Understanding The Role of Altcoins and Bitcoin in a Portfolio Strategy: Why Bitcoin Remains the Key Asset

By: Dominik Poiger, Head of Product Management, DDA

Marc des Ligneris, Chief Investment Officer, DDA

The cryptocurrency market is highly volatile and has seen significant changes over the past decade. As a result, the top 10 crypto assets at the end of each year have fluctuated considerably.

On the other hand, some assets have consistently maintained their position among the top 10 due to their strong fundamentals and market adoption.

| Rank | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Current |

| 1 | Bitcoin | Bitcoin | Bitcoin | Bitcoin | Bitcoin | Bitcoin | Bitcoin | Bitcoin | Bitcoin | Bitcoin | Bitcoin | Bitcoin |

| 2 | Litecoin | Ethereum | Ethereum | Ethereum | Ethereum | Ethereum | Ethereum | Ethereum | Ethereum | Ethereum | Ethereum | Ethereum |

| 3 | Dogecoin | Ripple | Ripple | Ripple | Ripple | Ripple | Ripple | Binance Coin | Binance Coin | Binance Coin | Ripple | Ripple |

| 4 | Ripple | Litecoin | Litecoin | Bitcoin Cash | Bitcoin Cash | Bitcoin Cash | Bitcoin Cash | Cardano | Rippe | Ripple | Binance Coin | Binance Coin |

| 5 | Peercoin | Dogecoin | Dogecoin | Litecoin | Litecoin | Litecoin | Litecoin | Dogecoin | Cardano | Cardano | Solana | Solana |

| 6 | NXT | Dash | Bitcoin Cash | Cardano | Cardano | Cardano | Cardano | Ripple | Solana | Solana | Dogecoin | Dogecoin |

| 7 | Namecoin | Monero | Dash | Stella Lumens | Stella Lumens | Stella Lumens | Stella Lumens | Solana | Dogecoin | Dogecoin | Cardano | Cardano |

| 8 | Feathercoin | NEM | Monero | NEO | NEO | NEO | Chainlink | Polkadot | Avalanche | Polygon | Tron | Tron |

| 9 | Monero | Steem | NEM | IOTA | EOS | EOS | Polkadot | Avalanche | Tron | Avalanche | Avalanche | Avanche |

| 10 | Novacoin | Tezos | Steem | Monero | Monero | Binance Coin | Binance Coin | Terra Luna | Polygon | Polkadot | Toncoin | SUI |

