Bitcoin vs. gold has grown into one of the biggest debates in the financial assets space and has been raging for years. This article seeks to settle this debate by illustrating why you’re probably better off buying “digital gold.”

Why Do They Call Bitcoin “Digital Gold”?

Many leading experts consider Bitcoin a store of value because of its similarities to gold, which has emerged as one of the most popular store of value assets over time.

A good store of value asset is characterized by the fact that if bought today, its value doesn’t decline tomorrow. It will still be worth the same amount in the future or more.

Investors have used gold as a store of value for centuries, helping them protect their wealth during economic downturns. Bitcoin has also emerged as a store of value because investors are using it as a hedge against weak currencies and economic uncertainty. This has earned the cryptocurrency the title of “digital gold.”

For instance, at the end of 2020 and into 2021, Bitcoin’s price climbed due to excessive monetary expansion by the major central banks. That means that more people were turning to it to protect their wealth. The rise in demand resulted in a price increase.

Bitcoin vs. Gold: Similarities and Differences

Bitcoin and gold share other similarities besides both serving as store of value assets. These include:

Limited supply

Gold is one of the rarest metals in the world. It’s in limited supply and is not easy to mine. According to a report by BBC, miners are yet to excavate roughly 20 percent of the gold from gold reserves. Also, experts say that new large gold deposits are becoming increasingly rare to find.

Similarly, Satoshi Nakamoto designed Bitcoin with scarcity in mind, capping the supply at 21 million. So far, Bitcoin miners have mined 19 million Bitcoin (90%), and they could mine the last Bitcoin in 2140. The limited supply nature of both assets leads investors to demand them for their scarcity.

Durability

Solid gold is oxidation-resistant and corrosion-proof, making it a durable metal. That’s why treasure hunters can still find gold free of rust in old shipwrecks. And that’s why, for instance, wheat is not a good medium of exchange as it degrades over time.

By contrast, no one can destroy Bitcoin because of its decentralized nature. It will always exist as long as the network is there. That makes Bitcoin a durable asset as well. Durability is one of the characteristics that experts use to define, which assets are stores of value or broader “money.”

Speculative Investments

Both gold and Bitcoin are speculative investments because profits depend on the price fluctuations of the markets. Neither Bitcoin nor gold have an intrinsic value that can be calculated through discounting cash flows. The high volatility of Bitcoin makes it a speculative investment. Gold, on the other hand, isn’t as volatile as Bitcoin. Still, investors buy and hold it hoping that it will store value over the holding period.

Bitcoin and gold have several differences as well. Let’s take a look at them.

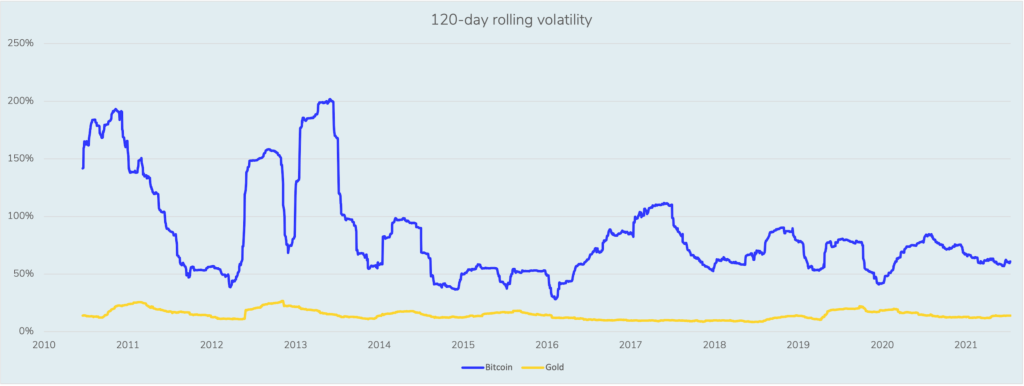

Volatility

Bitcoin experiences higher volatility than gold. Looking at the 120-day rolling volatility of both Bitcoin and gold, we can see that while Bitcoin’s price volatility has decreased in recent years, it is still substantially more volatile than gold.

More recently, gold recorded a (lower) high of $1,954.40 in 2021 compared to $2,058.40 in 2020. On the contrary, Bitcoin hit a high of $68,789.63 in 2021 compared to $29,244.88 in 2020, further highlighting the substantial differences in volatility between the two.

