Download the Full Report in PDF

by André Dragosch, Head of Research

Key Takeaways

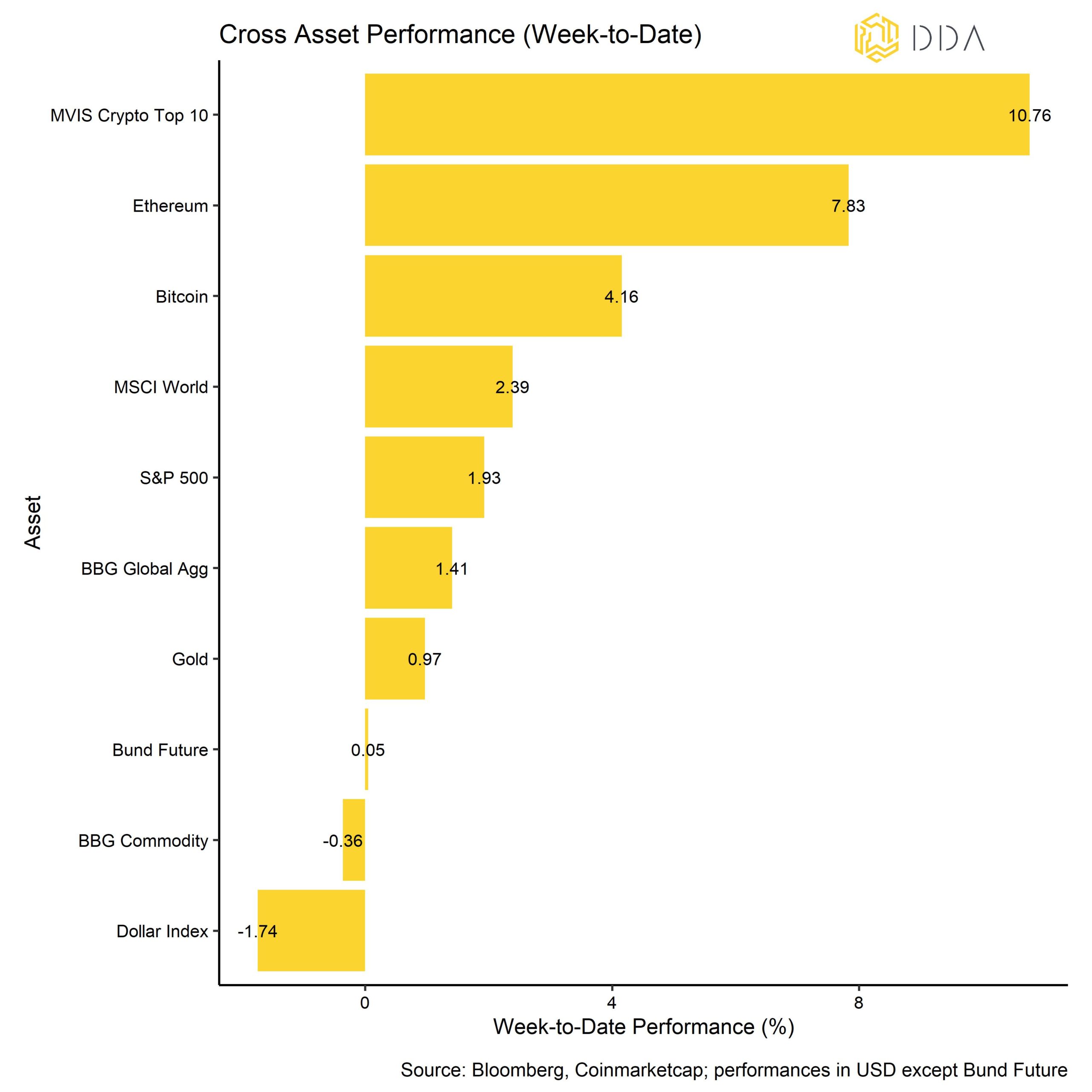

- Cryptoassets were the best asset class last week, outperforming global equities, bonds and commodities

- Our proprietary Crypto Sentiment Index has improved further as underlying sentiment was mainly supported by the planned distressed assets fund by Binance

- The market will probably focus on US employment data this week for hints of weakness in the US jobs markets that could lead the market to further price out a hawkish monetary policy by the Fed

Chart of the Week

Performance

Performance

Last week, cryptoasset prices managed to creep back up mostly being supported by the news that exchange behemoth Binance is aiming for a roughly 1bn USD fund for the potential purchase of distressed assets in the digital-asset sector and will make another bid for bankrupt lender Voyager Digital.

