Performance in Focus: Positive AuM Growth Driven by one Primary Market Creation and Market Sentiment- DDA Crypto Select 10 ETP

By Dominik Poiger, Chief Product Officer, DDA

Key Takeaways

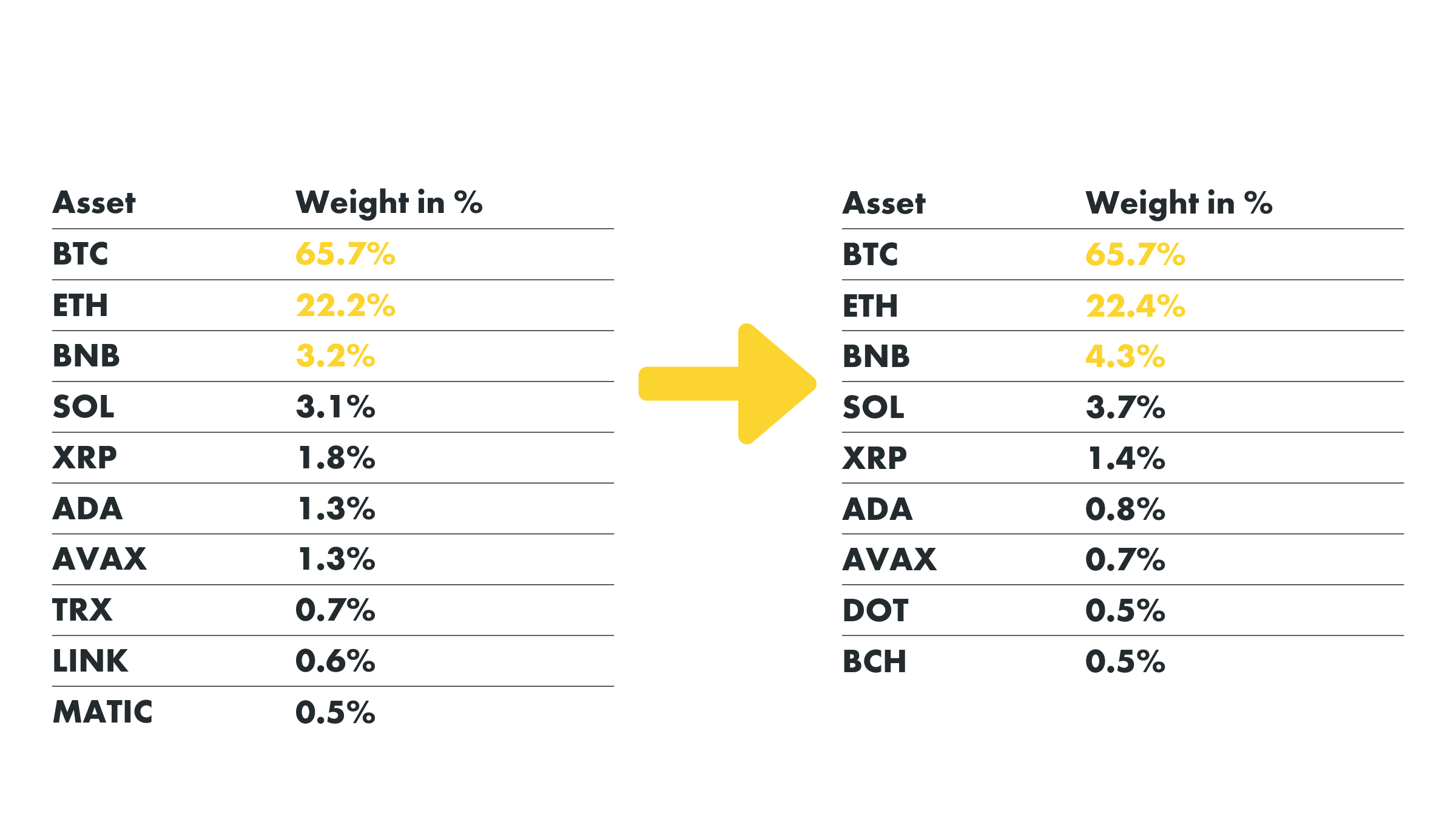

- Index and product rebalanced at 17:00 CET, 31 May 2024

- Polygon (“MATIC)”, Chainlink (“LINK”), Tron (“TRX”) were removed from the index, Bitcoin Cash (“BCH”) and Polkadot (“DOT”) were added