Source: DDA, as of January 2025

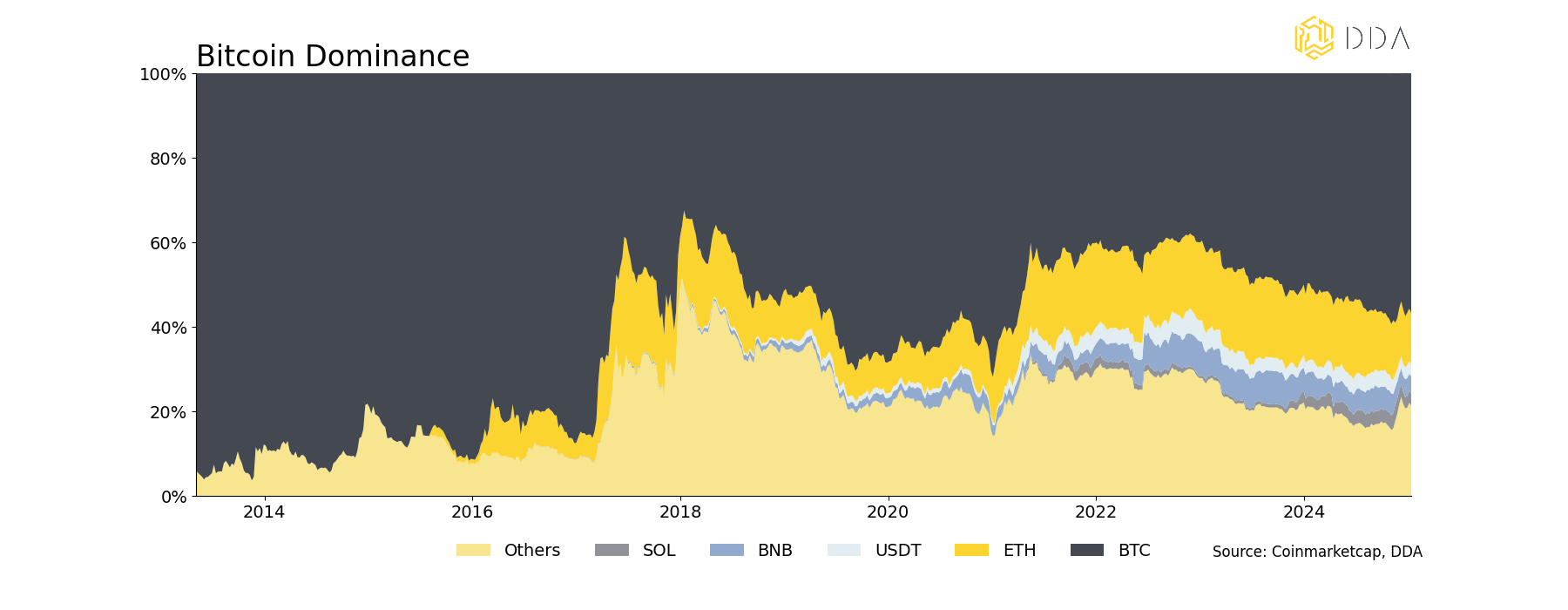

The past decade has shown that not only cryptocurrencies itself are volatile but also their ranks amongst the top coins. While Bitcoin and Ethereum have dominated the pack since 2014, others have appeared only to disappear soon again.

Looking from an (institutional) investor perspective, not all these coins have been or are investable, since they are Memecoins (e.g. Dogecoin), privacy-oriented coins (e.g. Monero) or have simply not been approved by the relevant exchanges to be eligible as ETP underlyings.

| Der ETP-Wrapper An ETN, or Exchange-Traded Note, is a debt security that tracks the performance of an underlying asset or index. ETNs offer a convenient and accessible way to invest in exotic asset classes that might otherwise be difficult or costly to access directly. ETNs allow investors to gain exposure to complex assets like commodities, currencies, cryptocurrency, or specific market indices through a simple, recognized investment vehicle. On top, ETNs are traded on regulated exchanges, offering investors liquidity and the ability to buy and sell them easily. |

There are very few cryptoassets that have managed to outperform Bitcoin over the course of various market cycles: So far, only Ripple (XRP), Dogecoin (DOGE), and Ethereum (ETH) managed to outperform Bitcoin (BTC) over two market cycles, i.e. managed to make two new highs in relative terms (denominated in Bitcoin).

When it comes to strategic/passive portfolio construction, professional investors are mostly concerned about two aspects:

