Stay up to date with our monthly crypto overview:

- The crypto markets were largely in the red in September, in line with global markets sentiment.

- Bitcoin and Ether closed -3.98% and -16.13%, respectively, versus last month.

- The top outperformer among the leading crypto assets in September was Ripple’s XRP.

Crypto Market Overview September 2022

In the past month, we witnessed one of the biggest events in the history of the crypto asset markets. The so-called Ethereum Merge saw the second-largest crypto network by market capitalization move from a Proof of Work consensus algorithm to Proof of Stake, making it more energy-efficient and a more easily scalable network.

In the weeks building up to the Merge, crypto traders placed their bets on whether this large-scale protocol upgrade would be successful or not, causing the price of ETH to rally leading up to the Merge. However, despite the success of the upgrade, which occurred without any technological hiccups, the price of ETH dropped significantly following the Merge.

While the success of the Merge was arguably already priced in and global economic figures turned markets sour, ETH’s price drop (-16.13% month-on-month) was likely exasperated by SEC Chair Gary Gensler’s statement that tokens of Proof of Stake blockchains, like Ethereum, could become classified as securities, which would attract regulator scrutiny to the Ethereum ecosystem.

Bitcoin, on the other hand, managed to remain relatively stable at around $20,000, dropping only 3.98% versus last month’s close. Despite the tremendously difficult global economic environment, Bitcoin has seemingly found its footing, following the market correction in H1/2022.

Moreover, the “Bitcoin nation,” El Salvador, celebrated the one-year anniversary of making Bitcoin legal tender. Since adopting Bitcoin as a legally recognized medium of exchange, tourism has increased by 81%, and average remittance fees have decreased thanks to the increased use of Bitcoin as a remittance rail in the Central American country. El Salvador’s Bitcoin treasury holdings, however, are still in the red due to the 2022 crypto bear market.

Crypto Asset Performance Review

With inflation continuing to plague the global economy, numerous central banks have increased benchmark interest rates in an attempt to curb inflationary pressure on their economies. As a result, risk-on asset classes, including stocks, commodities, and crypto, have taken a hit in the past 30 days.

