DDA Crypto Market Pulse, March 13, 2023

by André Dragosch, Head of Research

Key Takeaways

- Cryptoasset performances were weighed down by two significant US bank failures (Silvergate and Silicon Valley Bank), but for different reasons.

- Our in-house Crypto Sentiment Index has significantly declined compared to last week and is now firmly in bearish territory

- While risk aversion has increased in the short-term, higher uncertainty in the traditional banking system might bring us closer to a pause in the Fed hiking cycle which would be very bullish for cryptoassets

Chart of the week

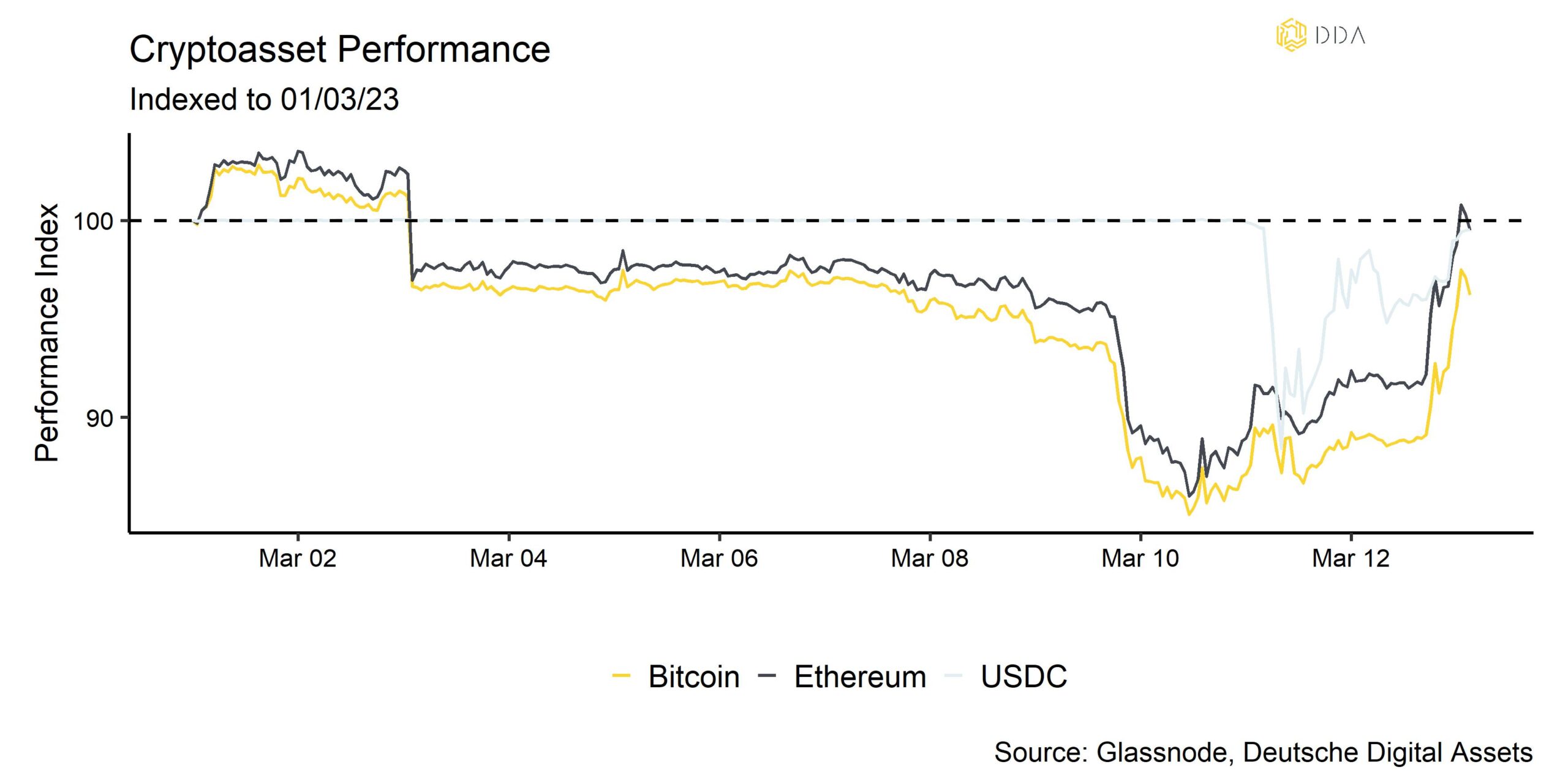

Cryptoasset Performance

Last week, cryptoasset performances were weighed down by two significant US bank failures (Silvergate and Silicon Valley Bank), but for different reasons.

