Bitcoin Seasonality “Sell in May and go away?”

by André Dragosch, Head of Research

Key Takeaways

- Historical Bitcoin performance patterns suggest that performances might have been influenced by human routine despite the fact that it is being traded 24/7/365

- There is a case to be made for a “summer lull” in cryptoassets with Bitcoin historically exhibiting below-average returns in the months from June to September while April, May, October, and November have historically exhibited the highest average returns

- Working days from Monday to Wednesday and London and New York daily trading hours historically exhibit above-average BTC performances

An old Wall Street proverb claims to “sell in May and go away” implying that the months following April have usually exhibited below-average returns for equities. There is also an extensive body of academic literature that suggests that seasonality can play a large role for equity returns and some months such as January have historically exhibited significantly higher returns than other months (so-called “January effect”).

But what about cryptoassets?

Using all available price data for Bitcoin, we have analysed monthly, daily and even hourly performance patterns over time.

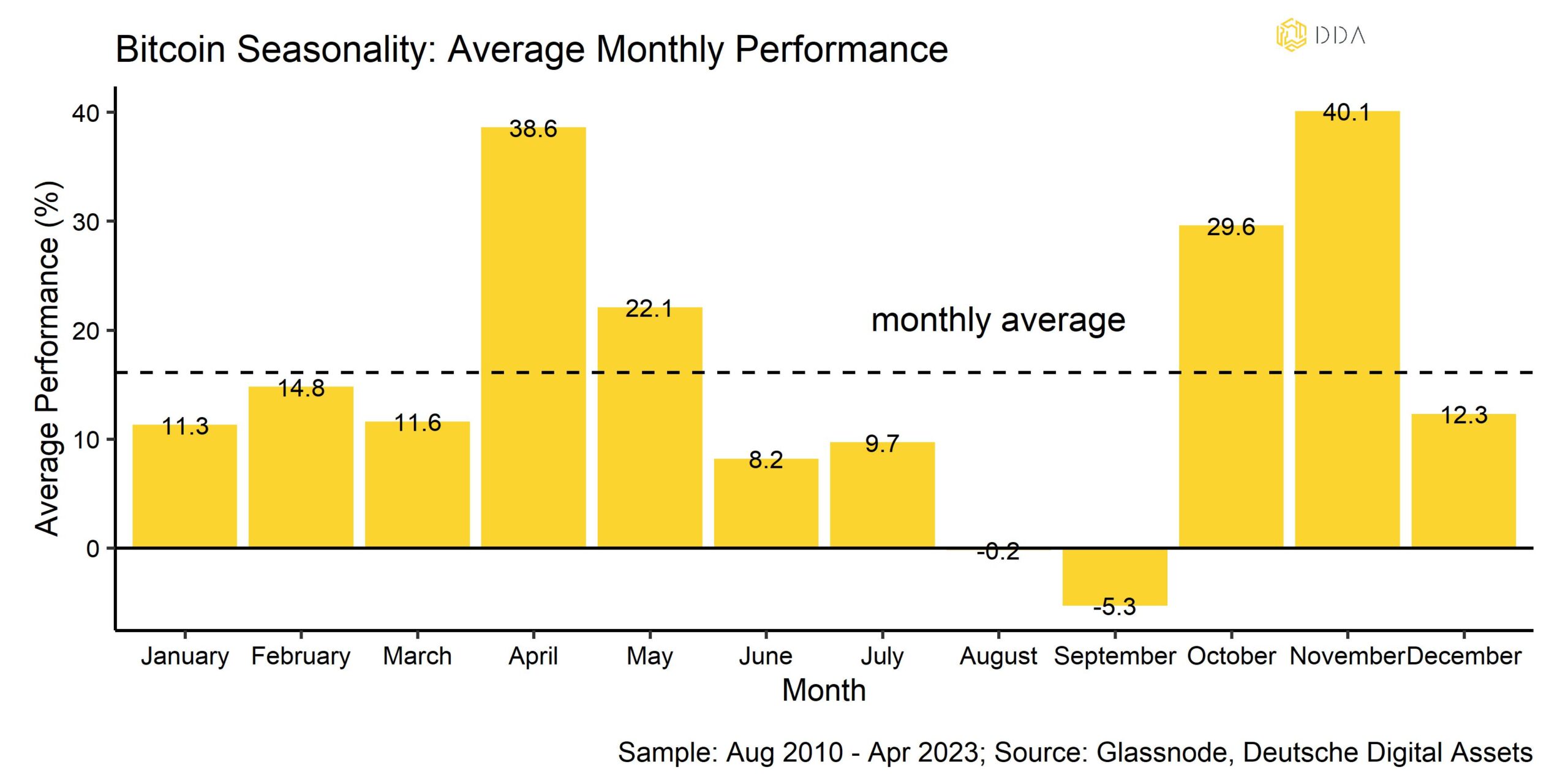

For instance, the chart above shows the average monthly performance by month from January to December since BTC/USD price data are available. The results suggest that the month of May has on average exhibited above-average returns of 22.1% since 2011. In general, April, May, October, and November have historically been the best months to hold Bitcoin.

