Stay up to date with our monthly crypto overview:

- The crypto markets corrected in August, following July’s relief rally.

- Bitcoin and Ether closed -14.07% and -6.94%, respectively, versus last month.

- The top outperformer among the leading crypto assets in August was Cosmos’ ATOM token.

Crypto Market Overview August 2022

While the crypto community is eagerly awaiting Ethereum’s Merge, which will see the second-largest blockchain network move from Proof of Work to Proof of Stake, the crypto markets reacted to Fed Chairman Jerome Powell’s hawkish statements, pushing Bitcoin below the $20,000 mark.

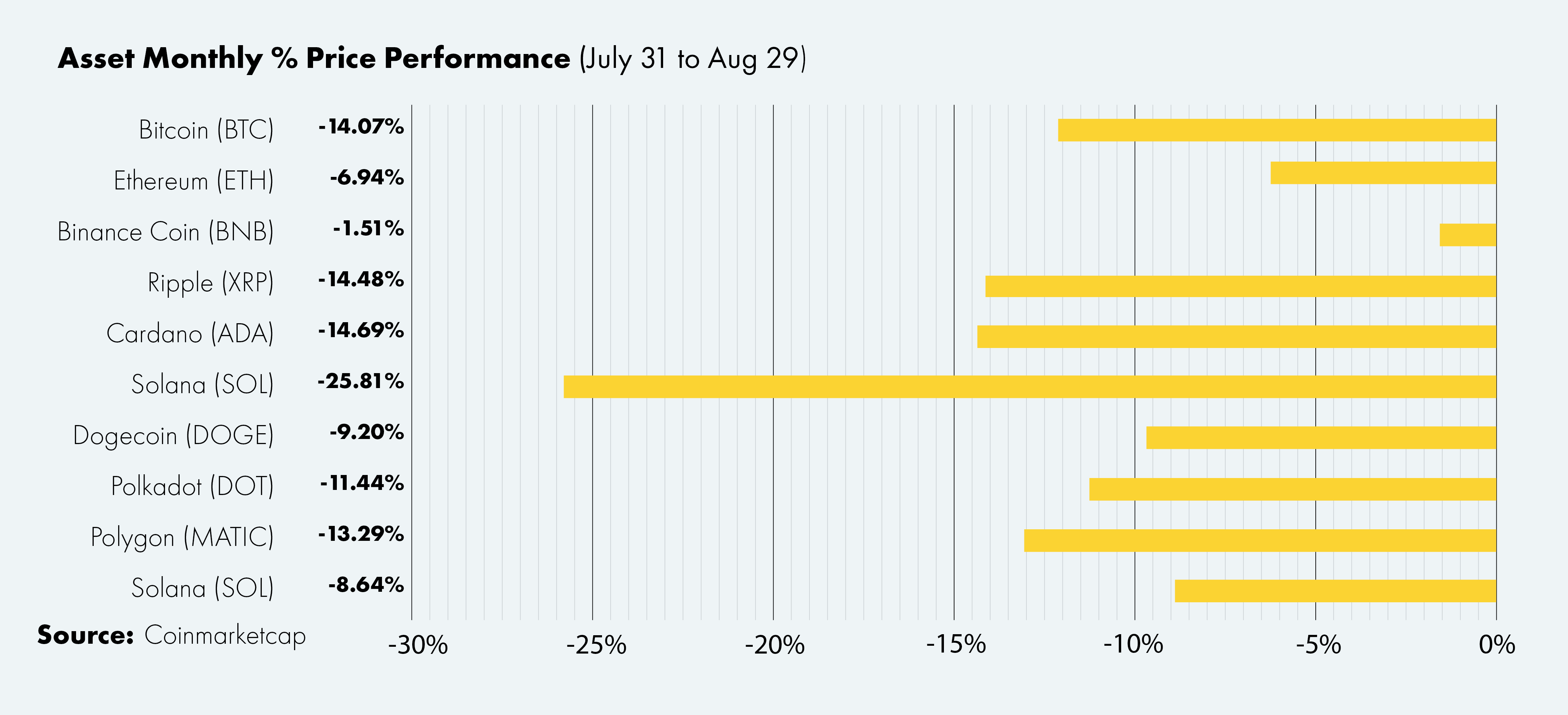

Hinting at further rate increases (estimated at 50bps to 75 bps), crypto assets moved a leg lower line with stocks. Most leading digital assets dropped between 10% to 15% in August, despite institutional interest increasing at current levels.