Although some other crypto lending platforms such as Nexo have recently come under scrutiny, the market appears to have adapted to this kind of news.

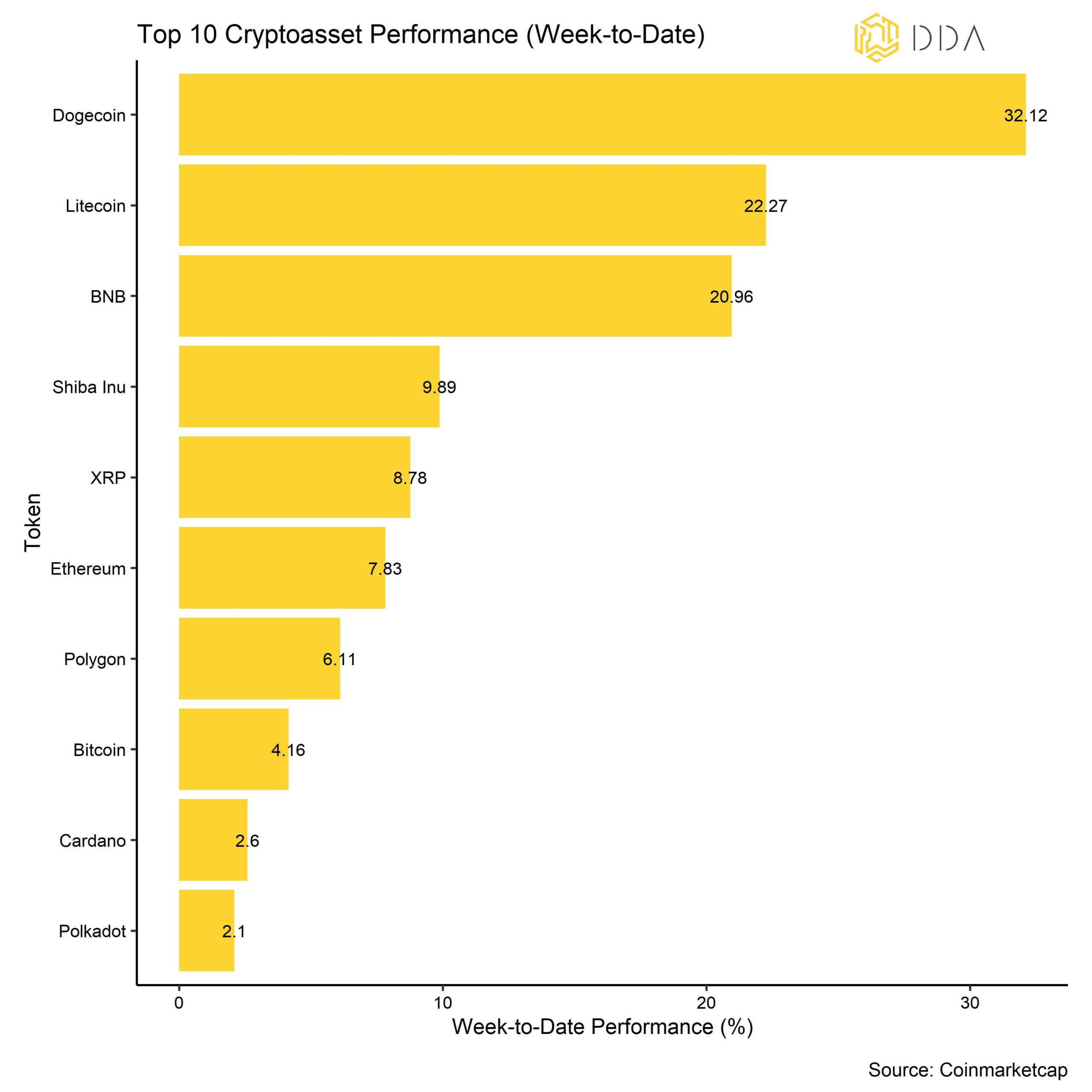

Accordingly, cryptoasset prices have mostly performed positively. Among the major cryptoassets, Dogecoin, Litecoin, BNB and Shiba Inu were the relative outperformers. Cryptoassets were also the best asset class last week, outperforming global equities, commodities and bonds. The dollar weakened last week.

