Ethereum Shapella Upgrade. What’s next?

by André Dragosch, Head of Research

Key Takeaways

- Shanghai-Capella (Shapella) upgrade has been completed last night, allowing users to withdraw their staked ETH principal and rewards

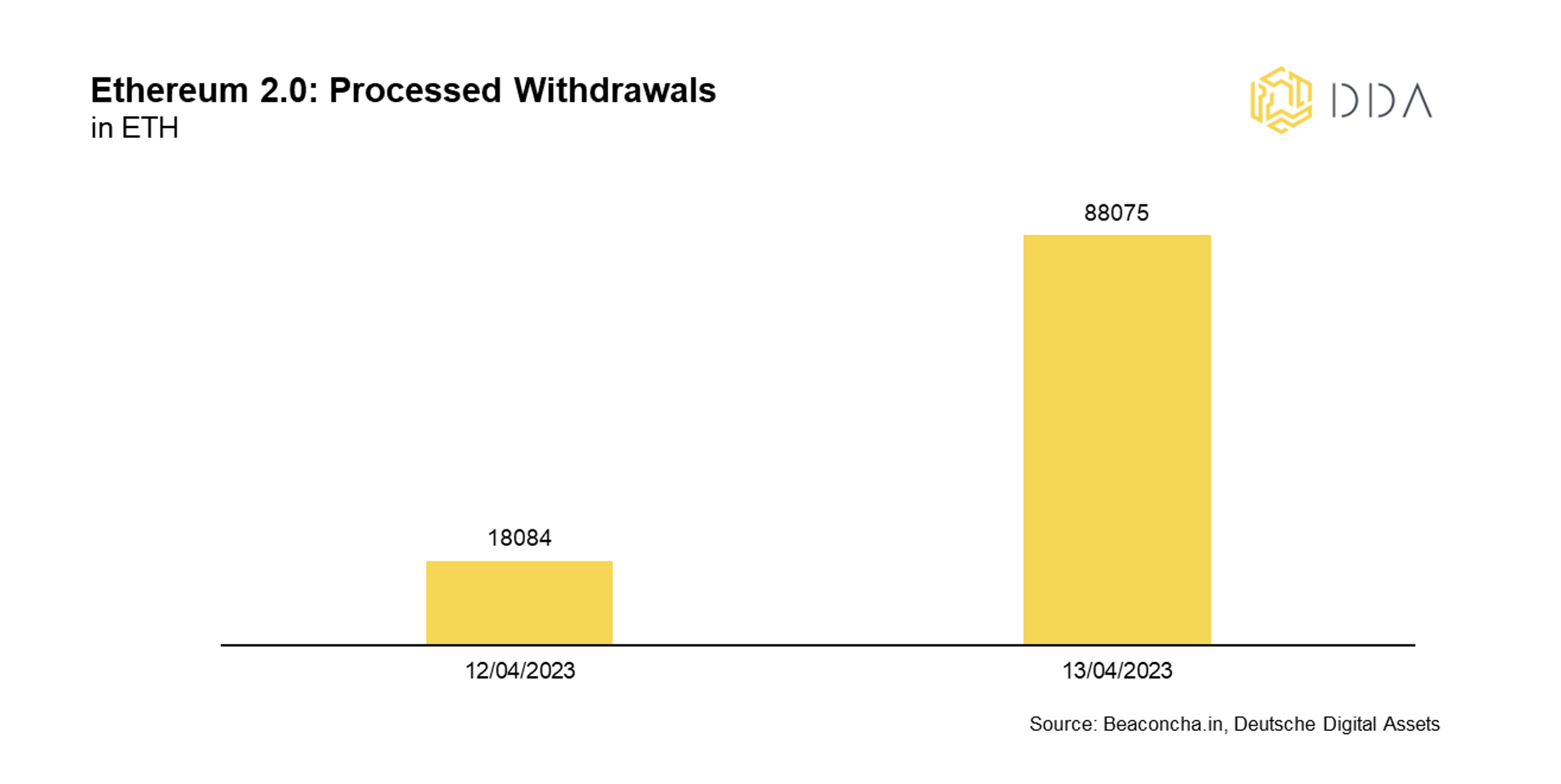

- At the time of writing, withdrawals totaling 106,158 ETH (~$206 million) have been processed but exchange inflows for Ethereum still appear to be moderate

- Although the upgrade was successful, some key risks remain in the short term

Introduction

The Shanghai-Capella hard fork of Ethereum, also known as “Shapella,” has been completed, allowing users who “staked” their ether (ETH) to protect and confirm transactions on the blockchain to withdraw their funds.

Yesterday at 22:27 UTC, the Shanghai update began, and it was completed at around 22:42 UTC.

