Impending liquidity drawdown and whale exchange inflows put short-term pressure on cryptoassets

DDA Crypto Market Pulse, June 5, 2023

by André Dragosch, Head of Research

Key Takeaways

- Last week, most major cryptoassets were trading to the downside as investors are contemplating the impending liquidity drawdown due to the TGA rebuild

- Our in-house Crypto Sentiment Index has increased again throughout last week

- Whale deposits to exchanges have recently picked up as have BTC miner transfers to exchanges which could exert some downward pressure on prices in the short term

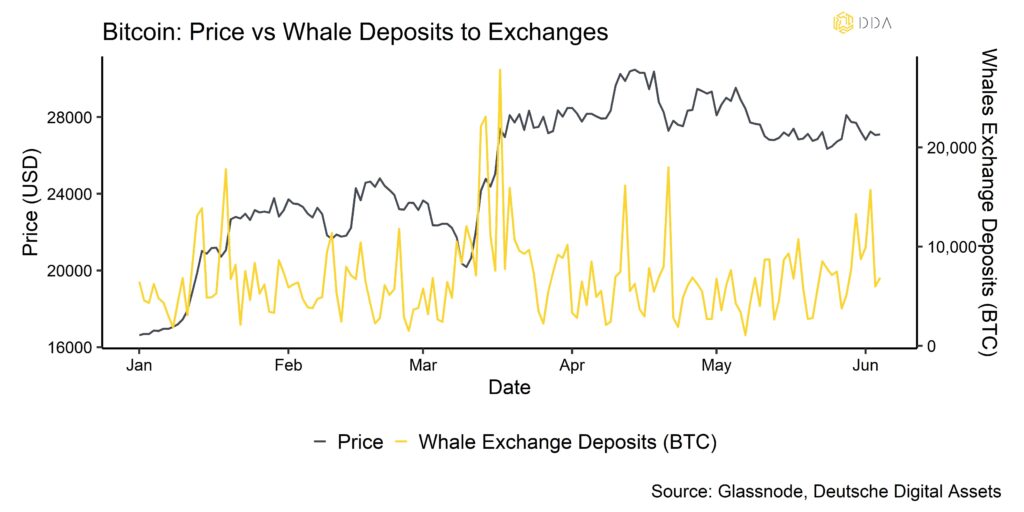

Chart of the week

Cryptoasset Performance

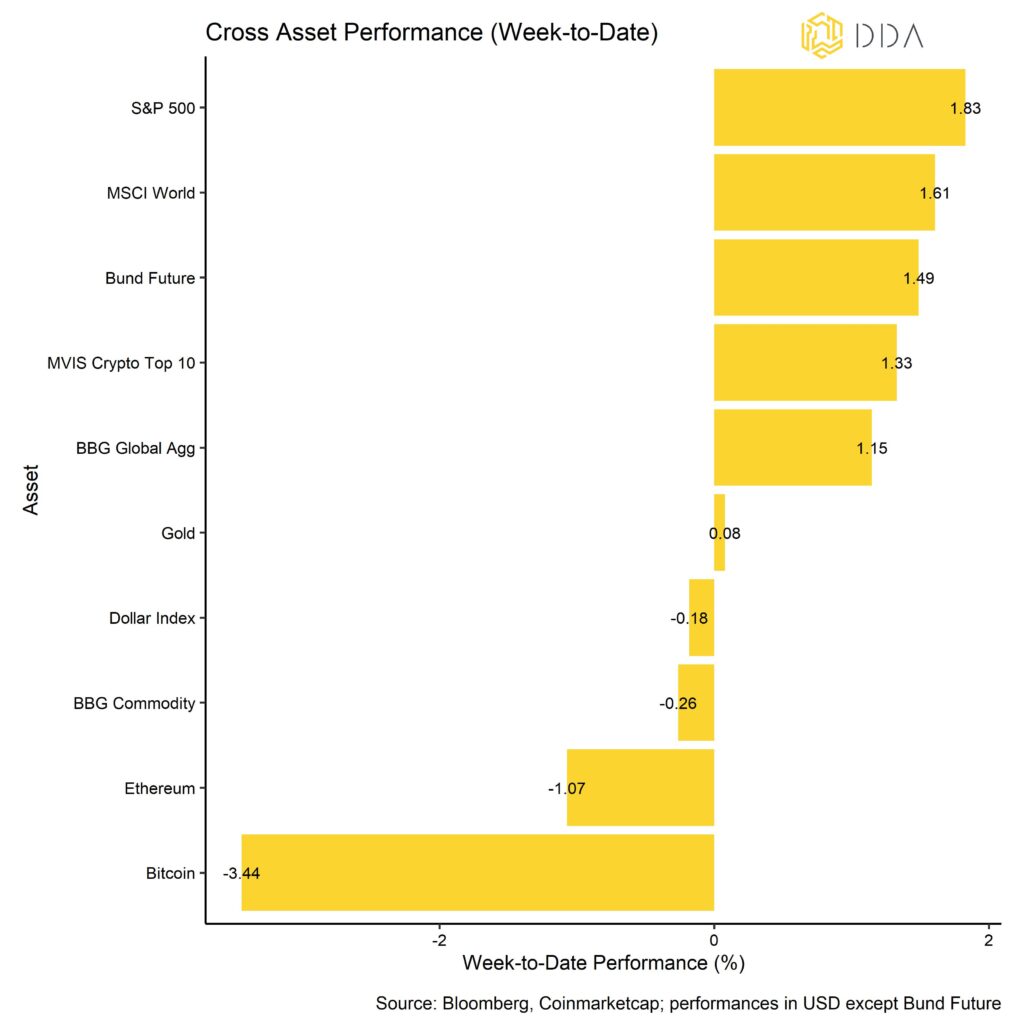

Last week, most major cryptoassets were trading to the downside. Investors have been contemplating that the impending bank reserve drawdown in the US, due to the Treasury General Account (TGA) rebuild, may prove to be headwind for cryptoassets. It is expected that the US Treasury will likely issue up to 1 trn USD in T-Bills that could divert significant amounts of liquidity from cryptoassets and other assets.

At the same time, there has been a pick-up in Whale Bitcoin exchange deposits recently (Chart-of-the-Week) which could exert some downward pressure on prices in the short term. Whales are defined as network entities (cluster of addresses) that hold at least 1000 BTC.

All in all, the top 10 cryptoassets have performed slightly positive last week. In general, global equities outperformed bonds while commodities retreated last week.

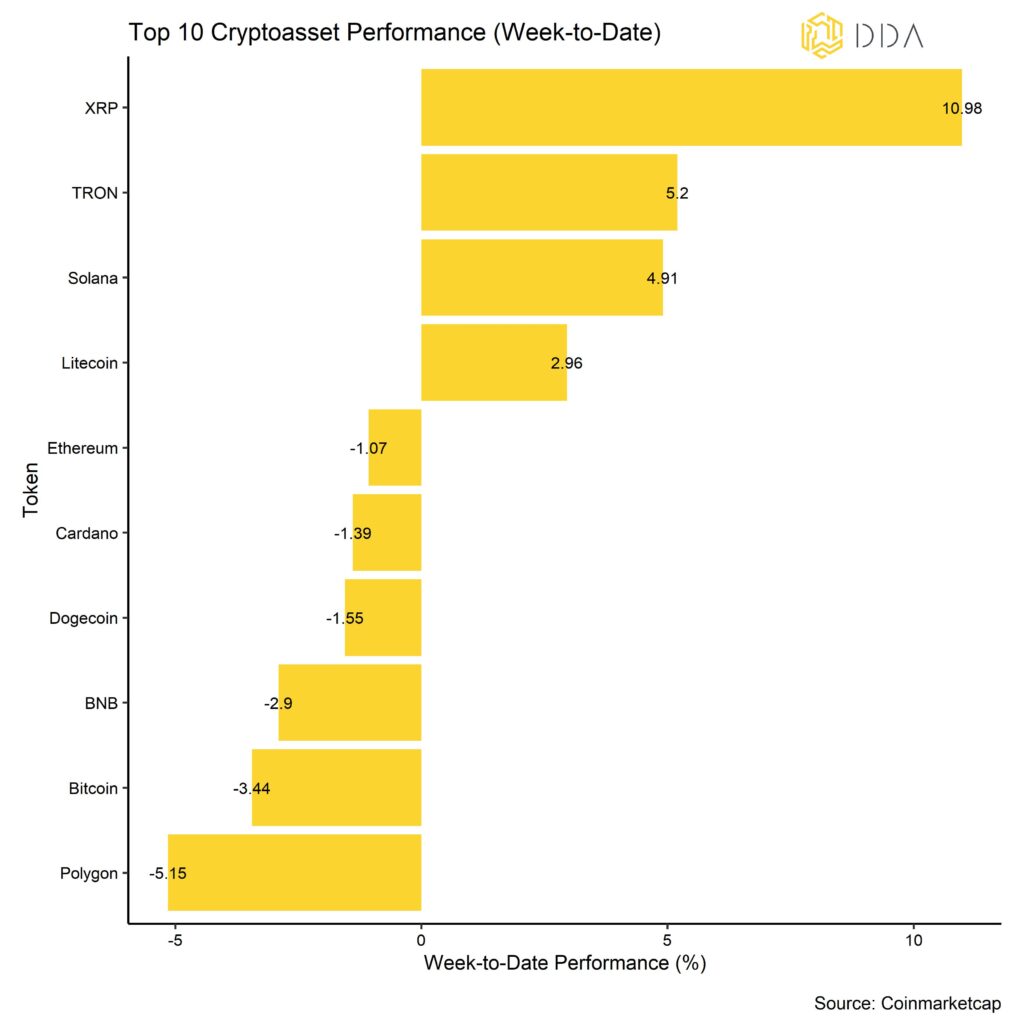

Among the major cryptoassets, XRP, TRON, and Solana were the relative outperformers. Overall altcoin outperformance increased last week with 60% of tracked altcoins outperforming BTC on a weekly basis.

