Download the Full Report in PDF

by André Dragosch, Head of Research

Key Takeaways

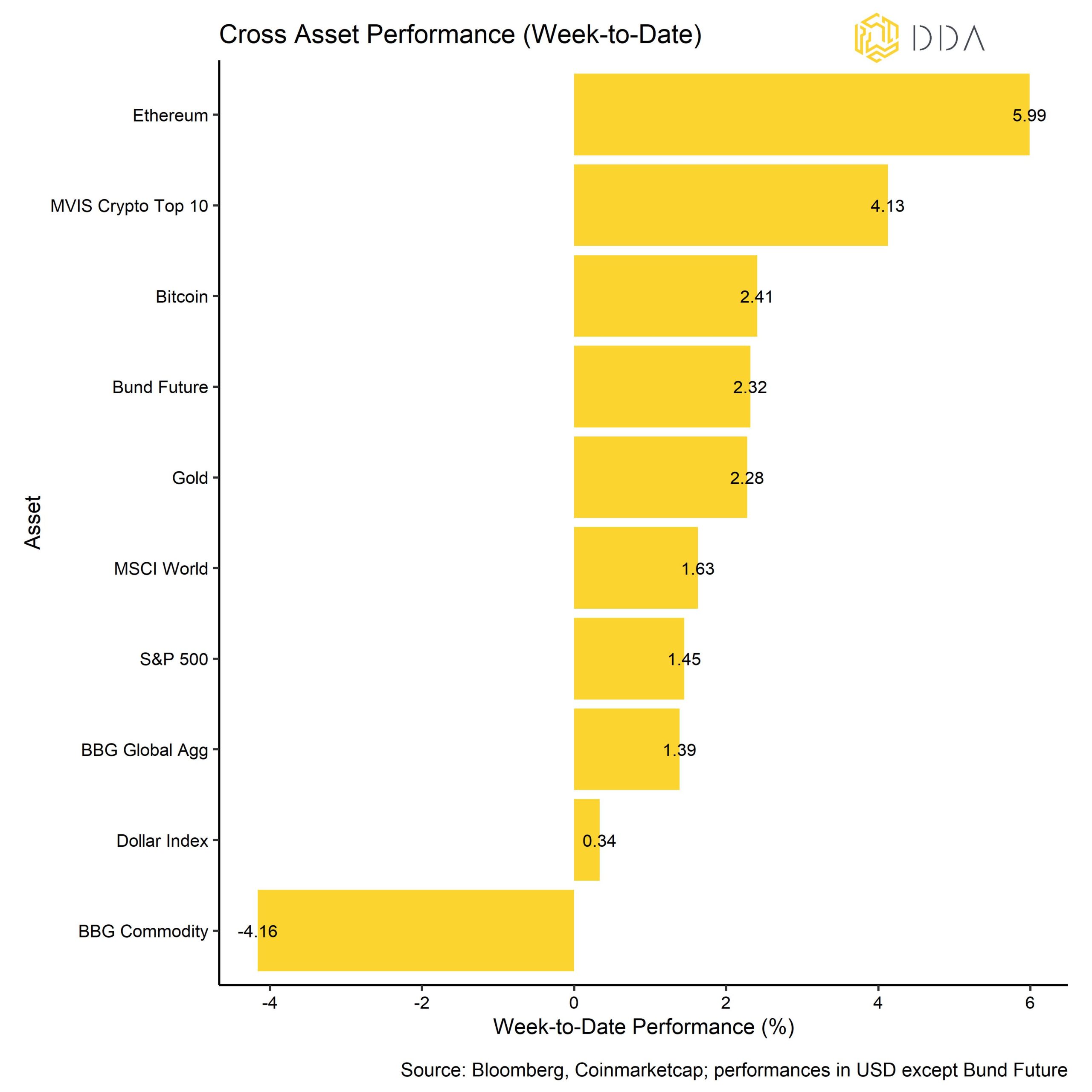

- Cryptoassets were the best asset class last week, outperforming global equities, bonds and commodities

- Our in-house Crypto Sentiment Index has increased significantly and is clearly in positive territory now