The insolvency of highly-interconnected crypto merchant bank Silvergate (SI US Equity) had increased uncertainty in crypto markets on account of the fact the “Silvergate Exchange Network” (SEN), a real-time payments platform run by the bank, allowed cryptocurrency exchanges, organizations, and users to trade fiat currencies including US dollars and euros. The failure was most-likely related to the collapse of cryptoasset exchange FTX late last year.

In contrast, the failure of Silicon Valley Bank (SIVB US Equity) was a result of a number of causes, including bad risk management and a bank run organized by investors in the tech sector. The reason there was financial contagion to cryptoassets was because the company Circle – the issuer of the USDC stablecoin – reportedly held approximately 3.3 bn USD of its cash reserves at Silicon Valley Bank. This led to a short de-peg of the US Dollar-backed stablecoin to below 90 Cents on the Dollar as shown by our Chart-of-the-Week, which weighed on the whole cryptoasset sector.

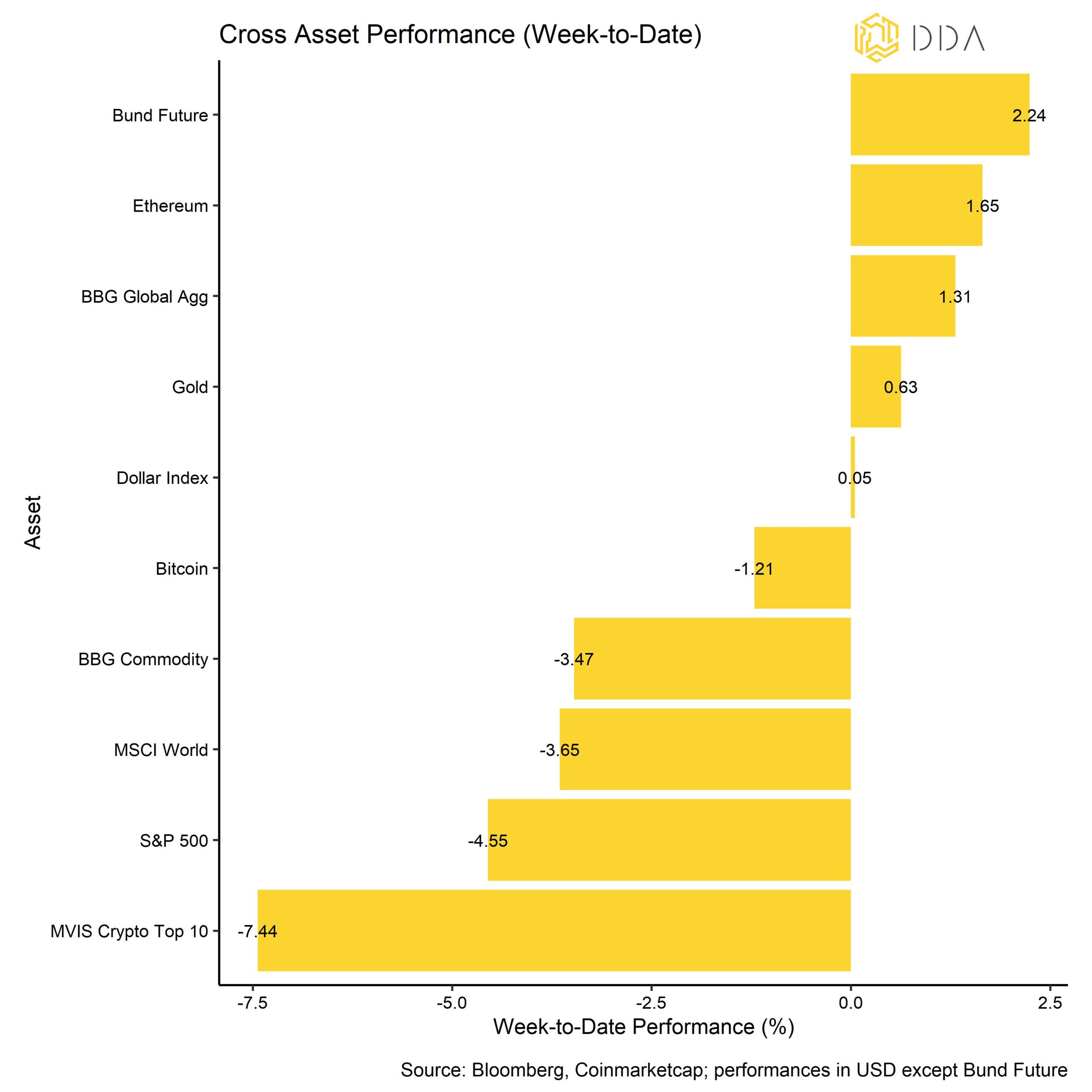

Other traditional financial assets were also negatively affected, especially US and global equities. Bonds and Gold advanced.

