Key Takeaways

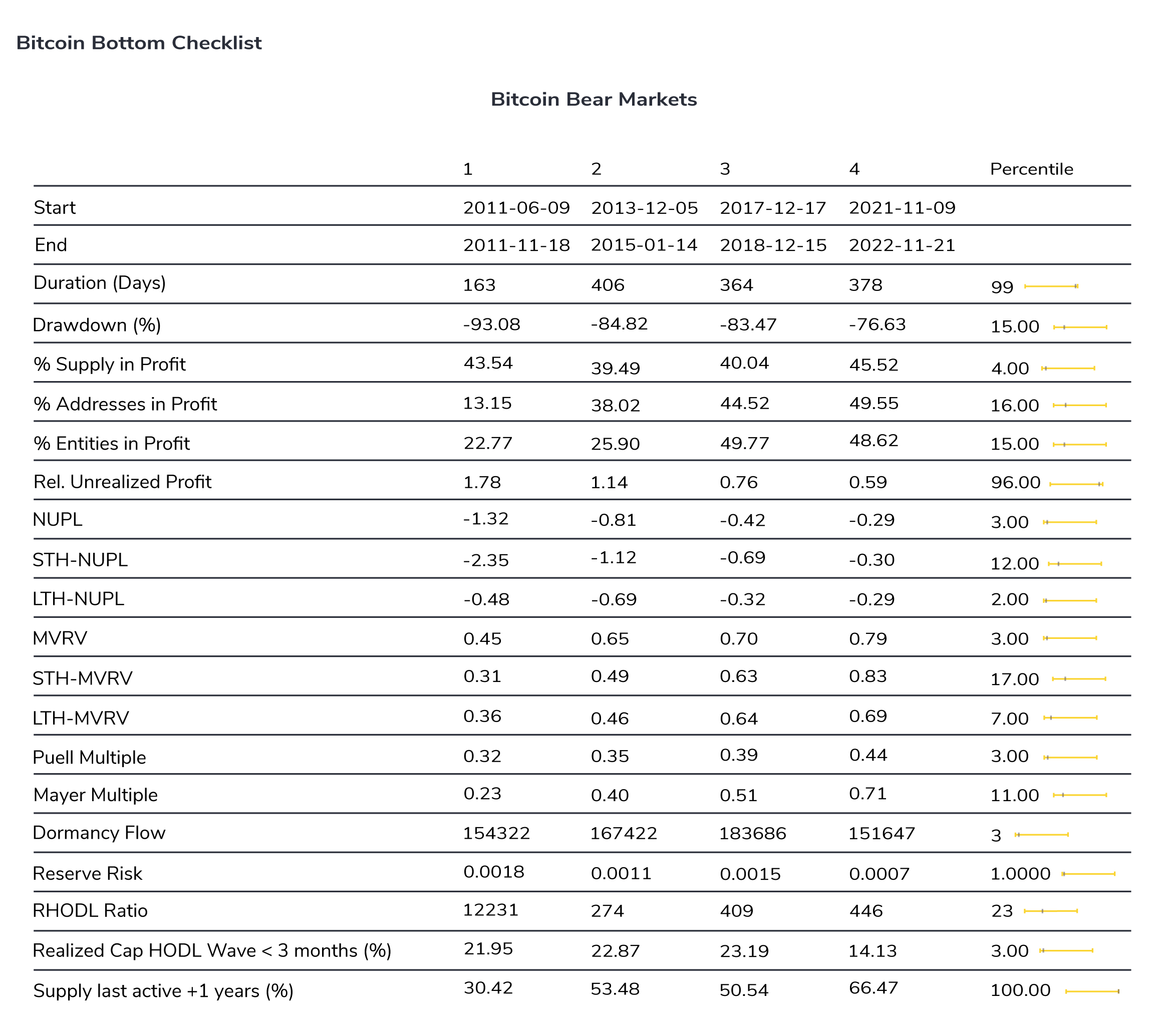

- The current Bitcoin bear market is very similar in terms of on-chain fundamentals compared to previous bear markets

- However, the degree of “pain” during the previous 3 bear markets was even higher, although “hodling mentality” among Bitcoin investors is very strong in this cycle and short-term investors have mostly exited the market

- Nonetheless, the probability of a Bitcoin cycle bottom remains relatively low based on different statistical models that we estimate

One of the key concerns for investors is when cryptoasset markets and in particular Bitcoin prices will finally reach their bottom in this cycle.

On a positive note, this is already one of the longest bear markets in Bitcoin’s history with 378 days and a -76.6% drawdown if you take the current low marked on the 21st of November 2022. However, we also saw deeper drawdowns in the last bear markets with even -93% drawdown from peak to trough in the 2011 bear market.

The degree of “pain” during previous bear markets was also higher when looking at the percentage of supply, addresses or entities in profit which was also lower in previous bear markets than in the current bear market.