This week, we have an array of important US jobs numbers coming up, with particular attention on Thursday, where the market will probably focus on the Job Cuts Announcements and Initial Claims data for hints of weakness in US employment. November already saw the biggest year-to-date increase in layoff announcements at big tech companies such as Amazon or Google both of which announced to cut around 10000 jobs each. Hints of weakness in US employment could lead the market to further pricing out a hawkish monetary policy by the Fed which most likely would be positive for both traditional financial markets and crypto markets.

Sentiment

Our proprietary Crypto Sentiment Index has improved further compared to last week. The major contributors were the increase in hedge fund beta to BTC as well as the outperformance in Altcoins which is usually indicative of an increase in risk appetite within cryptoassets. We also saw a significant moderation in risk aversion within the Bitcoin derivatives market and the Crypto Fear & Geed Index also increased from “Extreme Fear” to “Fear” territory.

Flows

Fund flows have moderated during the last week and we saw net outflows from global crypto ETPs in the amount of -23.6 mn USD after two weeks of inflows. All our categories of crypto ETPs experienced net outflows with Bitcoin ETPs being the most-affected (-11.7 mn USD) while basket & thematic crypto ETPs only experienced mild net outflows (-1.1 mn USD).

On a positive note, the Beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to rise, implying that hedge funds might have further increased their exposure to cryptoassets during the month. In fact, their beta has increased to one of the highest readings ever recorded.

On-Chain

There was a suspicious on-chain transaction in the amount of ~10k BTC on the 24th of November which was one of the largest transactions of dormant coins ever. These Bitcoins have been dormant for more than 7 years. Transactions of previously dormant coins are usually bearish as they imply selling intentions of these coins after a long period of inactivity. On-chain analysts have attributed these coins to the Mt Gox exchange hack in 2014 that are currently being liquidated via smaller transactions. This could exert some downward pressure on the price in the short term. Apart from this, coins continued to flow out of exchanges on a net basis which implies ongoing accumulation, especially by the largest wallet cohorts.

