Unraveling Last Week’s Crypto Market Turbulence: SEC Charges, Sentiment Shifts, and Bitcoin’s Market Dominance

DDA Crypto Market Pulse, June 12, 2023

by André Dragosch, Head of Research

Key Takeaways

- Last week, cryptoassets were significantly under pressure with the SEC’s charges against the major exchanges Coinbase and Binance as main negative catalysts

- Our in-house Crypto Sentiment Index has decreased throughout last week but is not yet as bearish as during the SVB collapse in March 2023

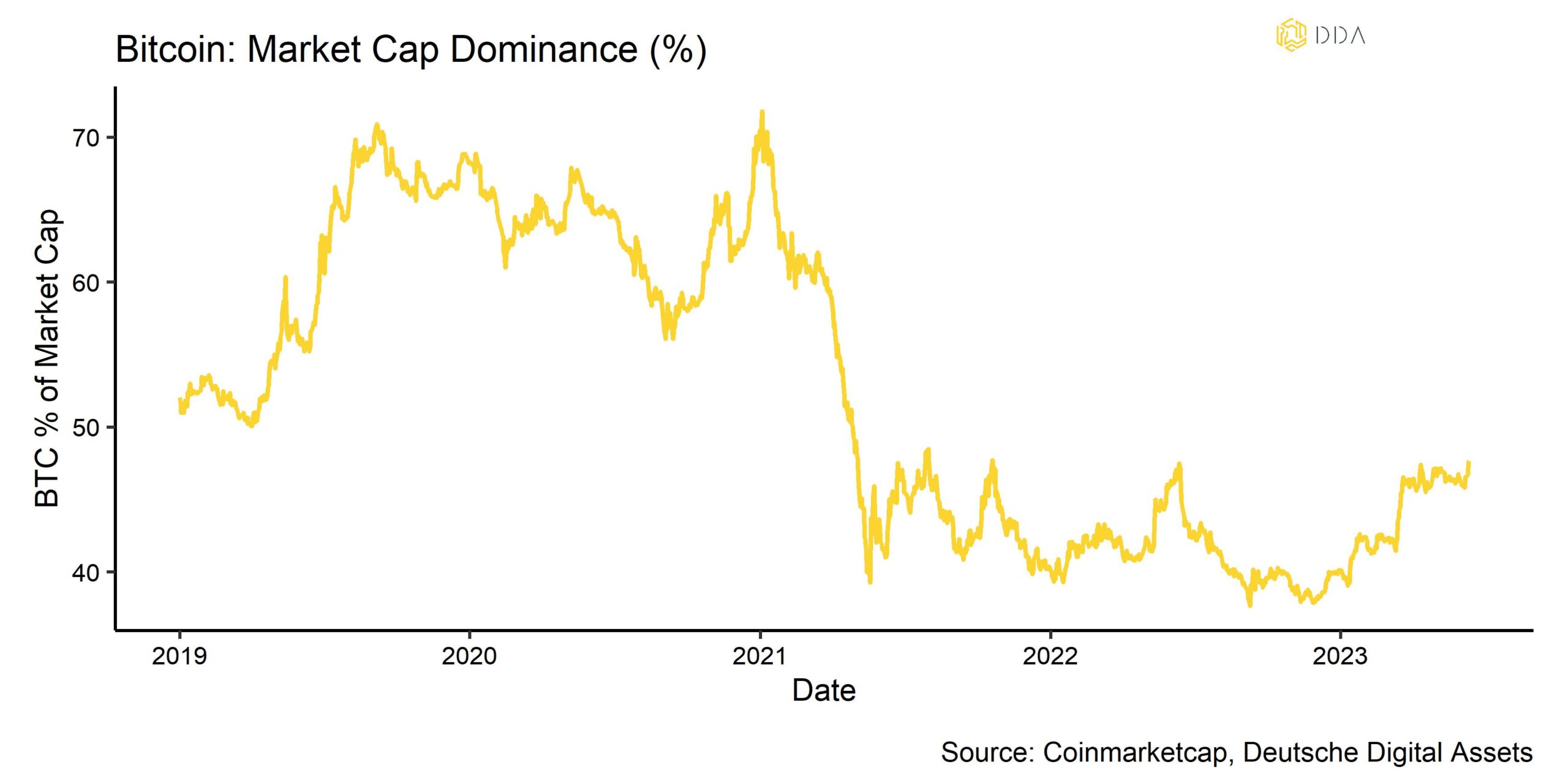

- Bitcoin’s market cap dominance has increased to the highest level since April 2021 amid the recent market rout in altcoins

Chart of the week

Cryptoasset Performance

Last week, cryptoassets were significantly under pressure with the SEC’s charges against the major exchanges Coinbase and Binance as main negative catalysts.

