Download the Full Report in PDF

by André Dragosch, Head of Research

Key Takeaways

- Cryptoassets were mostly unchanged during the last week and there are increasing signs for at least a temporary set-back

- Our in-house Crypto Sentiment Index has come off its multi-year highs in the last week as the short-term exuberance is slowly coming down

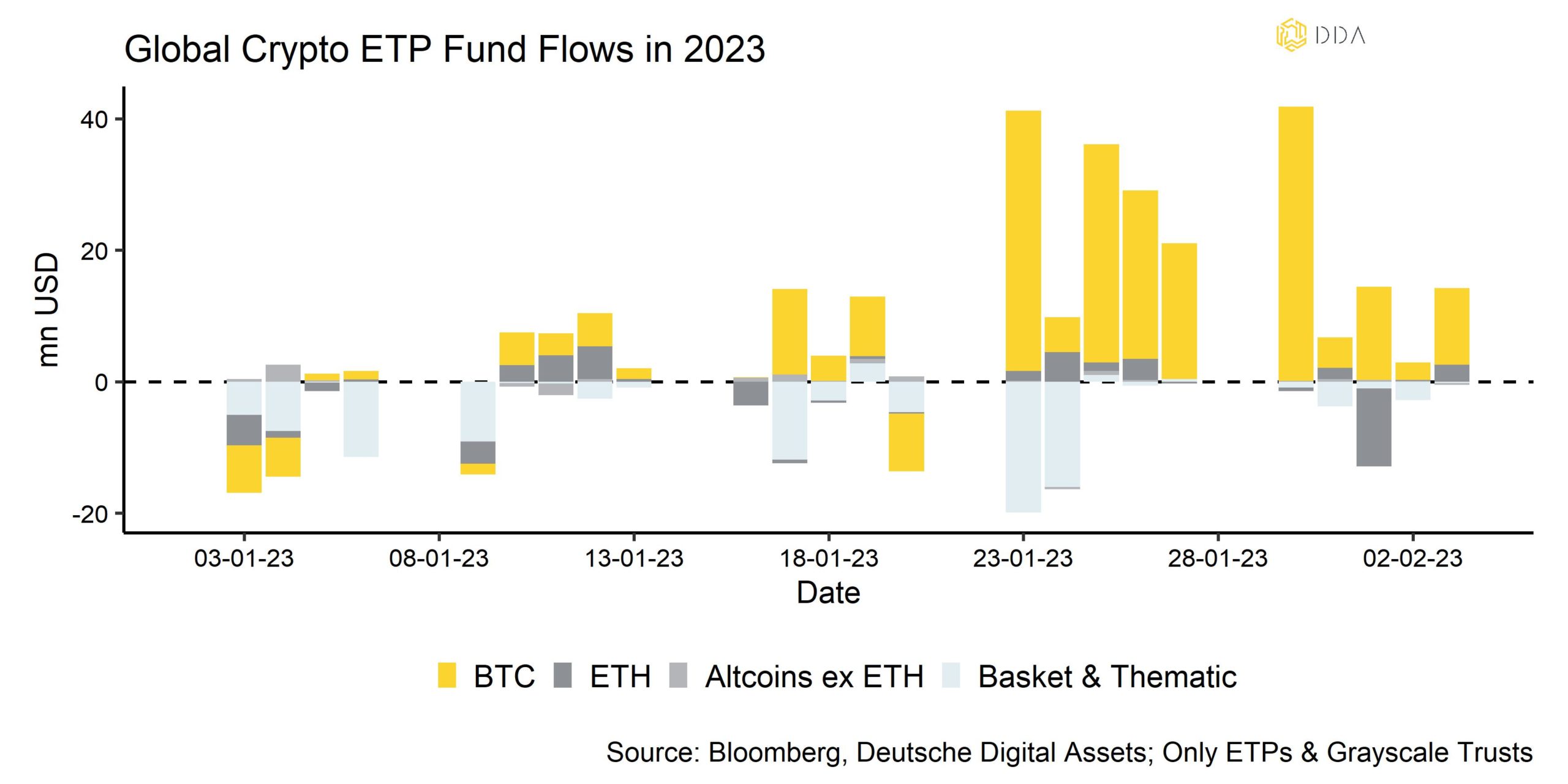

- Nonetheless, fund inflows continued to be high during the week implying ongoing institutional buying interest in cryptoassets

