Despite the liquidity crisis faced by centralized crypto lending firms, decentralized finance (DeFi) lending protocols managed to withstand the pressure, continuing to operate as intended. Read on to learn about the difference between DeFi vs. CeFi and why the recent drama in the centralized crypto lending sector has made a strong case for decentralized finance.

CeFi vs. DeFi: What’s the Difference?

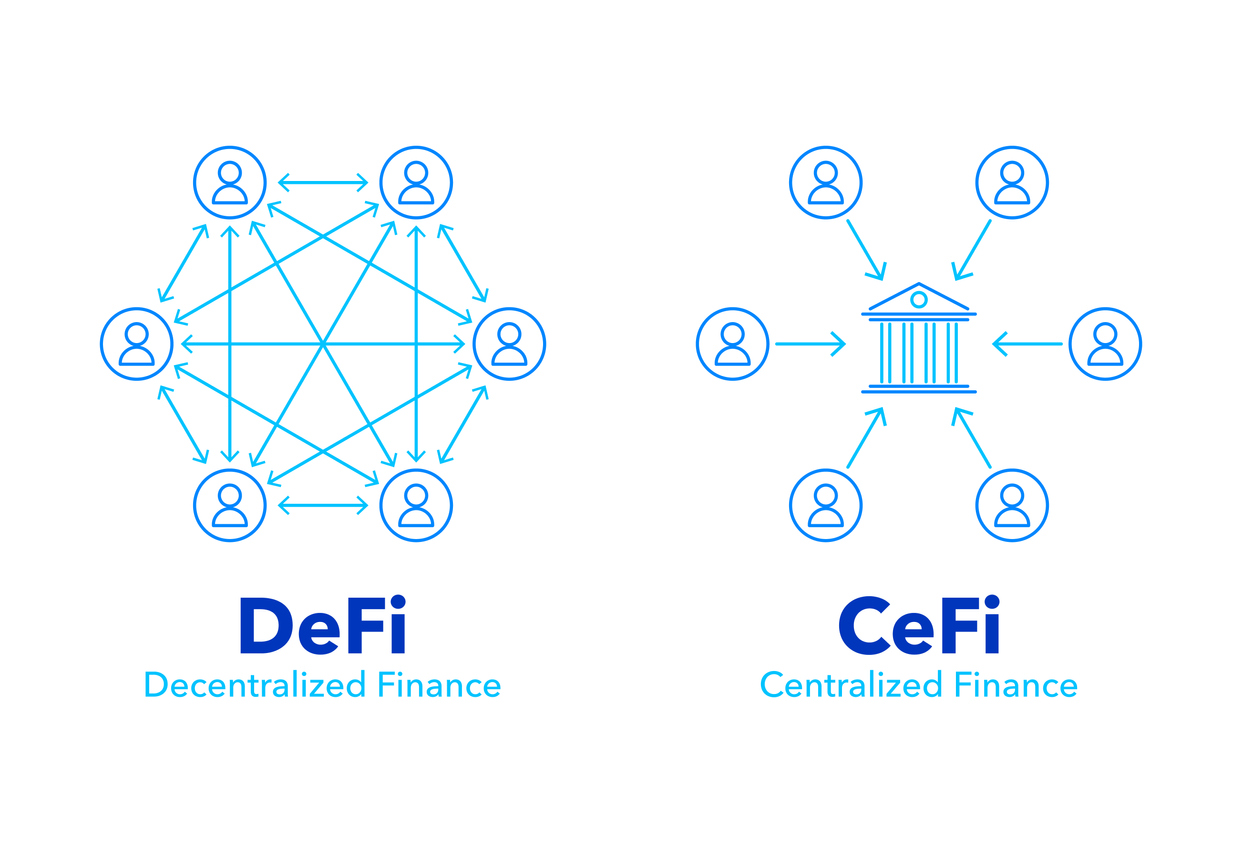

Traditionally, financial products and services have been operated by trusted, centralized intermediaries, such as banks, brokers, and other financial institutions.

Cryptocurrency companies have applied the same model to offer services such as trading, investing, and lending. In the crypto markets, these companies are referred to as centralized finance (CeFi) providers. Crypto exchanges and crypto lending platforms are examples of CeFi companies.

Conversely, decentralized finance (DeFi) is a new suite of Internet-native financial products and services that are powered by blockchain technology. Instead of centralized authorities acting as intermediaries, DeFi protocols are operated by smart contracts and run autonomously to alleviate the need for a single entity to process transactions.

While most leading DeFi platforms have companies behind them developing and maintaining the protocol’s code, once the DeFi application is deployed, it can typically only be altered with the approval of the protocol’s community.

The community is typically composed of protocol token holders who form a DAO (decentralized autonomous organization) and vote on proposals put forth by members.

The key difference between CeFi and DeFi is that trust remains with centralized entities in CeFi, whereas DeFi operates in a trustless manner as the entire workings of decentralized finance applications can be viewed on-chain.