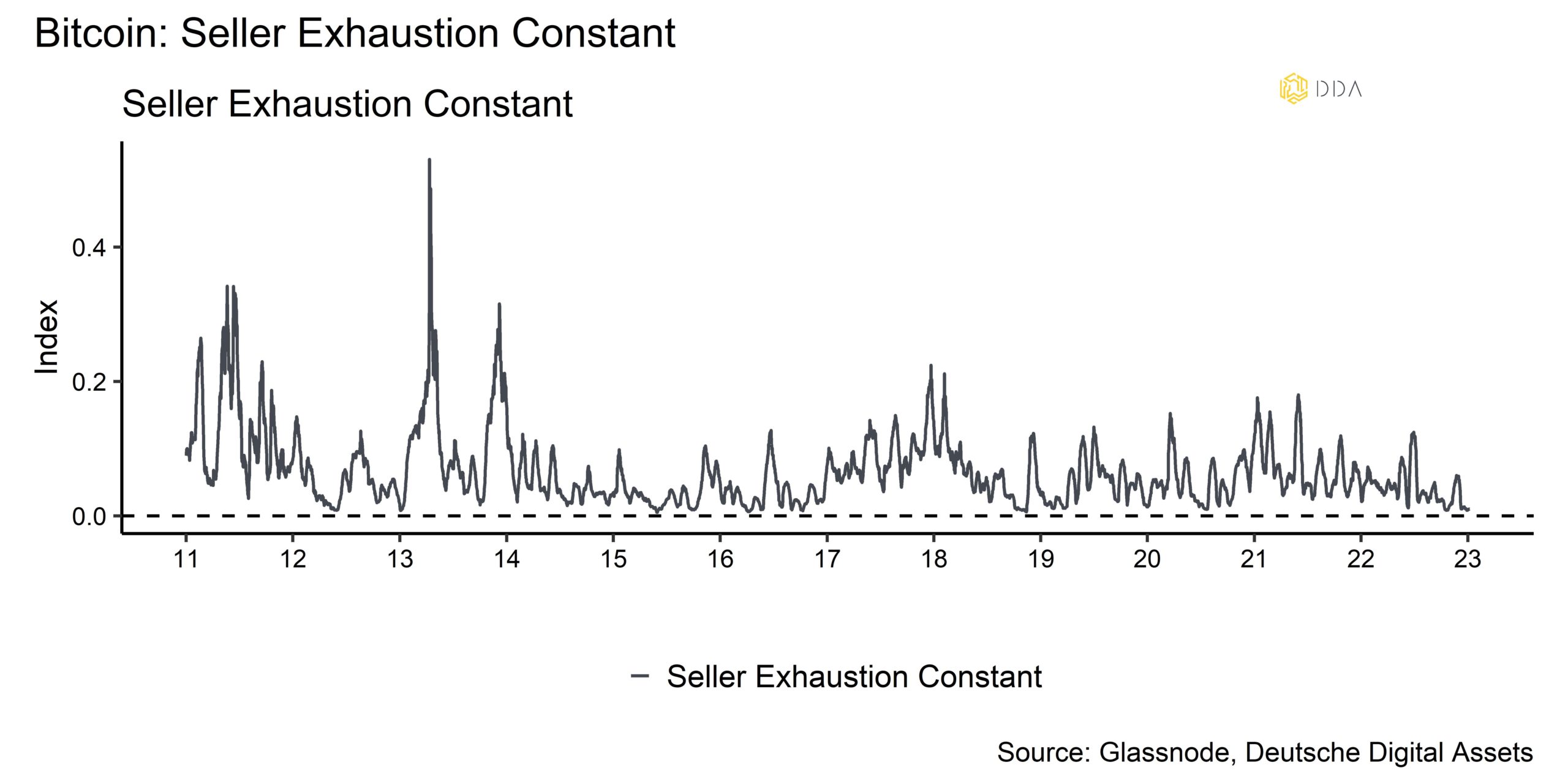

- In general, there appears to be increasing seller exhaustion as recent spending behavior by Bitcoin investors has not affected the price significantly

Chart of the week

Performance

Last week, cryptoasset prices managed to outperform again, as risk aversion gradually declined throughout the week. A positive catalyst was the US employment report that contained first hints of slowing wage growth which could prompt the Fed to adopt a more moderate stance of monetary policy.

