DDA Crypto Market Pulse, March 27, 2023

by André Dragosch, Head of Research

Key Takeaways

- Cryptoasset performances have stabilized last week after strong gains the week prior

- Our in-house Crypto Sentiment Index has remained neutral throughout the week

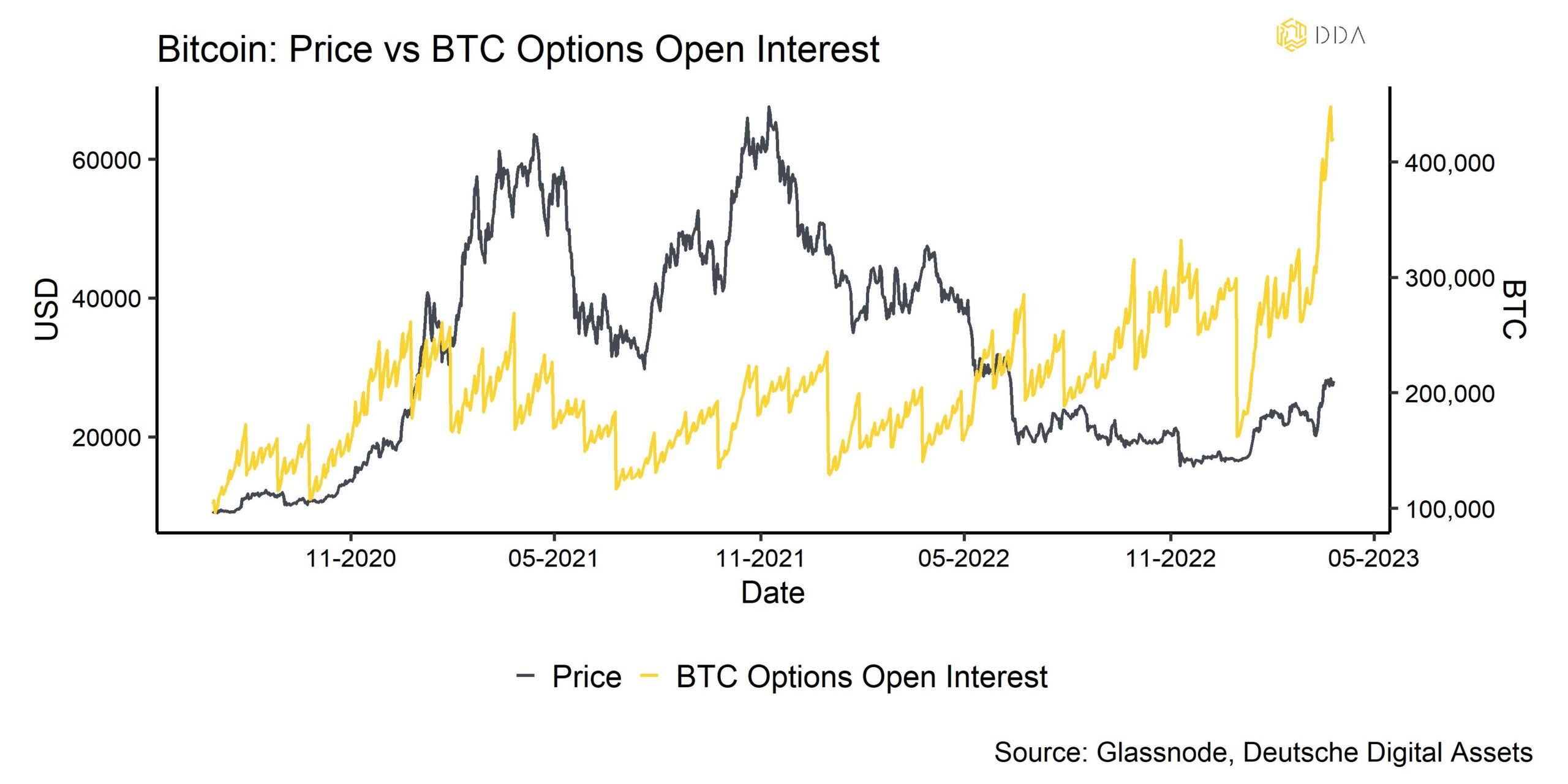

- There has been a very significant increase in cryptoasset exposure via Bitcoin options in the last 2 weeks

Chart of the week

Cryptoasset Performance

Last week’s cryptoasset performances were rather muted compared to the week prior, where we saw one of the strongest performances since early-2021. It appears that cryptoasset markets have stabilized and do not seem to react to the ongoing stress in the traditional banking sector anymore.