Chart of the week

Performance

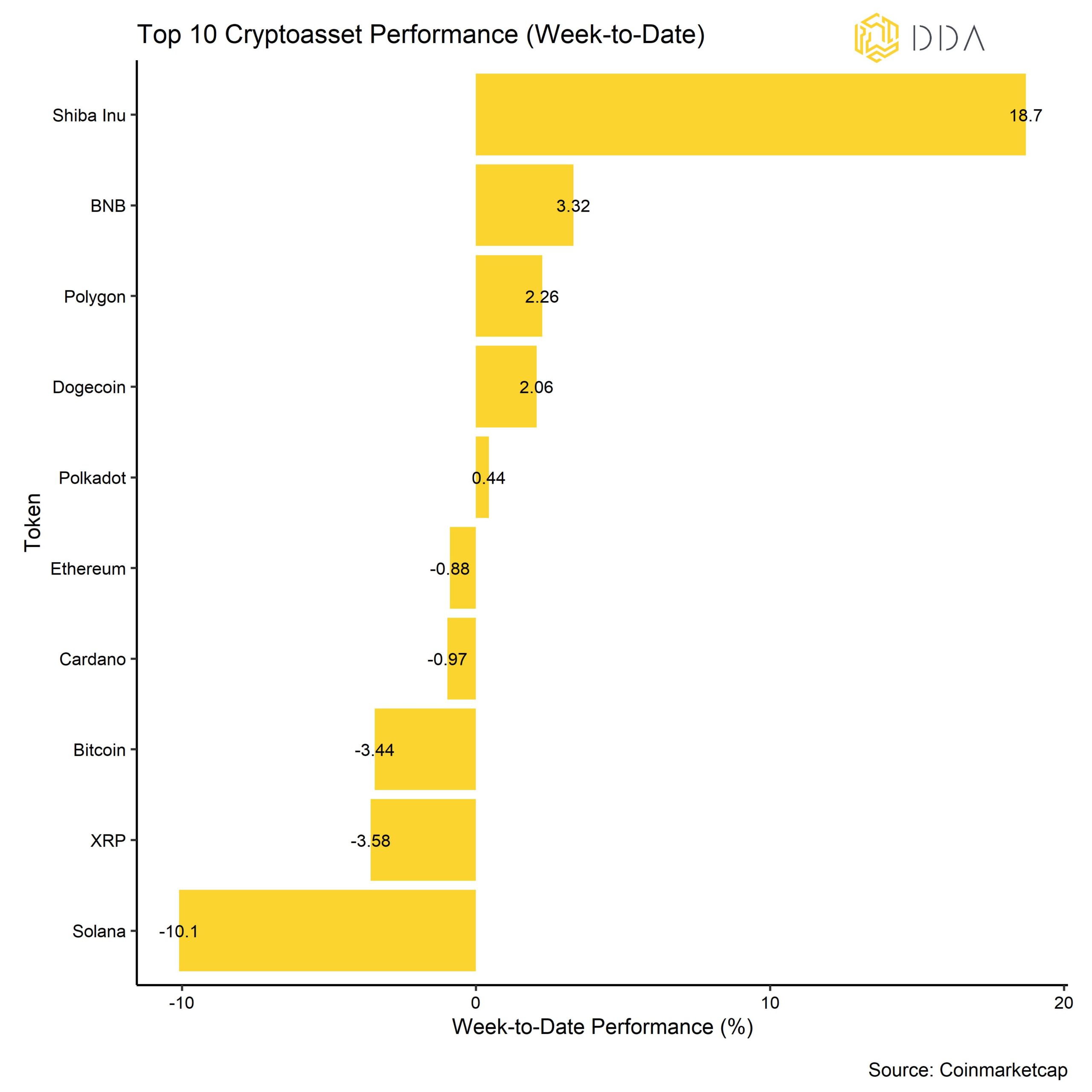

Last week, cryptoasset prices were mostly flat, as there are increasing signs that the latest rallye is slowly losing momentum. In fact, our in-house Crypto Sentiment Index has come off its multi-year highs which implies that the short-term market exuberance is slowly fading out.