In contrast, the months from June to September have historically shown the weakest Bitcoin performances. So, there is a case to be made for a “summer lull” in cryptoassets, in particular Bitcoin. Generally speaking, the results suggest that cryptoasset investors should at least hold on to their Bitcoin positions until June and “sell at the end of May”.

For instance, a simple trading rule could reduce BTC exposure before the start of the summer months from June to September but increase exposure during the months from October to May again.

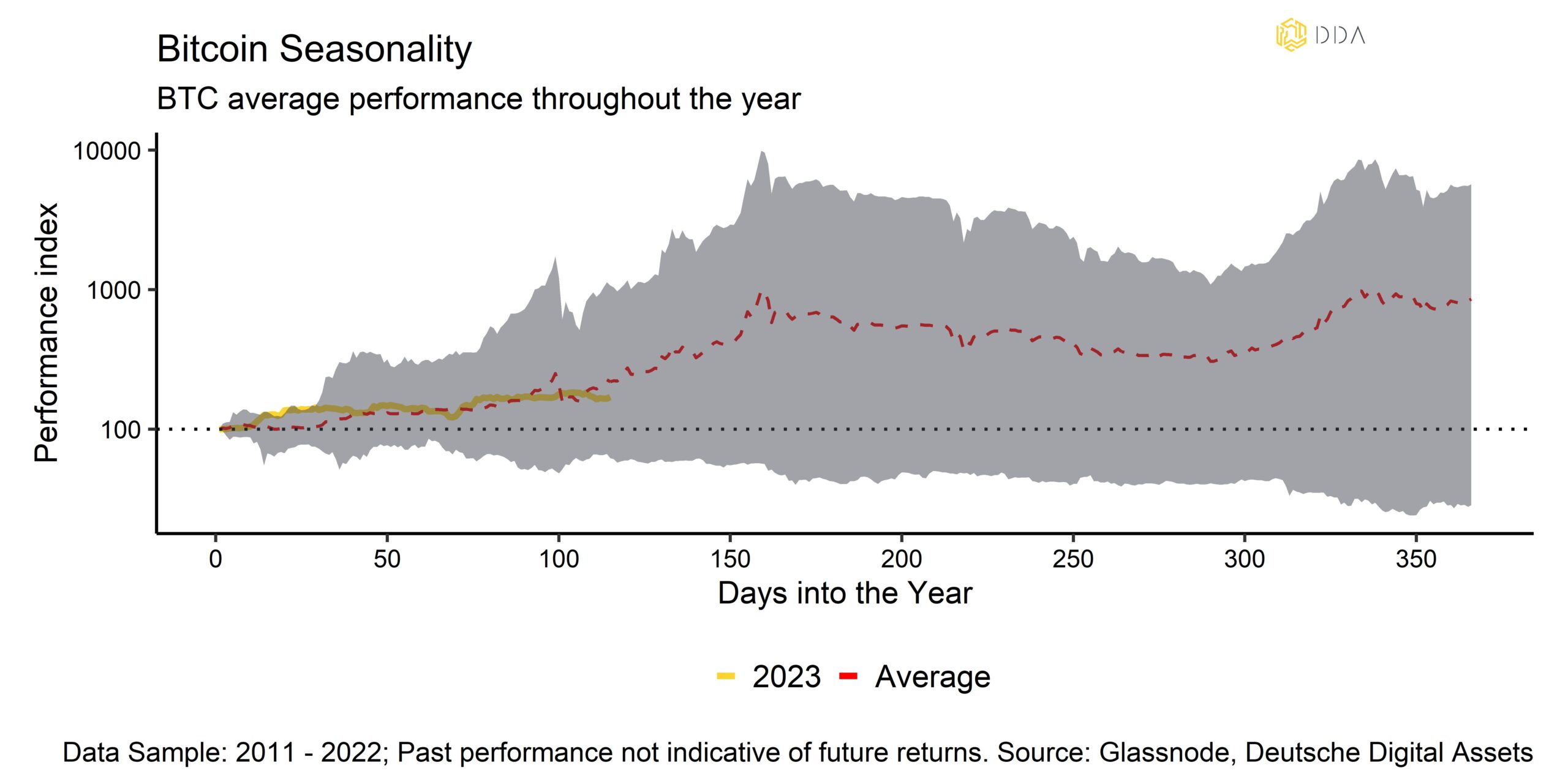

This is also highlighted in the following chart that shows Bitcoins average, and respective min and max performances over the year:

So far, the performance of Bitcoin has been tracking historical performance patterns rather closely and still suggests a bit more upside in the short term before beginning to move sideways.

