Key Takeaways

- Simplified Access and Diversification: Unlike purchasing individual coins directly, SLCT provides access to the crypto market through a traditional securities account.

- Lower Trading Fees: Trading SLCT can be associated with lower fees than trading individual coins on cryptocurrency exchanges.

- Regulated Market: SLCT is traded on regulated exchanges such as Deutsche Börse Xetra.

- Regulated Custody: The components of the ETP are stored in a “cold storage” by a regulated custodian. Investors therefore do not need to worry about the management or the security of their private keys.

- Tax free after one year holding period (1): All DDA crypto ETPs can be tax-free for German private investors after a one-year holding period.

For a long time, access to crypto-assets has been insecure, unregulated and full of technical hurdles. However, with the introduction of physically backed crypto ETPs, now easily accessible through banks or brokers, the landscape has fundamentally changed. Thanks to established product structures, regulated custody, and high liquidity on major European exchanges, these products have become the preferred choice for both private and institutional investors to seek exposure in this exciting market. As a European pioneer in this field, Deutsche Digital Assets (DDA) offers innovative crypto investment opportunities. But which product holds the greatest potential? Bitcoin as digital gold? Ethereum as a highly promising infrastructure for blockchain-based business models? Or perhaps a broader diversification with the DDA Crypto Select 10 ETP (ISIN: DE000A3G3ZD0, WKN: A3G3ZD, “SLCT”), which provides access to the top 10 cryptocurrencies in a single ETP?

DDA Crypto Select 10 ETP – Advantages and Risks of an Allocation to the “Global” Crypto Market

The DDA Crypto Select 10 ETP is an exchange-traded product (ETP) that tracks the performance of up to 10 of the largest and most liquid crypto assets, specifically the MarketVector Digital Assets Max 10 VWAP Close Index (MVDAMV). Instead of investing in individual coins, the ETP allows investors to gain exposure to the overall performance of this top segment of the crypto market with a single investment. This focus provides investors with access to the established coins in the crypto universe while simultaneously reducing the risk of exposure to smaller, more volatile coins. Although coins with smaller market capitalizations than Bitcoin exhibit higher volatility, the correlation among them contributes to the diversification of the (crypto) portfolio. This diversification is of immense importance for investors as it can contribute to a lower portfolio volatility.

As of: August 2024, past performance is no guarantee of future results.

