Download the Full Report in PDF

by André Dragosch, Head of Research

Key Takeaways

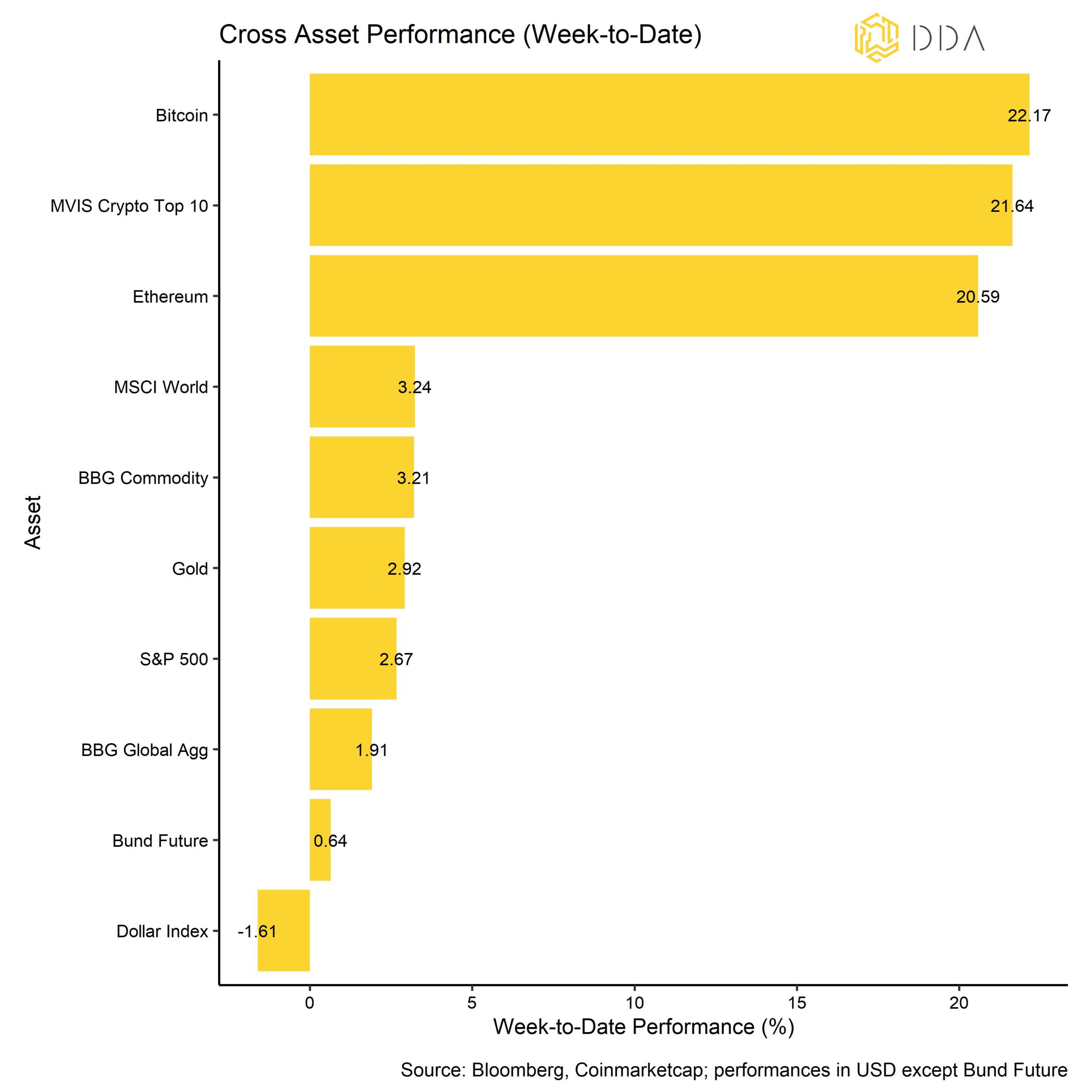

- Cryptoassets were again the best asset class last week, outperforming global equities, bonds and commodities by a very wide margin on the back of a weak US Dollar

- Our in-house Crypto Sentiment Index has increased significantly to the highest level since early 2021 and is clearly in positive territory now

- In general, there appears to be renewed institutional buying interest which we can observe in different segments of the market including fund flows, on-chain activity, and derivatives markets

