Key Takeaways

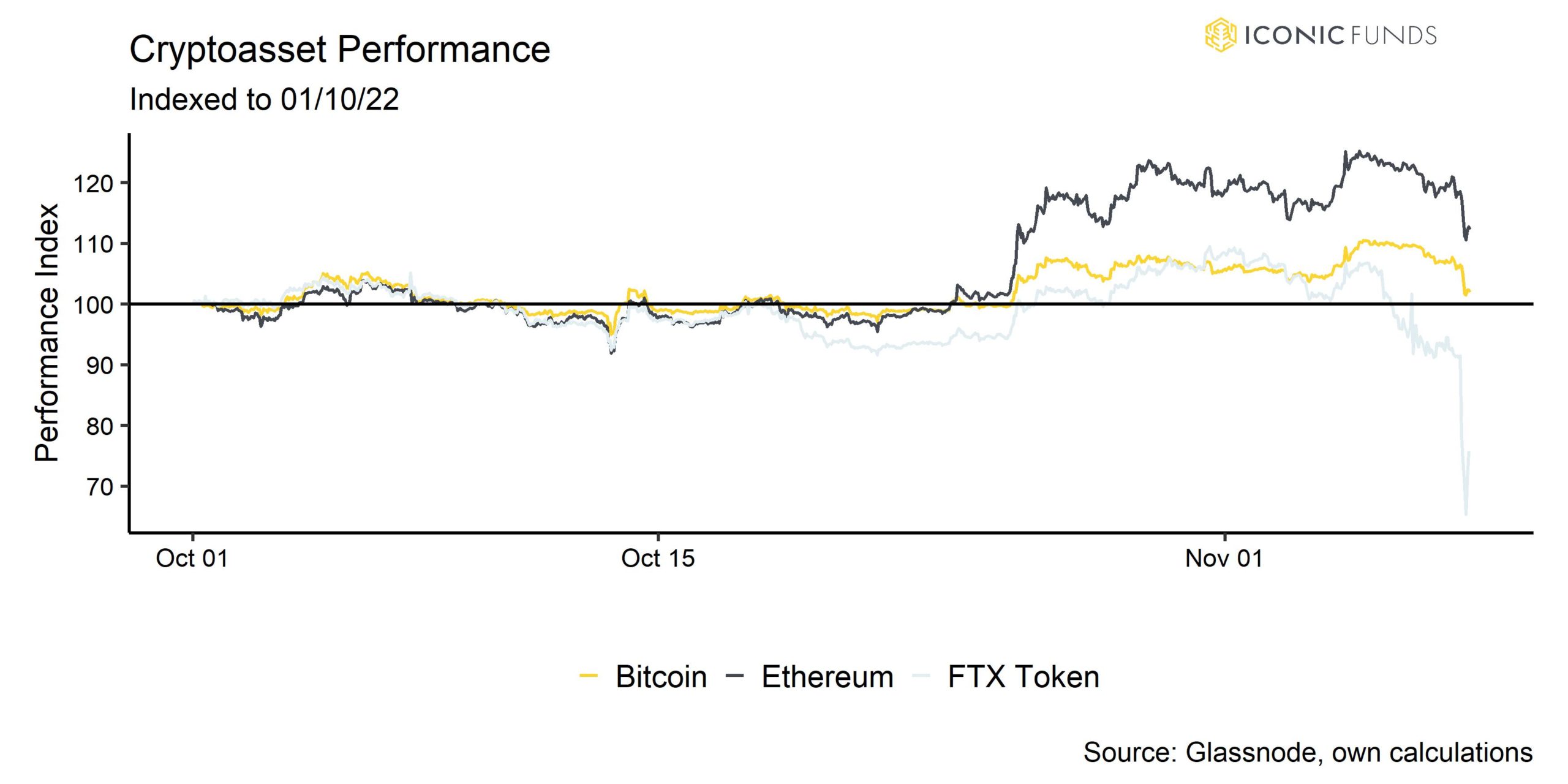

- The FTX exchange token FTT has come under speculative attack following a report by Coindesk that questions the solvency of FTX’s parent company Alameda

- Investors should expect more volatility in the short term but watch out for attractive buying opportunities in major cryptoassets

What just happened?

