One of the basic principles of portfolio theory is diversification. Diversification, which aims to minimize risk – measured by standard deviation – without reducing the expected return. Read on to learn more about the role of correlations in portfolio theory and crypto asset investing.

By Patrick Lowry, CEO of Deutsche Digital Assets

The Role of Correlations in Portfolio Diversification

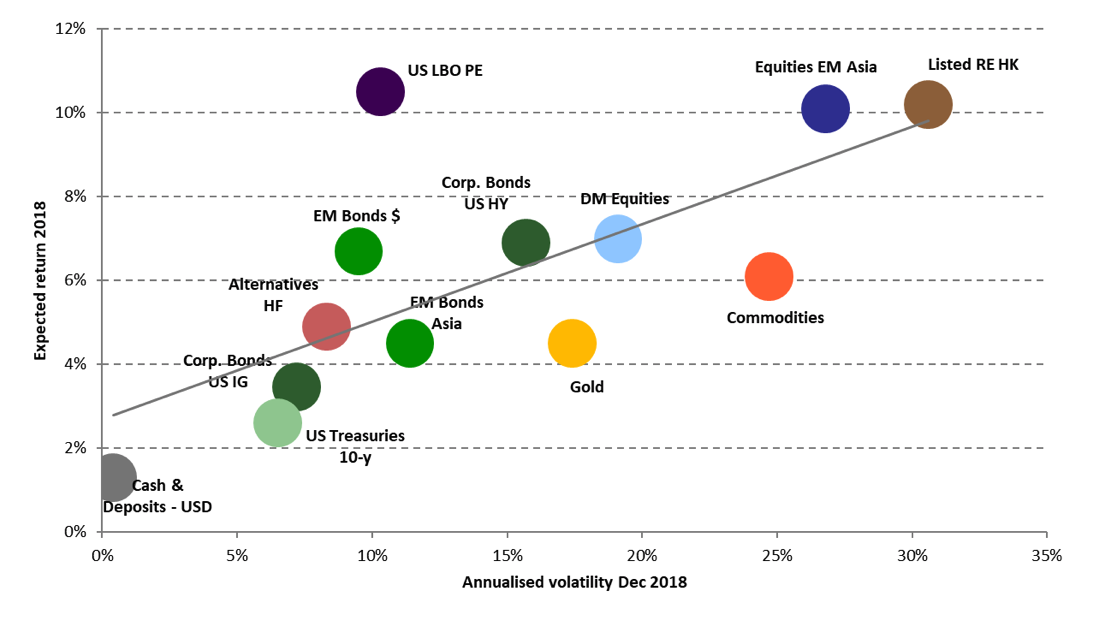

Each individual asset class has its own risk/return profile. In the chart below, you can see the risk/return profiles for a range of popular asset classes.

The optimal investment would be located in the upper left corner, i.e. a high expected return with a low standard deviation. Normally, a riskier investment also provides a higher expected return.

Correlations are measured with the so-called correlation coefficient, which can be anywhere between +1 (perfect positive) and -1 (perfect negative).

In terms of risk diversification, both values are not desirable. Either the entire portfolio rises or falls with one event, or half of the portfolio rises while the other half falls.

Diversification is mainly achieved by adding an asset that ideally shows no correlation with other asset classes. The lower the correlation between the assets in a portfolio, the more risk can be eliminated.

An uncorrelated asset is the holy grail of portfolio construction.

In the context of this article, strategic asset allocation is assumed, not tactical asset allocation. Subsequently, we are posing a question of long-term allocation into different asset classes and are not considering short-term opportunities in certain industries or the selection of outperforming asset managers.

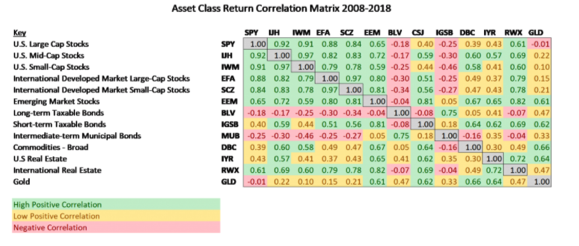

Correlations of Traditional and Alternative Asset Classes

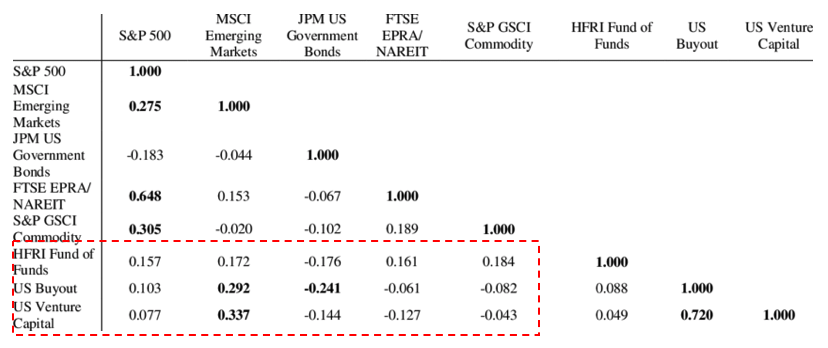

Let’s first take a look at traditional asset classes such as equities, bonds, commodities and real estate.

