The number of asset managers adding Bitcoin to their portfolios is on the rise. The growing institutional trading ecosystem makes it easier than ever to add digital currencies into institutional portfolios. However, there are still plenty of fund managers who remain skeptical about crypto as an investment asset.

Read on to learn about the role for Bitcoin in a diversified portfolio.

Source: unsplash.com

Why is Bitcoin Valuable?

Before we look at the numbers, let’s discuss why Bitcoin has value.

First and foremost, Bitcoin has a limited maximum coin supply of 21 million BTC. Unlike fiat currency, of which more can be printed, or gold, of which more can be mined, there can only ever be 21 million units of Bitcoin.

What’s more, out of the roughly 18 million Bitcoin that have already been mined, an estimated 3 to 4 million BTC are “lost coins,” i.e., inaccessible that will not reenter the circulating coin supply, reducing the circulating coin supply.

In addition to a fixed total coin supply, the Bitcoin network’s monetary policy slows down the speed at which new coins are introduced into the circulating supply through an increasing mining difficulty and a reduction in block reward for miners every four years (known as the Bitcoin Halving).

The growing demand for Bitcoin as a hedge against inflation, as a diversification asset, as a digital payment method, and as a remittance rail is met with the digital currency’s limited supply, which creates upward pressure on the price.

It’s unlikely that the demand for crypto currencies will slow down anytime soon, given the digital asset’s adoption rate among institutions and retail buyers, which suggests that the “digital gold” could still have a long way to go before it hits its peak.

A handful of corporate treasuries also share this view. MicroStrategy, under the leadership of Michael Saylor, has been very consistent with its Bitcoin purchases since mid-last year, which has rubbed off on other publicly-listed companies, including Tesla. After Saylor advised Elon Musk via a tweet to do his shareholders “a $100 billion favor” and convert Tesla’s balance sheet to BTC, roughly two months later, the electric car company announced a $1.5 billion purchase.

Jack Dorsey’s Square also added Bitcoin to its balance sheet, highlighting the demand for Bitcoin in a time when inflation is making it challenging for corporate treasuries to generate a positive yield on working capital and cash reserves.

In addition to Bitcoin’s limited supply, disinflationary and programmatic monetary policy, and growing perception as a hedge against inflation, the digital currency is – after over a decade – starting to be used as an actual currency. In order to be regarded as “money”, a currency has to fulfil three properties: store of value, unit of account and means of payment.

In El Salvador, Bitcoin was declared legal tender in September 2021, allowing El Salvadorans to pay with Bitcoin at a wide range of merchants and retailers, as well as send and receive low-cost remittances via the Bitcoin Lightning Network. While bitcoin was perceived as a store of value before, El Salvador’s law made it – all of a sudden – a unit of account and means of payment in the country.

While the Central American nation remains a standalone case for now, numerous other nation states have voiced their interest in adopting Bitcoin as a legal currency, which could lead to increased usage of Bitcoin as a medium exchange, adding upward pressure to the price of the digital currency.

Finally, Bitcoin shares many characteristics with gold, such as scarcity, divisibility, portability, durability, and utility, but can be transported in minutes at minimal cost. As a result, the “digital gold” Bitcoin is starting to outshine the precious metal, especially among younger investors.

If Bitcoin manages to replace gold as a safe haven asset and inflation hedge to reach the same total market value as the yellow metal, the value of the cryptocurrency would likely trade at a multiple of its current market price.

The Role of Bitcoin in a Diversified Portfolio

Now that we’ve discussed Bitcoin’s value proposition, let’s dive into some numbers to cement the exposure for Bitcoin as a “should-have” asset in a diversified portfolio.

According to a research paper by Morgan Stanley titled “The Case for Cryptocurrency,” Bitcoin can have a positive impact on a diversified portfolio when added in small amounts.

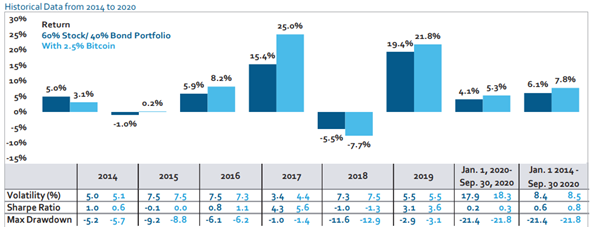

The researchers found that when 2.5% of a 60% stock and 40% bond portfolio was allocated to Bitcoin over a period of five years (2014-2018) with monthly rebalancing, annualized returns improved “without significantly increasing volatility of maximum drawdowns.”

Regular rebalancing (quarterly or monthly) of Bitcoin back to the initial weight in a portfolio can minimize volatility and boost returns.

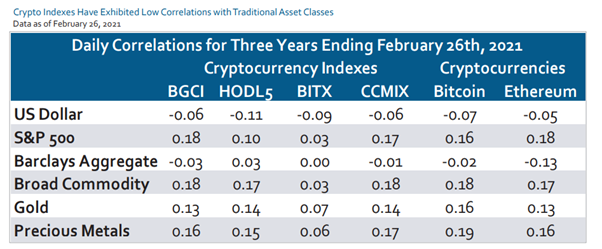

Crypto currencies have – over the long run – a low correlation with traditional asset classes. For instance, Bitcoin is essentially uncorrelated with the bond market, while showing only a small positive correlation with risk-on assets such as stocks and commodities.

Here’s how two crypto currencies relates to traditional asset classes, as reported in Morgan Stanley’s research paper:

How to Add Bitcoin to Your Portfolio

Institutional investors whose mandate allows them to purchase crypto currencies directly and hold it with a qualified custodian can choose to buy it “physical”. Most investors, however, will likely prefer (or are obliged to by their mandate) to gain exposure through the purchase of exchange-traded crypto investment products, such as Bitcoin Futures ETFs, Bitcoin ETPs, or Bitcoin futures.

European investors that want indirect exposure to price of the cryptocurrency could buy the Iconic Funds Physical Bitcoin ETP. The exchange-traded product (ETP) tracks the price of Bitcoin as represented by the NYSE Bitcoin Index, giving investors exposure to the price development of the digital currency without having to self-custody the cryptocurrency. The ETP is 100 percent physically backed that is safely kept in cold storage at a BaFin-regulated custodian. Additional safety is provided via third-party insurance.

Iconic’s Physical Bitcoin ETP (XBTI) is listed and traded on Deutsche Börse Xetra, SIX Swiss Exchange (in USD and CHF), Euronext Paris, and Amsterdam. The investment product only incurs an annual management fee of 0.95 percent.

To learn more about Iconic’s Physical Bitcoin ETP, click here.

About Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Iconic Funds’ mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

- Cryptocurrencies and the Sharpe Ratio of Traditional Investment Models ➡ Download here

- Analyzing the Primary Value Drivers of Leading Cryptocurrencies ➡ Download here

- How Effective are Common Investment Strategies with Bitcoin? ➡ Download here

- Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices ➡ Download here

For further information, please visit deutschedastg

Legal Disclaimer

This article represents solely a non-binding preliminary information which serves exclusively advertising purposes and is not a prospectus in the sense of the European Securities Prospectus Act, the German Investment Act or the German Investment Code or a corresponding foreign law. The prospectus for the physically backed Bitcoin ETP is available at https://deutschedigitalassets.com/xbti-iconic-funds-physical-bitcoin-etp/. Please refer to the Prospectus before making any final investment decisions.

In no event will you hold ICONIC HOLDING GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

ICONIC HOLDING GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond ICONIC HOLDING GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

ICONIC HOLDING GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.