Stay up to date with our monthly crypto overview:

- October was another historic month for Bitcoin as we witnessed the approval and launch of the first-ever Bitcoin ETF in the United States.

- The biggest (and most surprising) gainer in October was the meme coin, Shiba Inu, which climbed by 919.13% to become the ninth-largest cryptocurrency by market capitalization.

- US Bank launches bitcoin custody service as institutions race to cater to crypto demand.

- PSV Eindhoven became the first European football club to hold Bitcoin on its balance sheet.

Crypto Market Overview

October was another historic month for Bitcoin as we witnessed the approval and launch of the first-ever Bitcoin ETF in the United States.

The ProShares Bitcoin Strategy ETF (BITO) provides traditional investors with a convenient way to gain exposure to the price of Bitcoin by holding CME Bitcoin futures as the underlying asset. The fact that the ETF is a Bitcoin futures-based ETF and not a “physical” Bitcoin ETF is what helped ProShares gain SEC approval for its fund.

On October 19, the Bitcoin ETF began trading on the New York Stock Exchange and experienced so much demand that it became the fastest ETF in history to reach $1 billion in assets under management (AUM).

On the back of ProShares’ listing success, numerous Bitcoin futures-based ETFs are now emerging. The Valkyrie Bitcoin Strategy ETF (BTF) is the second Bitcoin ETF to hit the market only three days after BITO.

The journey to list a Bitcoin ETF started in 2014 when the Winklevoss brothers first sought approval for an ETF that tracks the price of Bitcoin. Now, seven years later, the first Bitcoin ETF finally launched on US soil.

Boosted by the positive momentum created by the first-ever US Bitcoin ETF, the price of Bitcoin hit a new all-time high in October, peaking at around $67,000 on October 20.

In light of Bitcoin’s positive price momentum coming into Q4/2021 combined with the high demand for Bitcoin ETF in the US, many Bitcoin experts believe we could see another move higher to hit a new all-time high before year-end.

Crypto Asset Performance Review

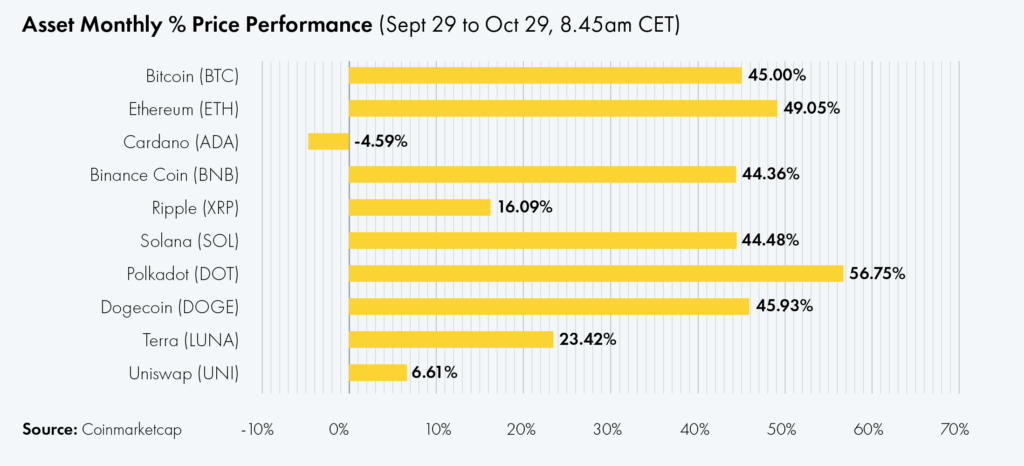

Bitcoin hit a new all-time high of just under $67,000 on October 20 following the Bitcoin Futures ETF approval, continuing its positive price momentum since the start of the month to book a 45.00% month-on-month price increase.

Boosted by the Bitcoin rally, the broader crypto market followed suit, resulting in substantial gains for Ethereum (ETH), Binance Coin (BNB), Solana (SOL), and Polkadot (DOT), which increased in value by 49.05%, 44.36%, 44.48%, and 56.75%, respectively.

The biggest (and most surprising) gainer was the meme coin, Shiba Inu (SHIB), which climbed by 919.13% to become the ninth-largest cryptocurrency by market capitalization. The Dogecoin spin-off even managed to flip its meme coin predecessor Dogecoin, despite DOGE rallying 45.93% month-on-month. While a $39 billion total market value seems way too high for a meme coin based on a meme coin, the Shiba Inu rally highlights the growing power of memes in the crypto markets.

While the crypto markets experienced an impressive October rally driven by Bitcoin’s new all-time high, US stocks also set new record highs, with both the S&P 500 and Nasdaq reaching all the highs to close out the month. The S&P gained 5.43% month-on-month to hit $4,596 while Nasdaq climbed to $15,448, up 6.44% versus September. The global equity markets edged 5.06% higher in October, measured by the MSCI World Index.

The value of gold (XAU) climbed by 3.46% in October, while US Treasuries closed the month a touch lower on the back of the risk-on rally in stocks, with the S&P US Government Bond Index closing the month 0.11% lower.

Institutional Interest in Crypto

With the first US Bitcoin ETF hitting the New York Stock Exchange, institutional interest for crypto has never been higher. As a result, Wall Street is gearing up to provide more crypto products and services to keep up with the growing customer appetite for crypto.

To address the growing demand, Minneapolis-based US Bank announced that it has launched a crypto custodian service that allows fund managers to securely store their digital assets. Gunjan Kedia, of the bank’s wealth management and investment services division, said: “Our clients are getting very serious about the potential of cryptocurrency as a diversified asset class. I don’t believe there’s a single asset manager that isn’t thinking about it right now.”

CME Bitcoin futures trading volumes have skyrocketed, boosted by the launch of Bitcoin futures-backed ETFs. The Chicago Mercantile Exchange is now reportedly the largest Bitcoin futures exchange in the world, replacing Binance after the amount of funds locked in the CME Bitcoin futures contracts has tripled in October.

Bitcoin on Balance Sheets

PSV Eindhoven became the first European football club to hold Bitcoin on its balance sheet.

In August, the Dutch football club announced that the Bitcoin exchange AnyCoin Direct has become an official club sponsor for two seasons, with the sponsorship fee having been paid entirely in Bitcoin. A few weeks ago, an PSV Eindhoven club official confirmed that the club has retained some of the Bitcoin in self-custody, making them the first football club to hold Bitcoin in their treasury.

The “Bitcoin nation” El Salvador, which made the cryptocurrency legal tender in September, has purchased an additional 420 BTC for its treasury, according to a tweet by President Nayib Bukele. The Central American nation has purchased a total of 1120 BTC since it has declared Bitcoin legal tender.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Iconic Funds’ mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- What would the world look like with Bitcoin as a Reserve Currency?

- The Institutionalization of Bitcoin: What Does It Mean for Crypto Investors?

- The Great American mining migration is now complete.

- Iconic Funds Receives Approval to List Europe’s First Crypto Asset Fund on a Regulated Market.

Iconic in Press

- ETF Magazine, The primary value drivers of Bitcoin and Ethereum, by Michael Geister, Head of Crypto ETPs

- Fundview, Bitcoin, Ethereum & Co.: Which factors affect the value of cryptocurrencies?

- Der Fonds, Crypto Roundtable, Maximilian Lautenschläger, Co- founder and MP of Iconic Holding

Recent Research Reports

- How did portfolios perform during the pandemic? ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

In no event will you hold ICONIC HOLDING GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

ICONIC HOLDING GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond ICONIC HOLDING GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

ICONIC HOLDING GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.