However, as the US government and the Fed have recently intervened to stop further financial contagion, most of the underperformance in cryptoassets has essentially reversed as of today.

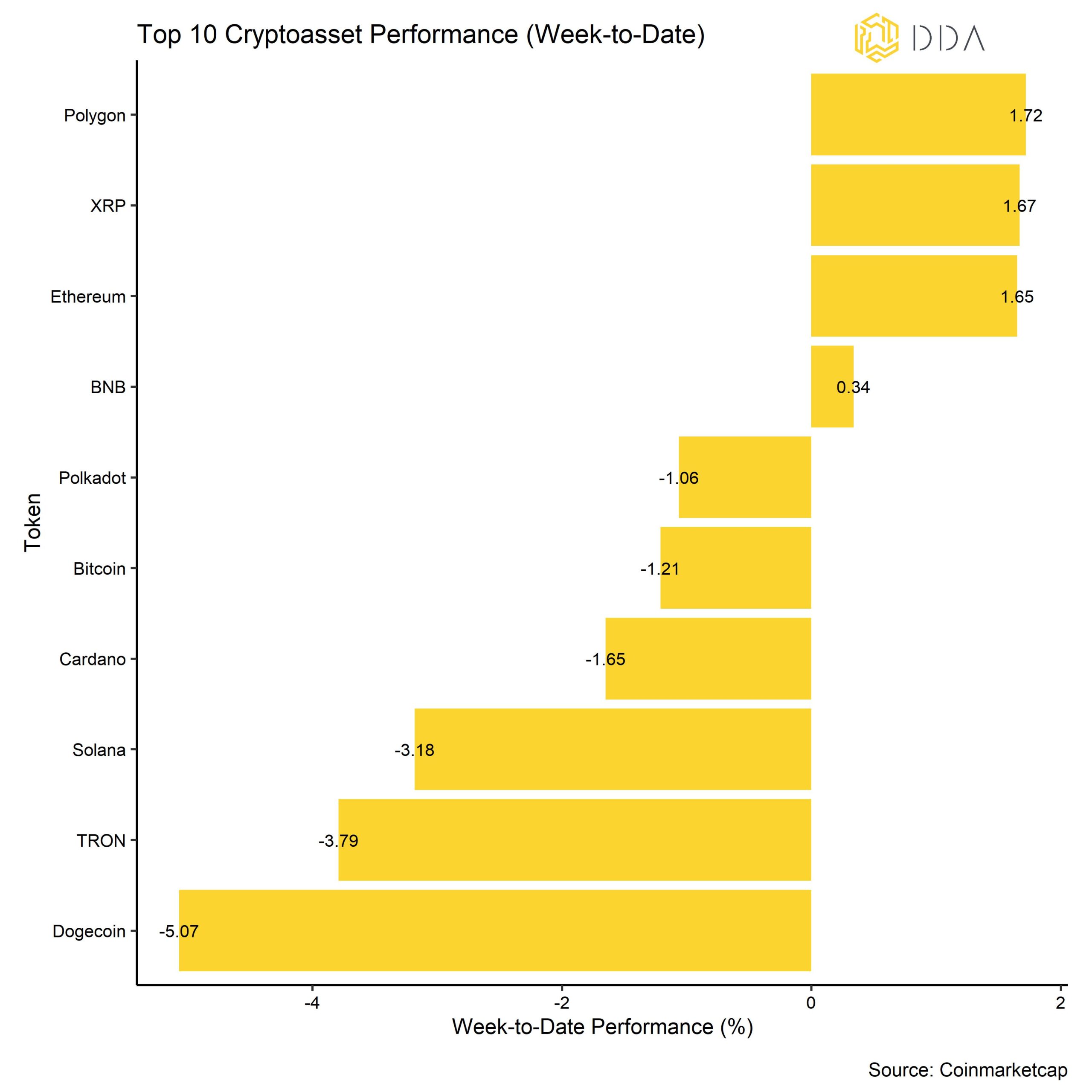

Among the major cryptoassets, Polygon, XRP, and Ethereum were the relative outperformers. In particular, Ethereum outperformed Bitcoin despite the risk-off environment which was mainly associated with the ongoing supply deflation of Ethereum relative to Bitcoin.