What just happened?

Preceeding events

Sam Bankman-Fried (henceforth SBF) was previously regarded as the crypto industry’s king.

Known for founding crypto exchange FTX and Alameda, engaging in arbitrage trading, and making hugely profitable investments like Solana (SOL).

At his peak, Sam had an amazing estimated net worth of $10–14.5 billion dollars.

FTX has recently been quite busy conducting sizable fundraising rounds for new initiatives.

The most recent examples are Sui and Aptos.

Sam could do no wrong.

Despite the mayhem Luna had caused, he made use of it as leverage to carry out his ambitious expansion strategy.

- Made a bid for Voyager’s assets;

- Paid $240 million to bail out BlockFi;

- Thought about bailing out Celsius

However, there were cracks beginning to show in the distance.

Sam Trabucco, CEO of Alameda, abruptly announced his resignation. In addition, Brett Harrison, the president of FTX, resigned a month later.

These resignations took place right before it became public knowledge that FTX was being investigated by the securities authority for possible legal violations.

SBF has a blatant political interest, as seen by his contributions of approximately $50 million to the forthcoming midterm elections.

This follows his intention to give $1 billion to the 2024 U.S. presidential election (which he later backtracked on).

Sam obviously has his political aims in mind.

Even if Sam’s reputation was deteriorating, the DCCPA draft law represented a significant shift in public opinion.

The bill’s first online leak was a draft.

Sam seems to have been in favor of the legislation.

However, despite Sam’s efforts to appear like the “nice guy” publicly, there were numerous issues with the law that should have raised serious concerns for DeFi.

A number of significant industry leaders, most notably Ben Armstrong, have come out against the law.

During a Bankless interview, Erik Voorhees notably questioned SBF over his position.

The crypto community has continued to be skeptical as a result of this video (which went viral).

For Sam, the public backlash was severe.

People’s attitudes changed as they realized that his motives might not be what they initially believed.

This shift in attitude served as a signpost for what was to come and was a significant factor in the intensity of the current rumours.

Questions about Alameda’s solvency

When Alameda’s balance sheet was disclosed on Wednesday last week, worries began to surface.

It became clear that “FTX’s own centrally controlled and printed-out-of-thin-air token is actually the net equity in the Alameda firm,” according to Cory Klippsten.

Is Alameda Insolvent? Was the title of a report that was issued by one of the accounts that initially predicted Celsius’ demise.

The situation in Alameda was described in the study as “precarious, to say the least.”

Rumors about FTX’s bankruptcy began to spread.