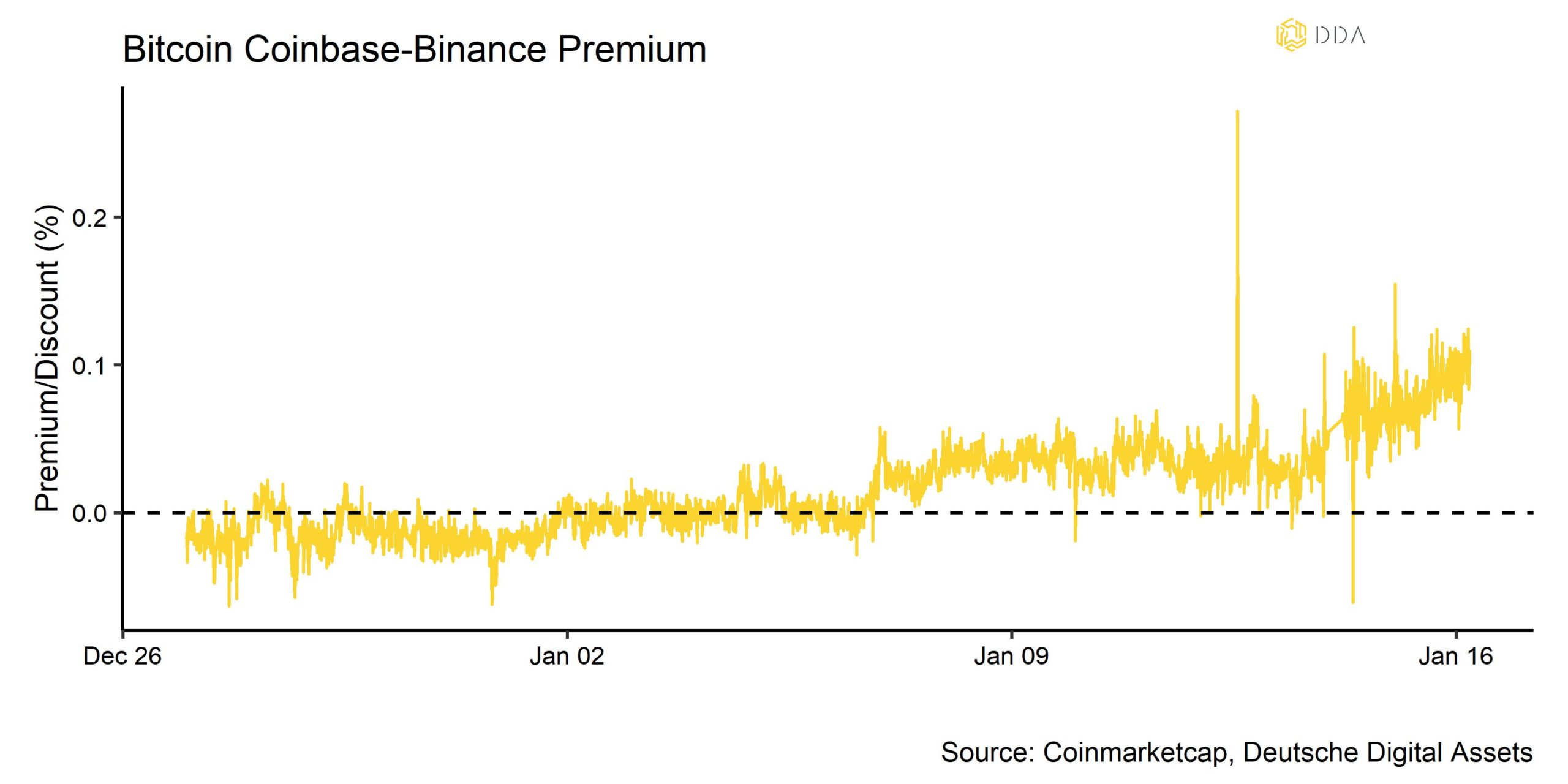

Chart of the week

Performance

Last week, cryptoasset prices managed to outperform again, as there were signs of increasing institutional buying interest throughout the week. Overall market sentiment was lifted by another expected decline in US inflation numbers that were released on Thursday last week. Although inflation numbers were mostly in line with consensus expectations, the CPI headline inflation number declined another -60 basis points compared to November 2022, adding evidence that the peak in inflation is well behind us. The broad Dollar depreciation during the week helped as well.

