Download the Full Report in PDF

by André Dragosch, Head of Research and Dominik Poiger, Chief Product Officer

Key Takeaways

- Bitcoin had best start into a year since 2013

- Fed rate path is still on a collision course with market expectations

- Our in-house macro indicators suggest that the recent improvement in global growth expectations was the main driver behind the ascent in cryptoasset prices

- Genesis files for chapter 11 but on-chain data suggests institutional buyers are back

Chart of the Month

Performance Review

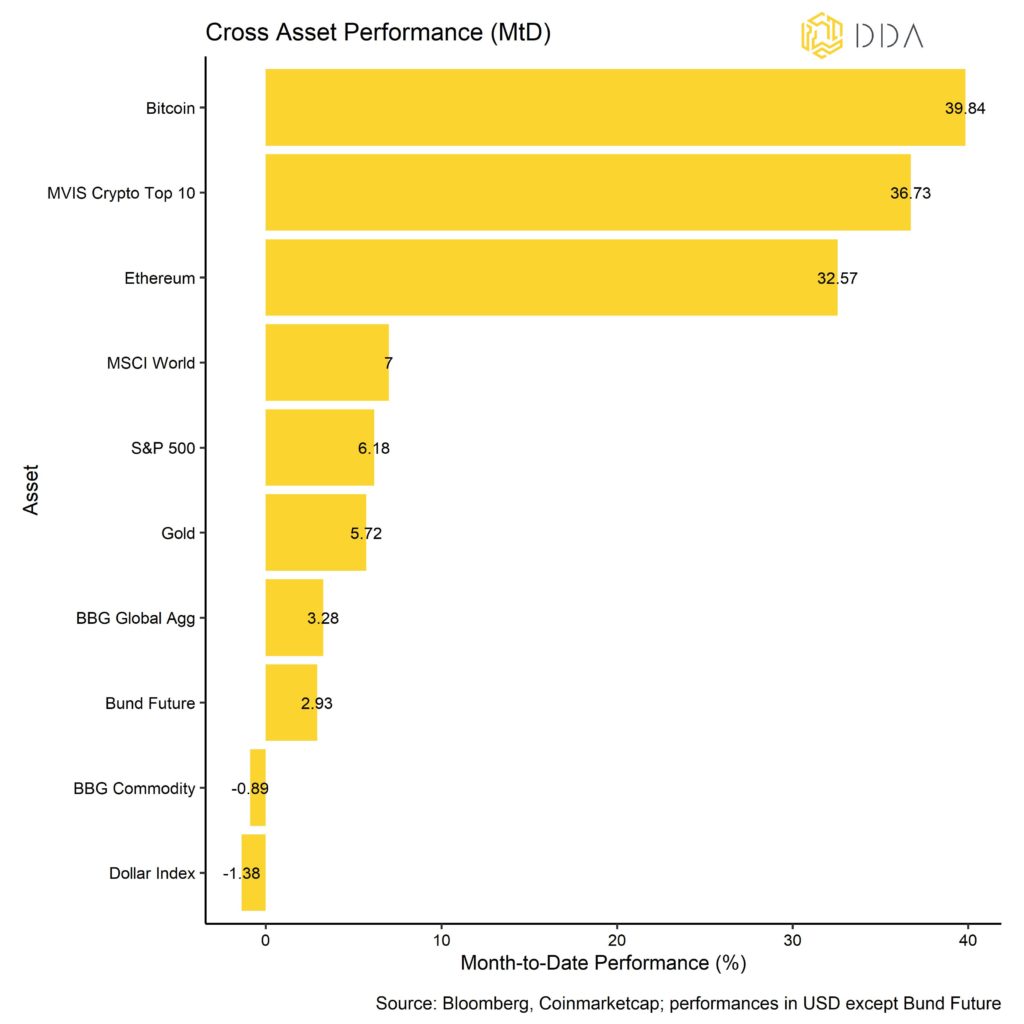

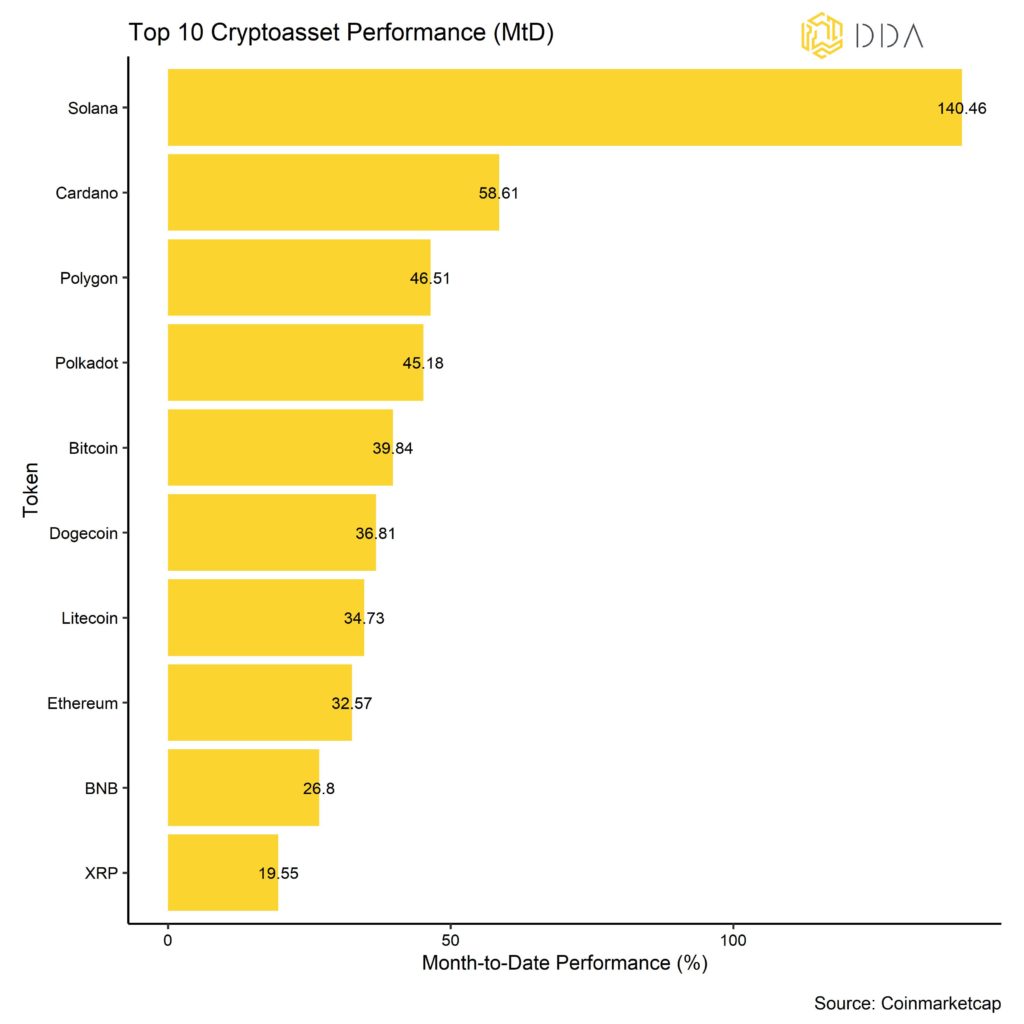

Cryptoassets staged an extraordinary comeback this year outperforming other asset classes by a very wide margin in January. More specifically, the top 10 cryptoassets performed 36.7% while global developed market equities as the second-best asset class only advanced 7%.