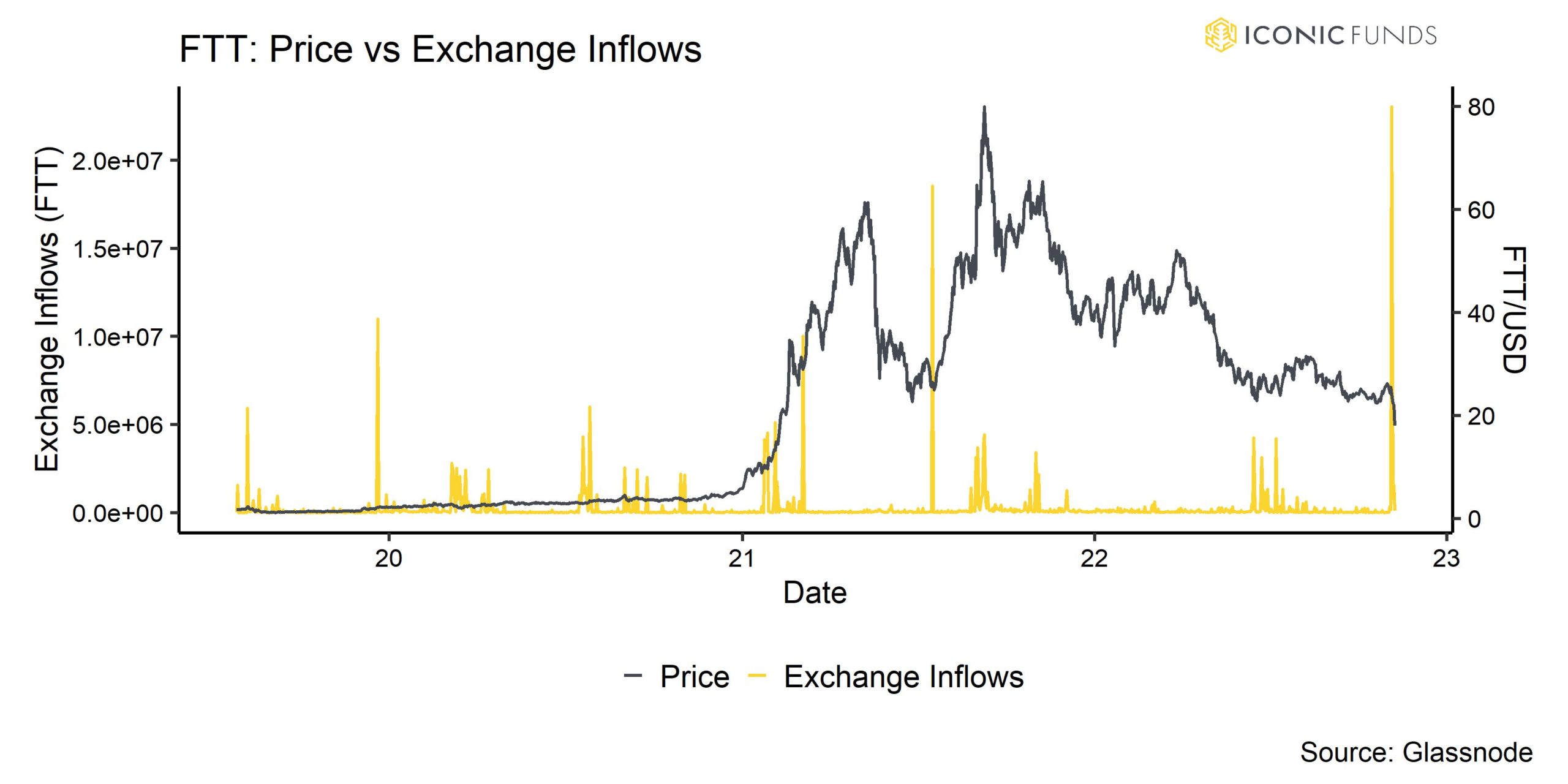

In consequence, we saw significant exchange inflows of FTX tokens, which are usually a bearish sign as they signal selling intentions by investors. In fact, we saw the biggest exchange inflows ever recorded on Saturday following these rumors.

The CEO of rivaling exchange Binance, Changpeng Zhao (CZ), confirmed that a significant part of these exchange flows were conducted on behalf of Binance itself.

When CZ declared his intention to “liquidate any remaining FTT on our books,” we received full confirmation that Binance was selling its FTT stake.

Binance used to be an early investor in FTX but exited last year. The equity exit was paid out in Binance USD (BUSD) as well as FTX Tokens (FTT) itself, that are now reportedly being liquidated by Binance following the recent revelations.

Alameda Research’s CEO, Caroline, was compelled to respond to CZ’s sale.

The response raised some red flags because it seemed a little desperate and was interpreted by the market that 22 USD per FTX Token was somewhat of a price where Alameda had to intervene.

Apart from that, Alameda holds numerous additional tokens that could see downside pressure if the situation worsens, and create contagion for the broader cryptoasset market as a whole. Alameda has significant stakes in Serum (SRM), Lido DAO (LDO), SushiSwap (SUSHI) as well as significant stakes in Bitcoin (BTC) and Ethereum (ETH) in general.