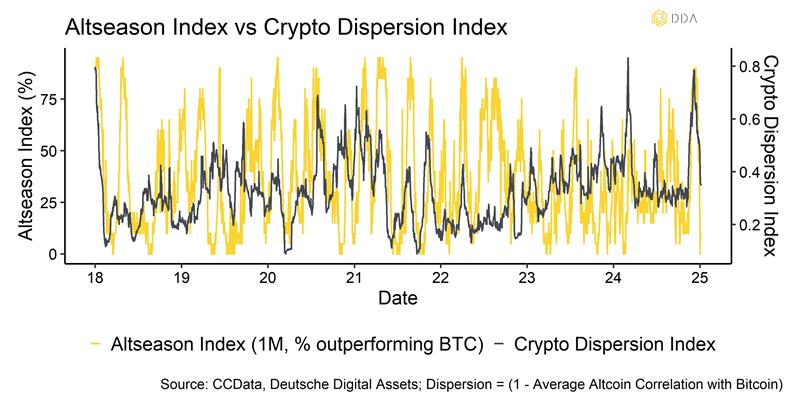

The degree of outperformance by non-core holdings (altcoins versus Bitcoin) and the degree of diversification added by these non-core holdings (relative correlation versus Bitcoin). In general, altcoins tend to outperform Bitcoin (BTC) in bull markets when performance dispersion among them increases/correlations decrease, and they start trading more on token-specific factors rather than systematic factors.

In contrast, there is usually a decrease in dispersion among altcoins during bear markets that is associated with an underperformance vis-à-vis Bitcoin (BTC) when altcoins mostly trade in the same direction as Bitcoin.

This is also depicted in the following chart that shows a positive relationship between the % of altcoins outperforming Bitcoin on 1-month basis (“Altseason Index”) and the average dispersion among altcoins (“Crypto Dispersion Index”):

In other words, there are also less benefits from diversification into altcoins during bear markets when dispersion among cryptoassets tends to decline (correlation tends to increase), and altcoin outperformance vis-à-vis Bitcoin is usually low.

But in bull markets, other altcoins might be able to outperform Bitcoin (BTC) due to their higher beta. Therefore, professional investors should treat most altcoins as a cold shower: move in during bull markets but move out during bear markets.

All in all, the results imply that some altcoins do have a place in a diversified portfolio of cryptoassets but that Bitcoin (BTC) should be a core holding of the passive portfolio itself.

