Our monthly crypto overview for December:

- The crypto markets consolidated in December.

- Bitcoin and Ether dropped by 19.54% and 18.04%, respectively.

- The top outperformers last month were Terra and Avalanche.

- El Salvador and MicroStrategy added more Bitcoin to their treasury reserves.

Crypto Market Overview – December 2021

Unfortunately, there was no Santa rally in the crypto markets to close out 2021. A few outliers aside such as Terra (LUNA), crypto assets ended the year a leg lower as the market consolidated during the holiday period.

The prices of Bitcoin (BTC) and Ether (ETH) dropped by 19.54% and 18.04% in December, closing the year at $46,005 and $3,649, respectively. Without a major catalyst to push prices higher, the two leading cryptocurrencies failed to climb back up to their November all-time highs.

However, that shouldn’t deter from the fact that the two largest crypto assets by total market value booked healthy gains of 56.48% and 399.87% in 2021.

Crypto Performance Overview for December

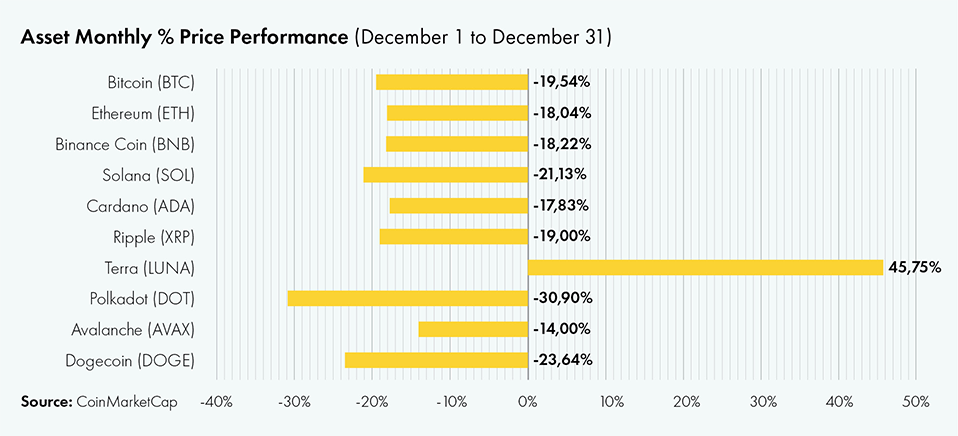

In December, the crypto markets were largely in the red, with only a handful of outperformers in the green.

Leading crypto assets, including Bitcoin (BTC), Ether (ETH), and Binance Coin (BNB), lost between 18% and 20% in value month-on-month. Whereas Solana (SOL) and Dogecoin (DOGE) dropped by over 20%. The biggest loser among the top crypto assets was Polkadot (DOT), which dropped by over 30% in December.

The standout performer last month was Terra (LUNA), boosted by the protocol’s uptake in the burgeoning DeFi market. The price of LUNA increased by 45%, continuing its strong Q4/21 price rally.

Equities recovered from the Omicron scare in November, rallying into the New Year. The S&P 500 Index increased by 5.60% in December.

U.S. Treasuries, measured by the S&P U.S. Government Bond Index, closed December -0.68% lower versus the prior month. Conversely, gold (XAU) rallied by 2.70% in the last month of the year.

Institutional Interest in Crypto

According to research by The Block, crypto derivatives trading volumes skyrocketed in 2021. The combined trading volume of Bitcoin and Ether options increased 443% in 2021, totaling $387 billion. Bitcoin and Ether futures volumes have increased by 338% year-on-year, totaling over $32 trillion.

2021 was hence a good year for crypto custodians. In the past twelve months, institutional crypto custodians reportedly managed to raise over $3 billion, highlighting the market’s belief that the demand for qualified custodians that can hold digital assets on behalf of institutional investors is going to increase.

Bitcoin on Balance Sheets

The Bitcoin nation El Salvador added more Bitcoin to its treasury in December, according to a tweet by President Nayib Bukele. Bukele stated that the central American country bought 21 BTC to mark the last 21st day of the year 21 of the 21st century. Additionally, he said that El Salvador’s landmass is 21,000 km2 in a tongue-in-cheek tweet thread, alluding to Bitcoin’s finite supply of 21 million coins. Currently, El Salvador holds 1,391 BTC.

Public-traded MicroStrategy (MSTR), led by outspoken Bitcoin advocate Michael Saylor, also bought more bitcoin as cash reserves in December, reportedly adding $94.2 million

Worth of BTC to its already sizable holding. As of year-end 2021, the technology company holds 124,391 BTC that were purchased at an average price of $30,159. This makes MicroStrategy one of the largest Bitcoin holdings in the world.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Our mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Bitcoin Education Will Pave the Way for Hyperbitcoinization

- Iconic Funds lists Ethereum ETP on Xetra

- Bitcoin’s Road to Sound Money for the Digital Age

- Bitcoin vs. Bitcoin Stocks: What Performs Better?

Iconic in Press

- E-fundresearch.com, Asset Managers and their crypto engagement

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

- ETF Magazine, How Blockchain and Bitcoin change the worldBTC Echo, Bitcoin: “No significant correlation to any other asset class“

Recent Research Reports

- How did portfolios perform during the pandemic? ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

In no event will you hold ICONIC HOLDING GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

ICONIC HOLDING GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond ICONIC HOLDING GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

ICONIC HOLDING GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.