Regulation

Bitcoin is censorship-resistant because it’s impossible to modify its protocol without consensus from nearly its entire network. Therefore, governments can only regulate companies that facilitate the trading and use of Bitcoin, but they cannot regulate how Bitcoin works. Additionally, they can’t prevent people from owning and holding BTC.

In contrast, governments have more levers to pull when it comes to gold. They can regulate companies in the gold industry, gold ownership, storage, and transfer. Or they can try to enforce a repetition of executive order 6102 from 1933, “forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States”.

Utility

People use gold as a financial asset, in jewelry and medals production, and in the electronics, medicine, and aerospace industries.

By contrast, Bitcoin has fewer uses in the physical world. Bitcoiners use it as a financial asset and money. As a medium of exchange, though, Bitcoin isn’t widespread because its adoption is still low. But this could change with the widespread adoption of the Bitcoin Lightning Network, which enables instant, low-cost transactions.

Moreover, Bitcoin is programmable money, which means it can potentially be used in a more versatile way to process an array of payments. Gold cannot be used in such a manner.

History

Bitcoin has been around since 2009, while gold has existed for thousands of years. Hence, gold has a substantially longer history than Bitcoin.

Authenticity

The authenticity of Bitcoin lies with its code, which is publicly available for anyone to view. Moreover, the underlying blockchain technology ensures that no one can question whether one bit of Bitcoin is more authentic than the other. That’s because the blockchain is tamper-proof and it prevents double-spending. On the other hand, traders can dilute the purity of gold or fabricate other metals and present them as gold. This makes Bitcoin infinitely easier to verify.

Portability

Physical gold isn’t easy to move because it’s heavy. It needs proper storage and insurance during transportation. As a result, it is expensive to transport from place to place. In contrast, you can transfer Bitcoin from one wallet to another in seconds straight from your phone. Because Bitcoin is digital, it is highly portable.

Divisibility

You can divide both gold and Bitcoin into smaller amounts. However, it’s not as easy to divide up gold. Dividing it accurately is also a problem. Conversely, Bitcoin is divisible up to eight decimal places – one Bitcoin is 100,000,000 satoshis.

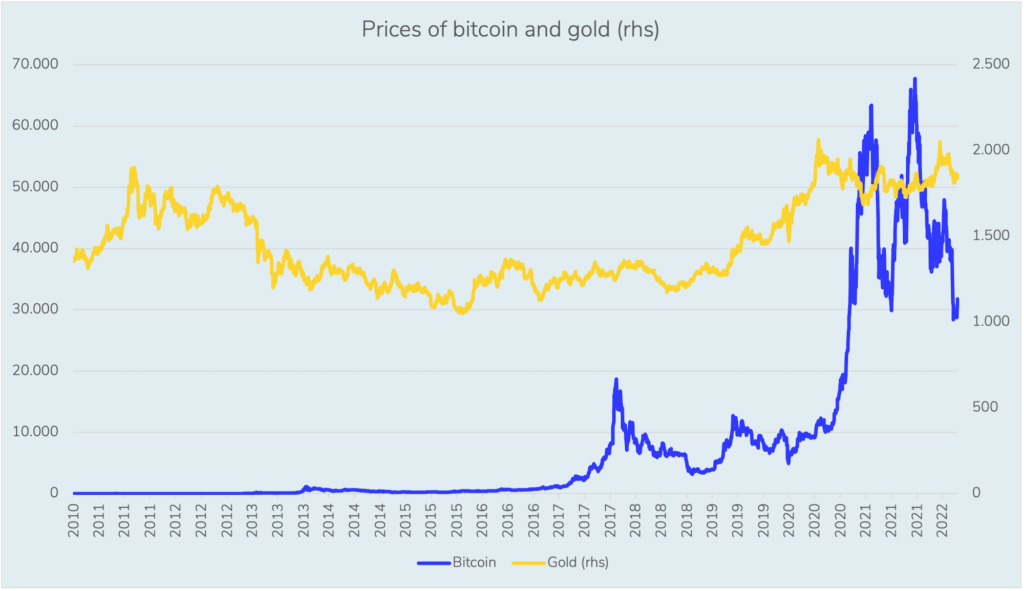

Bitcoin vs. Gold: Historical Price Performance

Compared to gold, Bitcoin has recorded a higher annual price change over the years. As a result, it has performed better as a speculative asset.

