Reversal in Bitcoin Network Congestion, Declining Sentiment Index, and the Cost-Basis of Short-Term Holders

DDA Crypto Market Pulse, May 15, 2023

by André Dragosch, Head of Research

Key Takeaways

- Cryptoasset prices continued to be under pressure last week due to congestion in the Bitcoin network – that trends seems to have reversed itself

- Our in-house Crypto Sentiment Index has declined throughout last week and is now slightly negative

- A flush-out of ‘weak hands’ has not yet occurred with the short-term holder cost-basis sitting at around 25.2k USD for Bitcoin

Chart of the week

Cryptoasset Performance

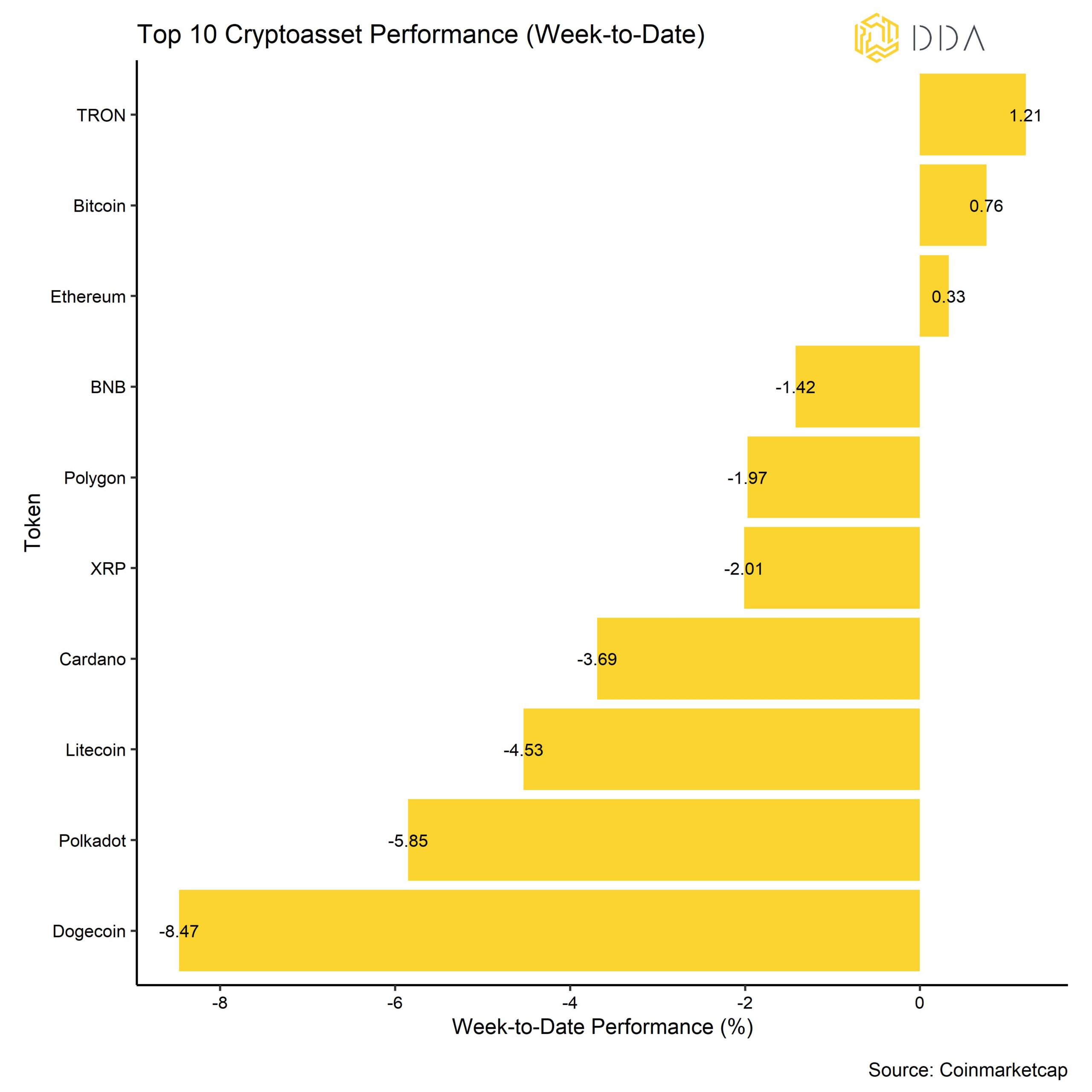

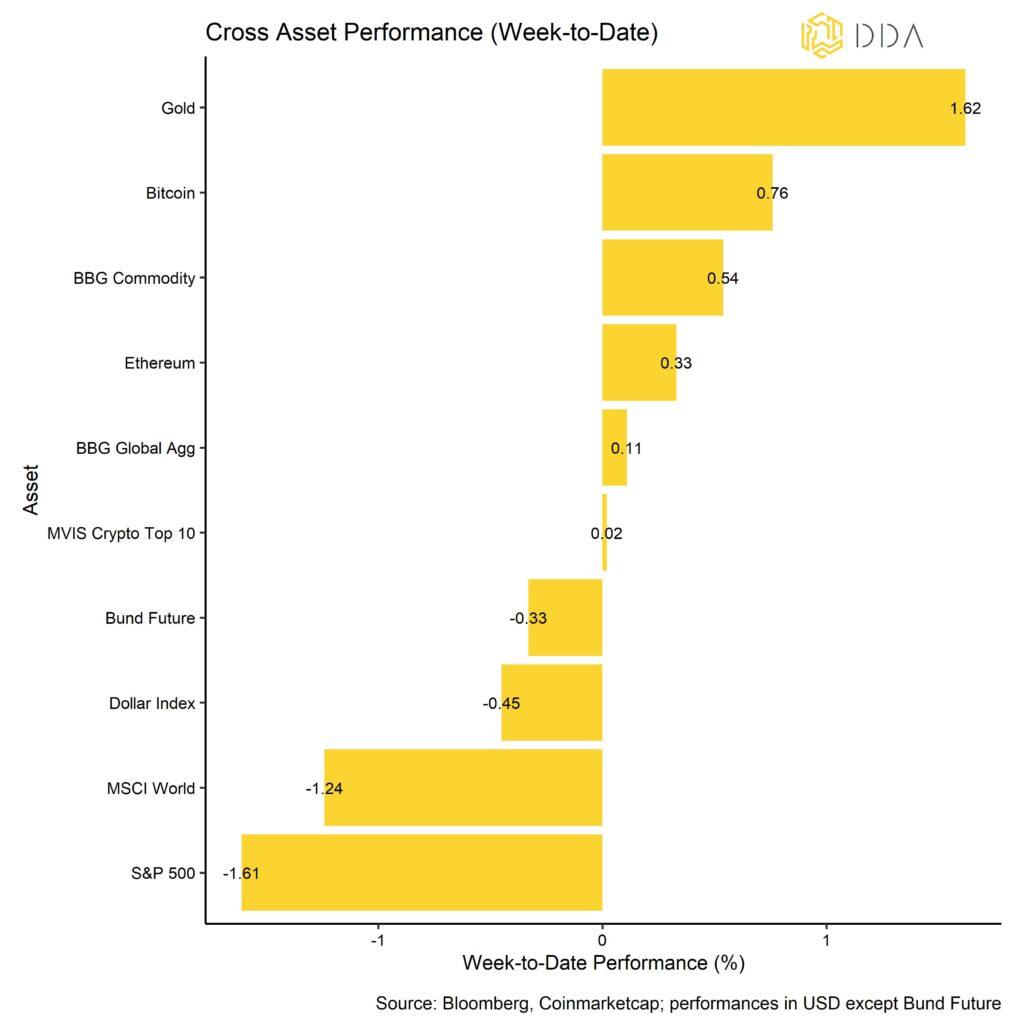

Last week, cryptoasset performances were mainly weighed down by the congestion of the Bitcoin blockchain due to high usage of inscriptions for token issuance and a high number of transactions. In consequence, cryptoassets have been the main underperformers last week. This trend seems to have reversed again lately.

In comparison, traditional investors sought the safety of the US Dollar and German Bunds. Global equities and gold performed negatively last week. Meanwhile, key macro data such as the US CPI and initial unemployment claims have provided more reasons for the Fed to pause as inflation has come down more than anticipated and initial unemployment claims have increased significantly.

Among the major cryptoassets, TRON, Cardano and BNB were the relative outperformers. In general, Altcoin outperformance of Bitcoin have picked up last week, but is still below 50% of Altcoins outperforming Bitcoin.

Crypto Market Sentiment

Due to the risk-off environment in cryptoassets, our in-house Crypto Sentiment Index has decreased last week. Only 4 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals in the BTC short-term holder Spent-Output-Profit-Ratio (STH-SOPR) and the Global Hedge Fund Beta to Bitcoin.

