Stay up to date with our monthly crypto overview:

- The crypto markets rallied in July, following a challenging Q2.

- Bitcoin and Ether are up 19.11% and 51.95%, respectively.

- The top outperformer among the leading crypto assets in June was Polygon’s MATIC token

Crypto Market Overview July 2022

After an incredibly challenging Q2/2022, the crypto markets bounced back, with leading crypto assets booking double-digit, month-on-month gains.

Following a mix of bankruptcies and bailouts in the crypto lending sector, digital asset investor sentiment has turned positive again, suggesting that the market may have stomached the fallout of the liquidity crisis in the crypto lending sector.

After successfully defending the $20,000 mark for the last one and a half months, Bitcoin rallied by almost 20%, moving above the $23,000 mark, highlighting the digital currency’s resilience and investor’s faith in the leading crypto asset.

Leading layer-1 blockchains have also seen their tokens rally, with Ethereum’s ETH receiving a boost, rallying over 50% month-on-month, with “The Merge” expected to take place in the coming weeks. The Merge is Ethereum’s long-awaited blockchain upgrade that will complete the chain’s transition from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) network.

Crypto Asset Performance Review

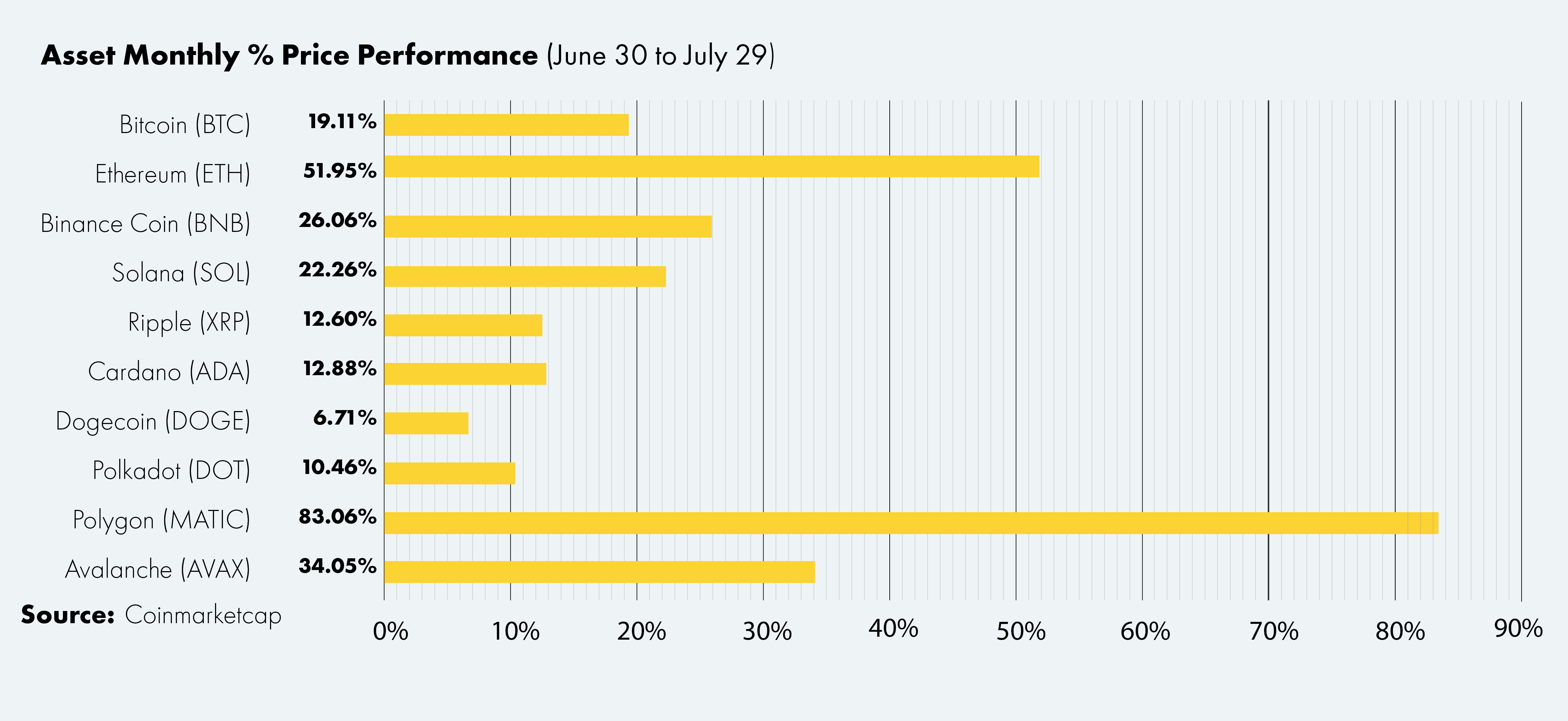

Despite the challenging economic backdrop, Bitcoin (BTC) and Ethereum (ETH) rallied by 19.11% and 51.95%, respectively, dictating the tone for the rest of the crypto markets.

Most leading crypto assets followed suit, with the likes of BNB (BNB), Solana (SOL), Cardano (ADA), and Avalanche (AVAX) rallying by 26.06%, 22.26%, 12.88%, and 34.05%, respectively.

The top outperformer among the world’s largest digital assets by market capitalization was Polygon (MATIC), which rallied by over 80% month-on-month, following the announcement of Polygon joining the Walt Disney Company’s business development program and the announcement of its innovative new zkEVM – a zero-knowledge Ethereum Virtual Machine.

The Ethereum layer-2 solution’s token also benefited from investors’ bullishness on a successful Ethereum Merge, which has been highlighted by an increase in ETH options trading in the past few weeks.

The stock market also recovered in July. Despite economic data stating that the US is technically in a recession, US stocks (measured by the S&P 500 Index) rallied 6.65% month-on-month, pushed higher by the performance of tech stocks.

U.S. Treasuries rallied by 1.41%, while the value of Gold (XAU) dropped by -3.03% month-on-month. The precious metal hit a nine-month low on July 20, dropping to $1,696.16.