More specifically, the SEC has filed 13 different charges against Binance and its founder Chenpeng Zhao including operating an unregulated securities exchange, misrepresenting trading controls and oversight on the Binance.US platform, and the unregistered offer and sale of securities. In contrast, the pending Coinbase lawsuit also focuses on the unregistered offer and sale of securities in connection with its staking-as-a-service program.

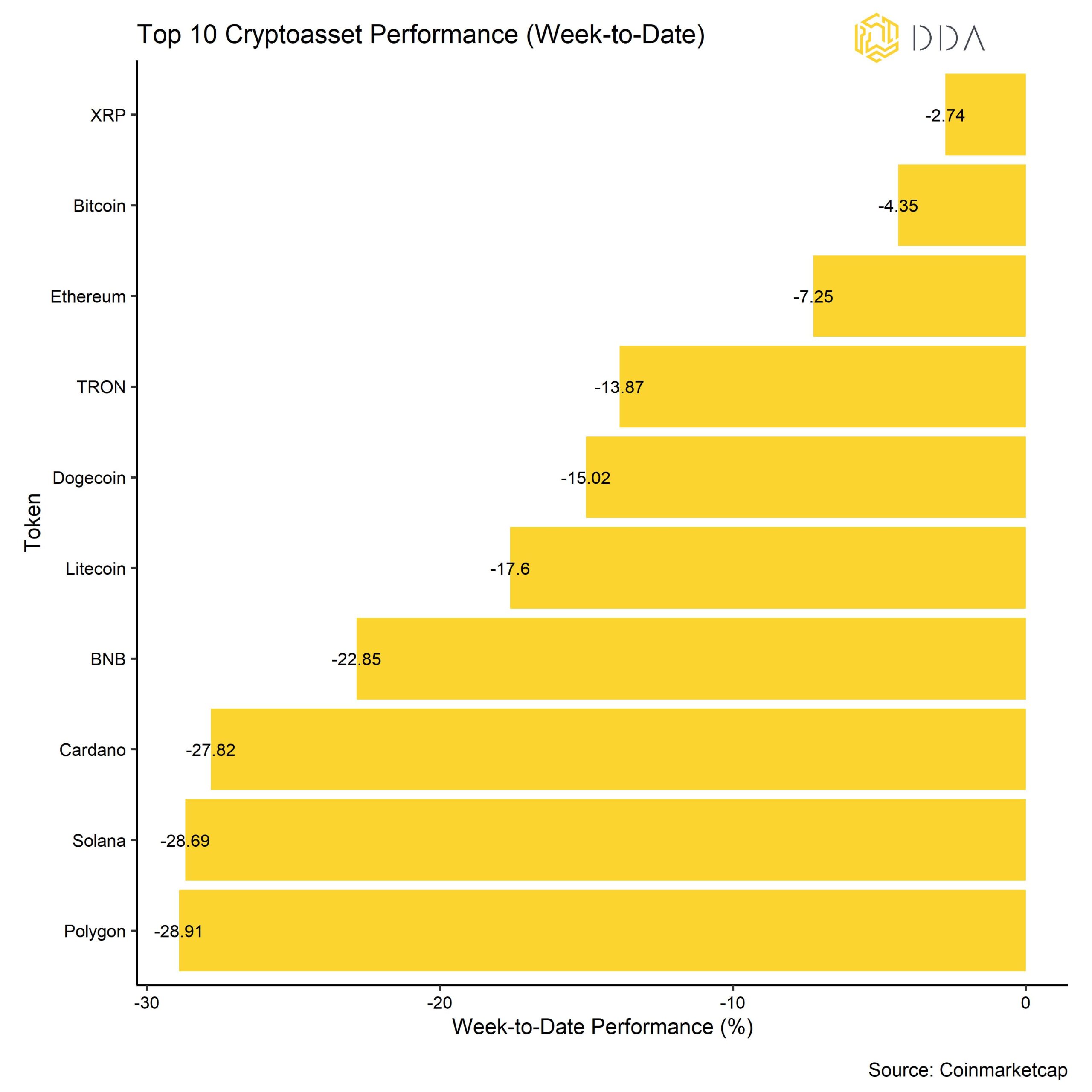

More importantly, both charges mentioned a set of major cryptoassets that the SEC deems to be a security. These tokens include: SOL, ADA, MATIC, FIL, SAND, MANA, ALGO, and AXS. These tokens have been mentioned both in the Binance and Coinbase charges which is why they were at the eye of the storm during the latest market rout.

Neither Bitcoin (BTC), Ethereum (ETH) nor Ripple (XRP) were mentioned in any of these charges by the SEC which is probably the reason why these cryptoassets were the relative outperformers. As a result of the latest sell-off in altcoins, Bitcoin’s market cap dominance has increased to 49.3% – the highest level since April 2021 (Chart-of-the-week).

