overall network activity has increased significantly because of this new emerging trend:

An increase in network activity is also usually associated with an increase in price as the overall value of the network increases with more network participation and utility. In the case of Bitcoin, the recent increase in network activity is mostly due to an increase in transaction count and block size as inscriptions usually take more space in any Bitcoin block.

Inscriptions are likely going to continue to increase retail participation for Bitcoin and could be a significant value-driver like in other blockchains such as Ethereum or Solana where NFT transactions contributed to a significant portion of value transacted.

For example, in the case of Ethereum, NFT transactions currently account for roughly 25% of Gas usage/transaction fees paid and roughly 15% of transaction count relative to other types of transactions. Some on-chain analysts claim that the emergence of NFT transactions on the Ethereum blockchain from mid-2021 onwards, has put a significant support on the price during the bear market as overall network usage had been significantly lower without NFTs.

By type of inscriptions, images currently are the most prominent data type inscribed onto the Bitcoin blockchain, followed by simple text messages. So far, as a result of inscriptions, the Bitcoin Mempool is now significantly less congested and is filled with many transactions that pay extremely cheap fees—typically 1-2 sat/vByte.

The thesis that the increase in inscriptions/NFTs has been the main driver behind the latest break-out is also supported by the fact that Taproot adoption rates have significantly increased lately. The Taproot soft fork upgrade has enabled inscriptions in the first place so utilization is an indicator of increased inscriptions.

Apart from the inscription trend, we have seen a variety of positive on-chain developments that have clearly increased the probability of a new bull cycle.

Consider the following developments:

- Prices are trading above Realized Price both for short-term and long-term holders of Bitcoin

- New Addresses Momentum has recently picked up as overall network activity has increased and new users are joining the network

- On-chain spends are now, on average, profitable for the market. This typically corresponds with a stronger inflow of demand (to absorb profit taking) as well as a more positive assessment of the asset.

- Realized P/L Ratio’s also turned positive at the start of the year. A Realized P/L Ratio breaking and holding above 1.0 indicates that the market is now realizing a bigger proportion of profits and losses in USD than losses. This typically indicates that sellers with unrealized losses have run out of options and that there is a stronger influx of demand to counteract profit-taking.

- Some indicators such as the RHODL multiple are signaling more participation of short-term vs long-term investors; short-term investor participation (which is mostly retail-driven) is usually one of the necessary conditions for a new bull cycle

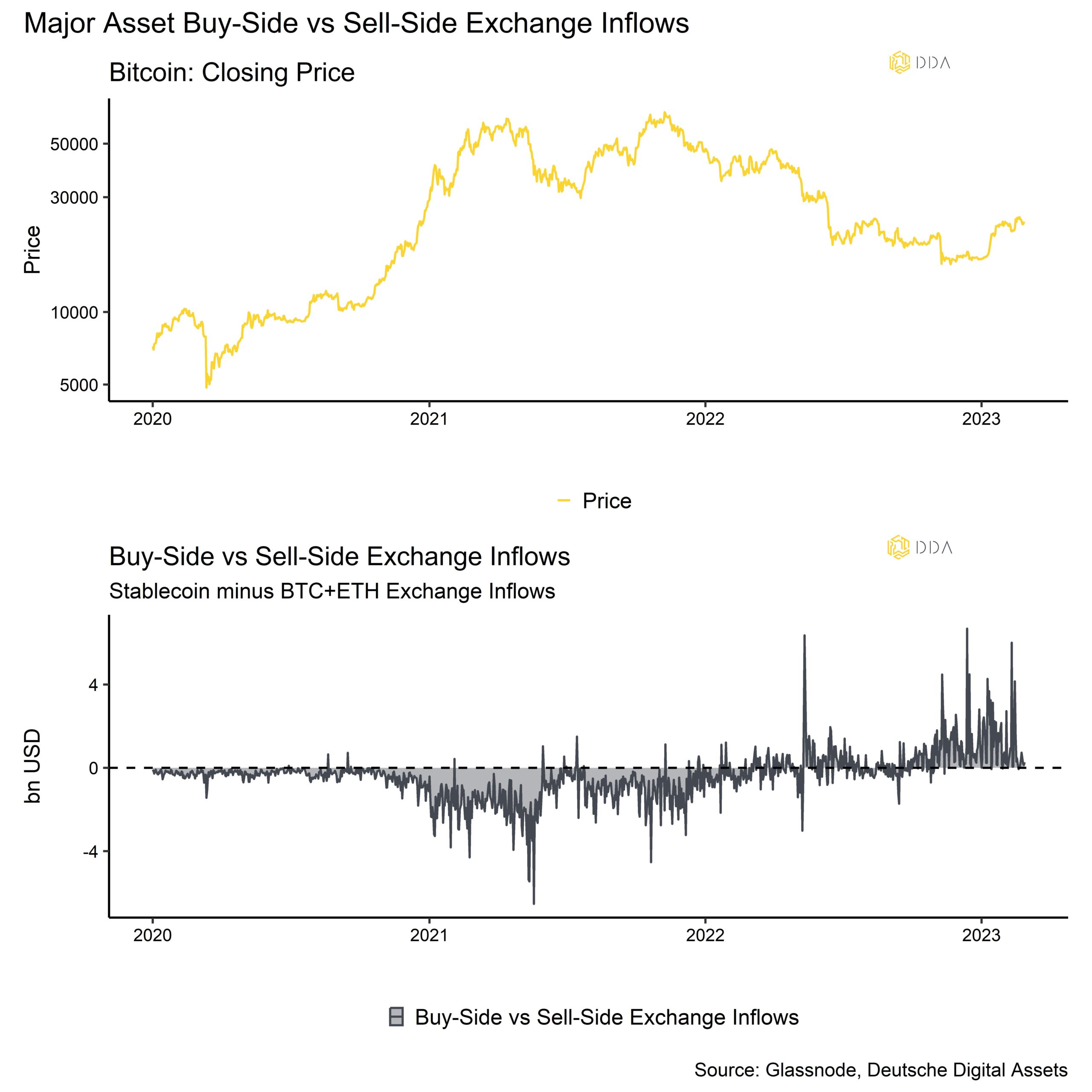

The increase in global liquidity is also showing up in on-chain analytics in the way that stablecoin exchange inflows now outweigh Bitcoin exchange inflows which implies an increase in potential buying power/”dry powder” for cryptoassets going forward.

All in all, spot prices have started trading above key thresholds (both technical and on-chain), the use of the network is accelerating (higher on-chain activity, increased network congestion, more fee revenue), market profitability has returned, and the balance of wealth is mostly on the side of long-term holders who can now start distributing their holdings to new short-term (retail) market participants. At the same time, we are seeing increasing exchange liquidity which should also support cryptoasset prices going forward.

Bottom Line: Bitcoin prices have been recently propped-up by increased network activity due to the increasing usage of inscriptions. Many on-chain indicators imply that we might be at the cusp of a new bull market including higher market profitability, higher network activity and an influx of new investors. At the same time, on-exchange buy-side exchange inflows relative to sell-side inflows have been increasing which should also support cryptoasset prices going forward

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.