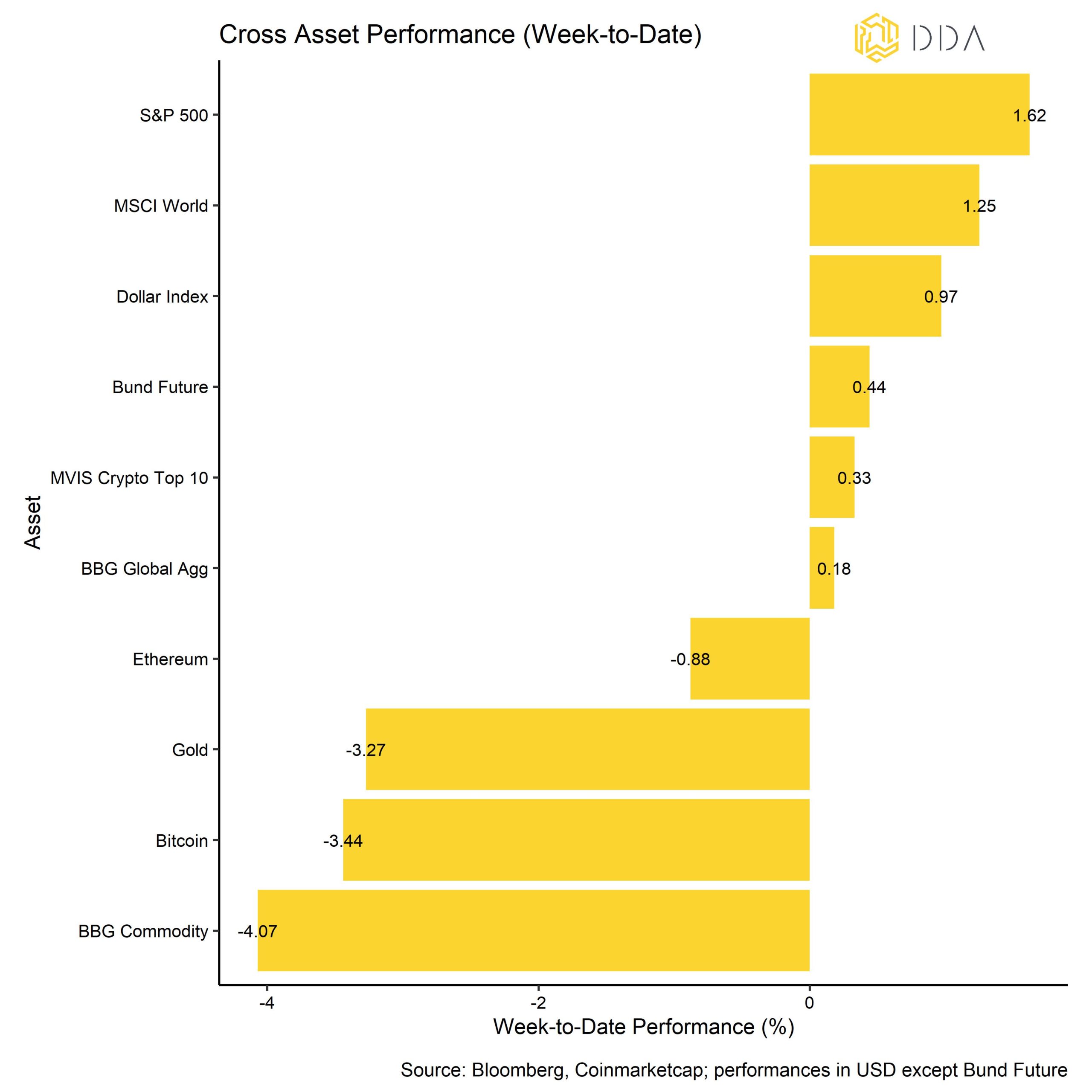

A major positive catalyst last week was the FOMC meeting on Wednesday where Fed Chairman Powell failed to address the recent easing in financial conditions which the market interpreted as dovish. However, strong labour market data that were published on Friday quickly reversed the excitement of the market as it implied that the Fed might continue to tighten monetary policy for longer than anticipated.

Among the major cryptoassets, Shiba Inu, BNB, and Polygon were the relative outperformers. After it was announced that Shibarium Beta launch is “soon,” according to ShibaSwap’s head developer Shytoshi Kusama, whales have begun to express interest in Shiba Inu (SHIB). A possible launch date for the Beta Testnet has not yet been determined, though.

However, overall Altcoin outperformance remains low based on our in-house “Altseason Index” which tracks the outperformance of Altcoins vis-à-vis Bitcoin over the last 3 months. At the same time, cryptoassets appear to be mostly driven by coin-specific factors rather than systemic factors judging by the relatively high level of statistical dispersion among cryptoassets.