Cryptoasset prices managed to outperform, as there were signs of increasing institutional buying interest throughout the month. This is evident in a variety of market segments, including institutional fund flows and on-chain metrics. In general, overall cross asset market sentiment was lifted by another decline in US inflation numbers, ongoing Chinese Re-Opening expectations and a depreciation of the US Dollar. Among the top 10 major cryptoassets, Solana, Cardano and Polygon have been the main outperformers. Less than half of our tracked Altcoins managed to outperform Bitcoin during the last month as depicted by our “Altseason Index” (see appendix). Nonetheless, dispersion among cryptoassets remains relatively high, meaning that cryptoassets are rather trading on coin-specific factors than on systematic factors.

Bottom Line: Cryptoassets staged an extraordinary comeback this year outperforming other asset classes by a very wide margin in January.

Macro & Markets Commentary

Fed monetary policy is still on collision course with markets. While markets price in rate cuts in the (near) future, communication from central bank officials point into the other direction. The FOMC dot plot shows a higher terminal rate (between 5.25 – 5.50%) but the pace at which the Fed will hike seems to have decreased. The recent communicated halt of rate hikes by the Bank of Canada is noteworthy in this regard and has heightened speculation among market participants that the Fed might be next in halting rate hikes.

Another aspect which is regarded positively by financial market participants is the fact that due to the US Debt Ceiling, the US Treasury will likely draw on its Treasury General Account (TGA) at the Fed which should add liquidity to the banking system on a net basis. The drop in the TGA will more than offset any tightening in liquidity due to the Fed’s unwind of bonds and continuing reduction of its balance sheet.

This adds to the positive market sentiment on account of the fact that the US CPI numbers declined in December 2022 (0.1% on a monthly basis). The CPI is now well off the 9.1% peak rate in June 2022. This should – all things equal – lead to a slower pace of Fed hikes (already evident) and a weaker US Dollar (partly evident). DXY has come down substantially from its September to October 2022 highs. We have analysed the impact of a weaker US Dollar on scarce asset performance such as bitcoin. In November 2022 we wrote:

“Bitcoin performed +600% on average within 6 months in the bottom 1/5 of cases when the Dollar depreciated the most. On the other hand, Bitcoin performed -10% on average within 6 months in the top 1/5 of cases when the Dollar appreciated the most.”

Dollar weakness is currently also driven by the divestments of US treasuries of the top 2 holders, China and Japan. We continue to see this play out structurally where native buyers of US Treasuries disappear (China, Russia, potentially Saudi Arabia) while the US continues to hit the debt ceiling and needs to increase its borrowing leaving only one buyer, the Fed, to buy these securities.

Besides, the latest data from the Bank of Japan’s bond buying volume also imply that the BoJ has purchased the highest amount of Japanese Government Bonds on record in order to defend the Yield Curve Control policy range. This has fueled speculations that Quantiative Easing (“QE”) and more liquidity might return to financial markets in general as well.

Coming back to US inflations figures, we recently stated: “Nonetheless, although US inflation readings are likely to continue to come down in the coming months as supply chain indicators are easing and commodity prices have relaxed due to the current slowdown, it is still uncertain whether we will see a significant increase in unemployment in the short term. The reason investors are focusing on US employment is the fact that a weaker jobs market could pressure the Fed further to adopt a more moderate stance of monetary policy and therefore bring the market closer to the “Fed pivot”.”

While the US labor market data remains strong, layoff announcements are starting to pile up. The latest Empire State Manufacturing Index sank to -32.9 (January 2023 reading), the lowest reading since May 2020 and well below the consensus of -9. A US recession and therefore a Fed pivot ultimately seems inevitable.

This looming US recession falls together with the re-opening of the Chinese economy which has been a tailwind for risk assets/cross asset risk sentiment, particularly cryptoassets. This has been particularly visible in Hong Kong Stocks but also China- sensitive commodities like copper. This China re-opening has the potential to become an issue and might add to a toxic macro environment with increasing global and US inflation expectations while the US economy continues to slide into recession. The re- opening may well trigger higher inflation expectations and later Fed easing or even another Fed policy error tightening into a severe slowdown due to high inflation expectations.