- AuM grew from USD 24.5M to USD 26.7M

- Diversification into altcoins makes sense but bitcoin should be the core holding

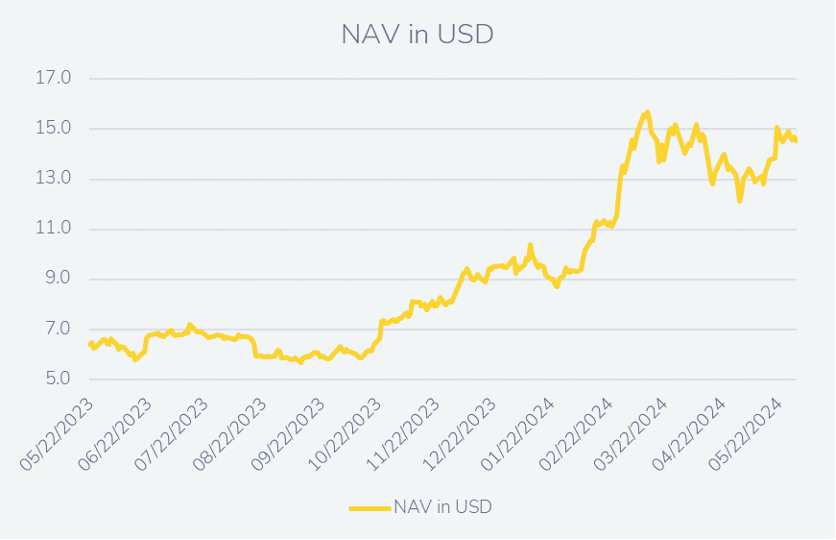

The DDA Crypto Select 10 ETP went through its third rebalancing since DDA incepted and listed the product on Deutsche Börse Xetra on 22 June 2023. The index provider MarketVector released its quarterly review of digital assets indices on 26 May 2024, including the MarketVector Digital Assets Max 10 VWAP Close Index (“MVDAMV”), the underlying index for the DDA Crypto Select 10 ETP.

According to the index methodology, the index was then rebalanced to its new target composition at the end of 31 May 2024. Find out more about the index and index methodology here:

New Allocation as of 31 May 2024

Source: DDA, MarketVector, data as of 31 May 2024

Bitcoin Cash (BCH) and Polkadot (DOT) Added to the index, Polygon (MATIC), Chainlink (LINK) and Tron (TRX) Removed

The index showed some turnover with Tron, Chainlink and Polygon being removed from the index while Bitcoin Cash and Polkadot were added to the index.

Polkadot is an open-source sharded multichain protocol that connects and secures a network of specialized blockchains, facilitating cross-chain transfer of any data or asset types, not just tokens, thereby allowing blockchains to be interoperable with each other. Polkadot was designed to provide a foundation for a decentralized internet of blockchains, also known as Web3.

Polkadot is known as a layer-0 metaprotocol because it underlies and describes a format for a network of layer 1 blockchains known as parachains (parallel chains). As a metaprotocol, Polkadot is also capable of autonomously and forklessly updating its own codebase via on-chain governance according to the will of its token holder community.

DOT was added to the index at a 0.49% weight.

Simultaneously, Bitcoin Cash was added to the index at a 0.45% weight.

Bitcoin Cash (BCH) is a peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy and larger block size. As a permissionless, decentralized cryptocurrency, Bitcoin Cash requires no trusted third parties.

Bitcoin Cash was created as an alternative to the first and most valuable cryptocurrency — Bitcoin (BTC). In 2017, BCH developers modified the BTC code, releasing their software version and a full-fledged competitive product, which split Bitcoin into two blockchains: Bitcoin and Bitcoin Cash. Bitcoin Cash is a result of a hard fork in the blockchain due to differences in the community over Bitcoin scaling and the SegWit upgrade. Moreover, another hard fork, which divided Bitcoin Cash into two parts, Bitcoin ABC and Bitcoin SV, took place in the fall of 2018.

The scaling debate involved two sides: small block supporters opposed increasing block size as it could lead to blockchain centralization and vulnerability by making it harder to host full nodes. Large block supporters, however, advocated for a faster solution, concerned that rising transaction fees could hinder growth.

Polygon, Chainlink and Tron have been underperforming and have been – according to the index rules – removed from the index. Consequently, the index is now only composed of 9 assets. This is due to the fact that the index universe is driven by the MarketVector Digital Assets 10 Index, which also includes coins that do not qualify for ETP underlyings on Deutsche Börse Xetra (The Open Network (“TON”) is currently not eligible on Deutsche Börse Xetra).