Sentiment

Our in-house Crypto Sentiment Index has decreased a bit compared to last week but is still clearly in positive territory. 13 out of 15 indicators (86.7%) are still above their short-term trend.

The major contributors were the increase in the Crypto Fear & Greed Index and crypto ETP fund flows which signal a significant increase in risk appetite among investors.

As mentioned previously, dispersion among cryptoassets continued to be high, implying that the crypto market was rather trading on coin-specific factors rather than systematic factors. At the same time, altcoins mostly underperformed Bitcoin on a 1-month and 3-months basis. On a 1-month basis, only 10% of tracked altcoins have outperformed Bitcoin. Altcoin outperformance is usually a sign of increased risk appetite.

The Crypto Fear & Greed Index increased significantly and is currently in “Greed” territory. In contrast, the BTC Twitter Sentiment Index is still muted and implies a bearish sentiment.

Flows

Last week saw some high institutional buying interest in cryptoassets again.

Fund flows continued to be during last week and we saw net inflows into global crypto ETPs in the amount of +58.8 mn USD during the week. The lion’s share of these net inflows went into BTC-based products though which experienced net inflows of +74.8 mn USD while other funds either experienced net outflows (ETH and Basket & Thematics) or were flat during the week (Altcoins ex ETH). So far, fund flows have mainly focused on Bitcoin this year with almost +200 mn USD net inflows in the last 2 weeks alone.

In this context, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – continued to decrease again which signals that institutional demand has somewhat levelled off.

The Beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to decrease slightly, implying that hedge funds might have further decreased their exposure to cryptoassets during the last 20 days.

Another rather bearish signal is the fact that the price premium between Bitcoins traded on Coinbase vis-à-vis those traded on Binance (Coinbase-Binance premium) was mostly negative throughout the week which is indicative of decreased buying interest from institutional investors vis-à-vis retail investors.

On-Chain

On-chain developments also corroborated the view, that overall buying interest has somewhat levelled of.

Exchange balances for Bitcoin continued to decrease to multi-year lows which is also indicative of ongoing institutional accumulation of coins. Nonetheless, accumulation activity has lately decreased as smaller wallets have decreased their purchase activity. It appears that these prices are not as attractive anymore judging by the level of accumulation late last year. This could put a lid on any further short-term price increases as well.

Another interesting development on the Bitcoin blockchain was the fact that the block size reached almost 4 MB on 2/2/2023. This was due to the “Taproot Wizard” non-fungible token (NFT) that was included in one of the blocks. The so-called Ordinals protocols allows users to store NFTs known as “inscriptions” on the Bitcoin blockchain. There is an ongoing debate between Bitcoin purists who claim that Bitcoin should only be used for payments and the supporters of this protocol.

On a different note, Ethereum’s supply growth reached a new deflation record with a net negative supply growth rate of -1.28% p.a. last week on Friday. Ethereum supply growth can be negative occasionally when the burn rate, i.e. the rate at which circulating coins are destroyed, exceeds the issuance rate of new coins.

Derivatives

In general, the degree of uncertainty has lately decreased judging by the decrease in implied volatilities of Bitcoin options. Implied volatilities have been decreasing since mid-January. At the same time, volatility premia (i.e. the difference between implied versus realized volatility) have compressed as well which could incentivize option traders to buy volatility and options instead of writing them. This could lead to an increase in implied volatilities again and more uncertainty in the short-term as well. In fact, we have recently observed a significant increase in put versus call option trading volume which is indicative of increased short-term downside hedging activity. The 1-month 25-delta option skew has recently flipped in favour of puts again which also implies that Bitcoin option traders price downside protection a bit higher than upside opportunities in the short-term. However, the market still remains significantly positioned in calls vis-à-vis puts at the moment judging by the open interest in options.

On the futures side, the curve remains in contango, and the 3-months annualized rolling basis is still positive at around ~3% p.a. This means that Bitcoin futures that expire in 3 months are still trading higher than spot prices which implies a moderately optimistic price outlook by derivatives traders. The perpetual funding rate is also positive which also supports the view that short-term Bitcoin derivatives traders prefer longs over shorts.

Bottom Line

Cryptoassets were mostly unchanged during the last week and there are increasing signs for at least a temporary set-back.

Our in-house Crypto Sentiment Index has come off its multi-year highs in the last week as the short-term exuberance is slowly coming down.

Nonetheless, fund inflows continued to be high during the week implying ongoing institutional buying interest in cryptoassets.

Download the full report with appendix here.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.