Nonetheless, cryptoasset investors appear to have increased their exposure to cryptoassets aggressively via Bitcoin options lately as shown by the increase in Bitcoin options open interest in our Chart-of-the-Week.

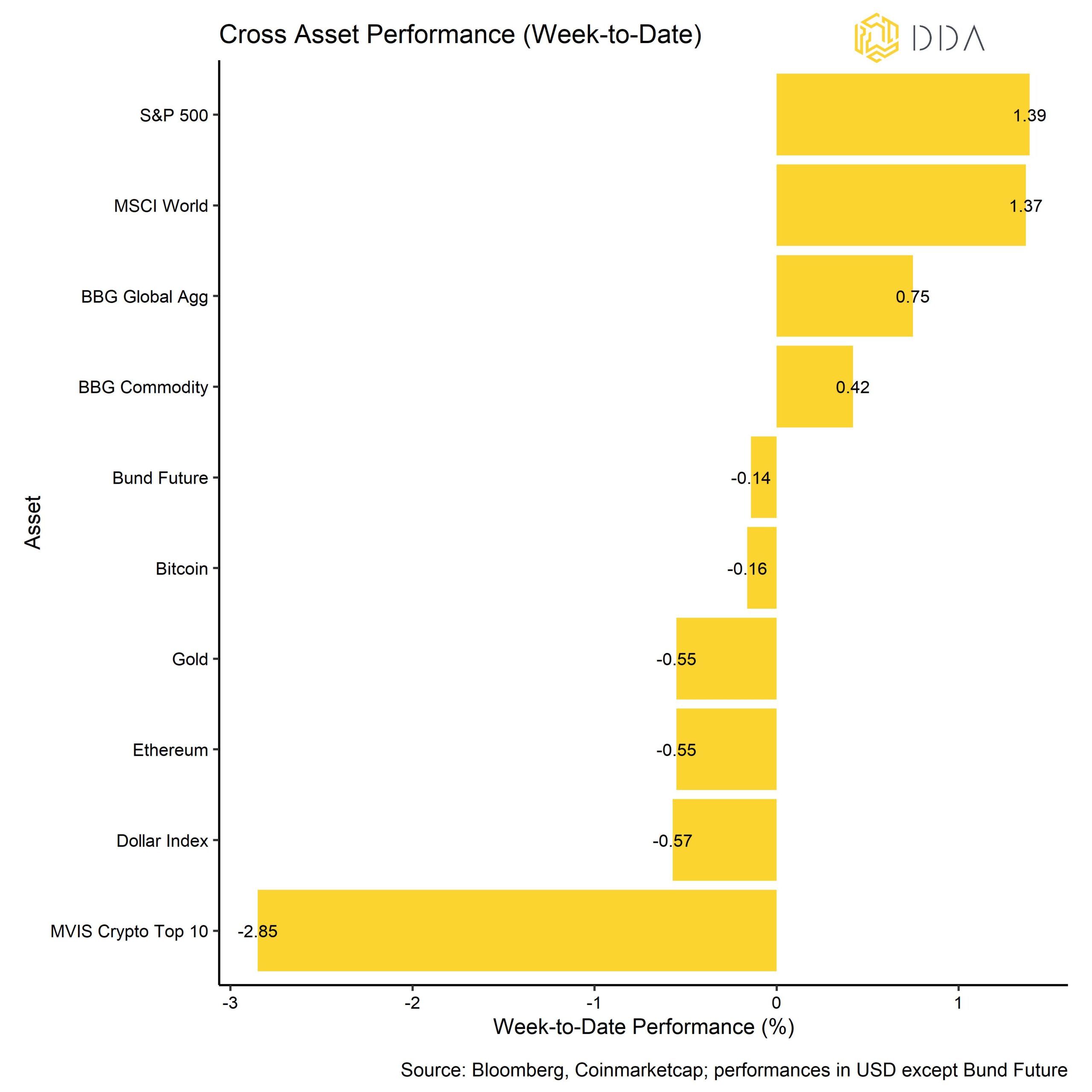

However, in comparison to traditional financial assets, cryptoassets were the worst asset class last week, underperforming global equities by -422 Bps. Global bond markets and commodities were able to deliver a positive performance while gold and the US Dollar also retreated last week.

