Download the Full Report in PDF

by André Dragosch, Head of Research

Key Takeaways

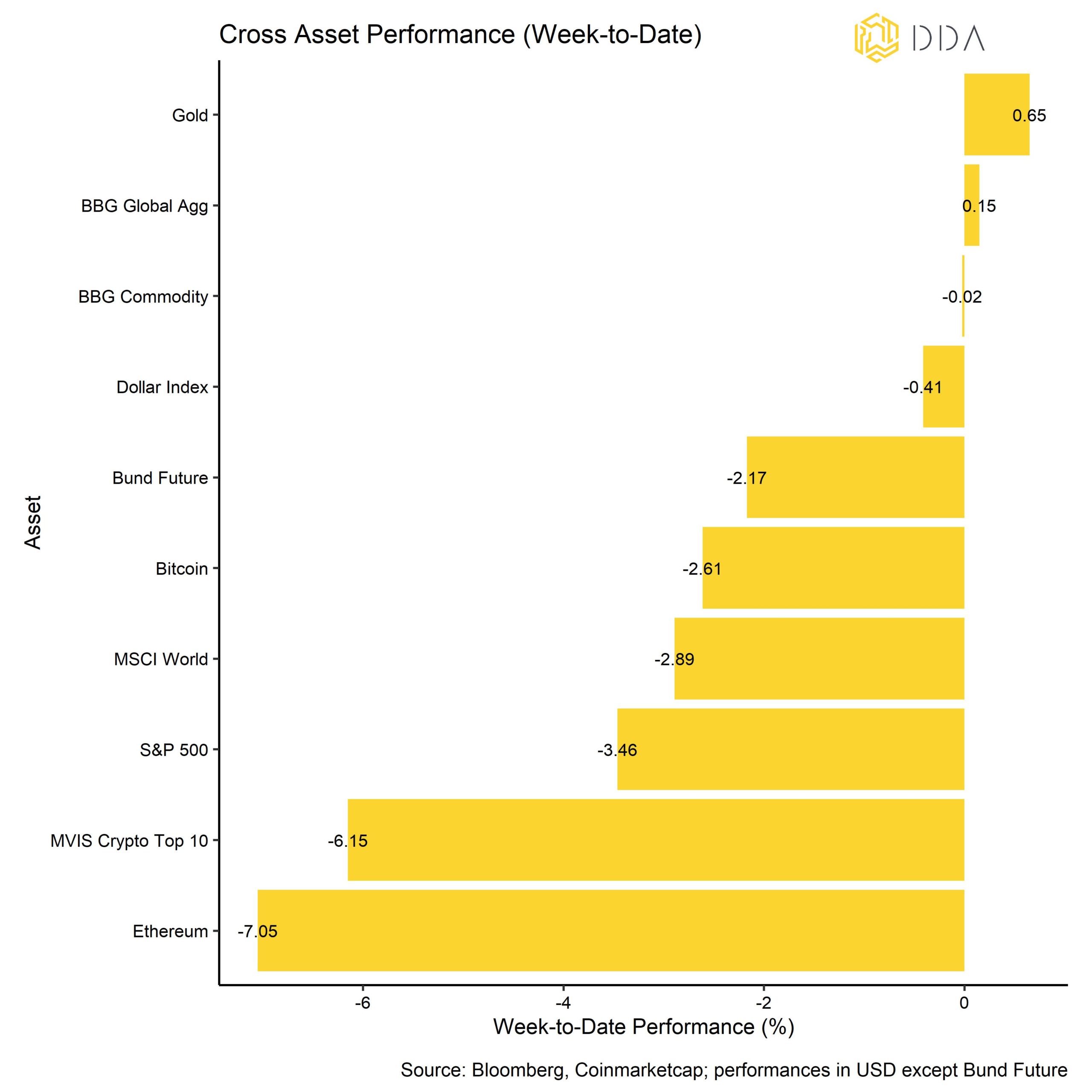

- Cryptoassets were worst asset class last week, underperforming global equities, bonds and commodities

- Because of the negative news flow, our in-house Crypto Sentiment Index has decreased again

- In general, exchange ouflows continued during last week on account of the rumors surrounding Binance

Chart of the week

Performance

Last week was also dominated by bearish news flow again.

