Bearish Sentiment in Crypto Assets still Lingers Casting a Shadow Over the ETF Euphoria

DDA Crypto Market Pulse, September 11, 2023

by André Dragosch, Head of Research

Key Takeaways

- Last week, crypto assets posted another weak performance amid the anticipated liquidation of FTX’s remaining crypto asset holdings

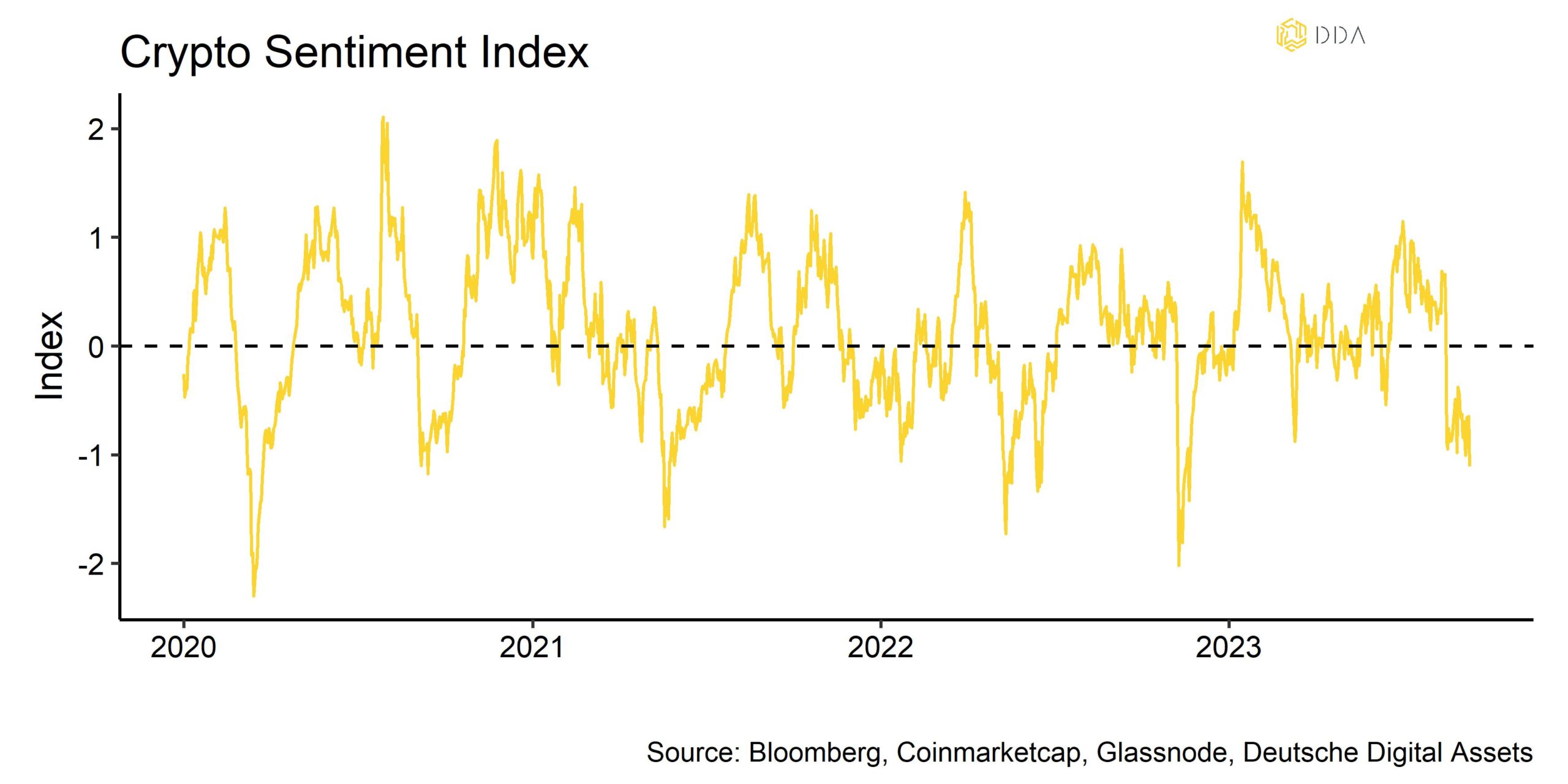

- Our in-house Crypto Sentiment Index remains in bearish territory

- Overall bearish market sentiment still casts a shadow over the ETF-related euphoria