Positive AuM Growth Driven by one Primary Market Creation and Market Sentiment

May started by a phase of post-halving consolidation; miners’ revenue have been mechanically cut in half with the halving and less efficient miners are currently suffering and selling their stock to survive. Some others have purely switched off their hardware, waiting for the end of this consolidation phase that generally lasts about 100 days.

Then the market suddenly started to rise again with the surprise approval of Ethereum ETFs in the US. This sudden turnaround, prompted by the high proportion of pro-crypto voters in the swing states, took many people by surprise. It is fascinating to see how quickly the United States has managed to move from an anti-crypto to a pro-crypto policy. The fact remains that Ethereum ETFs will be springing up from now on, and a few months later US institutional investors will have access to them.

On the macroeconomic front, inflation looks set to pick up again. Central banks, and the FED in particular, are faced with a dilemma: interest rates appear to be too low to bring inflation back in line with their targets, but they are also too high given the mountain of debt that needs to be rolled over soon and the additional costs that this entails for governments. A more lax stance on inflation to support the economy seems the most plausible outcome and would provide a particularly favorable environment for crypto-currencies in general, and bitcoin in particular.

Performance of DDA Crypto Select 10 ETP

| 1M | 3M | 1Y | 3Y | YTD | Since Inception* | |

| DDA Crypto Select 10 ETP | 13.9% | 7.4% | 125.8% | n/a | 53.2% | 127.4% |

The top performing coin (as over the last observation period) was Binance Coin (“BNB”) with +45.4%.

| Top 3 | Performance in % since last rebalancing (or inception) |

| BNB | 45.4% |

| SOL | 26.5% |

| ETH | 8.8% |

| Bottom 3 | Performance in % since last rebalancing (or inception) |

| ADA | -35.4% |

| MATIC | -33.6% |

| TRX | -21.5% |

There is no Second Best? The Advantages and Disadvantages of Portfolio Diversification

When investing into cryptocurrencies, it is important to consider that diversification – as in traditional capital markets – delivers a net benefit to investors. However, there are very few crypto assets that have managed to outperform Bitcoin over the course of various market cycles: So far, only Ripple (XRP), Dogecoin (DOGE), and Ethereum (ETH) managed to outperform Bitcoin (BTC) over two market cycles, i.e. managed to make two new highs in relative terms (denominated in Bitcoin).

In one of our previous research articles (DDA Crypto Espresso – Cryptoassets: There is no second best? The advantages and disadvantages of portfolio diversification), we have studied the alpha (outperformance vs bitcoin), beta (sensitivity of a token vs bitcoin) and the theta (time trend measured in days) of various cryptocurrencies.

The results were the following:

- most Altcoins are high beta and negative theta derivatives of Bitcoin (BTC)

- Binance Coin (BNB), Solana (SOL), Polygon (MATIC), and TRON (TRX) that exhibit a positive theta relative to Bitcoin (BTC)

- Altcoins do have a place in a diversified portfolio of crypto assets but Bitcoin (BTC) should be a core holding of the passive portfolio itself

When investing in cryptocurrencies, it is therefore of utmost importance to consider the design of the concept. While other basket ETPs artificially cap the exposure to bitcoin, the DDA Crypto Select 10 ETP was specifically designed with the above-mentioned analysis in mind: Bitcoin needs to be the core holding of a passive portfolio; altcoins do have a place in a portfolio, but their weight should not be artificially inflated.

About DDA Crypto Select 10 ETP

| Product name | DDA Crypto Select 10 ETP |

| Ticker Xetra / Bloomberg | SLCT GY / SLCT |

| ISIN / WKN | DE000A3G3ZD0 / A3G3ZD |

| TER | 1.69% |

| Base Currency | USD |

| Trading Currency | EUR |

| Underlying | MarketVector™ Digital Assets Max 10 VWAP Close Index (“MVDAMV”) |

| Product Structure | Physically replicating |

| Rebalancing Frequency | Quarterly |

| Index Provider | MarketVector |

| Domicile | Liechtenstein |

| Issuer | DDA ETP AG |

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.

Important Notices

This article represents solely a non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129(Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG).

Risk Considerations

The price of an investment in a DDA ETP may go up or down and the investor may not get back the amount invested.

The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of deciding to invest in the securities.

The prospectus of each ETP product is available at https://deutschedigitalassets.com/products/etp/