The Crypto Fear & Greed Index has come down slightly and remains in “Neutral” territory as of this morning.

Performance dispersion among cryptoassets has recently picked up as correlations among cryptoassets have decreased which means that cryptoassets are increasingly trading on coin-specific factors. At the same time, altcoin outperformance has continued to increase last week but is still below 50% of Altcoins outperforming Bitcoin on a 1-week and 1-month basis.

In general, altcoin outperformance goes hand in hand with an increase in crypto dispersion, i.e. Bitcoin and altcoins are generally trading up during “altseason” with altcoins outperforming Bitcoin. Broader altcoin outperformance is usually a sign of increased risk appetite and low altcoin outperformance is indicative of a rather cautious market environment.

Crypto Asset Flows

Last week saw net fund outflows of cryptoassets again.

In aggregate, we saw net fund outflows in the amount of -33.7 mn USD (week ending Friday) with the very large majority of outflows flowing out of Bitcoin funds (-35.4 mn USD). Ethereum funds only experienced minor net outflows of -1.7 mn USD. In contrast, both Altcoin funds ex Ethereum as well as Basket & Thematic Cryptoasset funds attracted some net inflows again (+0.7 mn USD and +2.8 mn USD, respectively).

Besides, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – has increased a bit again which implies some minor net outflows out of this fund vehicle.

Meanwhile, the beta of global Hedge Funds to Bitcoin over the last 20 trading days has reversed sharply but continues to be positive, implying that global hedge funds still continue to have a long bias to cryptoassets.