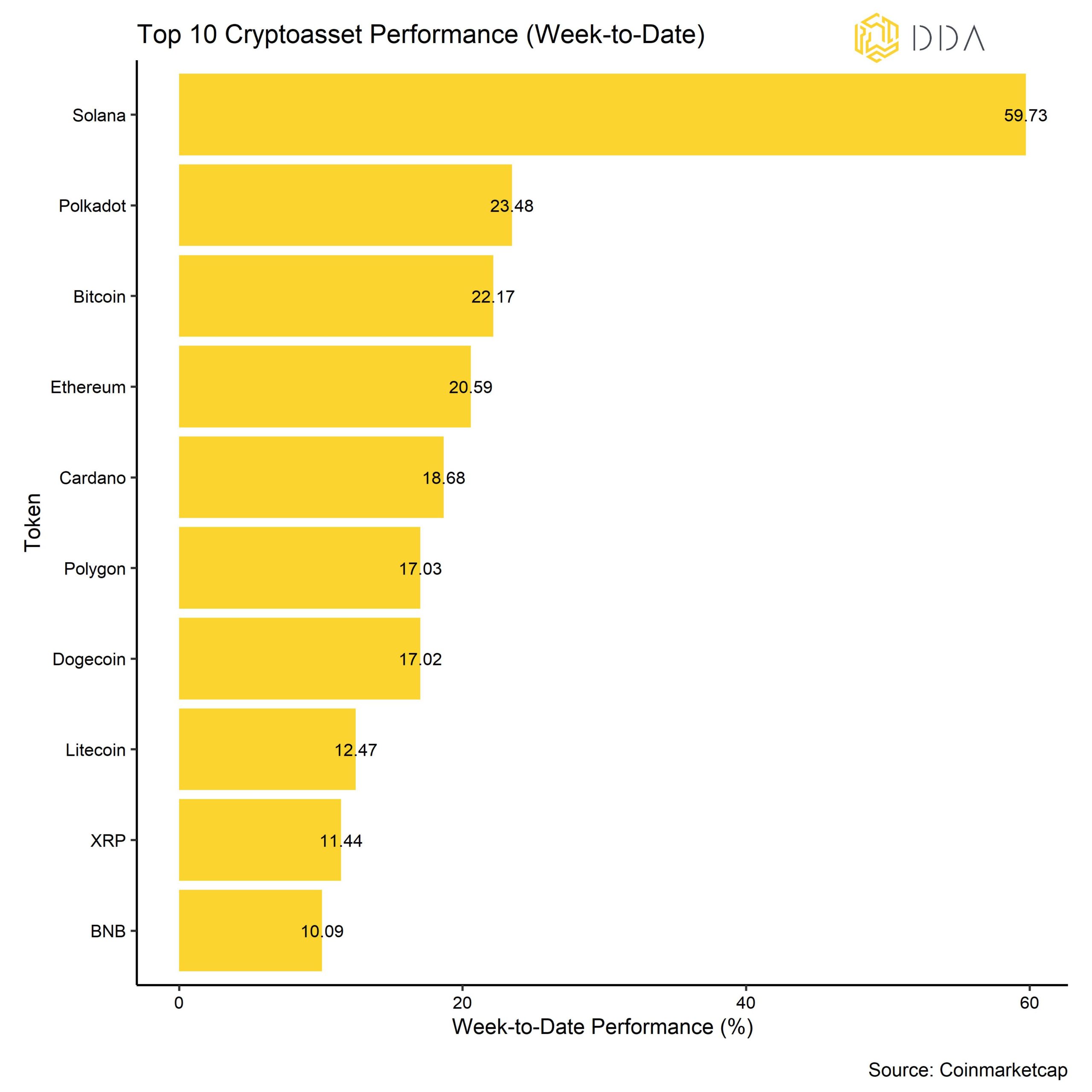

Among the major cryptoassets, Solana, Polkadot, and Bitcoin were the relative outperformers. Solana continued its sharp technical reversal after being one of the worst cryptoassets last year. Cryptoassets were the best asset class in the second week of the year again, outperforming global equities, bonds and commodities by a very wide margin. Bonds were the worst asset class last week, while the Dollar depreciated significantly.

Sentiment

Our in-house Crypto Sentiment Index has increased further compared to last week and is clearly in positive territory now. 11 out of 15 indicators (73%) are above their short-term trend.

The major contributors were the increase in the Crypto Fear & Greed Index and 25-delta Bitcoin Option Skew which signal a significant decrease in risk aversion among investors.

Dispersion among cryptoassets continued to be high, implying that the crypto market was rather trading on coin-specific factors rather than systematic factors. At the same time, altcoins mostly underperformed Bitcoin on a 1-month basis and have only recently started to outperform again. On a 1-month basis, 25% of tracked altcoins have outperformed Bitcoin. Altcoin outperformance is usually a sign of increased risk appetite.