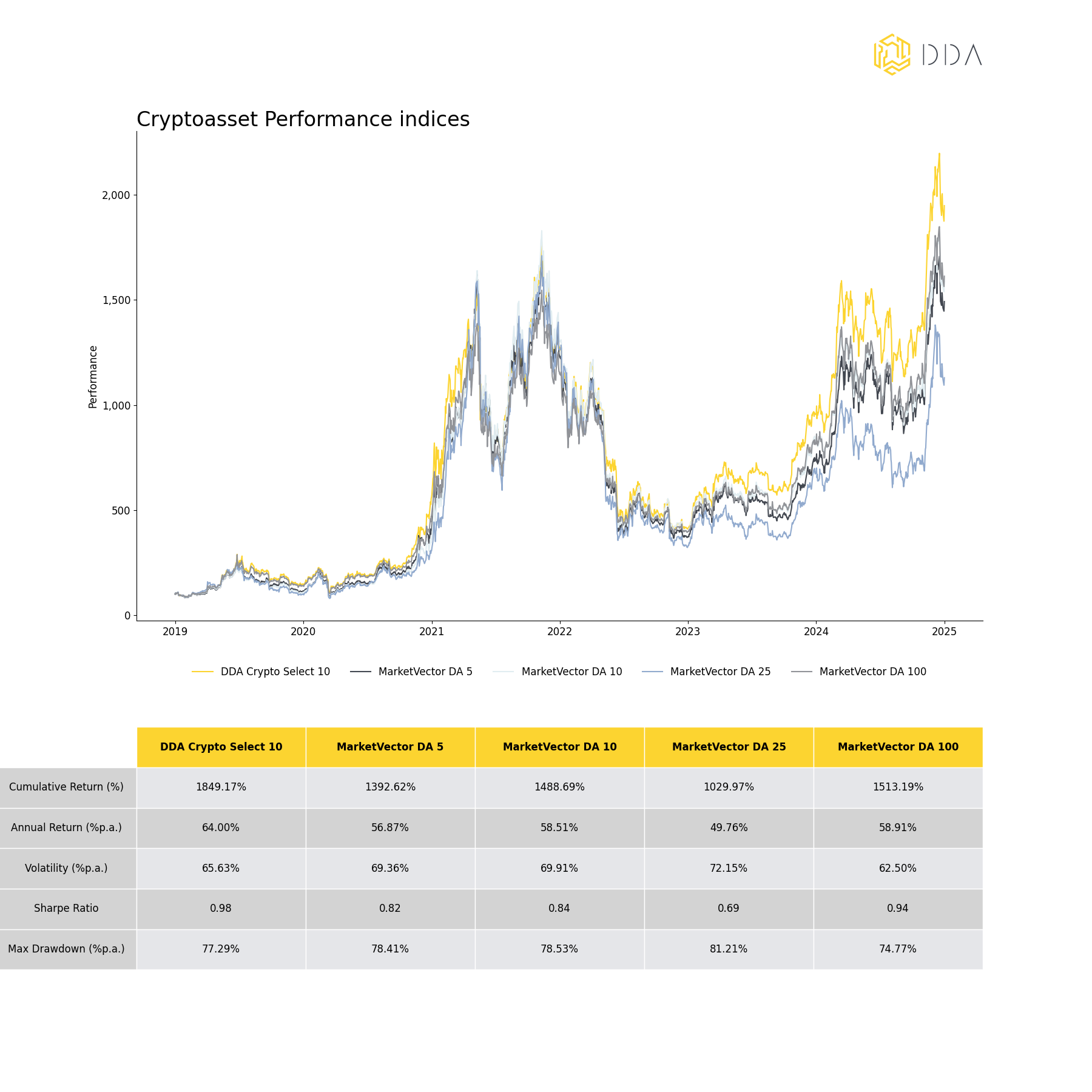

An ETP wrapper, as explained above, can be a suitable solution for investors to gain diversified exposure in the crypto sphere. As these ETPs based on transparent index methodologies are rebalancing periodically, they offer several advantages over a static allocation that was picked at a random point in time:

- Adaptability: Rebalancing ensures that the portfolio aligns with the changing dynamics of the cryptocurrency market. As certain coins rise or fall, rebalancing allows to adjust holdings accordingly.

- Optimized Returns: A rebalanced portfolio can lead to better long-term performance by consistently allocating capital to the best-performing assets.

While many existing basket ETP concepts employ a capped weighting scheme that leads to a relatively low weighting of Bitcoin (BTC) and Ethereum (ETH) and an inflated weight of altcoins, some concepts, e.g. the DDA Crypto Select 10 ETP, employs an uncapped weighting scheme that allows coins to float freely according to their market capitalization. A decision that has been consciously made to reap most of the statistical benefits for investors. A performance comparison of the ETP’s underlying index benchmark (MarketVector Digital Assets Max 10 VWAP Close Index, MVDAMV) reveals that it exhibits the highest (historical) cumulative return, highest risk-adjusted return (Sharpe Ratio) and the lowest maximum drawdown compared to other capped benchmarks that track the top large cap cryptoassets:

What investors should take away from this (”Conclusion”):

From a pure statistical point of view, most Altcoins are high beta and negative theta derivatives of Bitcoin (BTC). There are few Altcoins among the top 10 that have exhibited a systematic outperformance that is not explained by relatively higher market risk (beta).

Exceptions are Binance Coin (BNB), Solana (SOL), Polygon (MATIC), and TRON (TRX) that exhibit a positive theta relative to Bitcoin (BTC).

Altcoins do have a place in a diversified portfolio of cryptoassets but Bitcoin (BTC) should be a core holding of the passive portfolio itself!

Important Notices

This is a marketing communication. The material and information contained in this article is for informational purposes only.

Deutsche Digital Assets GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities.

Performance is unpredictable. Past performance is hence not an indication of any future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control.

We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.

This article represents solely a non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129(Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG).

Risk Considerations

The price of an investment in a DDA ETP may go up or down and the investor may not get back the amount invested.

The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of deciding to invest in the securities.

The prospectus of each ETP product is available at https://deutschedigitalassets.com/products/etp/