Exchange behemoth Binance faced significant withdrawals throughout the week as there were rumors of a “Flywheel scheme” comparable to FTX. A Flywheel scheme involves a token that is artificially inflated via sophisticated marketing strategies and insider buying to raise the overall market value that can then be used to acquire more assets via collateralized loans based on these inflated token prices.

As a result, we saw significant Bitcoin and Ethereum exchange withdrawals from Binance.

We also saw significant exchanges from BUSD (Binance’s USD stablecoin) balances into Tether USD (USDT) and USD Coin (USDC) on account of rising risk aversion. However, these outflows and exchanges appear to continue as of this morning.

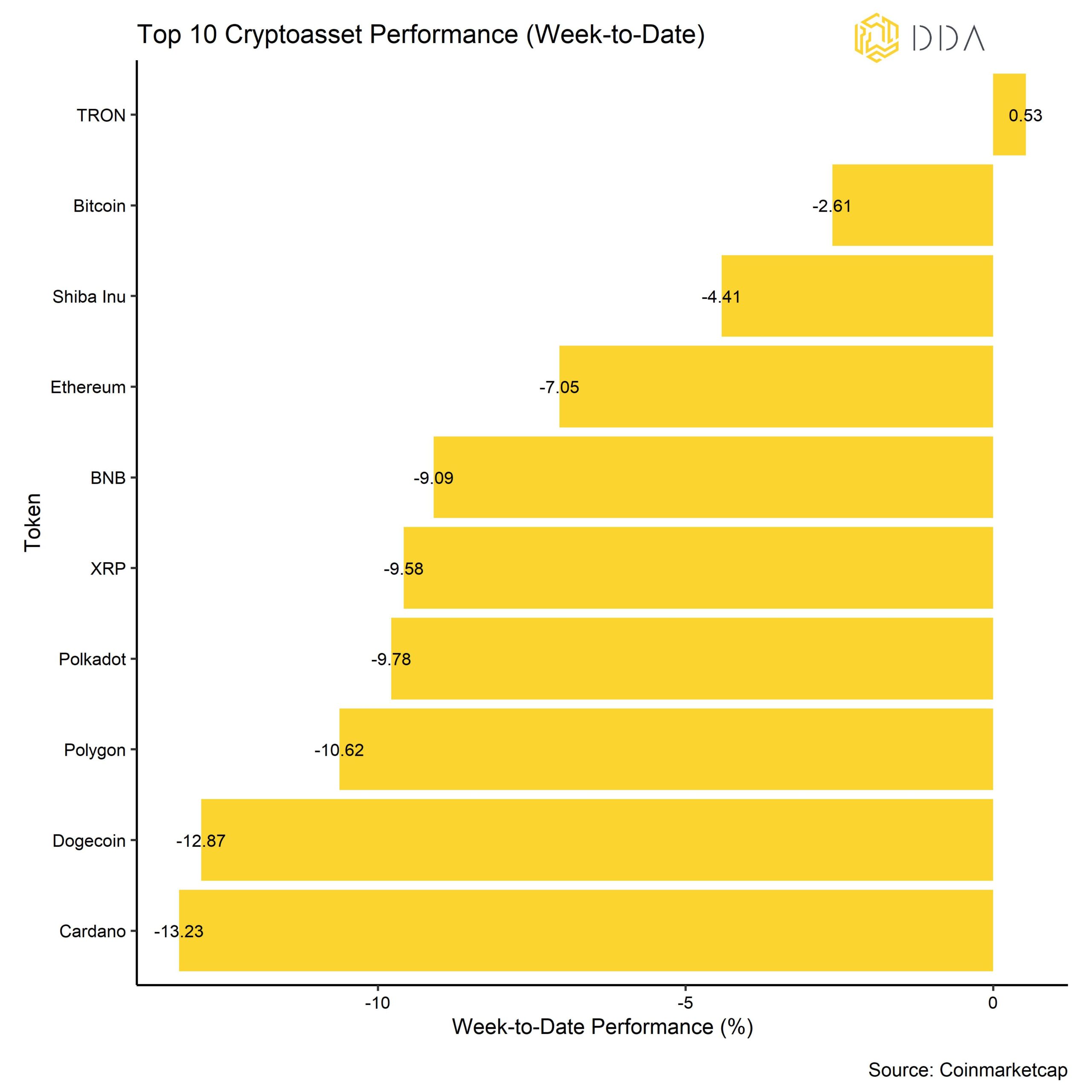

Accordingly, cryptoasset prices and other risky assets have underperformed. Among the major cryptoassets, TRON, Bitcoin and Shiba Inu were the relative outperformers.