The blacklisting of crypto-mixing service Tornado Cash by the U.S. Treasury in early August, which prohibits all U.S. persons from interacting with the privacy-enhancing technology, sparked concerns in the crypto community about the potential ramifications.

Crypto advocates believe that privacy layers are essential for financial services to operate on public blockchains (where all transactions can be viewed) and that open-source technology should not be censored by authorities.

While sanctioning crypto-mixing services, which have been used by cybercriminals to launder funds, may make sense from a regulatory and legal point of view, crypto advocates are concerned about the potential of U.S. authorities to apply similar actions toward other open-source platforms, such as DeFi protocols.

Crypto Asset Performance Review

The crypto markets retracted in August, following a relief rally in July. The two leading crypto assets, Bitcoin and Ether, have dropped -14.07% and -6.94%, respectively, versus last month’s close. The remainder of the crypto markets largely followed suit, with only a handful of cryptocurrencies closing the month in the green.

The meme coin Shiba Inu (SHIB), Bitfinex’s UNUS SED LEO (LEO) token, and Cosmos (ATOM) were the only digital assets that booked month-on-month gains among the top 25 assets by market capitalization.

Cosmos’ ATOM token was this month’s top performer, closing the month 6.26% higher, following reports that the token will be used as collateral in MakerDAO-style stablecoins and the Cosmos team making headway in the chain’s development with new upgrades expected in the coming months.

The stock market also corrected in August, with U.S. stocks (measured by the S&P 500 Index) dropping by 2.14% month-on-month, following the anticipation of further interest rate increases by the Fed in an attempt to curb the country’s soaring inflation.

U.S. Treasuries corrected by 1.89%, while the value of Gold (XAU) dropped by -2.05% month-on-month. The precious metal is up slightly from its nine-month low of $1,696.16, which it hit on July 20, closing the month at around $1,771.

Institutional Interest in Crypto

BlackRock announced that it will offer Bitcoin investment services to institutional investors through a spot Bitcoin private trust in partnership with Coinbase, opening up billions of dollars of capital that could potentially flow into the world’s leading cryptocurrency. “Despite the steep downturn in the digital asset market, we are still seeing substantial interest from some institutional clients,” the company stated.

Publicly traded cryptocurrency company Coinbase has launched Ethereum staking for US-domiciled institutional investors through Coinbase Prime. The new product will enable institutions to stake Ether (ETH) to earn staking rewards, similar to earning interest on a fixed income security. The only difference is that the “interest” is paid in ETH.

Bitcoin on Balance Sheets

The publicly traded bitcoin mining company, Hut 8 Mining Corp, added 330 BTC to its balance sheet in July, according to a press release. The Canadian company now holds 7,736 BTC on its balance sheet. “We continued to deliver results, growing our stack to 7,736 Bitcoin – one of the largest holdings globally – by mining efficiently,” said Jaime Leverton, CEO.

English football club, Oxford City FC, announced the acceptance of Bitcoin as a payment method for tickets and food and beverages on match day. The sixth-tier club has partnered with Isle of Man-based Bitcoin company CoinCorner – which has also become a back-of-shirt sponsor – to integrate Bitcoin payments. It’s not confirmed whether or not the club will keep the Bitcoin on its balance sheet or convert the Bitcoin payments into fiat currency at point of sale.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Our mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Bitcoin vs. Gold: Why You Are Probably Better Off Buying “Digital Gold”

- Why Bitcoin’s Volatility Shouldn’t Scare You

- How Green Mining Will Become the Norm for Bitcoin Network

- How accurate is the Bitcoin Stock-to_Flow Model?

- How Layer 2 Solutions Are Helping Ethereum Scale

Iconic in Press

- ETF stream: White-label issuers in Europe quietly tripled in a week

- ETF strategy: Iconic Funds debuts world’s first ApeCoin crypto ETP

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

- How did portfolios perform during the pandemic? ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

The material and information contained in this article is for informational purposes only.

Iconic Holding GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities.

Performance is unpredictable. Past performance is hence not an indication of any future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Iconic Holding GmbH’s control.

We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.