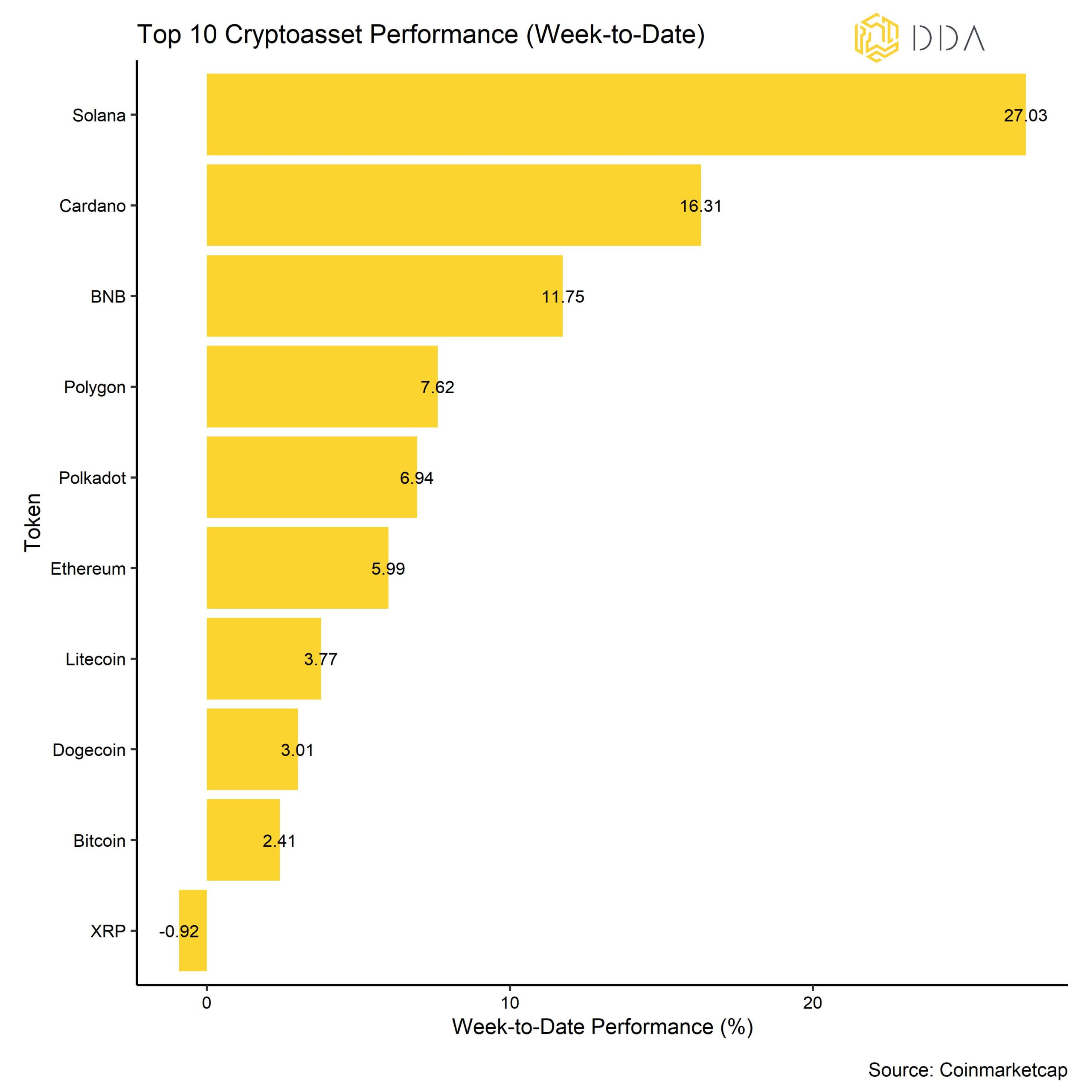

Among the major cryptoassets, Solana, Cardano, BNB were the relative outperformers. Solana staged a sharp technical reversal after being one of the worst cryptoassets last year. Cryptoassets were the best asset class in the first week of the year, outperforming global equities, bonds and commodities. Commodities were the worst asset class last week, while the Dollar appreciated.