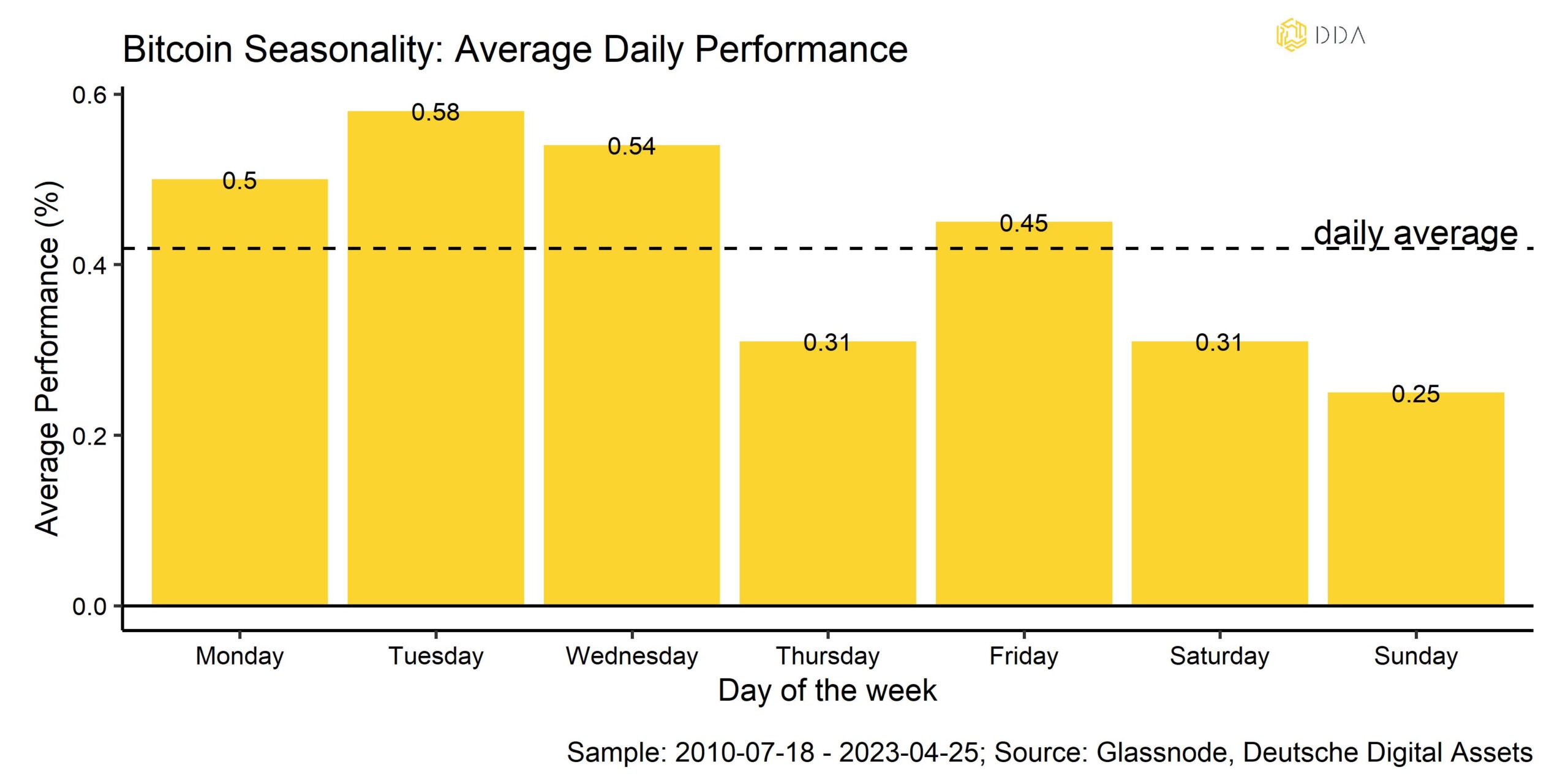

Looking at daily data, weekdays at the beginning of the week such as Monday to Wednesday have historically shown above-average returns for Bitcoin while Thursdays and weekends have exhibited below-average returns.

Thus, the daily performance patterns suggest that human routine (working Monday to Friday and taking weekends off work) might also influence Bitcoin returns.

For instance, a simple trading rule could exploit this performance pattern by increasing BTC exposure before the start of the week and reducing exposure thereafter especially before weekends.