Chart of the week

Cryptoasset Performance

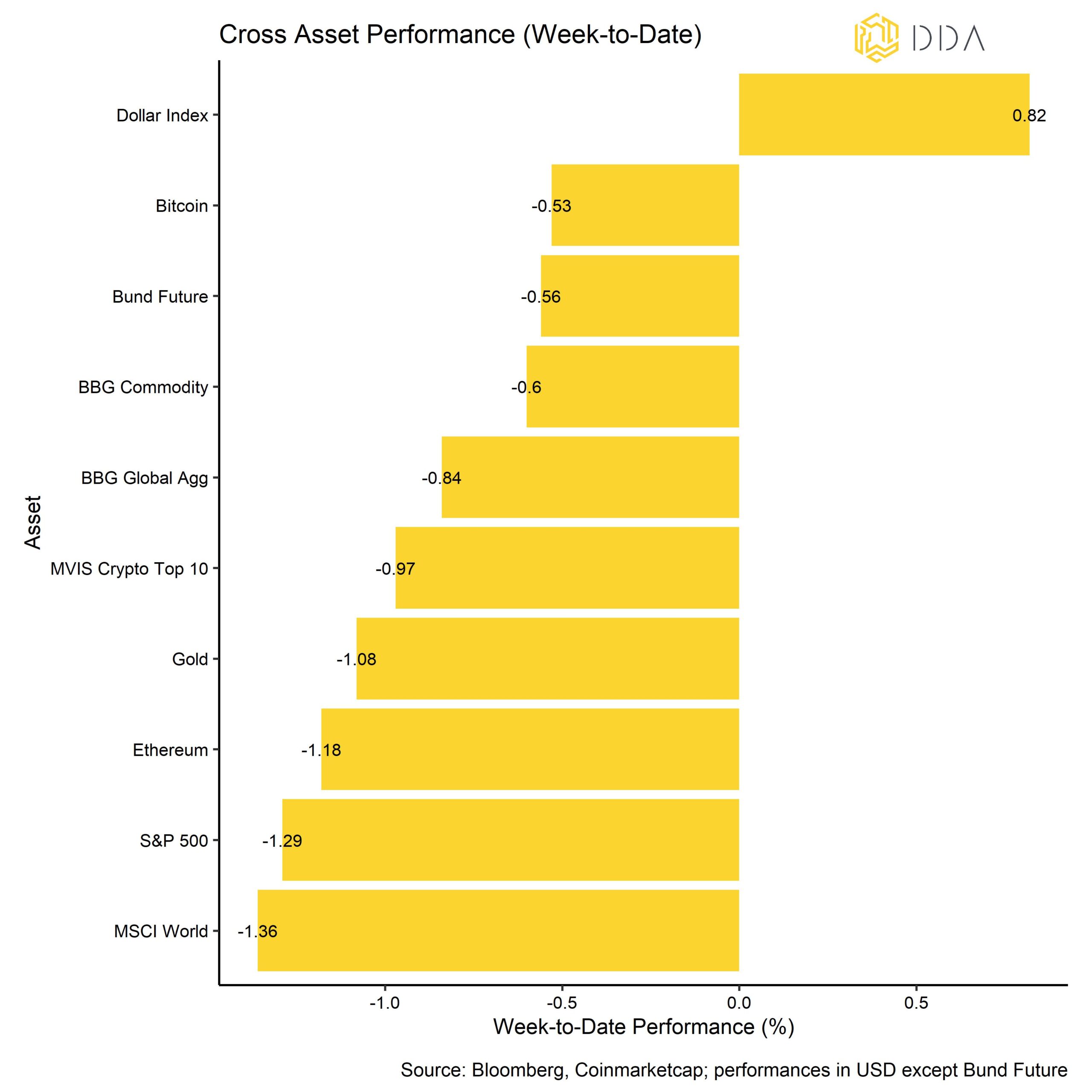

Last week, crypto assets posted another weak performance amid the anticipated liquidation of FTX’s crypto asset holdings. More specifically, the bankrupt exchange FTX might get court approval by the 13th of September to start liquidating its remaining crypto asset holdings.