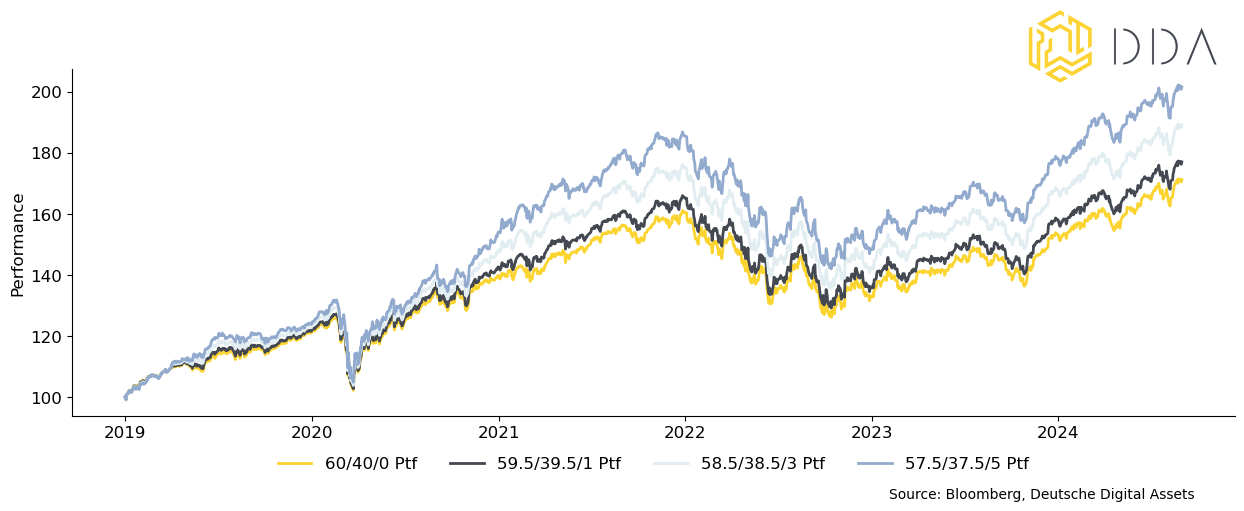

| Annualized return | Volatility | Sharpe Ratio | Maximum Drawdown | |

| 60% Equities / 40% Bonds | 9.71% | 12.11% | 0.80 | -21.71% |

| 59.5% Equities / 39.5% Bonds / 1% Crypto | 10.39% | 12.15% | 0.86 | -22.17% |

| 58.5% Equities / 38.5% Bonds / 3% Crypto | 11.74% | 12.34% | 0.95 | -23.08% |

| 57.5% Equities / 37.5% Bonds / 5% Crypto | 13.08% | 12.68% | 1.03 | -23.99% |

As of: August 2024, past performance is no guarantee of future results.

As of: August 2024, past performance is no guarantee of future results.

A key aspect of the index concept is the weighting of the various coins. The index, and consequently the ETP, follows the concept of market capitalization. Here, the weight of each component corresponds to the coin’s share of the top 10. Although there is a seemingly endless number of crypto assets, the DDA Crypto Select 10 ETP still provides exposure to approximately 90% of the crypto market. In other words, the ten largest coins (by market capitalization) account for about 90% of the total market capitalization.

As of: August 2024, past performance is no guarantee of future results.

Investors seeking exposure to cryptocurrencies can benefit from the below advantages offered by the DDA Crypto Select 10 ETP:

- Simplified Access and Diversification: Unlike purchasing individual coins directly, SLCT provides access to the crypto market through a traditional securities account.

- Lower Trading Fees: Trading SLCT can be associated with lower fees than trading individual coins on cryptocurrency exchanges.

- Regulated Market: SLCT is traded on regulated exchanges such as Deutsche Börse Xetra.

- Regulated Custody: The components of the ETP are stored in a “cold storage” by a regulated custodian. Investors therefore do not need to worry about the management or the security of their private keys.

- Tax free after one year holding period (1): All DDA crypto ETPs can be tax-free for German private investors after a one-year holding period.

An investment in crypto assets has become indispensable in a future-oriented investment strategy. For investors seeking broad diversification and exposure across all asset classes, the MarketVector Digital Assets Max 10 VWAP Close Index and the product based on the index, the DDA Crypto Select 10 ETP, are an essential tool in their asset allocation.

| Name | DDA Crypto Select 10 ETP |

| ISIN | DE000A3G3ZD0 |

| WKN | A3G3ZD |

| Exchange Ticker | SLCT |

| TER | 1.69% |

| Inception Date | 22.05.2023 |

| Product Structure | ETN – 100% collateralized |

About Deutsche Digital Assets

Established in 2017, Deutsche Digital Assets GmbH (DDA) is a German crypto and digital asset manager that serves as a trusted gateway for investors seeking exposure to crypto assets. DDA, through various subsidiaries, offers a menu of crypto investment products and solutions, ranging from passive to actively managed, as well as financial product white-labeling services for asset managers. By leveraging traditional financial products, DDA provides investors with familiar access to a range of crypto asset ETPs and quantitative strategies, making crypto and digital asset acquisition as easy as buying a stock. For more information, please visit www.deutschedigitalassets.com.

Legal Disclaimer

This is a marketing communication. The material and information contained in this article is for informational purposes only.

Important Notices:

This article represents solely a non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129(Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG). It does not constitute an offer of securities for sale in the United States and the securities referred to in this notice may not be offered or sold in the United States absent registration or an exemption from registration.

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.

Risk Considerations

The price of an investment in a DDA ETP may go up or down and the investor may not get back the amount invested.

The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of deciding to invest in the securities.

The prospectus of each ETP product is available at https://deutschedigitalassets.com/products/etp/