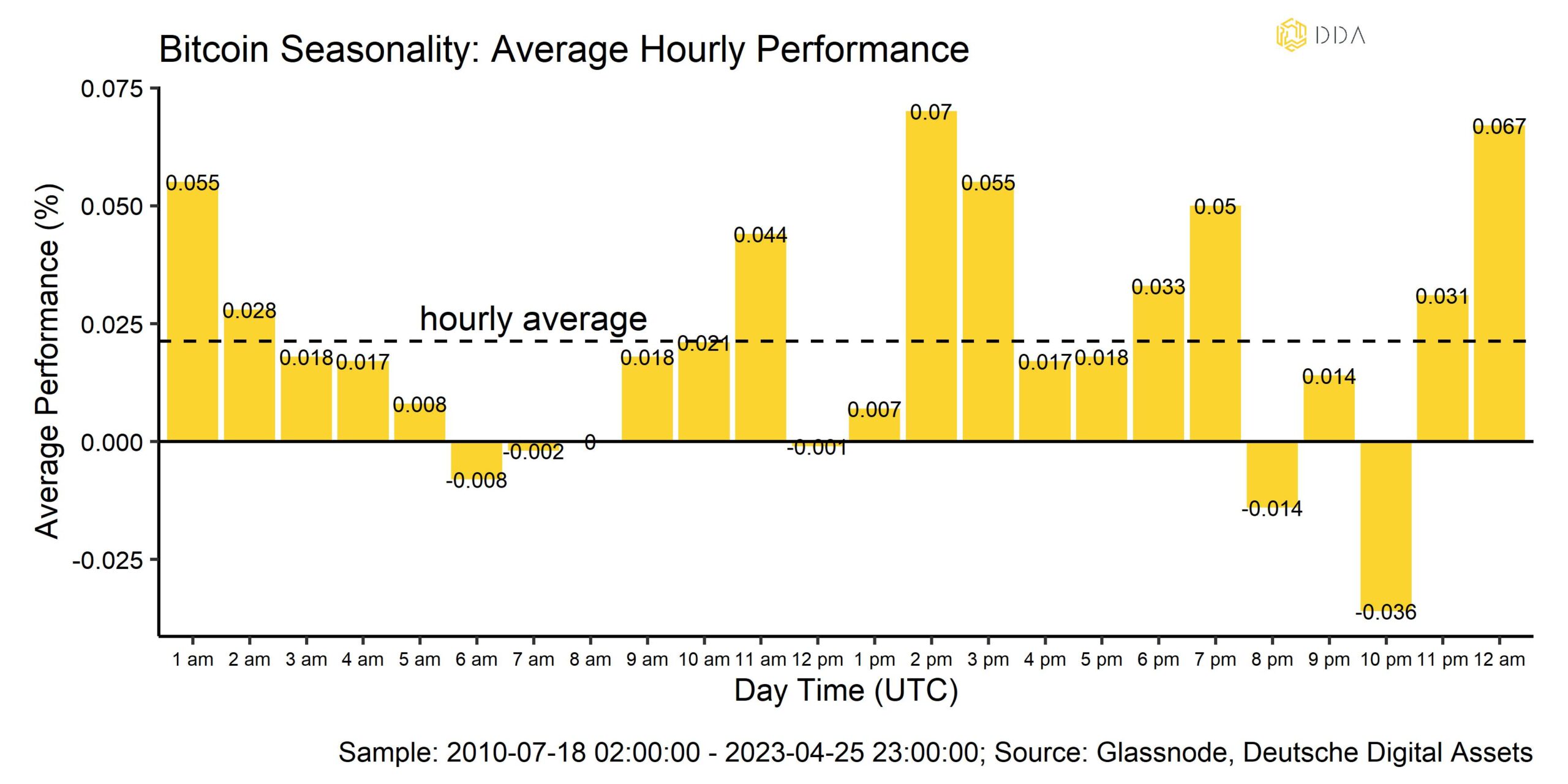

In this context, it is interesting to observe that London (7 am – 4 pm) and New York (1 pm – 10 pm) daily FX trading hours have historically exhibited above-average returns for Bitcoin as well while Tokyo trading hours (1 am – 9 am) have shown below-average returns.

For instance, a simple trading rule could increase BTC exposure before London & New York trading hours and reduce exposure during Tokyo trading hours (“overnight”).

All in all, the results suggest that Bitcoin performances might have been influenced by human routine despite the fact that Bitcoin is being traded 24/7/365.

In general, based on these results cryptoasset investors should indeed “sell [at the end of May] and go away”.

“But remember to come back in September” as the old saying goes.

As always, we hope that you will find these insights useful.

Stay humble and stack Sats,

André

Sign up for the DDA Newsletter here and receive our latest research reports, weekly market analysis and the latest insights on macro, industrial and crypto market trends from our top experts, delivered straight to your inbox.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.