People are rushing to withdraw money due to the rumours surrounding FTX, which has caused astounding withdrawals.

Yesterday, when some people had to wait 4 hours to execute withdrawals, there was a real possibility of a “bank run.”

Sam recently responded, saying that FTX and assets are both fine.

Nonetheless, this led to further selling pressure via increased short positions in perpetual futures, in particular on Binance.

FTX has recently halted withdrawals and the price has hit new multi-year lows.

However, there is been a tweet by CZ which was also confirmed by SBF who announced that Binance intends to fully acquire FTX. This has significantly stabilized prices of FTT and the wider crypto market so far.

What should we expect from these events?

At the time of writing, the FTX Exchange Token (FTT) is trading at around 19 USD. The token has already lost approximately 1 bn USD in market cap in the last 7 days and around 7 bn USD since the general market peak in September 2021. FTX used to be the second most important centralized exchange token after Binance Coin (BNB) and the major competitor for its Asian counterpart. It is to be expected that the landscape will consolidate further, following a potential takeover by Binance, and that Binance Coin (BNB) will stay the dominant asset within the centralized exchange space.

Nonetheless, the current events may create attractive buying opportunities for investors looking to increase their exposure to the market in general.

As we have outlined in our last “Crypto Market Intelligence”, the degree of monetary policy tightening is so high that we expect to reach “peak hawkishness” of US monetary policy rather sooner than later. The moment we will reach peak hawkishness of US monetary policy might provide an environment for a more sustainable macro bottom in cryptoasset prices going forward.

Based on our analysis, increasing evidence of peak hawkishness is in our view the necessary condition for a sustained macro bottom in Bitcoin and cryptoassets in general.

Furthermore, Bitcoin on-chain metrics imply that selling pressure has recently receded, longer term investors have continued to accumulate strongly and valuations are relatively cheap. In combination with recent developments and potential “seller’s exhaustion”, this may provide a good environment for a more sustainable price bottom going forward.

Stay humble and stack Sats,

André

References:

- https://twitter.com/Bitboy_Crypto/status/1586406345879695360?s=20&t=mDIX1KLLniG0Va9lDYD38Q

- https://twitter.com/artofbagholding/status/1586117772005605376?s=20&t=3dA8FQt4fJJm50uZtngLfA

- https://www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-trading-titan-alamedas-balance-sheet/

- https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

- https://twitter.com/cz_binance/status/1589283421704290306?s=20&t=MS_oprYod_WdVpsBbHFR1Q

- https://twitter.com/carolinecapital/status/1589287457975304193?s=20&t=g3ZYuGrR_-y83tGlbIxlnw

- https://twitter.com/SBF_FTX/status/1589598284322328579?s=20&t=wnq42m4iVvo32secwFoobA

- https://twitter.com/cz_binance/status/1590013613586411520?s=20&t=tLMWTKf7p7OgKvFEB4_D1Q

- https://iconicholding.com/wp-content/uploads/2022/11/CMI_October-2022.pdf

About Iconic Funds

Iconic Funds is the bridge to crypto asset investing through trusted investment vehicles. We provide investors both passive and alpha-seeking strategies to crypto, as well as venture capital opportunities.

We deliver excellence through familiar, regulated vehicles offering investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption.

Recent News and Articles

- Institutional Crypto Adoption: Why & How Institutions Are Going Crypto

- Crypto Portfolio Composition: How Different Portfolios Have Performed During the Recent Bull and Bear Markets

- Tailor-Made Crypto Funds: How the Iconic Quant Solutions Team Enables Investors to Earn Target Returns

- How to Invest in Ethereum (ETH): A Guide for Professional Investors

- The Case for Actively Managed Investment Strategies in the Crypto Markets

- How to Invest in NFTs: A Guide for Professional Investors

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How accurate is the Bitcoin Stock-to_Flow Model?

Iconic in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- ETF strategy: Iconic Funds debuts world’s first ApeCoin crypto ETP

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Iconic Holding GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Iconic Holding GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.