According to beaconcha.in, withdrawals totaling 106,158 ETH (~$206 million) have already been processed since the Shapella upgrade was activated (see Chart above).

Validators will now be able to both withdraw their staked ETH principal (so-called “full withdrawal”) and the amount of ETH staking rewards (so-called “partial withdrawal”), both of which have been activated with the newest upgrade.

More than 18 million ETH, or around 15% of the available ETH supply, have been staked since the Beacon Chain became live in December 2020. With Shapella operational, 1.1 million accumulated ETH from awards are now available for quick withdrawal.

The Shapella upgrade represents a significant milestone for Ethereum’s transition from Proof-of-Work to Proof-of-Stake validation of transactions.

Users “stake” money in a proof-of-stake mechanism to help secure and confirm new blocks of transactions. Since the blockchain’s old proof-of-work consensus process was abandoned last year, users have been unable to withdraw staked ether or cash out accrued staking rewards, which is a key component of the new paradigm.

When the Shanghai hard fork was initiated last night, the price of ETH was largely flat and there was no significant price reaction to the upgrade. Moreover, there has not been a large exodus of validators which was somewhat anticipated before the upgrade due to a spike in so-called “voluntary exits” last Sunday (see here).

Voluntary exits represent the total number of validators that have exited the validator pool voluntarily and don’t participate in the Proof-of-Stake validation anymore. Last week also saw the first back-to-back decrease in the number of active validators.

Apart from the unlock of staked ETH, the Shapella upgrade has implemented the following improvements to the Ethereum protocol, most of which intend to lower transactions fees (Gas prices):

- EIP-3651 has a lower gas cost and accesses the “COINBASE” address, a piece of software used by validators (with no relation to the well-known exchange). This blockchain code modification may enhance customers’ MEV (Maximum Extractable Value) payments;

- EIP-3855, which makes “Push0,” a code that will reduce developers’ gas expenses;

- EIP-3860, which restricts gas prices for developers that utilize “initcode” (a code for smart contracts);

- EIP-6049 will inform developers of the depreciation of a code called “SELFDESTRUCT,” which also lowers gas prices.

What’s next?

Ethereum founder Vitalik Buterin has emphasized just right after the upgrade that the focus will now be on further reducing transaction fees and increasing scalability of Ethereum’s base layer, something that has also been partially addressed with the newest upgrade. At the time of writing, the mean transaction fee on Ethereum’s base layer is around 5 USD per transaction which is one of the reasons many developers have looked for alternative bridge protocols such as Polygon (MATIC) or Arbitrum (ARB) to scale Ethereum’s base layer and reduce their transaction costs.

Therefore, reducing transaction fees appears to be the top priority on the development list for Ethereum.

The good news for investors is that Ethereum now offers a flexible solution to earn interest/rewards via staking, i.e. in the validation of transactions. The estimated ROI per validator is around 4.26% p.a. at the moment. Staking rewards are a feature that Proof-of-Work cryptoassets such as Bitcoin do not possess.

However, after the upgrade, key risks remain.

Large holders of staked ETH such as the insolvent Celsius Network, who still hold around 158k ETH, could use the unlock to liquidate their holdings to recover funds for their creditors.

In order to resolve SEC allegations, the US-based crypto exchange Kraken just decided to shut down its staking business. As a result, they will probably have to unstake all of their 1.2 million ETH. This does not necessarily mean that these staked ETH end up being liquidated but this still poses a risk.

At least part of the staked withdrawals could eventually end up at exchanges being liquidated to cash in the staked ETH. This could exert some downward pressure on the price in the short-term. However, exchange inflows for Ethereum so far appear to be relatively low which implies no significant selling pressure.

Given the implemented withdrawal queue – the protocol will only allow up to 115200 validators to withdraw per day – the aggregate amount of selling pressure will be somewhat limited by this hard factor.

Lastly, probably the greatest risk is that, after withdrawals have now been enabled, the SEC might increase its scrutiny on the blockchain again as the distribution of staked ETH could imply a distribution of profits in a common enterprise – a key criterion of the infamous “Howey Test” to identify whether any undertaking represents a security in the US.

This could potentially induce further price volatility in cryptoasset markets down the road as it could increase regulatory uncertainty in the US again.

At least in the short term, the unwinding of downside protections via ETH options and futures after the successful implementation of Shapella, could result in some upside pressure on the price, which is good news.

Before the upgrade, there was some significant hedging activity visible in the increased premium for ETH options expiring after the upgrade and the negative skew in favor of put options that give the holder the right to sell a specific amount of ETH at a pre-specified price.

We will continue to monitor these metrics going forward and highlight any upcoming salience.

As always, we hope that you will find these insights useful.

Stay humble and stack Sats,

André

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.