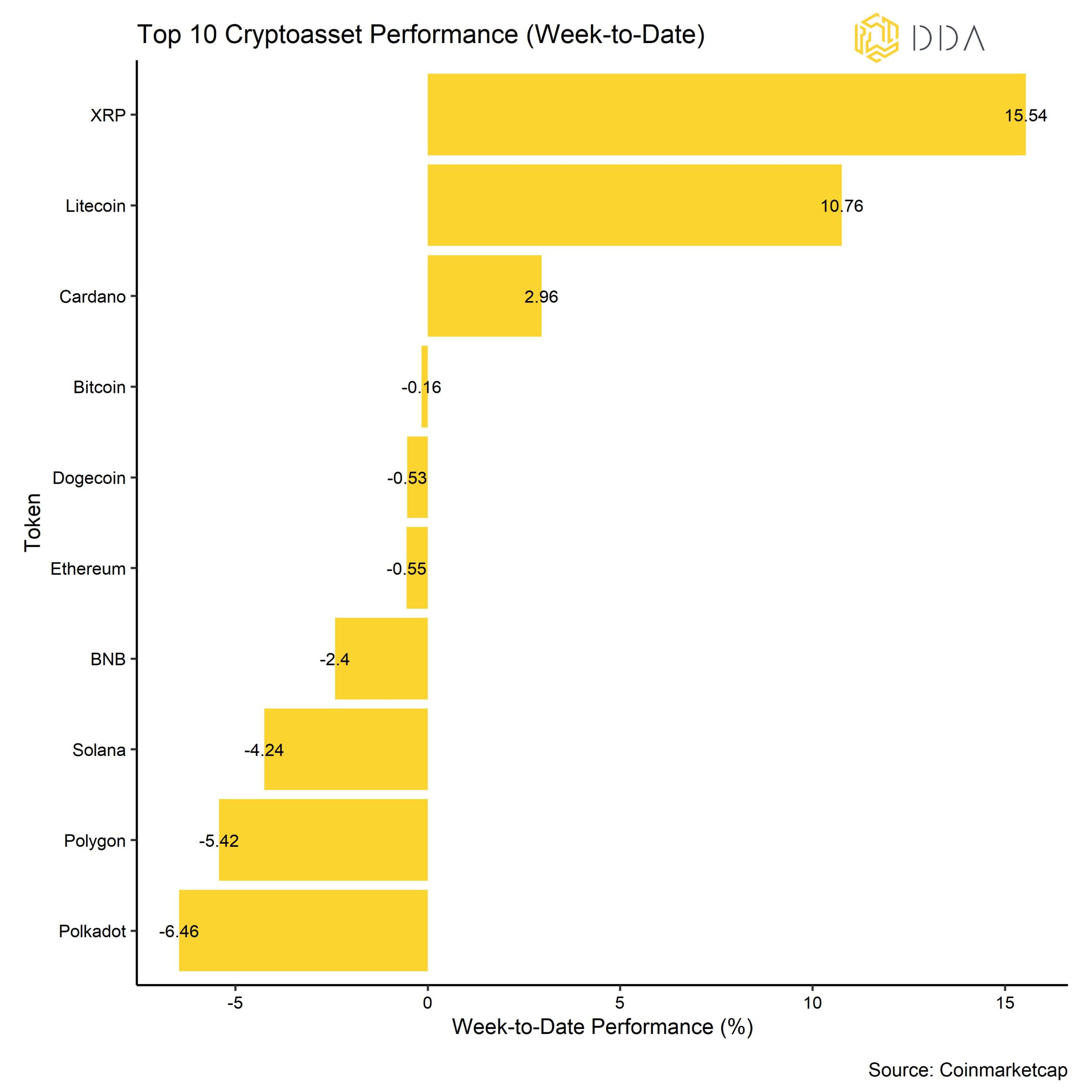

However, this hides an increasing dispersion among the top 10 cryptoassets with a performance spread of 22%-points between the top and bottom cryptoasset.

Among the major cryptoassets, XRP, Litecoin and Cardano were the relative outperformers. XRP was able to outperform significantly on the back of rumours that the Ripple may win the ongoing court case against the SEC.

Crypto Market Sentiment

Our in-house Crypto Sentiment Index has remained neutral throughout the week with no major moves in either direction. 7 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals in the BTC Put-Call Volume Ratio and Crypto Fund Flows.