Accordingly, cryptoasset prices and other risky assets have underperformed. Among the major cryptoassets, TRON, Bitcoin and Shiba Inu were the relative outperformers.

The macro event of the week was that US CPI inflation surprised to the downside on Tuesday which was interpreted positively as the market expected a more moderate stance of US monetary policy going forward.

Nonetheless, Fed chairman Powell struck a hawkish tone after the latest FOMC meeting last Wednesday, where the committee decided to raise rates by another 50 basis points.

Based on its own projections, the FOMC now sees the terminal rate (the highest potential Fed Funds Rate in the cycle) above 5%. Market expectations, however, are well below that level (~4.8% in May ’23). An increasing divergence could put the market on a collision course with the Fed if the Fed continued to hike rates despite further negative surprises in both inflation and employment.

We also saw a relatively hawkish tone by the ECB who also increased key interest rates by 50 basis points. The ECB said it would need to raise rates “significantly” further to tame inflation.

This led to an overall bearish risk sentiment across risky assets such as US equities as well.

Cryptoassets were the worst asset class last week, underperforming global equities, commodities, and bonds. The Dollar weakened slightly last week again.

Sentiment

News flow was predominantly bearish which is why our in-house Crypto Sentiment Index has decreased again compared to last week and is currently in negative territory. That means that most of our indicators are slightly below their short-term trend. On a positive note, we saw an increase in the Crypto Fear & Greed Index, in the 3-months “Altseason Index” as well as In the Short-term Holder Net Unrealized Profit/Loss-metric (STH-NUPL) which implies an increase in unrealized profits in aggregate.

The Crypto Fear & Greed Index improved slightly as well but is still in “Fear” territory.

Flows

Fund flows were very weak the last week and we saw net outflows out of global crypto ETPs in the amount of -54.4 mn USD during the week. All types of crypto ETP-products experienced net outflows, with ETH-based products being the most affected (-22.6 mn USD net).