The court documents reveal a desire to liquidate up to 100 mn USD worth of crypto assets per week. Per April 2023, FTX possessed approximately 3.4 bn USD worth of crypto assets most of which consisted of Solana (SOL), FTX Token (FTT) and Bitcoin (BTC). There is also a larger uncertainty surrounding FTX’s crypto asset holdings on other 3rd party exchanges.

The rising uncertainty has recently triggered a flurry among SOL investors that manifested in a significant price drop in the token.

All these developments still cast a shadow over the ETF-related euphoria that appears to have faded. Grayscale has recently filed for the conversion of its Ethereum Trust (ETHE) into an ETF in the US that has led to a significant narrowing of the trust’s NAV discount. Meanwhile, Grayscale has also increased pressure on the SEC to review its US Bitcoin ETF application following its recent court victory against the SEC. Nonetheless, overall crypto asset sentiment remains bearish and has even become gloomier compared to last week (Chart-of-the-Week).

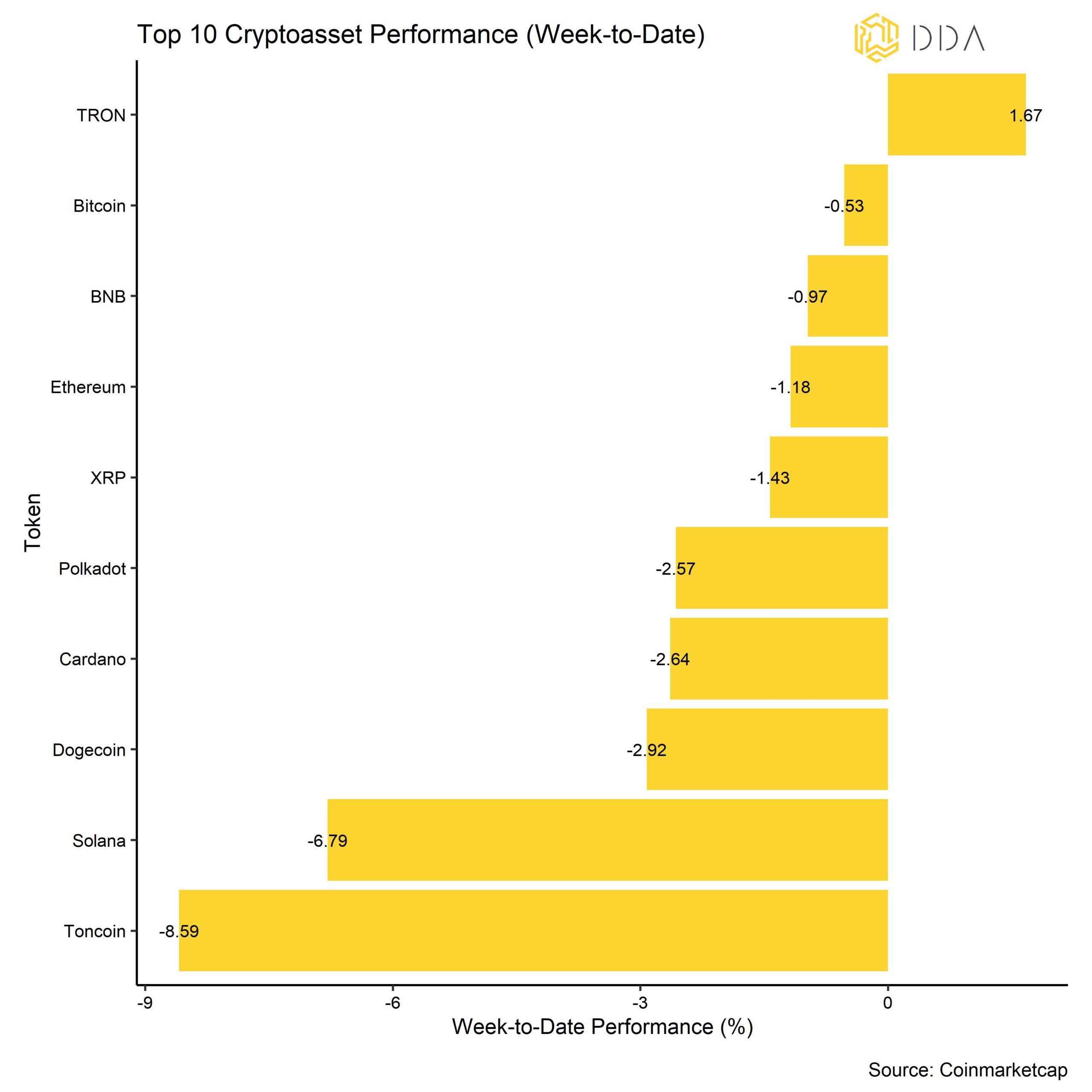

Among the top 10 crypto assets, TRON, Bitcoin, and BNB token were the relative outperformers.

In general, altcoin outperformance vis-à-vis Bitcoin reversed sharply last week from 70% outperformance at the beginning of last week to only 35% outperforming Bitcoin on a weekly basis.

Crypto Market Sentiment

Our in-house Crypto Sentiment Index decreased once again compared to last week and firmly remains in bearish territory. Only 3 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals to the downside in the BTC Put-Call Volume Ratio and the 3-months BTC futures basis.

The Crypto Fear & Greed Index remains in “Fear” territory as of this morning.

Performance dispersion among cryptoassets has increased slightly compared to last week.

In general, higher performance dispersion among cryptoassets implies that correlations among cryptoassets has decreased which means that cryptoassets are trading more on coin-specific factors.

At the same time, as mentioned above, altcoin outperformance has reversed last week and is now at 35% of altcoins outperforming Bitcoin on a weekly basis.

In general, altcoin outperformance goes hand in hand with an increase in crypto dispersion, i.e. Bitcoin and altcoins are generally trading up during “altseason” with altcoins outperforming Bitcoin. Broader altcoin outperformance is usually a sign of increasing risk appetite and broader altcoin underperformance a sign of increasing risk aversion.