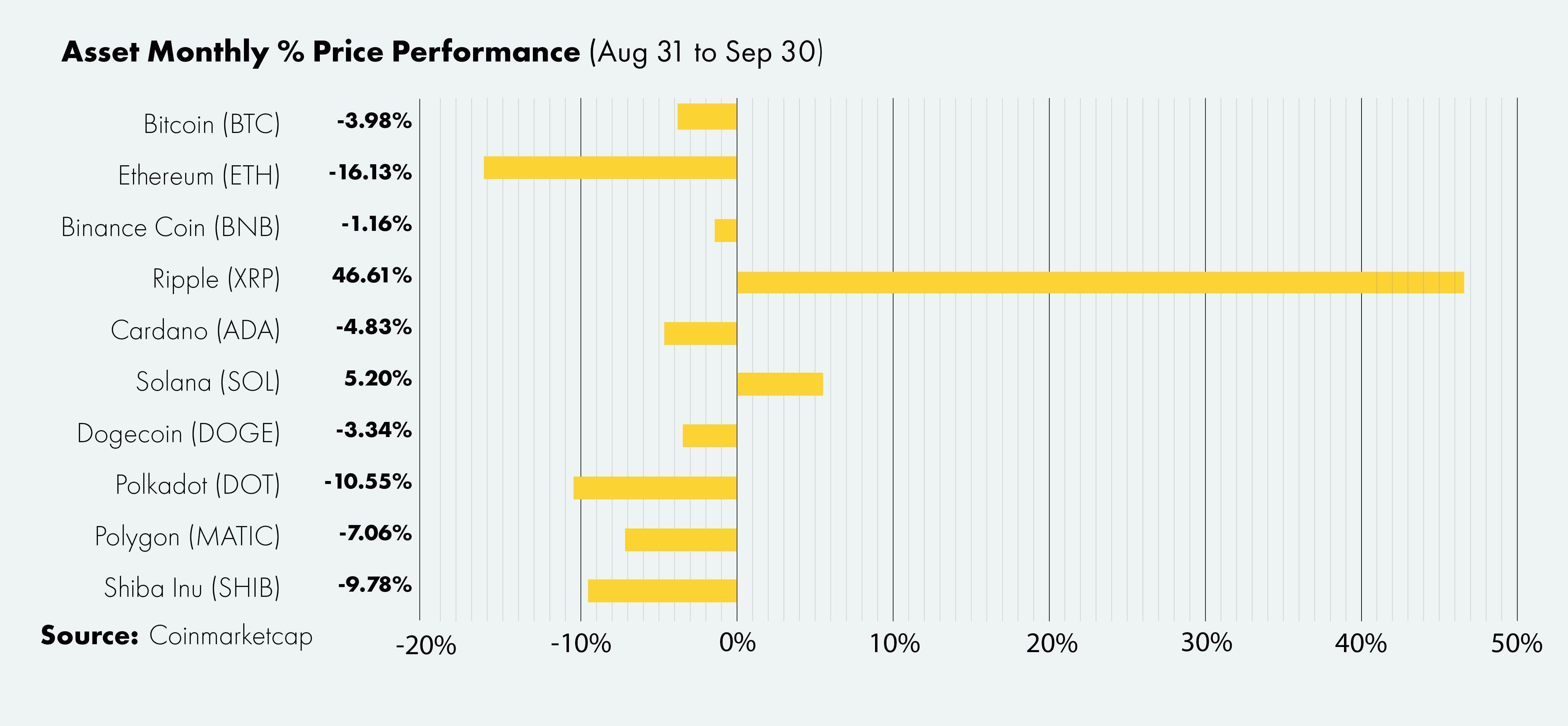

With a few exceptions, most leading crypto assets are down in the single digits, with Bitcoin (BTC), Binance Coin (BNB), Cardano (ADA), Dogecoin (DOGE), and Polygon (MATIC) dropping by -3.98%, -1.16%, -4.83%, -3.34%, and -7.06%, respectively.

However, the crypto markets weren’t all in the red. Solana (SOL), booked a 5.20% gain, while Ripple’s XRP was this month’s outperformer among the top ten crypto assets, gaining over 46% versus last month’s close.

Ripple Labs, the company behind the cryptocurrency XRP, which has been faced with an SEC lawsuit for allegedly selling unregistered securities, booked a decisive win in court. District Judge, Analisa Torres, of the Southern District of New York didn’t give in to the SEC’s request for an immediate ruling and, instead, ordered the regulator to hand over documents that strengthened Ripple’s case that XRP is not a security.

While the case is expected to carry on until early 2023, a win for Ripple now looks likely, which could have a positive ripple effect on the crypto industry’s challenge of tokens potentially being classified as securities in the United States.

Another outperformer this month was ApeCoin (APE), which powers the Bored Ape Yacht Club (BAYC) ecosystem. APE closed the month up 12.81%, boosted by the announcement that ApeCoin staking is scheduled to go live at the end of October.

The stock market took a hit, with the S&P 500 Index dropping by almost 8% month-on-month as September’s Fed rate hike took a toll on US stocks. The picture was similar in Europe, where the EURO STOXX 50 dropped by 5.65% versus last month’s close.

U.S. Treasuries dropped by 2.70%, while the value of Gold (XAU) dropped by -2.20% month-on-month. The precious metal has been on a downward trend since March, struggling to act as a safe haven asset. September’s closing price of $1,672 marks a 29-month low for Gold.

Institutional Interest in Crypto

Nasdaq is reportedly planning to launch a crypto custody service that will enable investors to store the private keys to their digital assets with a qualified custodian. Initially providing the service for Bitcoin (BTC) and Ethereum (ETH), the New York-based securities exchange is reportedly targeting institutional investors, such as hedge funds.

The interbank messaging service SWIFT has started working with Chainlink (LINK), a provider of blockchain data and price feeds, to enable SWIFT to messages to instruct on-chain transactions in a proof-of-concept. SWIFT’s Strategy Director Jonathan Ehrenfeld Solé based the company’s decision to foray into blockchain because there is “undeniable interest” in crypto from the institutional investor community.

The world’s largest asset manager, BlackRock, is planning to roll out a new crypto ETF that will focus on the Metaverse. The iShares Future Metaverse Tech and Communications ETF will provide exposure to companies developing metaverse technologies.

Bitcoin on Balance Sheets

Nasdaq-listed tech company MicroStrategy (MSTR) has added a further 301 BTC to its balance sheet for around $6 million. The additional purchase has increased the company’s Bitcoin holdings to almost 130,000 BTC, making it one of the largest holders in the market.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Our mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Bitcoin vs. Gold: Why You Are Probably Better Off Buying “Digital Gold”

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How Green Mining Will Become the Norm for Bitcoin Network

- How accurate is the Bitcoin Stock-to_Flow Model?

- How Layer 2 Solutions Are Helping Ethereum Scale

Iconic in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- ETF strategy: Iconic Funds debuts world’s first ApeCoin crypto ETP

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

- How did portfolios perform during the pandemic? ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

The material and information contained in this article is for informational purposes only.

Iconic Holding GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities.

Performance is unpredictable. Past performance is hence not an indication of any future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Iconic Holding GmbH’s control.

We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.