Crypto Market Sentiment

Our in-house Crypto Sentiment Index has further increased. 8 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals to the upside in the Altseason Index and the BTC Put-Call volume ratio.

The Crypto Fear & Greed Index has mostly remained unchanged compared to last week and still remains in “Neutral” territory as of this morning.

Performance dispersion among cryptoassets has recently continued to increase as correlations among cryptoassets have decreased which means that cryptoassets are trading more on coin-specific factors. At the same time, altcoin outperformance has also increased last week and is now at 60% of Altcoins outperforming Bitcoin on a weekly basis.

In general, altcoin outperformance goes hand in hand with an increase in crypto dispersion, i.e. Bitcoin and altcoins are generally trading up during “altseason” with altcoins outperforming Bitcoin. Broader altcoin outperformance is usually a sign of increasing risk appetite.

Crypto Asset Flows

Last week saw a yet again net fund outflows of cryptoassets.

In aggregate, we saw net fund outflows in the amount of -53.8 mn USD (week ending Friday). However, last week’s outflows were mostly concentrated on Altcoin-based ETPs which saw net outflows of -50.6 mn USD in aggregate. A TRON-based ETP alone saw -51.2 mn USD in outflows last week on Wednesday.

Bitcoin funds experienced minor net outflows of -2.8 mn USD and Ethereum funds also experienced minor net outflows of -3.7 mn USD. In contrast, basket & thematic cryptoasset funds experienced net inflows (+3.2 mn USD).

Besides, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – has widened slightly again which also implies some minor net outflows out of this fund vehicle.

Meanwhile, the beta of global Hedge Funds to Bitcoin over the last 20 trading days increased again albeit from low levels, implying that global hedge funds have increased their exposure to cryptoassets a little bit. However, the beta is still too small to consider it statistically significant. Global hedge funds generally appear to be neutrally positioned with respect to cryptoassets at the moment.

On-Chain Activity

Last week, core on-chain metrics for Bitcoin such as new or active addresses continued to recover from the low levels we had seen because of the congestion in the Bitcoin network that had stalled network participation. The number of transactions waiting in the Bitcoin mempool to be picked up by miners has also continued to decrease but still remains elevated compared to the pre-ordinals period (i.e. before end of April 2023).

The number of transactions has also declined albeit from very high levels experienced due to the ordinals hype. In the same context, median transaction fees for Bitcoin have also declined again and are currently around 1.10 USD.

Overall network growth still remains quite positive with approximately 4% growth in non-zero addresses in the last 30 days.

At the same time, there has been a pick-up in Whale Bitcoin exchange deposits recently (Chart-of-the-Week) which could exert some downward pressure on prices in the short term. Whales are defined as network entities (cluster of addresses) that hold at least 1000 BTC. Exchange deposits are usually interpreted as increasing selling pressure.

At the time of writing, 66% of Bitcoin addresses are in (unrealized) profit. The net % of unrealized profit minus loss is currently around 27%. The majority of coins in profit is held by long-term holders, i.e. entities that have held coins at least 155 days. These entities are also the ones who have been realizing gains in the past two weeks.

Moreover, there has been a significant pick-up in BTC miner transfers to exchanges over the weekend. They have now reached the highest level since November 2019. Bitcoin miners are increasingly feeling the pressure from the parabolic increase in hash rate.

Increasing exchange inflows from whales and miners are likely going to exert some downward pressure on prices in the short term.

Cryptoasset Derivatives

Probably the most important development on the derivatives side was the fact that 1-month Bitcoin implied volatilities reached an all-time low over the weekend. More specifically, 1-month implied volatilities fell below 35% – lower than the previous low marked in January 2023. This highlights some element of complacency in the market right now and the probability of a spike in volatility has been increasing as volatilities are usually mean-reverting. Put-call volume ratios have been trending lower (in favour of calls). The put-call open interest ratio is currently at 0.46 for Bitcoin options. So, traders are generally more exposed to call options than to put options.

A call (put) option gives the holder the right to buy (sell) the underlying at a pre-defined price called “strike” in the future.

On the futures side, open interests have mostly sideways both for futures and perpetual contracts on BTC. The 3-months basis rate has also moved sideways and is currently at around 2.3% p.a. Perpetual funding rates are also positive.

Bottom Line

Last week, most major cryptoassets were trading to the downside as investors are contemplating the impending liquidity drawdown due to the TGA rebuild.

Our in-house Crypto Sentiment Index has increased again throughout last week.

Whale deposits to exchanges have recently picked up as have BTC miner transfers to exchanges which could exert some downward pressure on prices in the short term.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.