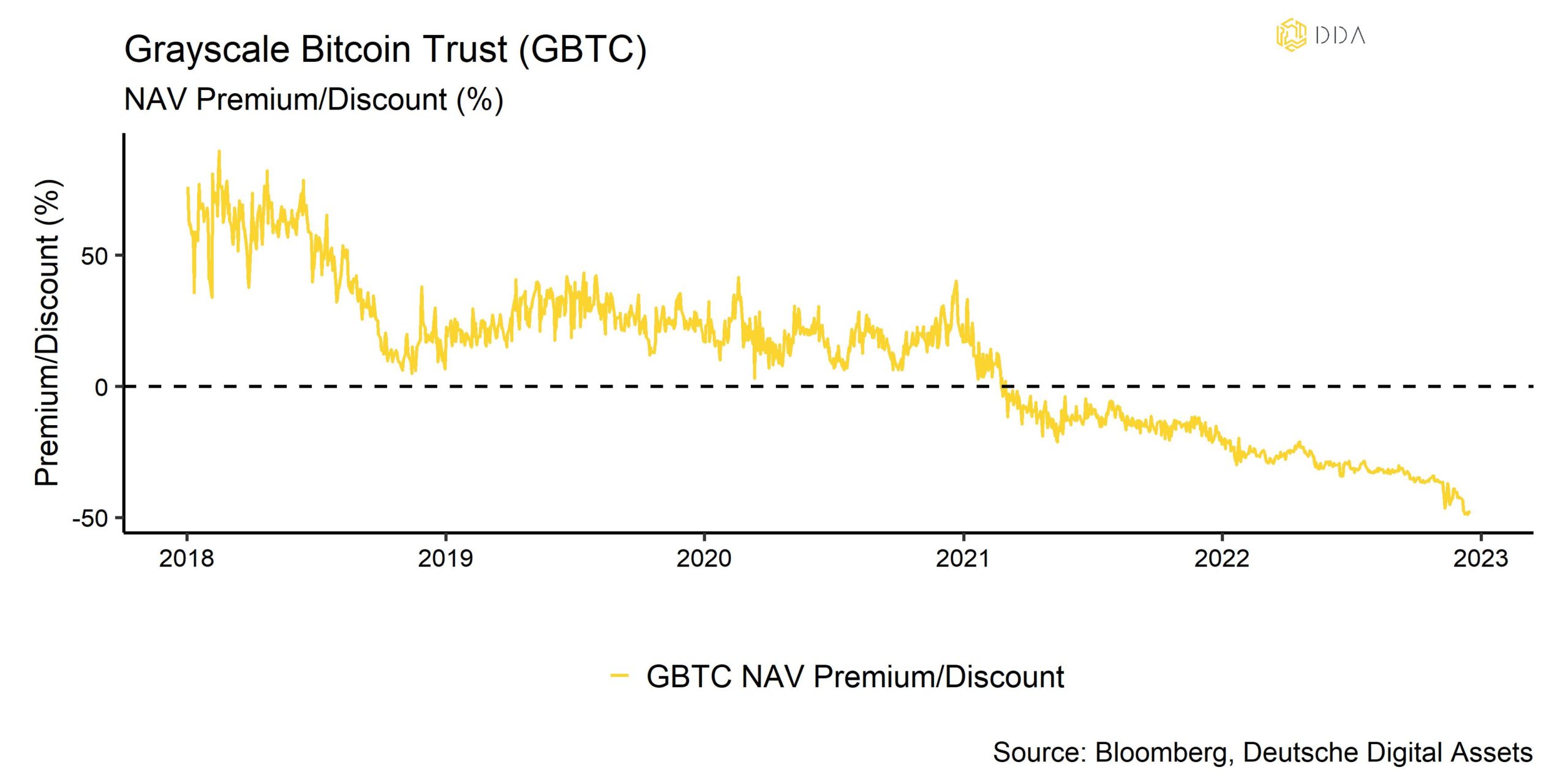

In this context, we also saw a new all-time low in the discount of the world’s biggest Bitcoin fund – the Grayscale Bitcoin Trust (GBTC) which is also shown in our Chart of the Week.

Unlike ETPs, shares in GBTC cannot be redeemed for the underlying Bitcoins which is why they trade at either premium or discount to Net Asset Value (NAV) in Over-the-Counter (OTC) markets. Investors in GBTC usually have a 6-months lock-up period. On a positive note, the NAV premium of the 3iQ Coinshares Bitcoin ETP (one of the biggest Bitcoin ETFs world-wide) increased significantly implying increased demand for this product.

The Beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to fall coming from high levels, implying that hedge funds might have decreased their exposure to cryptoassets during the month.

Another highlight is that the Coinbase-Binance premium continued to be positive throughout the most of the week which is indicative of relative buying interest from institutional investors vis-à-vis retail investors.

On-Chain

In general, exchange balances continued to fall during the week. In fact, both Bitcoin and Ethereum exchange balances reached a 4-year low, respectively. This is likely due to the increased risk aversion surrounding exchange holdings in general and Binance exchange balances in particular.

However, most of the trading activity centered around stablecoins last week. We saw a new all-time high in the number of Tether USD (USDT) sending addresses and 13-month high in the number of new addresses that were created on the USDT blockchain. As mentioned above, we saw significant exchanges from BUSD (Binance’s USD stablecoin) balances into Tether USD (USDT) and USD Coin (USDC) on account of rising risk aversion. These exchanges appear to continue as of this morning.

Derivatives

In general, we saw increase in risk aversion within the Bitcoin derivatives markets. This is evident in the reversal in implied volatilities for Bitcoin options. An increase in implied volatilities is usually indicative of rising uncertainty. There was also a renewed decrease in options’ skew in favour of put options which implies that demand for downside hedges has increased somewhat again.

The 3-months basis rate has also reversed and is currently negative again. The Bitcoin futures curve remains in backwardation which signals that traders have a rather pessimistic price outlook at the moment.

Bottom Line

Cryptoassets were the worst asset class last week, underperforming global equities, bonds, and commodities.

Negative news flow on both the macro and crypto front dominated market sentiment throughout last week.

In consequence, our in-house Crypto Sentiment Index has decreased and is currently negative again.

Crypto ETP fund flows were negative for all types of ETP products while the Grayscale Bitcoin Trust’s NAV hit a new all-time low. On-chain indicators imply continued outflows from exchanges in light of the recent rumors surrounding Binance.

Besides, we saw an increase in risk aversion within the Bitcoin derivatives markets.

Download the full report with appendix here.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.