Institutional Interest in Crypto

Brazil’s leading digital bank, Nubank, has reportedly acquired over one million users for its crypto trading platform, a milestone the bank reached eleven months ahead of schedule. Nubank offers Bitcoin (BTC) and Ether (ETH) trading in cooperation with trading infrastructure provider Paxos to its 46 million users across the South American nation.

Santander Brazil CEO Mario Leao stated that the lender plans to roll out crypto trading to its customers. “We recognize that it is a market that is here to stay, and it is not necessarily a reaction to competitors positioning themselves. It is simply a vision that our client has demand for this type of asset, so we have to find the most correct and most educational way to do it,” Leao said.

Bitcoin on Balance Sheets

Telsa sold 75% of its Bitcoin holdings, totaling $936 million, according to a shareholder deck. CEO Elon Musk didn’t make an official statement as to why his company sold a large amount of the Bitcoin they purchased.

Core Scientific, a publicly traded blockchain infrastructure and software solutions provider, sold 7,202 bitcoins at an average price of $23,000 to raise about $167 million, according to a press release. Proceeds from the sale of BTC were primarily used for payments for ASIC servers, capital investments in additional data center capacity, and scheduled repayment of debt. Moreover, Core Scientific plans to continue to sell self-mined BTC to cover operating expenses, fund growth, retire debt and maintain liquidity in this challenging market environment.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Our mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Bitcoin vs. Gold: Why You Are Probably Better Off Buying “Digital Gold”

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How Green Mining Will Become the Norm for Bitcoin Network

- How accurate is the Bitcoin Stock-to_Flow Model?

- How Layer 2 Solutions Are Helping Ethereum Scale

Iconic in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- ETF strategy: Iconic Funds debuts world’s first ApeCoin crypto ETP

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

- How did portfolios perform during the pandemic? ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

The material and information contained in this article is for informational purposes only.

Iconic Holding GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities.

Performance is unpredictable. Past performance is hence not an indication of any future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Iconic Holding GmbH’s control.

We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.