Breather for Cryptoasset Prices: On-Chain Metrics Reveal Some Profit-Taking by Long-Term Holders

DDA Crypto Market Pulse, April 25, 2023

by André Dragosch, Head of Research

Key Takeaways

- Cryptoasset prices have taken a breather as some investors appear to have taken profits after the strong rallye this year

- Our in-house Crypto Sentiment Index still remains neutral so far

- On-chain metrics suggest that there was some profit-taking by long-term holders as some older coins were on the move

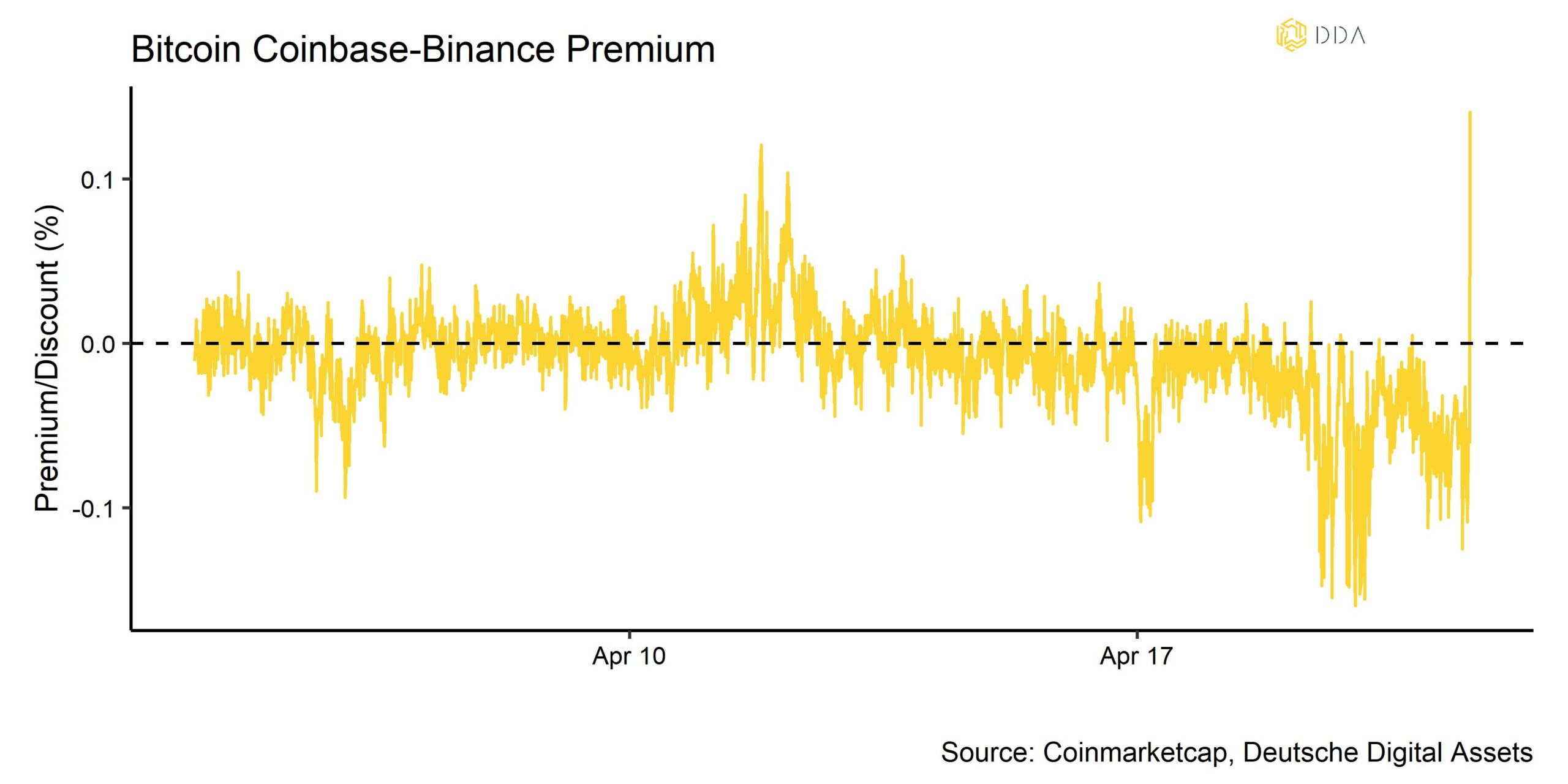

Chart of the week

Cryptoasset Performance

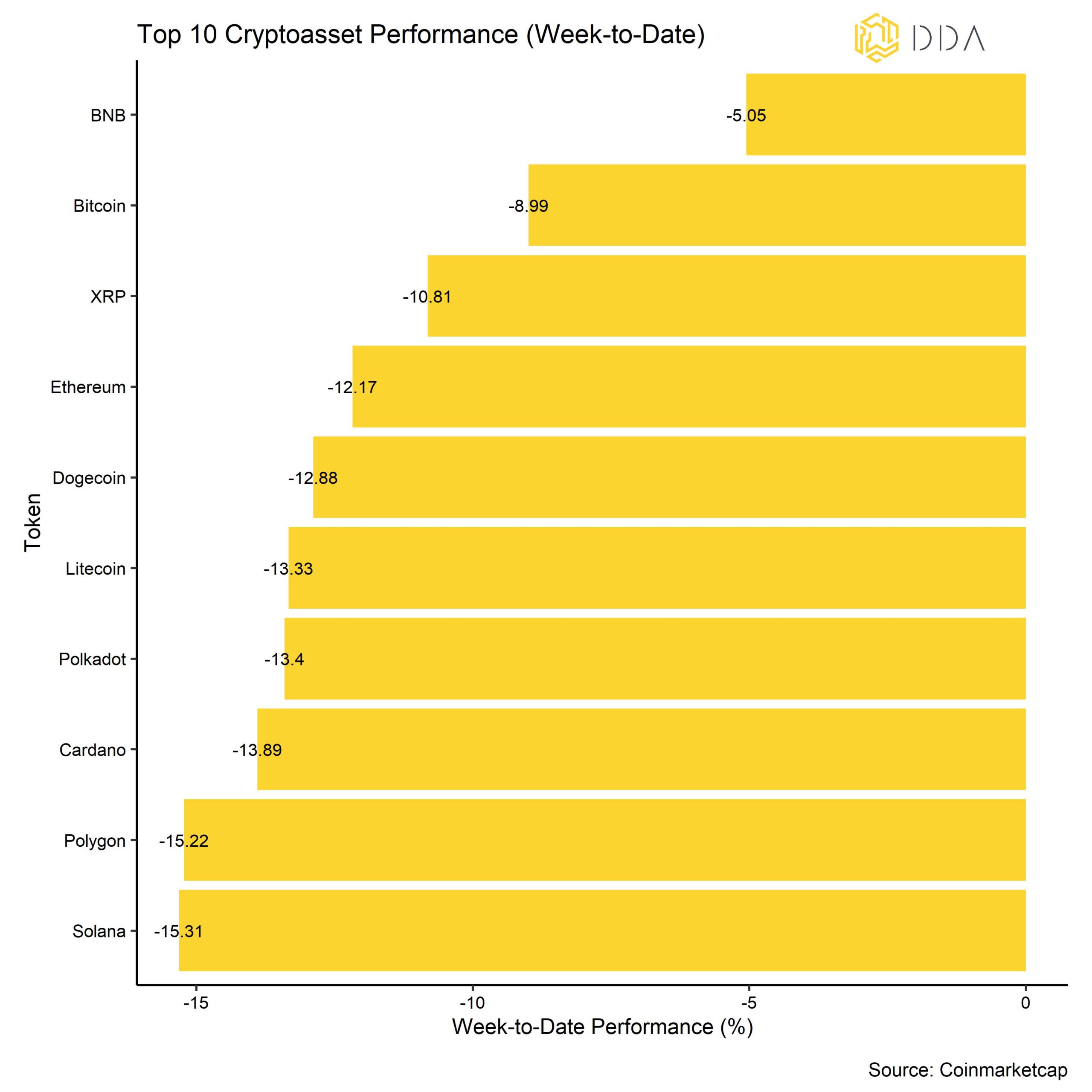

Last week’s cryptoasset performances were mostly weighed down by some profit-taking by long-term holders after major cryptoassets like Bitcoin had already advanced more than 80% this year. Hawkish Fed-speak that implied another rate hike in May also weighed on overall market risk sentiment.