As we can see from the upper left quadrant, equities correlate very positively with each other worldwide, so they are only suitable for risk diversification to a certain extent.

As we can see from the upper left quadrant, equities correlate very positively with each other worldwide, so they are only suitable for risk diversification to a certain extent.

Gold is very well suited for inclusion in an equity portfolio. However, it correlates relatively strongly with other commodities and real estate. In particular, adding bonds with a long lifetime next to stocks, commodities and real estate is excellent for diversification purposes.

But what about other alternative asset classes?

We can see that hedge funds, private equity, and venture capital are excellent for diversification versus traditional asset classes, with values ranging from 0.05 to 0.35.

From the results so far, we can conclude that stocks, commodities, real estate and bonds belong in a diversified portfolio just as much as hedge funds and private equity or venture capital.

From the results so far, we can conclude that stocks, commodities, real estate and bonds belong in a diversified portfolio just as much as hedge funds and private equity or venture capital.

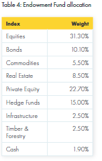

It is therefore not surprising that the most successful investment concept of the last decades is the so-called endowmnet model.

Unfortunately, not every investor has access to certain asset classes. Investing in private equity funds, for example, is only possible for professional (EU) or accredited (US) investors and the minimum investment amount is often more than 1 million USD.

In my previous article, I already discussed the effect of allocating crypto assets to different types of portfolios.

Crypto and other asset classes

How do crypto assets fit into a portfolio?

I have already shown in my last article (this Research Report ) that they not only generate decent alpha, but also have a positive effect on the Sharpe Ratio (risk/return profile).

But what about correlations? Do they legitimize crypto as an addition to a diversified portfolio?

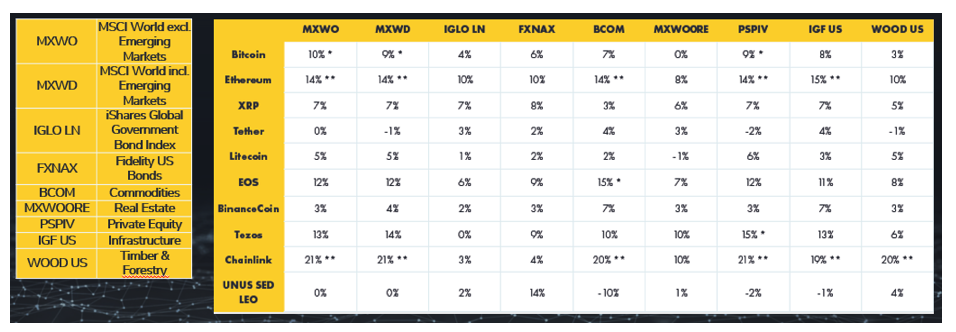

Looking at the entire history of cryptoassets, they have virtually non-existent correlations to stocks, bonds and real estate as well as to commodities, hedge funds and private equity.

In the case of Bitcoin just 0.03 (Timber) to 0.10 (stocks).

So, there is the holy grail: an asset class that has a very low correlation coefficient to all other traditional and alternative asset classes.

Taking Liquidity into Account

But we do not make it that easy for ourselves. Most crypto-kiddies, who travel around the world and tweet about zero correlations, unfortunately, leave one thing out: an asset can only correlate if it has a certain amount of liquidity (trading volumes).

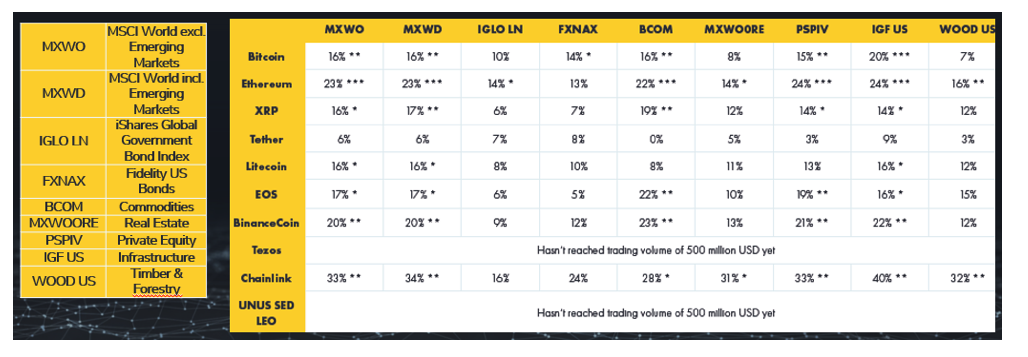

So, we do the exercise again, but this time only starting at a daily trading volume of >500 million USD.