Sentiment

Our in-house Crypto Sentiment Index continued to retreat compared to last week and is now firmly in bearish territory. Only 5 out of 15 indicators remain above their short-term trend.

Compared to last week, we saw major decreases in the BTC perpetual funding rate and crypto fund flows.

The Crypto Fear & Greed Index decreased below the 50%-line into “Fear” territory but is currently “Neutral” again. Sentiment measured on Bitcoin Twitter remained bearish throughout last week.

Dispersion among cryptoassets continued to decrease as most cryptoassets were increasingly trading on systematic factors. At the same time, altcoins also underperformed Bitcoin on a 1-month and 3-months basis. On a 1-month basis, only 20% of tracked altcoins have managed to outperform Bitcoin. Altcoin outperformance is usually a sign of increased risk appetite and low altcoin outperformance is still indicative of a rather cautious market sentiment.

Flows

Last week, cryptoassets saw very significant fund outflows, with most of the outflows happening on Wednesday last week and were mostly concentrated in a single Bitcoin fund vehicle in Canada.

In aggregate, we saw net fund outflows in the amount of -278.4 mn USD. All types of products experienced net outflows with the exception of Basket & Thematic funds (+7.4 mn USD). Fund outflows were heavily concentrated in Bitcoin funds (-260.4 mn USD). Ethereum funds and other Altcoin funds also experienced net outflows (-23.8 mn USD and -1.7 mn USD, respectively).

In contrast, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – had decreased since early March before increasing only slightly in recent days.

Compared to last week, the beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to decrease and is now at around 0, implying that global hedge funds have neutralized their market exposure to cryptoassets.

Bitcoin prices traded on Coinbase vis-à-vis those traded on Binance (Coinbase-Binance premium) were positive throughout the week, which is indicative of increased buying interest from institutional investors vis-à-vis retail investors in face of the market ructions.

On-Chain

On-Chain activity was consistent with an increase in overall risk aversion in crypto markets, although exchange inflows generally remained fairly muted despite the increased uncertainty. Nonetheless, there were some significant Bitcoin miners to exchange transfers last week which were the highest since October 2021. This highlights that miners are still operating in a very harsh environment as the hash rate has recently increased to new all-time highs and prices remain relatively low.

Overall, short-term investors have realized losses on-chain but generally remain above cost-basis in their wallets which should have a stabilizing effect on the market as these traders are not inclined to exit their positions with unrealized gains.

Another significant development is the fact that OTC desk balances have recently decreased significantly which could be a sign of decreasing institutional demand for Bitcoin.

Due to the heightened risk aversion surrounding Silicon Valley Bank and USDC, we saw significant activity on the USDC chain with the highest number of active addresses ever recorded on-chain on Saturday. The total transfer volume also reached an all-time high on Saturday with approximately 53.3 bn USD equivalents transferred on-chain. While USDC was trading significantly below par over the weekend, Tether USD (USDT) was significantly trading above par, implying that most investors probably exchanged their USDC holdings for USDT.

Derivatives

In general, the overall decline in cryptoasset sentiment has also led to a significant increase in risk aversion in derivatives markets. While implied volatilities in Bitcoin options only increased marginally, the 25-delta 1-month option skew significantly changed in favor of put options relative to call options. Put (Call) options give holders the right to sell (buy) a specified amount of Bitcoin in the future at a pre-determined strike price. The reversal in the option skew also coincided with an increase in relative put-call option open interest.

Moreover, there was a very significant reversal in both futures basis rate and perpetual funding rates which signal a steep increase in the demand for short positions in Bitcoin. The funding rate has fallen to levels last seen during the FTX collapse in November 2022. The basis rate is currently slightly negative again, implying a rather bearish price outlook by futures traders. However, funding rates that are this negative should already be regarded as a counter-cyclical buying opportunity as excessively low funding rates signal short-term seller exhaustion and one-sided positioning by futures traders.

Bottom Line

Cryptoasset performances were weighed down by two significant US bank failures (Silvergate and Silicon Valley Bank), but for different reasons.

Our in-house Crypto Sentiment Index has significantly declined compared to last week and is now firmly in bearish territory .

While risk aversion has increased in the short-term, higher uncertainty in the traditional banking system might bring us closer to a pause in the Fed hiking cycle which would be very bullish for cryptoassets.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.