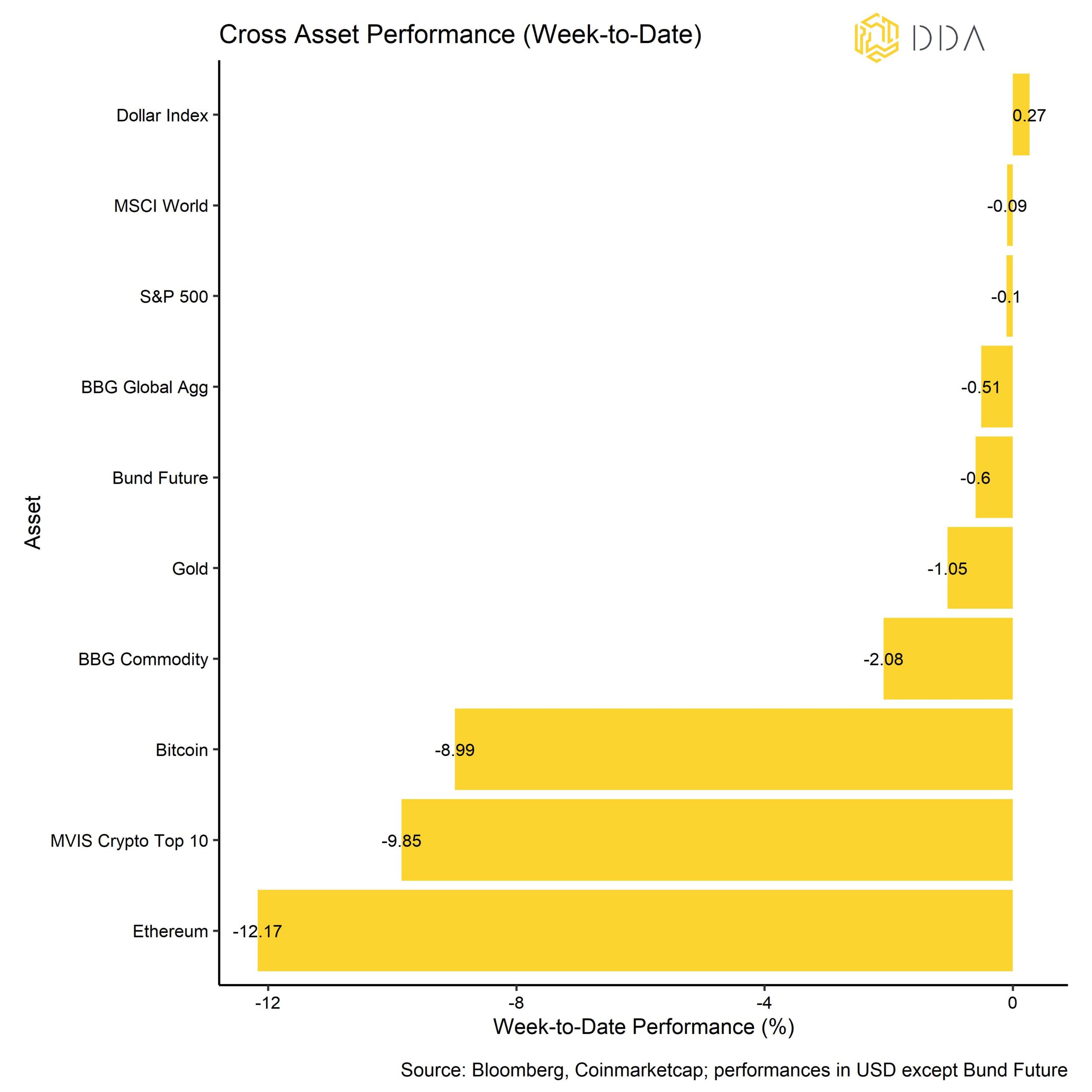

In comparison to traditional financial assets, cryptoassets were the main underperformers. Global equities and bonds also performed negatively while the US Dollar appreciated.

Among the major cryptoassets, BNB, Bitcoin, and XRP were the relative outperformers. Altcoin outperformance that was visible just after the Ethereum Shapella upgrade seems to have faded out again last week.

Crypto Market Sentiment

Consistent with this negative performance, our in-house Crypto Sentiment Index has reversed again but is currently still neutral. 7 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals in the Crypto Fear & Greed Index and the BTC 1-month 25-delta option skew.

The Crypto Fear & Greed Index has declined to “Neutral” territory last week.

Dispersion among cryptoassets has recently decreased a bit which means that cryptoassets are increasingly trading on systematic factors. At the same time, altcoin outperformance had started to pick up after the Ethereum Shapella upgrade but has reversed again and is still relatively low on a 1-week and 1-month basis. In general, altcoin outperformance goes hand in hand with an increase in crypto dispersion, i.e. Bitcoin and altcoins are generally trading up during “altseason” with altcoins outperforming Bitcoin.