On-Chain Activity

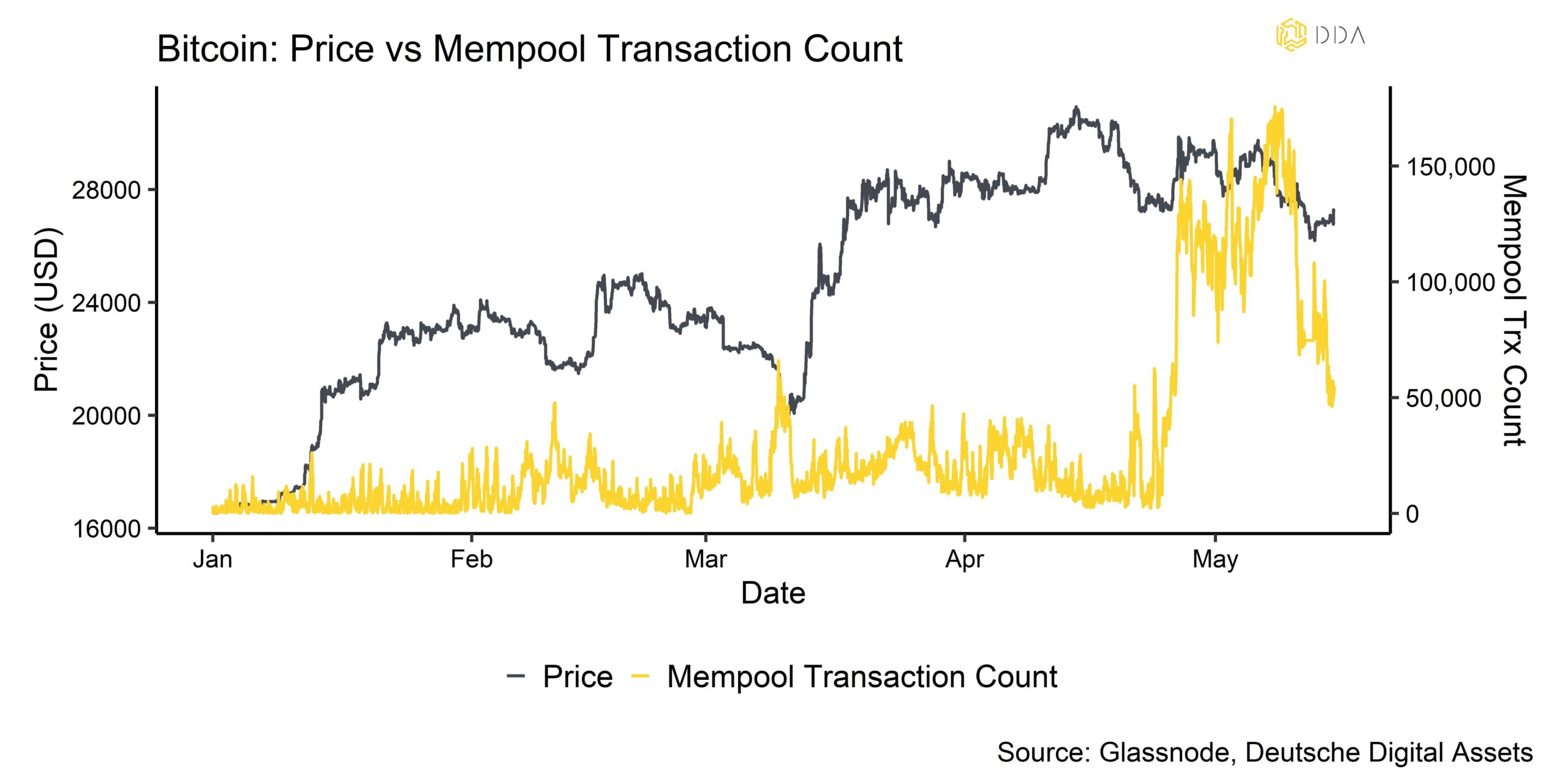

On-chain metrics suggest that the degree of congestion in the Bitcoin blockchain is already levelling off.

The number of transactions in the Bitcoin mempool, i.e. those waiting to be validated by miners, have decreased from above 170k at the heights of congestion on the 08/05/23 to around 51k transactions at the time of writing. Similarly, mean transaction fees have decreased from 45 USD per transaction on the 08/05/23 to around 3.5 USD per transaction at the moment.

The high degree of congestion appeared to be due to a significant increase in the number of inscriptions due to the issuance of BRC-20 tokens on the Bitcoin blockchain.

The BRC-20 protocol has developed to enable the separate transmission of fungible tokens on the blockchain. It was initially created to make it easier to create Bitcoin non-fungible tokens (NFTs) by embedding data such as photos, videos, codes, and text within the witness component of BTC transactions.

At some point during last week, the market cap of BRC-20 tokens circulating on the Bitcoin blockchain reached a market cap of 1 bn USD. Among these tokens are ORDI, PEPE or MEME.

At the time of writing, new inscriptions on the Bitcoin blockchain are still running at a rate of above 300k per day which is still comparatively high. In fact, our in-house index of Bitcoin network activity is also near its all-time highs. However, this obscures some major divergences in on-chain data. For instance, while transaction count reached a new all-time high last week, the number of active addresses had plunged to the lowest levels since June 2021. Regular users were obviously turned away by extraordinary high fees and waited for the congestion to vanish which must have led to the decline in active addresses.

As mentioned above, these trends have mostly reversed itself again, as fees have declined significantly.

From a traders’ perspective, a flush-out of ‘weak hands’ has not really occurred yet and market sentiment has turned only slightly bearish – the cost-basis for short-term investors is around 25.2k USD and short-term investors have started to take losses in aggregate and exit their positions only recently. A break below 25.2k USD, could reset the market again from a sentiment and positioning perspective and build the basis for new highs down the road.

At the same time, Ethereum on-chain metrics were only affected marginally by these latest developments on the Bitcoin blockchain. Active addresses and transaction count decreased only slightly. Mean Transaction Gas Price had also picked up but is still far away from the highs reached during the last cycle top in November 2021.

On a positive note, Ethereum exchange balances have continued to decrease throughout last week and are now at the lowest levels since July 2016.

Cryptoasset Derivatives

Over the last week, implied volatilities mostly continued to trade lower despite the negative price action. Bitcoin 1-month implied volatilities have decreased below 50 again. The 1-month 25-delta option skew continued to trade in favour of put options which implies a negative bias among Bitcoin option traders.

The perpetual funding rate has only slightly turned negative, especially on the 08/05/23 implying a preference of short over long contracts among perpetual traders.

During the latest decline in prices, BTC open interest has continued to increase, both for futures and perpetual contracts which implies that traders have increased their short positions pro-cyclically into weakness. This could create a set-up for a potential short squeeze if the market turns positive again.

Bottom Line

Cryptoasset prices continued to be under pressure last week due to congestion in the Bitcoin network – that trends seems to have reversed itself.

Our in-house Crypto Sentiment Index has declined throughout last week and is now slightly negative.

A flush-out of ‘weak hands’ has not yet occurred with the short-term holder cost-basis sitting at around 25.2k USD for Bitcoin.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.