Que Gaelic’s Storm Titanic party song that is the guilty toe-tapping pleasure of anyone alive during the 90’s. The only thing I know that gets people out of their seats and dance as well as this Irish classic is the yields being farmed and 1,000X returns traders are realizing on crypto in DeFi this summer. But what is Decentralized Finance and is it just 2020’s new crypto buzzword, or is it radically transforming financial and capital markets as we know them?

DeFi refers to the ecosystem being developed for what would traditionally be classified as financial products and services, albeit top of public blockchains. Open source software leverages the inherently decentralized nature of the blockchain, such as on Ethereum, to create permissionless, intermediary-less and trustless protocols ranging from:

- Monetary/Banking Services (IE the issuance of stable or asset crypto)

- P2P pooled lending and borrowing markets

- Decentralized exchanges, liquidity pools, tokenization and more.

The benefit of smart contracts enables decentralized applications (dApps) and protocols to offer these services without intermediaries such as central banks, traditional banks or financial institutions as we commonly know them. This severely reduces barriers to entry for users and eliminates most operational costs, particularly astronomical overhead expenses realized by financial institutions. Given the flexibility and trust DeFi offers, it is no wonder it has become the hot topic of the crypto sphere in 2020, with roughly $600M locked in DeFi smart contracts and applications to begin the year. As of this writing, that number has ballooned to nearly $5B, according to DeFi Pulse, with $4B of lockups occurring since June. There is no sign of DeFi slowing down yet!

The DeFi charge is largely being driven by the P2P lending space, with protocols such as Maker, the issuer of the popular DAI stablecoin, and Compound offering seamless ways to engage in collateralized and decentralized lending markets. The new darling of DeFi, Uniswap, has seen immense growth as liquidity pools become more and more popular, with even Andreesen Horowitz jumping in by leading Uniswap’s Series A. Coupling such platforms together has led to the advent of “Yield Farming” and “Liquidity Mining” which can be rather simply described as crypto traders/holders putting dormant crypto assets to work through these protocols for nominal daily returns ranging from a few basis points up to a few percent (although trust me, it is much more technically complex than this). To be sure, the concept of “Risk-Free Return” from capital markets has effectively been flipped on its head, while credit market counterparty risk has seemingly been eliminated from the equation. Oh My!

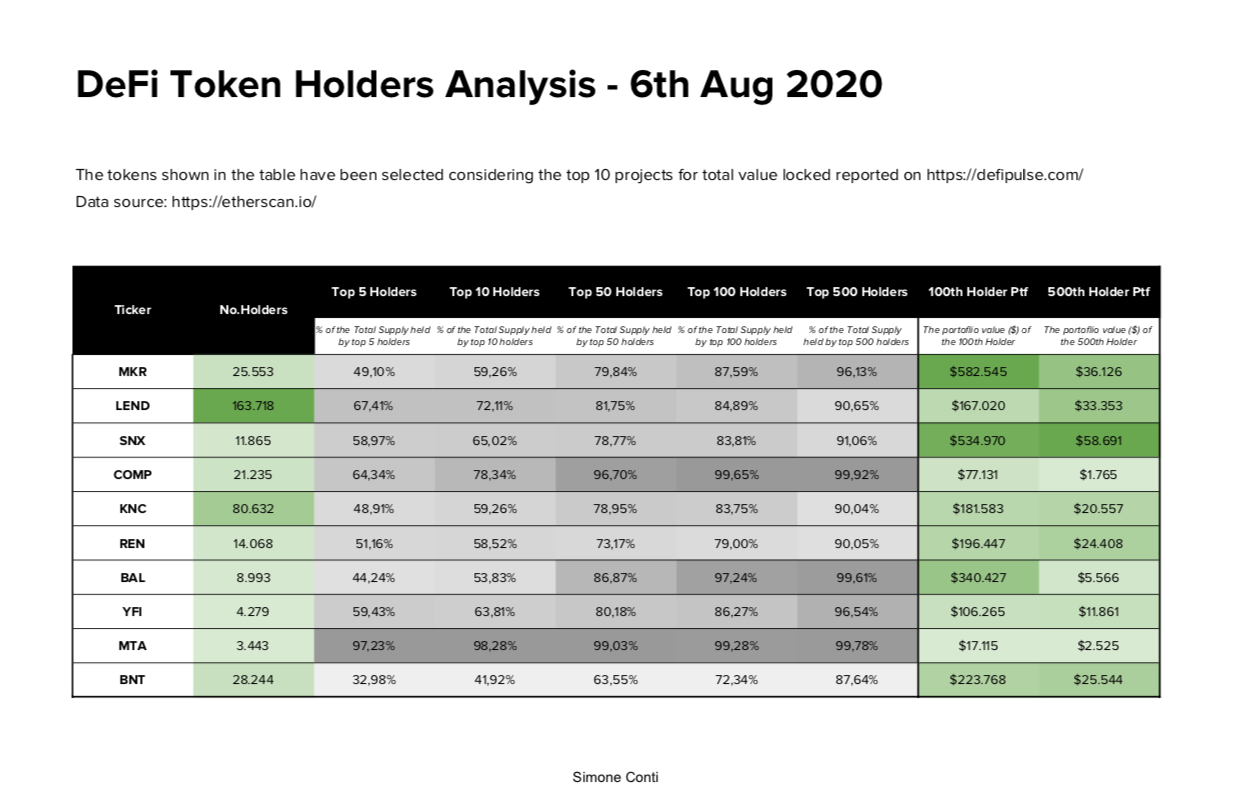

All of this sounds too good to be true, right? Well, in many ways, it is. Similar to ICOs in 2017, STOs in 2018 and IEOs in 2019 (seeing the trend?), 2020’s “DeFi” may prove to be nothing but a buzzword and bubble set to burst. A recent study found that most DeFi projects are highly concentrated amongst a few individuals (see pic below), and Vitalik himself has questioned the security of DeFi smart contracts. This doesn’t even begin to touch on the AML and compliance issues that will need to be overcome on many of these platforms as global regulators typically tend to not look to favorably on permissionless systems offering financial services that also happen to be unlicensed. The space is undeniably young, as is crypto as a whole, but not without its allure and clear upside.

What cannot be discounted is how powerful a decentralized financial market can be for providing basic financial services to disenfranchised individuals and organizations the world over. Enabling financial services and products without intermediaries is core to the spirit of crypto, and even one of Satoshi’s inspirations for Bitcoin itself as an intermediary-less currency. Bitcoin may have been the first DeFi protocol that permitted everybody to be their own bank, but entrepreneurs and innovators in DeFi are going a step further and building platforms that are not only banking the unbanked, but decentralizing wealth generation.

All said and done, the DeFi party is just getting started, and we even have toe-tapping Irish music and beer! Iconic even got its toes wet by providing liquidity to the ICNQ token on Uniswap as we look at the DeFi space with cautious, albeit immense, optimism. The future of capital markets is being right built before our very eyes, and it’s looking more and more like it will be decentralized!

- Dr. Satoshi or: How I Learned to Double (Risk-Adjusted) ROI and Love the Bitcoin

- Bitcoin’s Perfect Storm

- The Impact of Crypto Currencies on the Sharpe Ratio of Traditional Investment Models

_________

Legal Disclaimer

In no event will you hold ICONIC HOLDING GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

ICONIC HOLDING GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond ICONIC HOLDING GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

ICONIC HOLDING GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.