CeFi vs. DeFi Lending: A Comparison

CeFi and DeFi borrowing and lending platforms both come with benefits and drawbacks. Let’s look at the two types of crypto lending approaches and how they compare.

| CeFi Lending | DeFi Lending |

| Typically pays high-interest rates | Typically pays lower interest rates |

| Some regulatory compliance | Largely unregulated (with zero consumer protection) |

| Fiat to crypto on-ramp (enabling fiat currency deposits) | Users can only exchange, borrow, and lend crypto assets |

| Lower technical risk because intermediaries facilitate lending | Smart contracts may have bugs that hackers can exploit |

| Users have to register an account and wait for KYC approval before they can use a platform’s services | No KYC or ID documentation required |

| Asset custody lies in the hands of the crypto platform | Users have full custody over their assets |

| The centralized decision-making process regarding the use of lenders’ funds can result in opacity | Highly transparent because everything happens on-chain |

| Loan approval is subject to KYC/AML checks | No credit checks required |

| Borrowers may wait for one business day or longer for loan approval | Borrowers can secure loans within minutes |

As you can see in the table above, it’s difficult to argue that one is better than the other because both have clear advantages and disadvantages.

However, what we saw unfolding in the centralized crypto lending market in Q2/2022 suggests that the future of digital asset lending should probably operate on decentralized protocols that are not prone to the same problems as the traditional financial industry.

What Happened in the Centralized Crypto Lending Landscape?

Following the collapse of Terra (LUNA) and TerraUSD (UST), numerous centralized crypto lenders who had exposure (or counterparties with exposure) to these two assets experienced a liquidity crisis that led to bankruptcies and bailouts.

Initially, a handful of crypto lenders stopped client withdrawals to ensure they could remain liquid and meet obligations. However, it soon became evident that the hit these lenders took from the collapse of the Terra ecosystem would lead to company failures.

While some lenders were fortunate enough to receive de facto bailouts from well-funded crypto companies, others had to shut their doors, leaving depositors empty-handed.

But how did numerous leading crypto lenders fail simply because two cryptocurrencies collapsed?

The answer lies in how these lenders operated to achieve the high interest they were able to pay depositors.

When a crypto investor deposited funds into a centralized lending platform, the service provider lent these funds to large crypto borrowers. Typically, these borrowers were hedge funds or large VC companies that deployed the borrowed capital in high-yielding crypto investment strategies.

For example, some would buy UST and place it into Anchor Protocol that paid 20% APY. Others invested in LUNA or other digital assets they believed had the potential to increase in value substantially.

The issue arose when large borrowers could no longer repay the lending companies as they had lost substantial sums in LUNA and UST or other investments. As a result, lenders could no longer pay depositors because borrowers failed to repay them.

Additionally, some lenders reportedly also deployed customer funds in high-yielding crypto investment opportunities, essentially taking on too much risk with customer funds without their customer’s knowledge or approval.

Finally, as the liquidity crisis in the lending markets became apparent, the crypto asset market dropped significantly due to forced selling and investor sentiment turning negative.

As a result, counterparties that owed lenders couldn’t sell enough assets at a reasonable price to pay their loan obligations. That left lenders without the funds to meet their obligations to depositors.

Essentially, the liquidity crisis in the centralized crypto lending markets came from large industry players borrowing and lending from and to each other. Once the market turned sour following the collapse of Terra and UST, the interconnectedness of these large players resulted in a cascading failure of counterparties.

Why DeFi Lending Has Managed to Weather the Storm

While the centralized crypto lending market was rattled by the collapse of Luna (LUNA) and TerraUSD (UST), leading to an array of lender bankruptcies and bailouts, the decentralized crypto lending market continued to operate without any issues.

The credit crisis in the centralized lending market didn’t affect DeFi lending protocols because borrowers overcollateralize their loans. In DeFi, if borrowers fail to maintain the collateral above the margin call, the smart contract liquidates them. This prevents depositors (lenders) from losing their money.

DeFi platforms observe healthy risk management practices; most of them have a minimum loan-to-value (LTV) ratio of about 60 to 90%. For instance, stablecoins on Aave have an LTV of 75%, while the LTV of other assets ranges from 15-60%.

Moreover, the lack of intermediaries means that DeFi lending protocols cannot invest depositors’ money in strategies they haven’t approved. Also, the smart contract rules don’t favor particular borrowers over others. No one can receive preferential treatment based on their reputation (which was the case in the centralized crypto lending market).

In DeFi, every borrower has to overcollateralize their loan and keep it above the margin call. Failure to do this results in liquidation. The rules are clear and cannot be changed. Blockchain technology, therefore, keeps DeFi lending protocols transparent and accountable.

For these reasons, DeFi fared better than CeFi in the recent bear market, highlighting the power of crypto-powered, decentralized financial services.

About Iconic Funds

Iconic Funds is the bridge to crypto asset investing through trusted investment vehicles. We provide investors both passive and alpha-seeking strategies to crypto, as well as venture capital opportunities.

We deliver excellence through familiar, regulated vehicles offering investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption.

Recent News and Articles

- The Case for Actively Managed Investment Strategies in the Crypto Markets

- Iconic Launches Actively Managed Crypto Investment Platform with Recently Acquired Quantitative Solutions Team

- How to Invest in NFTs: A Guide for Professional Investors

- Bitcoin vs. Gold: Why You Are Probably Better Off Buying “Digital Gold”

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How accurate is the Bitcoin Stock-to_Flow Model?

Iconic in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- ETF strategy: Iconic Funds debuts world’s first ApeCoin crypto ETP

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

How did portfolios perform during the pandemic? ➡ Download here

Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Iconic Holding GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Iconic Holding GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.