Sentiment

Our in-house Crypto Sentiment Index has increased significantly and is clearly in positive territory now. That means that most of our indicators are above their short-term trend.

The major contributors were the decrease in 1-month implied option volatility for BTC as well as the increase in short-term Net Unrealized Profit/Loss (NUPL) which signal a decrease in risk aversion among investors.

Dispersion among cryptoassets continued to be high, implying that the cryptomarket was rather trading on coin-specific factors rather than systematic factors. Dispersion was rather unchanged during most of December 2022 and last week. At the same time, altcoins mostly underperformed Bitcoin on a 1-month basis and have only recently started to outperform again. Altcoin outperformance is usually a sign of increased risk appetite.

The Crypto Fear & Greed Index mostly hovered sideways and is still in “Fear” territory. Please note that we have recently added a new Indicator which shows the level of Bitcoin sentiment on Twitter (see appendix). This BTC Twitter Sentiment Index has also declined last week after having increased sharply the week before. This Index also suggests an overall bearish crypto sentiment.

Flows

Fund flows continued to be weak during the last week and we saw net outflows out of global crypto ETPs in the amount of -38.5 mn USD during the week. All types of crypto ETP-products experienced net outflows, except Altcoin ex ETH-based products which experienceed a light net inflow of +3.2 mn USD. BTC-based products showed net outflows of -10.8 mn USD and ETH-based products showed -6.6 mn USD net outflows.

In this context, large cryptoasset funds like 3iQ fund In Canada as well as the XBT Provider traded at a discount to their NAV. Interestingly, the NAV discount of the biggest Bitcoin fund In the world – Grayscale Bitcoin Trust (GBTC) – started to come off the lows In late December which Is a positive sign in light of the potential 20% tender offer of GBTC shares.

The Beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to decrease slightly, implying that hedge funds might have further decreased their exposure to cryptoassets during the last 20 days.

The Coinbase-Binance premium was neutral throughout the week which is indicative of only moderate buying interest from institutional investors vis-à-vis retail investors.

On-Chain

On-chain developments were rather calm during last week, with no major in- or outflows to or from exchanges. Both Bitcoin and Ethereum exchange balances have essentially been moving sideways since late-December. In general, there is continuing accumulation and holding (in)activity as the Bitcoin supply last active more than 1 year continues to increase. The fact that the short-term holder spent-output-profit ratio (SOPR) has been slowly recovering and Is currently only slightly below 1.0 Implies that most short-term traded coins are not being traded at a loss which could stabilize market sentiment further.

Moreover, there appears to be increasing seller exhaustion as recent spending behavior by Bitcoin investors has not affected the price significantly. In fact, the so-called “Seller Exhaustion Constant” for Bitcoin is at multi-year lows which also signals a high degree of seller fatigue (see our Chart-of-the-Week). We have recently published a detailed piece on this metric so make sure to check that out (link).

Derivatives

In general, we saw some significant moderation in risk aversion within the Bitcoin derivatives markets. This is evident in the continuing decrease in Bitcoin Implied volatilities and a normalization in the skew.

1-month option implied volatilities for Bitcoin options have declined below 40% – the lowest level ever recorded. Investors should exert caution in the short-term as volatilities are usually mean reverting, ie low levels of volatility beget high levels in future and vice versa.

Furthermore, the 3-months Bitcoin futures basis rate has increased and is now positive again, Implying that futures Investors are expecting higher prices, 3 months from now.

Bottom Line

Cryptoassets were the best asset class last week, outperforming global equities, bonds and commodities.

Our in-house Crypto Sentiment Index has increased significantly and is clearly in positive territory now.

In general, there appears to be increasing seller exhaustion as recent spending behavior by Bitcoin investors has not affected the price significantly.

Download the full report with appendix here.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.