The tables below indicate the annual price changes of both assets from 2013 to date.

In contrast to gold, Bitcoin has experienced more growth since 2013. It has gone from $13 to over $40,000 in nine years, while gold has remained within $1,000 per ounce based on the year open prices.

You can also draw the same conclusion based on the fact that gold has recorded more negative returns years than Bitcoin.

Gold or Bitcoin: What’s the Better Investment?

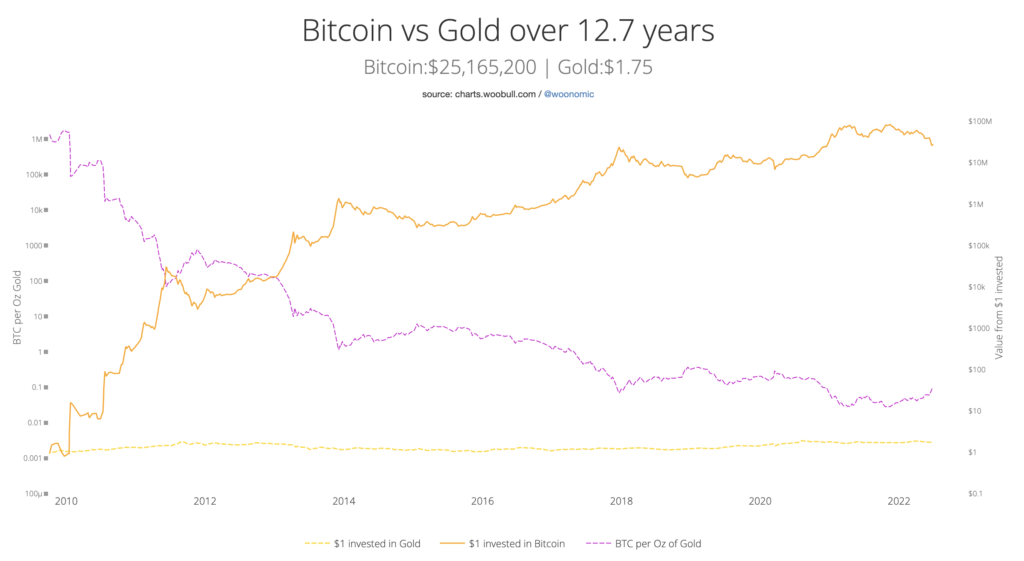

According to historical data, Bitcoin is a better investment than gold.

BTC has undergone tremendous growth over the last years compared to gold, enabling Bitcoin investors to enjoy higher returns than gold investors. These significantly higher returns came at significantly higher volatility though.

The Bitcoin vs. gold chart below compares $1 dollar investments in gold and Bitcoin over 12.5 years. The Bitcoin investment generated a significantly higher value.

While both assets share some similarities, Bitcoin can be considered superior to gold because of its characteristics that make it a better store of value. Bitcoin scores are better than gold in the areas of durability, divisibility, portability, scarcity, authenticity, and censorship resistance.

About Iconic Funds

Iconic Funds is the bridge to crypto asset investing through trusted investment vehicles. We provide investors both passive and alpha-seeking strategies to crypto, as well as venture capital opportunities.

We deliver excellence through familiar, regulated vehicles offering investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption.

Recent News

- How Green Mining Will Become the Norm for Bitcoin Network

- How accurate is the Bitcoin Stock-to_Flow Model?

- Bitcoin Education Will Pave the Way for Hyperbitcoinization

Iconic in Press

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin – das perfekte Beispiel für ein ESG-Investment?

- Institutional Money, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

How did portfolios perform during the pandemic? ➡ Download here

Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

“This article represents solely a non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129(Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG). It does not constitute an offer of securities for sale in the United States and the securities referred to in this notice may not be offered or sold in the United States absent registration or an exemption from registration.

Risk Considerations:

The price of an investment in an Iconic ETP may go up or down and the investor may not get back the amount invested. The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of deciding to invest in the securities. The prospectus is available at https://deutschedigitalassets.com/xbti-iconic-funds-physical-bitcoin-etp/.