The Crypto Fear & Greed Index has remained in “Greed” territory throughout the week.

At the same time, our in-house measure of Cross Asset Risk Sentiment, which measures the level of risk appetite across traditional asset classes such as equities, bonds, commodities and FX, continued to decrease sharply last week.

Dispersion among cryptoassets has recently increased albeit from low levels which means that cryptoassets are still mostly trading on systematic factors. At the same time, altcoins also underperformed Bitcoin on a 1-month and 3-months basis. There was only an increase in Altcoin outperformance in the last week but there were still less than 50% of tracked altcoins who managed to outperform Bitcoin. Altcoin outperformance is usually a sign of increased risk appetite and low altcoin outperformance is still indicative of a rather cautious market sentiment.

Crypto Asset Flows

Last week saw a significant reversal in cryptoasset fund flows.

In aggregate, we saw net fund inflows in the amount of +86.7 mn USD with the lion’s share of inflows flowing into Bitcoin funds (+121.6 mn USD). Altcoin funds ex Ethereum also managed to attract flows (+8.4 mn USD) while both Ethereum funds as well as Basket & Thematic Cryptoasset funds experienced net outflows (-27.5 mn USD and -15.8 mn USD, respectively).

In contrast, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – has managed to narrow even further which implies net inflows into this fund vehicle.

Compared to last week, the beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to be negative, implying that global hedge funds still have a net short position in cryptoassets.

Bitcoin prices traded on Coinbase vis-à-vis those traded on Binance (Coinbase-Binance premium) were mostly positive throughout the week, which is indicative of increased buying interest from institutional investors vis-à-vis retail investors in face of the market ructions. However, the premium appears to have moderated lately.

On-Chain Activity

On-Chain activity was still dominated by an increase in network participation as the number of new entities entering the network reached the highest level year-to-date, based on data provided by Glassnode. We also saw the fastest growth in Bitcoin addresses with more than 0 BTC since early 2021 (non-zero addresses). So, the current price level appears to be well-supported by underlying network activity.

That being said, we currently do not see a high congestion of the Bitcoin mempool relative to the degree of congestion we saw the week prior which implies that the rush to enter into Bitcoin has recently levelled off somewhat. The Bitcoin mempool represents a “waiting area” for valid transactions before they are included in a block.

At the same time, the hash rate of the Bitcoin network has continued to increase with another major upwards adjustment of the network difficulty of around +7% being anticipated. The network difficulty represents the estimated amount of computations needed to find the hash of the next block which is considered a proxy for the level of security of the network.

Apart from that, exchange volumes have been fairly muted with no major exchange inflows that could signal selling pressure at these higher price levels. To the contrary, Bitcoins continued to flow out of exchanges again, especially into larger wallet sizes which implies some degree of whale buying.

We also saw continued declines in Ethereum exchange balances last week which are also positive. Transactions on the Ethereum blockchain currently appear to be dominated by transactions different from NFTs, DeFi, ERC-20 or Stablecoins based on the relative Gas usage (i.e. transactions fees) which implies that pure investment demand has been a dominant force in the latest price increases as well.

Cryptoasset Derivatives

In general, we have seen an overall decrease in implied volatilities due to the stabilization in prices last week. The 25-delta Bitcoin option skew which measures the difference in implied volatilities between calls and puts also reversed slightly.

However, there was a very significant increase in Bitcoin options open interest to new all-time highs in BTC-terms as shown by our Chart-of-the-Week. The notional USD-value of these contracts is at par with the highs of the last bull market. Most institutional investors increasingly also use derivatives such as options to manage their exposure to cryptoassets.

Most of these option contracts represent out-of-the-money (OTM) calls, i.e. buy options. So, in aggregate, option traders are speculating on higher prices. The Put-Call Open Interest currently stands at 0.52, meaning that there are approximately 2 call options for every single put option.

In contrast, there has not been such a significant increase in either futures or perpetual futures open interest last week. As it currently stands, Bitcoin option open interest has surpassed both futures and perpetual open interest in terms of USD notional value.

The BTC 3-months futures basis rate is still positive and trending upwards while the perpetual funding is slightly positive implying that traders are generally positioned towards higher prices.

Bottom Line

Cryptoasset performances have stabilized last week after strong gains the week prior.

Our in-house Crypto Sentiment Index has remained neutral throughout the week.

There has been a very significant increase in cryptoasset exposure via Bitcoin options lately.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.