The Bitcoin stock-to-flow model has been a popular prediction metric for the price of Bitcoin. But how accurate is it really?

Numerous Bitcoin valuation methods have emerged to help investors to determine where the price of Bitcoin should be trading. However, none of the valuation methods has been as prolific as the Bitcoin stock-to-flow (S2F) model, which attempts to predict Bitcoin’s price based on its supply and production.

In this guide, we’ll explore the stock-to-flow model to determine how accurate it really is.

What is the Bitcoin Stock-to-Flow Model?

Created by a pseudonymous Bitcoin investor known as PlanB on Twitter, the Bitcoin stock-to-flow model compares the current stock (supply) to its annual production rate. A high ratio indicates scarcity, which should result in a high price.

PlanB first published the bitcoin stock-to-flow model in March 2019.

The S2F model has previously been used to predict the price of gold and silver. These two assets are scarce and expensive to produce, just like Bitcoin. That explains why the model has been adopted in forecasting the price of Bitcoin.

Bitcoin is an extremely scarce asset (there’ll only ever be 21 million coins) and this scarcity largely drives its value. The stock-to-flow ratio aims to predict Bitcoin’s value by evaluating its scarcity.

How Does the Stock-to-Flow Model Work?

The stock-to-flow model uses a simple formula where you divide the current supply (stock) of an asset by its yearly production (flow).

S2F = Stock (existing stock pile) / Flow (annual production)

When you divide Bitcoin’s current circulating supply by the annual rate of new coins entering the supply, you get the Bitcoin stock-to-flow rate.

At the time of writing this article, the total Bitcoin supply is 18,952,362 while the annual production is 328,500BTC. The annual production is calculated by multiplying the 900 BTC mined per day by 365 days. About 900 BTC are mined daily, which is calculated by multiplying the number of blocks mined per day (144) by the current block subsidy of 6.25 BTC.

Currently, tThe Bitcoin S2F ratio stands at 57.69. That means that it would take about 57 years to mine the current Bitcoin supply without taking into account the halvings and the maximum supply.

The S2F ratio has been increasing over the years as the rate of new supply has declined. For instance, the ratio was approximately 25 in 2019 (17.5 million/700,000). Today, it stands at around 57.

But how can investors use this value to make decisions?

The consistent rise in the S2F ratio (as rate of new supply drops) suggests that the upward price trend of Bitcoin should continue. Therefore, investors could surmise that the next Bitcoin block reward halving in 2024 (which will reduce the new supply further) will boost Bitcoin’s price, encouraging accumulation before the next halving.

How Has the Stock-to-Flow Model Performed?

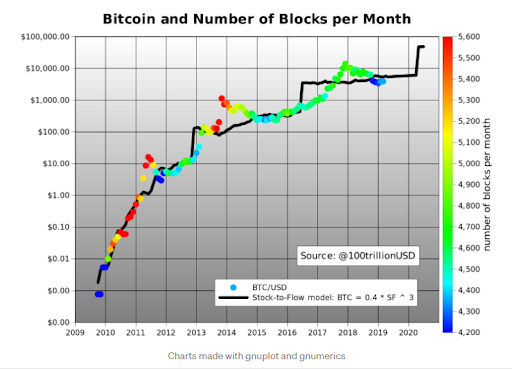

Historically, the Bitcoin stock-to-flow model has come close to predicting bitcoin’s price accurately, as indicated in the chart below. PlanB published this chart in 2019.

The black line represents the bitcoin model price based on S2F. The BTC/USD dots on the graph that represent the actual Bitcoin price aren’t plotted too far from the black line. For instance, the Bitcoin price was slightly below the predicted price in 2019.

Plan B predicted in a 2019 Medium article that the market value of Bitcoin would hit $1 trillion after the May 2020 Bitcoin halving. He also forecasted that this would translate to a price of $55,000.

About nine months after the halving, these were the headlines in the media:

According to data from CoinMarketCap, Bitcoin traded at a new high of $56,113.65 on February 19, 2021. Therefore, the S2F forecast was very close to Bitcoin’s actual price.

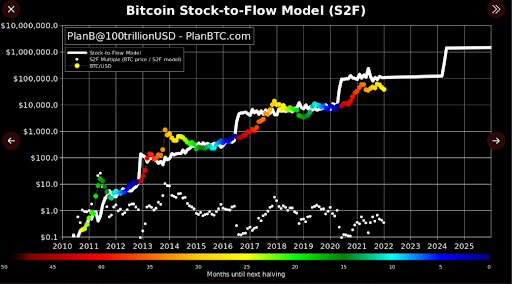

However, looking at PlanB’s S2F chart that features 2021 and beyond, we can see that the accuracy of the model has dropped.

According to the chart, bitcoin’s price should be $100,000 in 2022 but is currently at around $43,000 (February 9, 2022). At the close of January 2022, Bitcoin was trading 62% below the S2F target.

Why is S2F Suddenly So Far Off?

Experts believe that more factors have come into play. For example, there has been a dramatic increase in demand since PlanB first published the bitcoin S2F model in 2019. Institutional and retail investors have flooded the market, boosting bitcoin adoption. Moreover, NFTs gained mainstream popularity in 2021, attracting more people to the crypto markets.

While this demand has been good for the price of Bitcoin, it has made some regulators speed up the implementation of strict crypto regulations, for example, in China.

That means that assessing bitcoin’s scarcity alone is not enough.

PlanB’s S2F model predicts that Bitcoin’s price soars tenfold with each halving based on the cryptocurrency’s performance in its first ten years. However, that prediction hasn’t been achieved lately since Bitcoin is yet to surpass the $70,000 mark on its way to $100,000. However, we’re only in the second month of 2022 and anything can happen.

All in all, the stock-to-flow model has been fairly accurate if you zoom out far enough when looking at the chart overlay. However, investors cannot use S2F to accurately predict where the price will head in the coming months.

Instead, the S2F can only be used as an additional explanation for investors who are looking to make sense of why one Bitcoin is worth so much.

About DDA

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure (crypto ETP’s, diversified crypto index funds, and alpha-seeking strategies for investors), as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Recent News

- DDA Acquires Licensed Company to Become Regulated Crypto Portfolio Manager and Advisor

- How Layer 2 Solutions Are Helping Ethereum Scale

- Bitcoin Education Will Pave the Way for Hyperbitcoinization

- DDA lists Ethereum ETP on Xetra

DDA in Press

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, DDA Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

- How did portfolios perform during the pandemic? ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedigitalassets.com

Legal Disclaimer

In no event will you hold DEUTSCHE DIGITAL ASSETS GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

DEUTSCHE DIGITAL ASSETS GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond DEUTSCHE DIGITAL ASSETS GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

DEUTSCHE DIGITAL ASSETS GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.