It is important to note that, although most market observers attribute the recent outperformance of risky assets to a potential Fed pivot, our in-house macro indicators and their correlation to Bitcoin imply that the improvement in global growth expectations has been mostly associated with the recent ascent in cryptoasset prices. Thus, the Chinese re-opening appears to be more important from a statistical point of view than the expected change in US monetary policy.

Bottom Line: Although most market observers attribute the recent outperformance of risky assets to a potential Fed pivot, our in-house macro indicators and their correlation to Bitcoin imply that the improvement in global growth expectations has been mostly associated with the recent ascent in cryptoasset prices. The Fed is still on a collision course with financial markets’ expectations of an earlier exit from tight monetary policy. However, China’s re-opening could add to a toxic macro environment, prolonging a potential Fed pivot.

On-Chain Analytics

On-chain developments also corroborated the view that institutions came back to the market in January 2023.

Curiously, the chapter 11 bankruptcy filing of crypto lender Genesis (“Genesis Global Holdco LLC”) (on 20 January 2023) did not have a significant impact neither on price nor on on-chain flows as expected by many market participants. Genesis is an indirect victim of the collapse of Luna/UST and the subsequent collapse of crypto hedge fund Three Arrows Capital (3AC) and their exposure to FTX. Genesis was the go-to lender in the crypto space to facilitate the arbitrage trade in the Grayscale Bitcoin Trust (GBTC) where shares could be created by professional investors at NAV and sold to retail at a premium. As this premium disappeared, arbitrageurs (i.e. 3AC) had to go elsewhere to search for yield (which they seemingly found in the Luna/UST Anchor protocol) and borrowed further from Genesis.

On another note, Over-the-Counter (OTC) Desk Balances of Bitcoin have increased sharply to the highest reading since July 2022 (see latest Crypto Market Pulse Report). Higher OTC Desk holdings imply that institutional investors’ demand for Bitcoin has increased as these OTC trading desks are usually used by investors who perform large- scale transactions that need high liquidity on a bilateral basis. Typical users of OTC trading desks include private wealth managers, high net-worth individuals, or hedge funds wishing to convert large amounts of cash into cryptoassets seamlessly.

Another observation that corroborates increased institutional buying interest in cryptoassets is that exchange outflows during the last month was dominated by very large wallet sizes, > 1 mn USD (see appendix). In general, exchange outflows usually imply buying interest as investors take coins off exchanges in order to safe-guard them in cold-storage.