On the other hand, the degree to which short-term hodlers/”weak hands”/”tourists” have been squeezed out of the market in this cycle is unprecedented which is already indicative of a cycle bottom. This is apparent in the realized Cap HODL Wave of Coins < 3 months holding period as well as the supply last active +1 years ago. More than two thirds of supply hasn’t moved in over a year. In general, “hodling mentaility” among Bitcoin investors is very strong in this cycle and short-term investors have mostly exited the market.

We have combined an array of on-chain fundamentals and valuation metrics into a “Bitcoin Bottom Checklist”, where we look at critical indicators during the last three Bitcoin cycle bottoms and compare them to the current environment:

In the latest Crypto Market Espresso (12/11/2022), we wrote the following:

“In combination with “fire-sale” valuations, we think that there is an increasing probability of a cyclical bottom in Bitcoin and cryptoassets in general.”

We wanted to provide more transparency to our investors and readers and paint more color around this question.

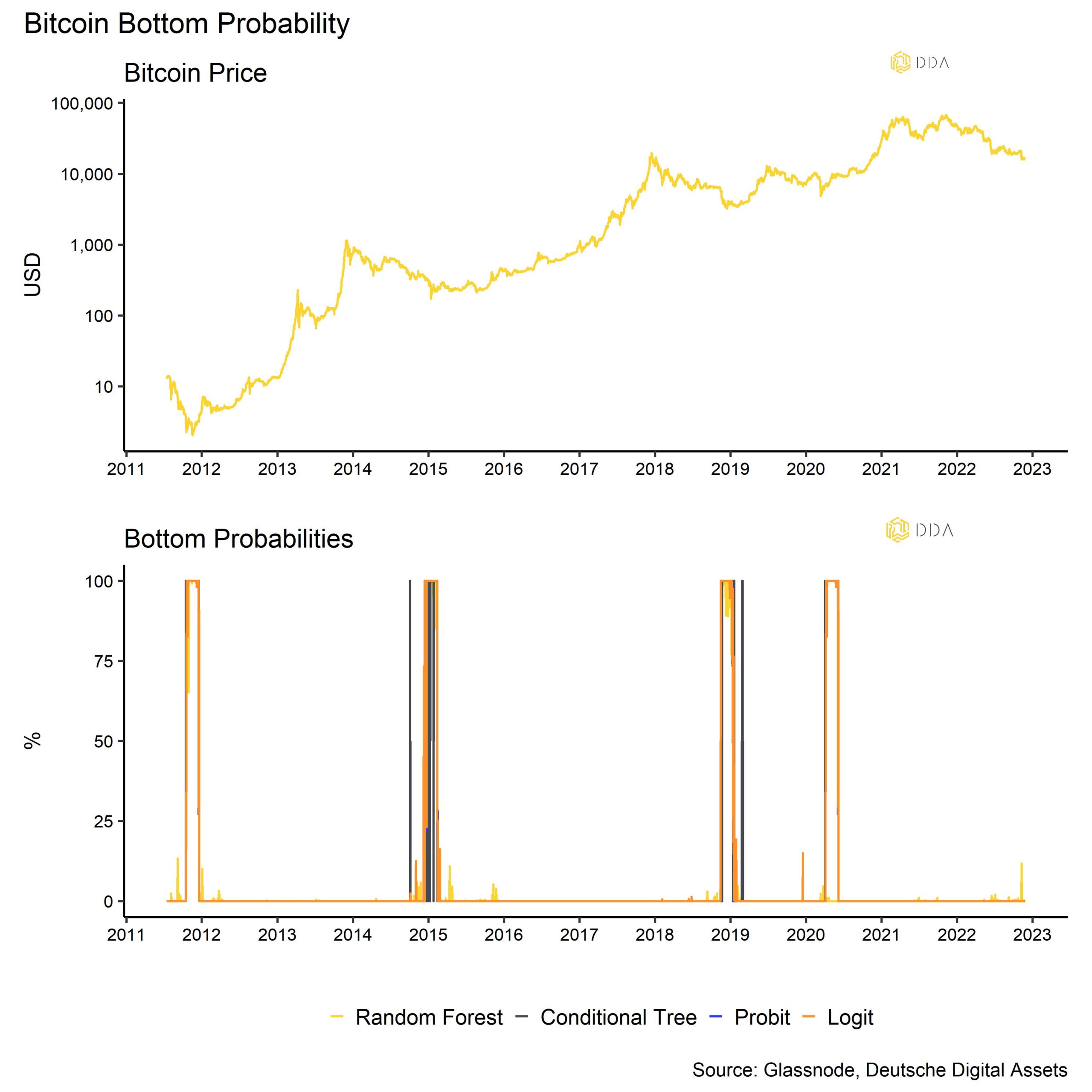

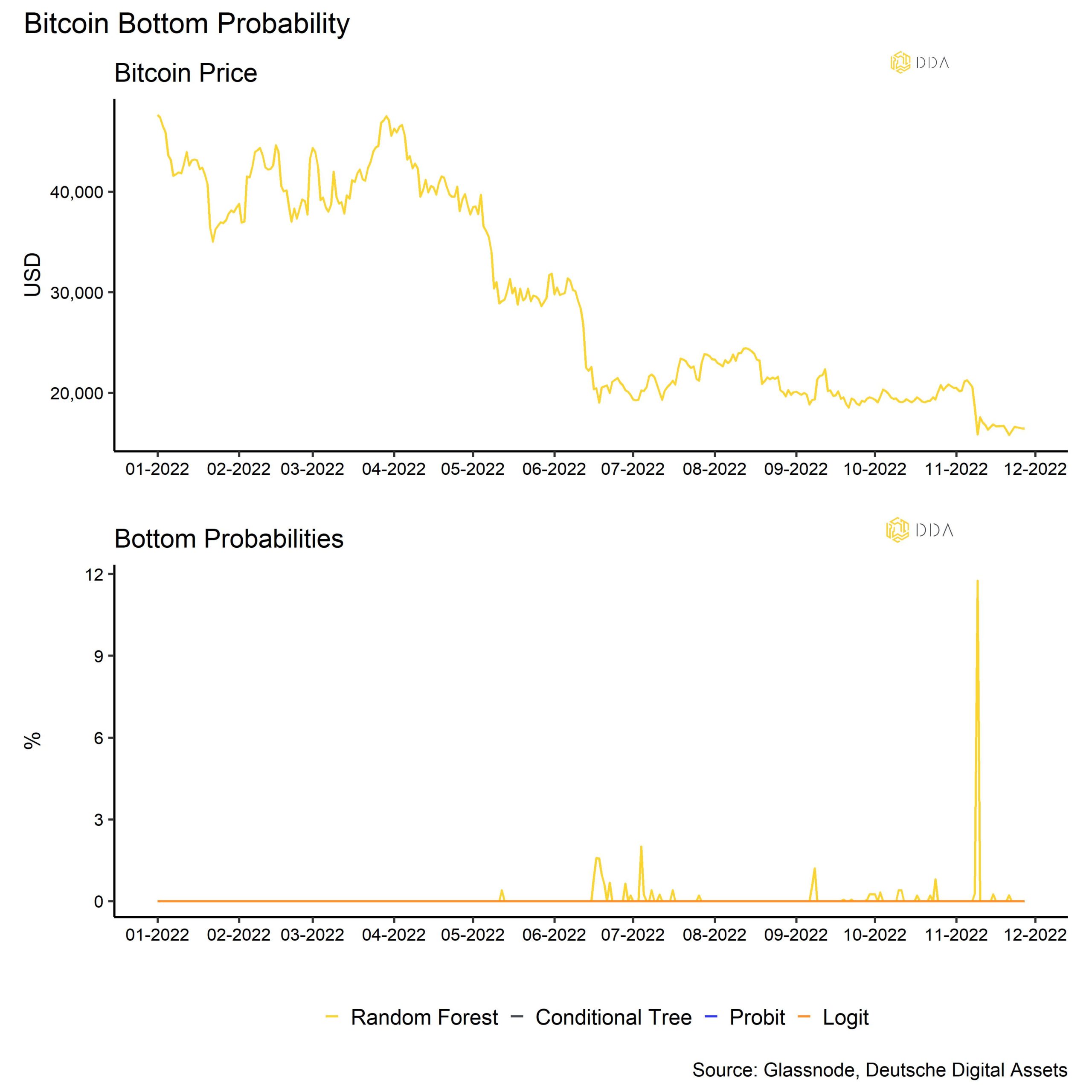

In fact, we observed an increase in our bottom probabilities the day FTX collapsed on the 9th of November. However, in general, the probability of a Bitcoin cycle bottom remains relatively low based on different statistical models that we have estimated.

In order to arrive at this assessment, we have used the above mentioned variables and estimated four different kinds of statistical classification models, namely “random forest”, “conditional tree”, “probit” and “logit”-model.

That way, we don’t need to depend on one type of model only and can look at on-chain fundamentals from different angles. These models also help us in assessing which variables are more important than others when it comes to identifying Bitcoin bottoms historically.

This is how our estimated probabilities look like:

Notice the latest spike in Bitcoin bottom probability o around ~12% on the 9th of November – the day FTX collapsed.

All in all, although the probability of a Bitcoin bottom has increased lately based on the random forest model, the overall probability remains relatively low.

We will monitor these developments closely and will inform our investors and readers as soon as we notice a significant change.

In the future, you will also find the above mentioned Bitcoin bottom probabilities in our monthly “Crypto Market Intelligence” report.

Hope you will find them useful.

Stay humble and stack Sats,

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Recent News and Articles

- Crypto Market Intelligence – October 2022

- Institutional Crypto Adoption: Why & How Institutions Are Going Crypto

- Crypto Portfolio Composition: How Different Portfolios Have Performed During the Recent Bull and Bear Markets

- How to Invest in Ethereum (ETH): A Guide for Professional Investors

- The Case for Actively Managed Investment Strategies in the Crypto Markets

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How accurate is the Bitcoin Stock-to_Flow Model?

Deutsche Digital Assets in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.