Overall altcoin outperformance decreased significantly last week with only 10% of tracked altcoins outperforming BTC on a weekly basis.

The market rout was amplified by the fact that retail trading app Robinhood will delist ADA, MATIC, and SOL in consequence of the SEC charges. Robinhood holds around 1.3 bn USD in altcoins of which approximately half is concentrated in the three abovementioned tokens. Other trading apps like Sofi have announced similar steps. There were also some rumours that US-based market makers could withdraw support of the abovementioned tokens involved in the SEC charges which also resulted in additional downside pressure for altcoins.

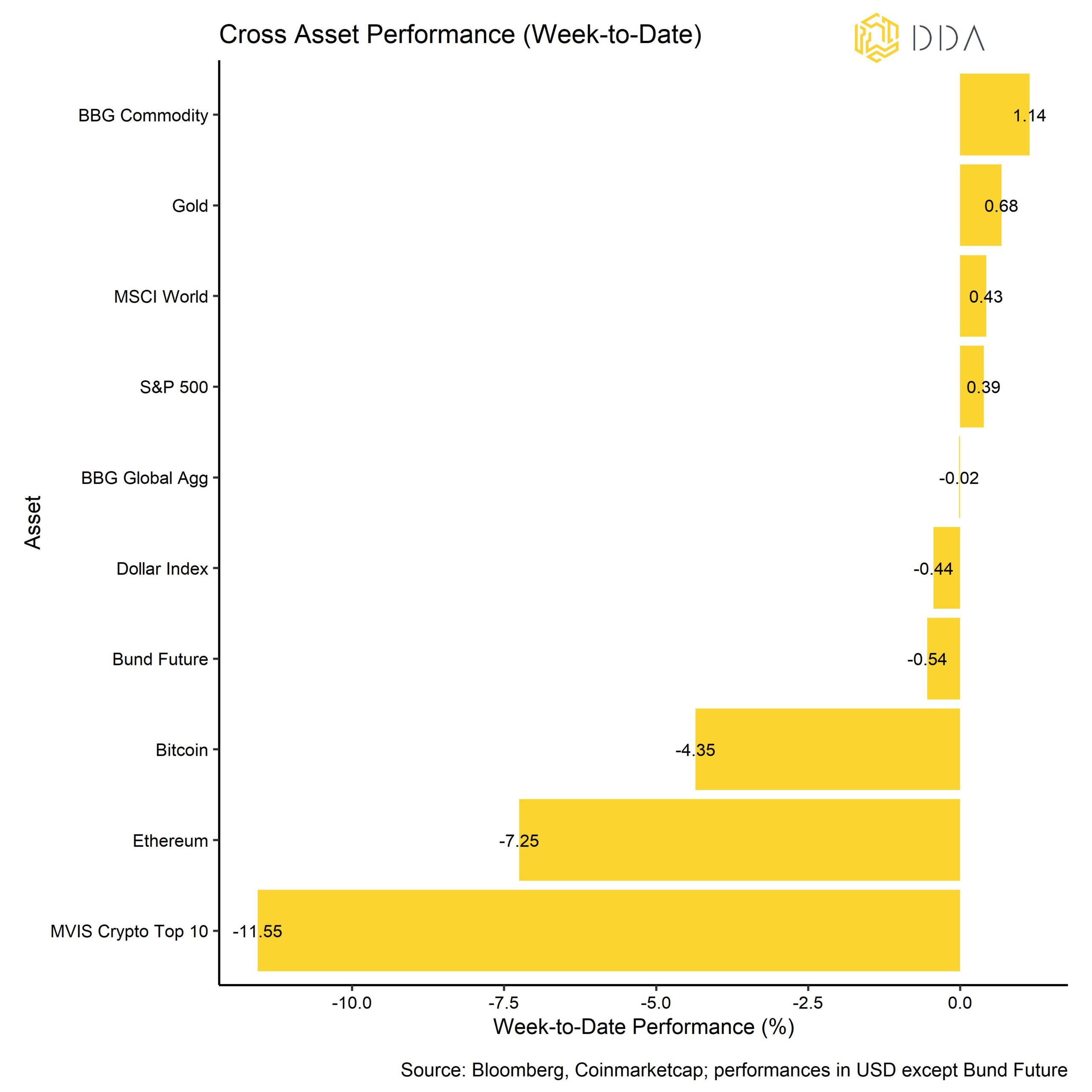

As a result, the top 10 cryptoassets have performed poorly last week. Meanwhile, global equities continued to move up. Commodities were the best asset class as the Dollar depreciated last week.