The correlations are now still very low, but at least perceptible. Ethereum, for example, now achieves a (still relatively low) correlation of 0.24 with private equity and infrastructure funds.

For more details, see the original report here.

Even when looking at crypto critically, it is currently the only asset class that has a low correlation to all traditional as well as alternative assets, making it an excellent portfolio diversifier.

While pension funds and endowments have been investing in cryptoassets for a long time, listed companies are now also using it to hedge their own treasury management.

Demand is growing and interest seems to have a much stronger foundation now than during the hype phase in 2017. Not only is more money is being printed worldwide than ever before, but also because “safe” investments are virtually non-existent in this low-interest environment.

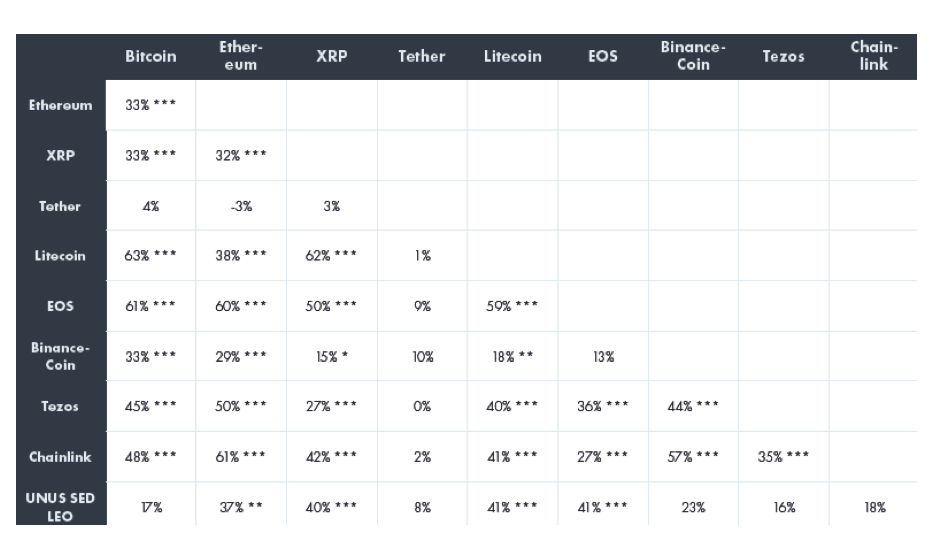

Correlations within Crypto Assets

Cryptoassets are an excellent “diversifier” and have their raison d’être in modern portfolio construction. They should be just as much a component of every portfolio as hedge funds and private equity or venture capital. But is it sufficient to allocate only Bitcoin or is it worthwhile to include a crypto index into the portfolio?

Compared to other asset classes, the correlations of 0.17 to 0.63 of Bitcoin to other cryptoassets are relatively high, but for the most part still low to moderate. It is particularly interesting that these correlations have decreased significantly in recent years.

Bitcoin, Ethereum and Binance Coin have completely distinct value drivers. You can witness this in their independent value developments as mass adoption increases. If these different value drivers continue to prove true, then individual cryptoassets should decouple even further in the future.

You can find more information about our fund here.

Key Takeaways

So, what can we take away from this analysis?

- A traditional portfolio should include not only stocks but also real estate, gold and bonds.

- Ideally, hedge funds and private equity exposure should also be in the portfolio to achieve the highest possible diversification.

- Taking trading volumes into account, crypto has at least a perceptible correlation to some other asset classes. However, crypto remains the only asset class with a very low correlation to all other portfolio components.

- Not only are pension funds and endowments now invested in crypto assets, but also publicly-listed companies.

- Crypto assets have different value drivers and seem to decouple from each other in the long term, which makes diversification within crypto essential.

Related Articles

- Crypto Assets In A Portfolio Theory Context

- The Impact of Crypto Currencies on the Sharpe Ratio of Traditional Investment Models

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices

- How to Determine the Value of Bitcoin

Legal Disclaimer

In no event will you hold Deutsche Digital Assets GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

Deutsche Digital Assets GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

Deutsche Digital Assets GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.