Broader altcoin outperformance is usually a sign of increased risk appetite and low altcoin outperformance is indicative of a rather cautious market sentiment. However, very low levels of altcoin outperformance should rather be considered a countercyclical buying opportunity.

Crypto Asset Flows

Last week saw a very significant net fund outflows of cryptoassets.

In aggregate, we saw net fund outflows in the amount of -33.9 mn USD (week ending Friday) with the very large majority of outflows flowing out of Bitcoin funds (-55.4 mn USD). In contrast, Ethereum funds were able to attract significant inflows following the successful Shapella upgrade (+14.7 mn USD) while both Altcoin funds ex Ethereum as well as Basket & Thematic Cryptoasset funds also attracted some net inflows (+1.7 mn USD and +5.0 mn USD, respectively).

Last week’s net fund flows support the notion of a potential “Altseason” in the making, i.e. an environment where altcoins tend to outperform Bitcoin more sustainably.

Besides, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – has widened a bit which implies some minor net outflows out of this fund vehicle.

Probably one of the major changes compared to last week, was the fact that the beta of global Hedge Funds to Bitcoin over the last 20 trading days kept increasing into positive territory, implying that global hedge funds have further increased their net exposure to cryptoassets.Bitcoin prices traded on Coinbase vis-à-vis those traded on Binance (Coinbase-Binance premium) were significantly under pressure throughout the week, which is indicative of increased selling pressure from institutional investors vis-à-vis retail investors (see Chart-of-the-Week). However, the have recently increased significantly again which signals another reversal in institutional buying interest.

On-Chain Activity

The impression that larger institutional were net sellers last week is also supported by some on-chain metrics. On-activity for Bitcoin was rather cautious last week as long-term holders appeared to take some profits. For instance, this is evident in the increase long-term holder dormancy that spiked just ahead of the latest sell-off on the 19/4.

Dormancy is the average number of days destroyed per coin transacted and is defined as the ratio of coin days destroyed and total transfer volume.

Coin days destroyed is a technical concept in on-chain metrics that takes into account the respective age of the coins spent. Older coins have a higher number of days that are being “destroyed” when these coins are spent. Spending of older coins is usually interpreted as a bearish signal as it signals some loss in conviction in long-term investors/”strong hands”.

In general, there was also a gradual increase in Bitcoin exchange balances over the last week implying that there were more inflows than outflows which also contributed to the bearish price action.

However, Ethereum exchange balances continued to drift lower and reached a new multi-year low last week.

Core on-chain metrics such as the number of active addresses, total number of non-zero wallet addresses, transfer volume in USD or the mean block size for Bitcoin also retreated which contributed to the weak performance as well. However, total transfer volume in terms of the total number of transactions on the Bitcoin blockchain reached the highest reading since April 2019. Transfer volume still appears to be well supported by the underlying amount of inscriptions as the number of new daily inscriptions just reached the highest ever, yesterday. However, as most of these inscriptions were only text type, mean block size was not affected significantly.

Cryptoasset Derivatives

The recent decline in prices was somewhat exacerbated by an increase in Bitcoin futures long liquidations that spiked to the highest reading since mid-March 2023. Ethereum futures long liquidations also increased to the highest reading since 09/03/2023.

Liquidations happen when traders are wrong-footed by adverse price movements and are not able to meet margin requirements by the exchange anymore. This has usually an amplifying effect on market movements as the exchange needs to take the contrarian position of the trade (in this case sell) in order to close the position.

However, a significant number of futures liquidations is also a contrarian indicator as it signals that market cleansing has taken place as selling pressure abates. Therefore, it is quite likely that the market begins to stabilize at these price levels again.

Meanwhile, implied volatilities across Bitcoin and Ethereum have trended downwards despite the recent price correction and now stand at 50% and 53% for 1-month options, respectively. However, 25-delta option skews have largely increased in favour of put contracts and are now positive again signalling that investors have increasingly switched to put options to hedge against further downside risks. Put options give the holder the right to sell a specific amount of coins at a pre-determined price (strike) in the future.

Bottom Line

Cryptoasset prices have taken a breather as some investors appear to have taken profits after the strong rallye this year.

Our in-house Crypto Sentiment Index still remains neutral so far.

On-chain metrics suggest that there was some profit-taking by long-term holders as some older coins were on the move.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.