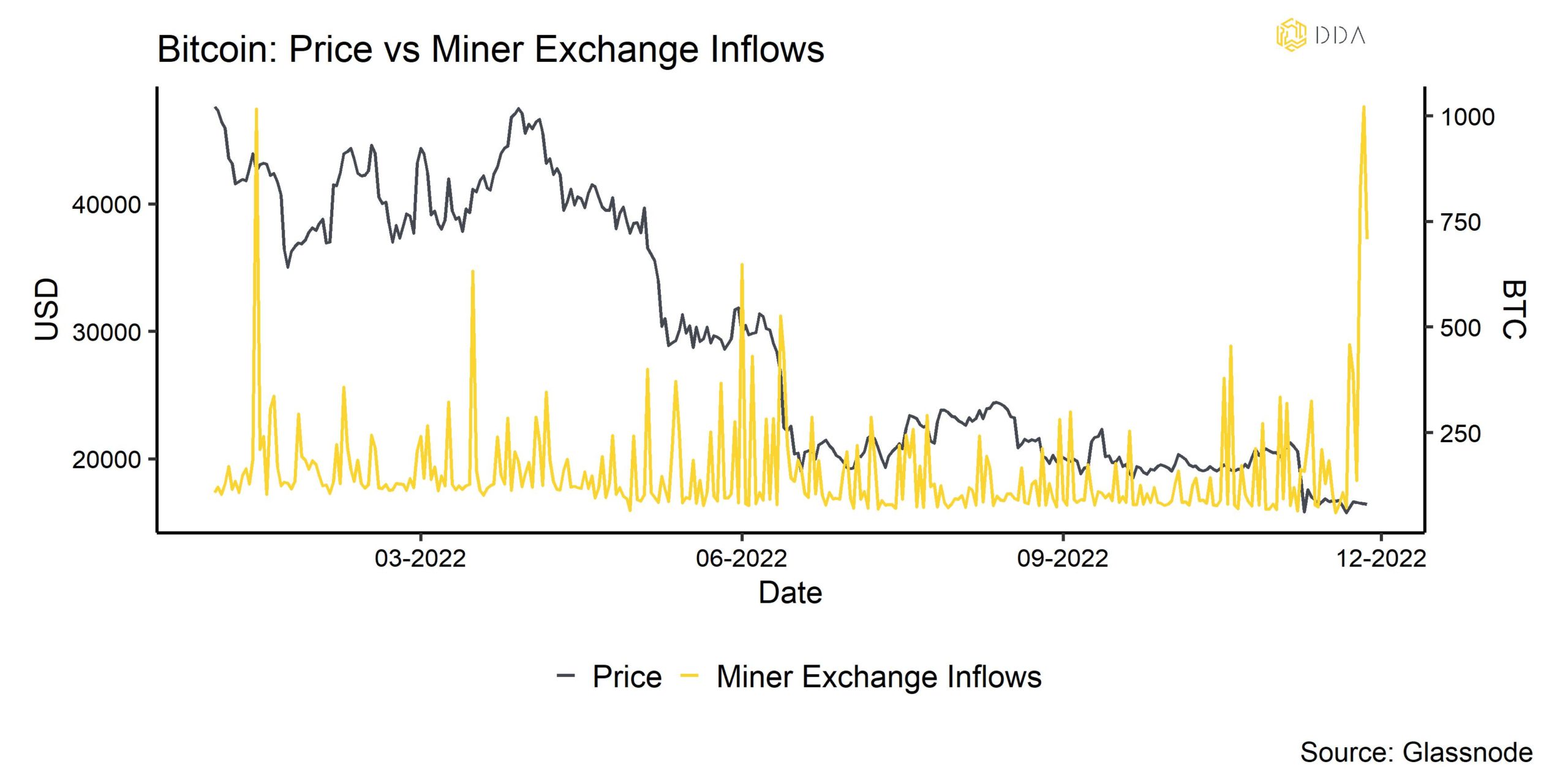

There were also some significant transfers of Bitcoin miners to exchanges (see Chart of the Week) which underline the risk that BTC miners are increasingly coming under pressure at these low prices and need to liquidate larger portions of their holdings to raise liquidity. Aggregate Bitcoin mining revenues have recently declined to the lowest levels in 2 years and the hash rate has started to decline again.

Derivatives

In general, we saw some significant moderation in risk aversion within the Bitcoin derivatives markets. This Is evident in the decrease in Bitcoin Implied volatilities and a normalization in the skew. The reduction in put-call volume ratios and open interest is also indicative of a gradual unwind of downside hedges and a reduction in risk aversion among derivatives traders.

However, the 3-month futures basis rate continues to be negative, implying that derivatives traders are still pessimistic about the near future.

Bottom Line

Cryptoassets were the best asset class last week, outperforming global equities, bonds and commodities.

Our proprietary Crypto Sentiment Index has improved further as underlying sentiment was mainly supported by the planned distressed assets fund by Binance. Crypto ETP fund flows were negative while global hedge funds’ beta to Bitcoin increased significantly. Bitcoin saw some suspicious on-chain activity of dormant coins that could put some downward pressure on the price in the short term and miners have transferred a significant amount of coins to exchanges.

Besides, we saw some significant moderation in risk aversion within the Bitcoin derivatives markets.

The market will probably focus on US employment data this week for hints of weakness in the US jobs markets that could lead the market to further price out a hawkish monetary policy by the Fed.

Download the full report with appendix here.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Recent News and Articles

- Institutional Crypto Adoption: Why & How Institutions Are Going Crypto

- Crypto Portfolio Composition: How Different Portfolios Have Performed During the Recent Bull and Bear Markets

- How to Invest in Ethereum (ETH): A Guide for Professional Investors

- The Case for Actively Managed Investment Strategies in the Crypto Markets

- How to Invest in NFTs: A Guide for Professional Investors

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How accurate is the Bitcoin Stock-to_Flow Model?

Deutsche Digital Assets in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.