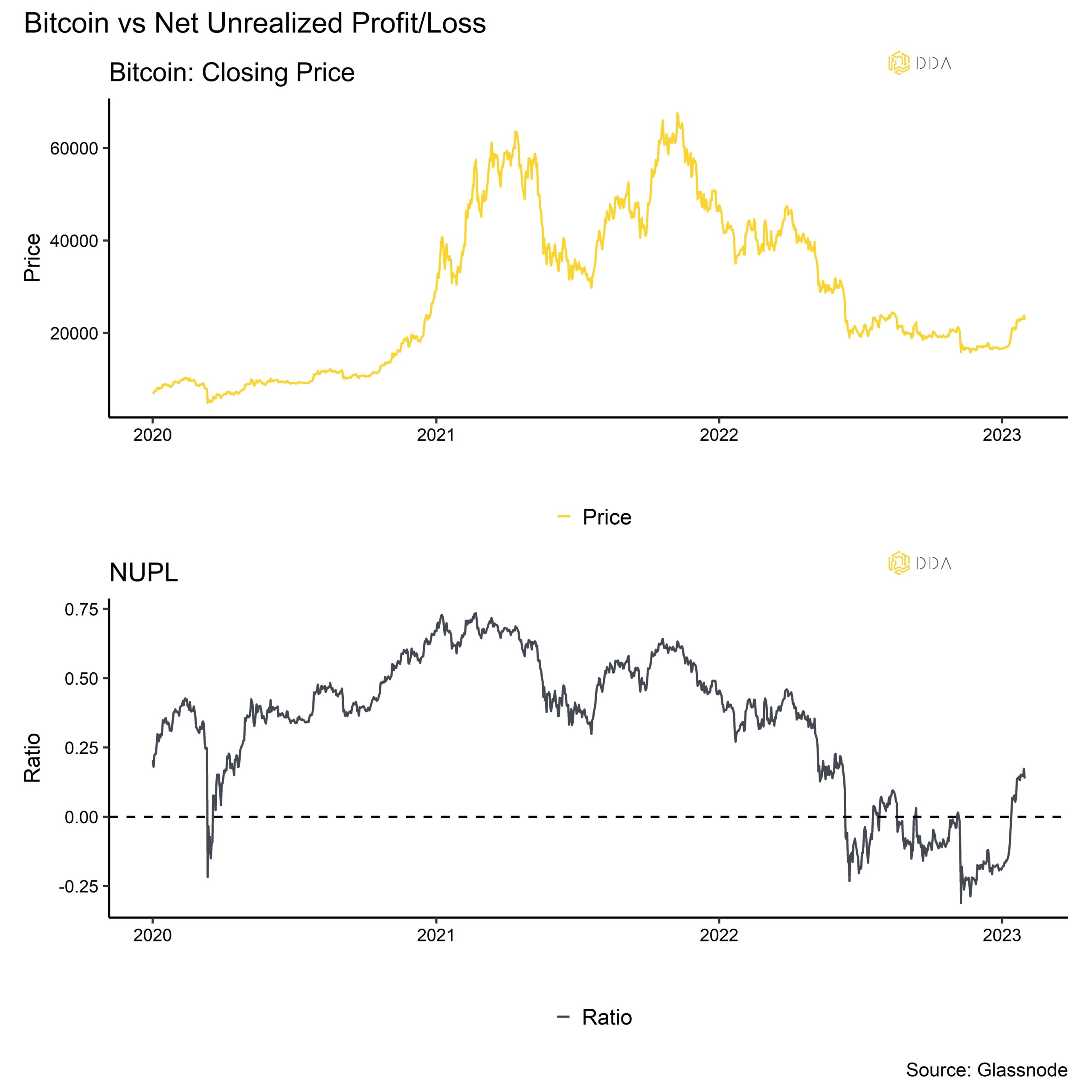

Besides, short-term holders appear to be in the profit-zone (STH-SOPR > 1.0) and overall short-term investors are not “under water” anymore, ie have unrealized gains on their investments in aggregate (STH-NUPL > 0). Generally speaking, the Spent-Output- Profit Ratio (SOPR) simply shows the relationship between price paid / price sold and readings above 1.0 imply profitable transactions in aggregate. The Net Unrealized Profit/Loss (NUPL) metric shows the amount of unrealized profits or losses that is still held in investors’ wallets. We are showing this relationship in our Chart of the month.

An environment where short-term traders are in aggregate profitable has a stabilizing effect on the overall market as these traders are less likely to sell their holdings. It is usually a phenomenon which is observed near the cycle bottom or at the very beginning of a new bull cycle.

In general, we saw an increase in the number of active addresses on the Bitcoin blockchain to the highest level since May 2022 which signals an overall increase in on- chain activity.

In our Crypto Espresso from 5 January 2023 we were reflecting on the BTC bottom probability and whether sellers are getting exhausted. We continued to see a (for now) short-term rally as bitcoin closed the month slightly above USD 23,000.

Bottom Line: OTC desk balance, SOPR and sellers’ exhaustion indicate that bitcoin has likely bottomed (for now). The Chapter 11 filing by crypto lending desk Genesis has not had a significant impact on the market.

Download the full report with appendix here.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.