We are living in incredible times. The World Health Organization (WHO) has declared a global pandemic over a new coronavirus which causes an illness known as COVID-19 which has spread to at least 170 countries and territories, killing more than 114,000 people and infecting more than 1,800,000, according to Worldometers.

The world as we know it is coming to a standstill and almost every aspect of every person’s life on this planet is being affected.

Many countries around the world are on lockdown, meaning all of the ‘non-essential’ businesses must remain closed for a period of time / until further notice. You can find further information on what is classed as non-essential from examples the UK provided here.

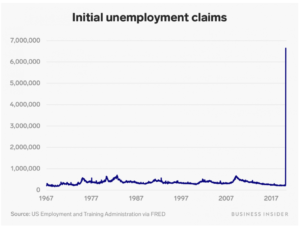

This means a massive toll is being taken on businesses of every scale in every country, from your local barbershop to giant software companies or manufacturing companies as employees are asked to stay and work from home. Unemployment around the world is sky-rocketing like it never has before and global economies are being hit hard. Every country, and everyone, is feeling the pain.

Chart 1

Chart 1

This graph should put things into perspective and note, we are only just getting started. I expect this trend to continue over the coming weeks.

You can read the detailed article from Business Insider here, but, note the quick summary below-

- US Labor Department reported Thursday, 9 April, 2020 that 6.3 million Americans filed for unemployment insurance in the week that ended Saturday – nearly matching the prior weeks total.

- US Labor Department reported Thursday, 2 April, 2020 that 6.64 million Americans filed for unemployment insurance in the week that ended March 28 – more than double the previous week’s total.

- US Labor department reported on Thursday the 26th of March that US Unemployment claims had spiked to a then-record 3.28 million for the week that ended March 21.

- This is nearly 17 million people seeking benefits in just three weeks.

Countries around the world are putting multi-billion-dollar aid packages into play and cumulatively injecting trillions of dollars into the economy.

Below should provide an indication of the speed at which actions are being taken.

Week commencing 9th March 2020:

Monday was “Black Monday”, the worst day in stocks since 2008.

Tuesday was Italy’s first full lockdown day and the world exceeded 100k Covid19 cases.

Wednesday the WHO declares coronavirus a pandemic.

Thursday was “Black Thursday”, the worst day in crypto and a horrible one in traditional markets, with the Fed adding $1.5T to the repo markets.

Friday the U.S. declares a national state of emergency.

Saturday sees the first corona fiscal stimulus passed in the U.S. House.

Sunday the Fed set rates to 0% and prints $700b out of thin air as though it’s 2008.

Monday the Fed says it will offer an additional $500b in repo funding.

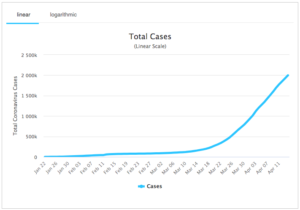

March 27, 500k+ cases recorded globally, and the US takes the lead in the number of recorded cases and the pandemic does not look like it will be slowing down.

April 5, 1.2 million cases recorded globally.

April 12 FED’s Neel Kashkri warns America should be ready for 18 months of rolling shutdowns.

April 13 1.8 million cases recorded globally.

The worst part is, we are not yet flattening the curve; as a matter of fact, the rate at which the virus is continuing to spread is alarming. The number of cases globally roughly doubled in a week.

I personally think this is due to lack of action from world leaders, but we are not here to point fingers, but rather see what can be done to stop it.

Chart 2

Humanity is now in uncharted territory, and frankly, no one has lived through or could even imagine a pandemic of this scale. As previously mentioned, everyone from individuals to the largest government bodies are having to take steps to try and get a handle on the situation, but we do not have the playbook on how this could be done.

Below are some of the examples of the steps the world is taking.

The Olympics have been postponed, the NBA, NFL and global sports leagues are shutting down till further notice.

Stimulus packages are limited to the US, below you can find other examples.

ECB unveils €750 billion stimulus against coronavirus.

Singapore unveils $34bn coronavirus relief package.

‘Whatever it takes’: UK pledges almost $400 billion to help businesses through coronavirus.

Once the FED realised slashing interest rates and printing trillions of dollars was not going to be enough, they decided to take even more drastic steps and in a recent interview said they could carry out unlimited asset purchases and “There is an infinite amount of cash in The Federal Reserve”.

Airlines across the world have grounded their entire fleets or are operating at single digit percentage levels.

Leading analysts and economists are warning people and asking them to “Brace for the ‘deepest recession on record”.

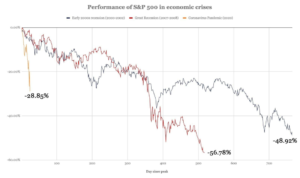

An article by Zerohedge gives a detailed look at the numbers on what is happening in the stock market. I understand some may not see this as the most reliable source of news, but all the information provided can be double checked and validated.

To put things into perspective, let’s compare the numbers with previous recessions with below chart.

Chart 3

The COVID19 pandemic has tanked global markets at an unprecedented rate.

