By Max Lautenschlaeger

The markets are gaining traction

From 2016 to 2017 the number of projects being financed through a token generating event increased fourfold from 46 to 175. While at the same time, financing raised twenty-two-fold more, totaling $2.7 billion, as of October 2017. More and more blockchain startups are considering an ICO as an alternative funding instrument and are in dire need of service providers who can guide them through this complex and steadily changing environment.

Breaking down geographical barriers

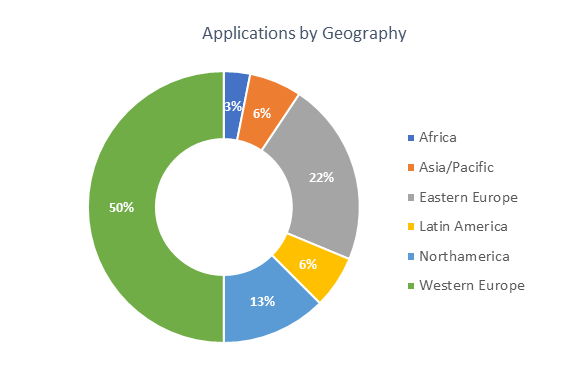

Since opening the gates, applications from all over the globe have reached Iconiq Lab through different channels such as f6s or LinkedIn. The pool of applications contains startups from 15 different countries. Most of them are from Germany, followed by the United States and the United Kingdom. Geographical barriers seemingly do not play a crucial role anymore in this highly tech oriented, modern and open-minded environment. All major regions of the world have already reached out to the Iconiq Lab.

Various industries and company stages

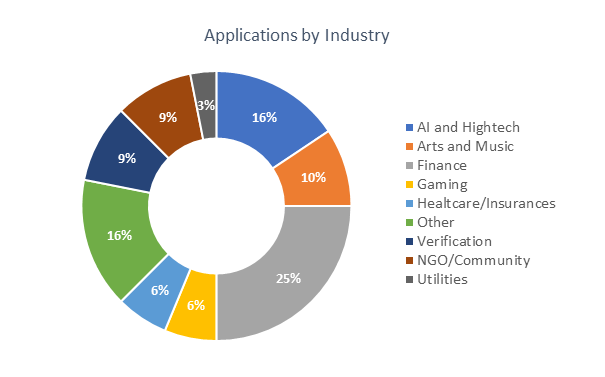

The pool of startups, which have reached out to Iconiq Lab, is very diversified in terms of both industry and stage. Not only pre-seed or seed companies are considering a token sale as an alternative financing instrument, but also profitable companies with existing revenue streams, a solid customer base and double-digit number of employees. This indicates the potential of the ICO markets for mature companies and that of tokenization in the future.

Almost all use cases of the blockchain technology are already in the pipeline for the Iconiq Lab accelerator program. Financial applications — including infrastructure, payment systems and real estate- is the leading group with 25 per cent. Nonetheless, the pipeline is very diversified ranging from artificial intelligence through humanitarian projects to gaming applications and arts.

Iconiq Lab started sourcing companies within the crypto-space in July 2017 and is accepting applications until the end of November for the first accelerator program batch. This article provides insights into the pipeline of blockchain startups to date, including geographical and industrial bandwidth.