Volatility is likely going to stay high this week as there are a number of important events coming up:

For instance, tomorrow there will not only be the SEC’s Coinbase rulemaking response and the Binance US hearing but we will also get the latest US inflation data for May 2023. On Wednesday, the FOMC meeting will take place and on Thursday we will get the latest US jobless claims data.

Crypto Market Sentiment

Our in-house Crypto Sentiment Index has decreased significantly last week but is still not as bearish as during the SVB collapse in March 2023. 8 out of 15 indicators are still above their short-term trend.

Compared to last week, we saw major reversals to the downside in the Altseason Index and the Crypto Fear & Greed Index.

Despite the recent market rout, the Crypto Fear & Greed Index still remains in “Neutral” territory as of this morning.

Performance dispersion among cryptoassets has recently decreased as correlations among cryptoassets have increased which means that cryptoassets are trading more on systematic factors. At the same time, altcoin outperformance has also decreased significantly last week and is now at only 10% of altcoins outperforming Bitcoin on a weekly basis.

In general, altcoin outperformance goes hand in hand with an increase in crypto dispersion, i.e. Bitcoin and altcoins are generally trading up during “altseason” with altcoins outperforming Bitcoin. Broader altcoin outperformance is usually a sign of increasing risk appetite and broader altcoin underperformance a sign of increasing risk aversion.

Crypto Asset Flows

Last week saw the 8th consecutive week of net fund outflows of cryptoassets.

In aggregate, we saw net fund outflows in the amount of -88.1 mn USD (week ending Friday).

The majority of fund net outflows focused on Bitcoin funds (-57.2 mn USD) and Ethereum funds (-37.6 mn USD) while altcoin-based funds as well basket & thematic crypto funds both experienced net fund inflows last week (+1.1 mn USD and +5.6 mn USD, respectively).

Besides, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – has widened slightly again which also implies some minor net outflows out of this fund vehicle.

Meanwhile, the beta of global Hedge Funds to Bitcoin over the last 20 trading days remained flat, implying that global hedge funds have only a very minor positive net exposure to cryptoassets. However, the beta is still too small to consider it statistically significant. Global hedge funds generally appear to be neutrally positioned with respect to cryptoassets at the moment.

On-Chain Activity

We had reported a pick-up in whale exchange inflows and miner transfers to exchanges in our last Crypto Market Pulse with the note that this could exert some downward pressure on prices in the short term.

Whales are defined as network entities (cluster of addresses) that hold at least 1000 BTC. Exchange deposits are usually interpreted as increasing selling pressure.

It appears that these whale exchange transfers have abated despite the recent market rout which is a positive sign. At the same time, miners continue to transfer coins to exchanges, exerting some downside pressure in the short term. Continuing miner transfers to exchanges are most-likely associated with the fact that Bitcoin’s hash rate has been increasing relentlessly to new all-time highs which puts significant strains on some miner. That being said, exchange inflows are still relatively muted despite ongoing miner transfers which is a positive sign. This is true for both Bitcoin and Ethereum.

Moreover, realized losses on-chain remain fairly-muted for Bitcoin implying that investors are not panicking to sell their holdings amid the recent market rout in altcoins. To the contrary, negative net exchange flows on an aggregate basis imply ongoing accumulation activity in the background. Net exchange outflows have been particularly strong for Ethereum recently.

However, the major issue for the overall market at the moment appears to be fading buying power evident in the slow-down in stablecoin inflows to exchanges relative to major cryptoassets such as Bitcoin and Ethereum. Judging by these relative inflows, the amount of capital flowing into cryptoassets has clearly slowed down compared to the beginning of the year. This is also evident in the change in realized caps.

Cryptoasset Derivatives

Despite increasing US regulatory uncertainty, Bitcoin implied volatilities have not increased meaningfully from the very low levels seen early June. However, 25-delta 1-month option skew for Bitcoin has clearly been trending up over the past week in favor of put options. The implied volatility on delta-equivalent put options is now around 6.5%-points higher than for call options.

Overall open interest for both options, futures and perpetuals has remained flat throughout last week.

The perpetual funding rate on Bitcoin perpetual contracts went shortly negative at the beginning of last week, when we also saw the highest amount of futures long liquidations since November 2022 during the FTX collapse with around 75.6 mn USD in long futures contracts force-liquidated on Monday alone. Long liquidations this large are usually indicative of a short term bottom. However, note that our Crypto Sentiment Index does not signal oversold conditions, yet.

Bottom Line

Last week, cryptoassets were significantly under pressure with the SEC’s charges against the major exchanges Coinbase and Binance as main negative catalysts.

Our in-house Crypto Sentiment Index has decreased throughout last week but is not yet as bearish as during the SVB collapse in March 2023.

Bitcoin’s market cap dominance has increased to the highest level since April 2021 amid the recent market rout in altcoins.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.