The Crypto Fear & Greed Index increased significantly bit but is still in “Fear” territory. In contrast, the BTC Twitter Sentiment Index has increased significantly last week and now implies a bullish Bitcoin sentiment again.

Flows

Last week saw some increased institutional buying interest in cryptoassets.

Fund flows rebounded during the last week and we saw net inflows into global crypto ETPs in the amount of +6.8 mn USD during the week. While BTC- and ETH-based products experienced net inflows (+13.3 mn USD and +8.5 mn USD), basket & thematic crypto ETPs and those that track Altcoins ex ETH experienced net outflows to the tune of -13.1 mn USD and -1.9 mn USD, respectively.

Judging by the overall sharp increase in sentiment, crypto fund flows still appear to be lagging this general development which implies significant upside for fund flows.

In this context, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – continued to narrow which also implies renewed institutional buying.

The Beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to decrease slightly, implying that hedge funds might have further decreased their exposure to cryptoassets during the last 20 days. Nonetheless, the price premium between Bitcoins traded on Coinbase vis-à-vis those traded on Binance (Coinbase-Binance premium) continued to be positive throughout the week which is indicative of increased buying interest from institutional investors vis-à-vis retail investors. This is also highlighted above in our Chart-of-the-Week.

On-Chain

On-chain developments also corroborated the view, that institutions came back to the market last week.

For one thing, Over-the-Counter (OTC) Desk Balances of Bitcoin have increased sharply to the highest reading since July 2022 (see appendix). Higher OTC Desk holdings imply that institutional investors’ demand for Bitcoin has increased as these OTC trading desks are usually used by investors who perform large-scale transactions that need high liquidity on a bilateral basis. Typical users of OTC trading desks include private wealth managers, high net-worth individuals, or hedge funds wishing to convert large amounts of cash into cryptoassets seamlessly.

Another observation that corroborates increased institutional buying interest in cryptoassets is that exchange outflows during the last week was dominated by very large wallet sizes, > 1 mn USD (see appendix). In general, exchange outflows usually imply buying interest as investors take coins off exchanges in order to safe-guard them in cold-storage.

Besides, short-term holders appear to be in the profit-zone (STH-SOPR > 1.0) and overall short-term investors are not “under water” anymore, ie have unrealized gains on their investments in aggregate (STH-NUPL > 0). Generally speaking, the Spent-Output-Profit Ratio (SOPR) simply shows the relationship between price paid / price sold and readings above 1.0 imply profitable transactions in aggregate. The Net Unrealized Profit/Loss (NUPL) metric shows the amount of unrealized profits or losses that is still held in investors’ wallets.

An environment where short-term traders are in aggregate profitable has a stabilizing effect on the overall market as these traders are less likely to sell their holdings. It is usually a phenomenon which is observed near the cycle bottom or at the very beginning of a new bull cycle.

In general, we saw an increase in the number of active addresses on the Bitcoin blockchain to the highest level since May 2022 which signals an overall increase in on-chain activity.

Derivatives

Recent changes in futures positioning also support the view that investors’ demand for cryptoassets has increased lately. This comes at the back of a further increase in the futures basis rate which is currently positive again. This implies that futures traders have an optimistic price expectation. Last week’s price increases were also supported by an increase in futures short liquidations and some increased short-covering activity. Short traders need to cover their short positions when their margins are under pressure due to wrong positioning which involves buying back the underlying asset to neutralize their position. This puts upside pressure on the price.

In fact, futures short liquidations on Saturday alone were slightly above 120 mn USD – the highest amount of short liquidations since July 2021.

Moreover, the 25-delta skew on Bitcoin options has significantly narrowed further implying that downside protection for Bitcoin has decreased. Delta-equivalent Call options on Bitcoin for a 1-month maturity are now more expensive than Put options. At the same time, implied option volatilities have increased a bit coming from all-time low levels the week before.

Bottom Line

Cryptoassets were again the best asset class last week, outperforming global equities, bonds and commodities by a very wide margin on the back of a weak US Dollar.

Our in-house Crypto Sentiment Index has increased significantly to the highest level since early 2021 and is clearly in positive territory now.

In general, there appears to be renewed institutional buying interest which we can observe in different segments of the market including fund flows, on-chain activity, and derivatives markets.

Download the full report with appendix here.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.