As travel and trade come to a halt, the demand for oil is dropping significantly and the price of oil dropped to the lowest it has been in 20 years, to nearly $20 per barrel.

A product of the most recent global recession, the Bitcoin whitepaper was released on the 31st of October 2008, when the world was going through the financial debt crisis.

The 2008 economic crisis was propped up by the imperfect mechanisms of QE (Quantitative easing) and near 0% interest rates, which was one of the largest Central Bank intervention in history, acting as the inspiration for and giving birth to Bitcoin.

In 2008 alone governments increased their base money by 41%. Since them, the central bankers have 3x’ed the amount of base fiat money—yen, USD, Euros, Yuan, etc.

Printing fiat worked for bankers in the 2010s. Meanwhile, Crypto was in its infancy.

I expect the bailouts from the 2008 financial crisis to be insignificant compared to what we are about to see over the coming years. The trickle-down effects of what we are currently going through won’t be felt for months to come, if at all.

Allow me to elaborate-

Since 2013, Boeing has spent over $100 billion buying back their own stock and inflating its value. They are now seeking a $60 billion bailout from the US Government, which President Trump is in favour of, understandably, to save American companies and jobs. This is happening while millions of Americans are losing their jobs and are having to resort to food banks.

And this is less than a week after the US declared the National State of Emergency.

Now, let’s refer back to what the steps the FED has taken in the last few weeks and see the direction we are heading in? Do you see any similarities? I feel this time around, it will be much worse and in order to keep the stock market propped up, governments are going to start buying national stocks on top of providing loans.

My personal prediction – I think we are just getting started and after the stock market mess is over, it is going to get much worse as the bond and corporate debt market starts to implode as developing countries and SMEs start to default on their loans. There may even be many more cases similar to Venezuela where currencies become worthless over a very short period of time.

The reason you have seen other strong currencies lose their value over recent weeks compared to the dollar is because this is a liquidity crisis. In times like these, everyone flocks to the US Dollar.

What I am trying to say is, I don’t think many people understand the scale or speed at which the global economy is unwinding and the effect it is going to have on everyone’s lives. It is going to be much worse than anything we have seen in history. I don’t mean to come across so negative and doom-and-gloom, but I cannot stress the sense of urgency people must have.

However, this time, the world has better options with sound monetary policies anyone with access to the internet can opt-in to, and it begins with Bitcoin. Allow me to elaborate once more…

Nearly 50% of the world today has access to the internet.

~50 million people across the world already own cryptocurrencies.

Millions more know about it but haven’t made the leap yet.

Billions more are about to learn about it.

In 2008, they didn’t have a choice, but this time round, they will.

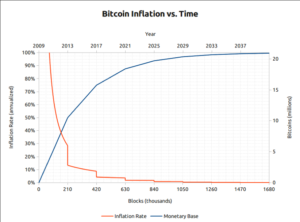

Some of the reasons for the astronomical rise in the price of Bitcoin and its adoption are below and the reasons I believe it will continue to grow-

- FIXED SUPPLY – there will only ever be 21,000,000 Bitcoin (BTC) in existence. This was hardcoded into the initial code of the product

- Bitcoin is the hardest form of money to have ever existed and has a deflationary emission rate

- It is completely decentralised and not controlled by a group of individuals or state

- Bitcoin is permissionless

- Bitcoin is transparent and pseudonymous

- Bitcoin is borderless

And most importantly, Bitcoin is run by math and code.

Modern money for modern times.

You are about to see Bitcoin grow up and face the crisis it was specifically designed for.

Finally, we are fast approaching the Bitcoin halvening, which means the amount of ‘new bitcoins’ generated per block would be reduced by 50%. Currently the reward is 12.5 Bitcoin per block. Roughly around 14 May, 2020, that will drop to 6.25 Bitcoin per block. The stock-to-flow ratio of Bitcoin continues to decrease, thus increasing its value through simple laws of economics.

Chart 4

Below is a Bitcoin price chart with halvings marked. Many believe that as the supply decreases and demand increases and price equilibrium comes into play, the price per Bitcoin will increase significantly.

Chart 5

Anyone that is paying attention to the crypto markets would have noticed that when the traditional markets crashed in March, so did the crypto markets. Many people point to this saying that the “Bitcoin is an uncorrelated” asset narrative no longer holds. I disagree as the sample size for this event is too small and it was a flash crash that occurred due to panic in the markets. Since then, Bitcoin has recovered significantly better than any other market, increasing in price by ~100%, continuing to prove out its non-correlation. I expect Bitcoin to keep outperforming the traditional markets as more people around the world choose Bitcoin and crypto markets to hedge their bets in the coming months.

A lot of this information I have presented has been individually covered the world over. I wanted to collate it all in one place and present you with facts around the pandemic, its impact on markets and Bitcoin to let you make your own judgment.

All I would like to say is, buckle up. We are about to find out exactly what Bitcoin is made of.

By Harsh Jani, Business Development, Iconic Holding

# # #

This article is strictly for educational purposes and isn’t to be construed as financial advice.