Crypto Asset Flows

Last week saw significant net outflows from global crypto ETPs.

In aggregate, we saw net fund outflows in the amount of -87.0 mn USD (week ending Friday).

All fund categories exhibited significant net outflows with the exception of altcoin-based funds that showed only minor net outflows (-0.1 mn USD).

The bulk of the net outflows occurred within Bitcoin and Ethereum funds (-72.5 mn USD and -12.8 mn USD, respectively).

Thematic & basket crypto funds also experienced net outflows of -1.6 mn USD last week.

Nonetheless, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – has continued to narrow last week. The narrowing NAV discount appears to be related to the expectation that this Trust is more likely to be converted into a Spot Bitcoin ETF.

Furthermore, the beta of global crypto hedge funds to Bitcoin over the last 20 trading has increased significantly, implying that global crypto hedge funds have recently increased their market exposure to crypto assets.

On-Chain Activity

Overall on-chain activity has improved significantly over the last week.

For instance, active addresses on the Bitcoin blockchain have increased to the highest levels seen year-to-date. Moreover, new addresses on the Bitcoin blockchain have increased sharply to new all-time highs.

Besides, the Bitcoin hash rate is also still hovering near all-time highs. The number of addresses with non-zero balances has also continued to move higher.

Meanwhile, on-chain BTC transfer volumes are still remain relatively low which currently aggravates market moves and volatility. BTC exchange balances have moved sideways over the last week with no significant inflows from whales.

However, the risk remains to the downside as overall macro liquidity is still tightening which can also be seen in the declining aggregate market capitalization of stablecoins.

On average, long-term holder cost basis is currently around 25.8k USD for Bitcoin. Any break below that level could increase overall selling pressure on the market. Coins transacted currently have a loss bias, i.e. on-chain realized losses are currently larger than on-chain realized profits.

Interestingly, overall accumulation activity across all wallet cohorts has recently picked up again going into the most recent market correction which is an encouraging signal. In that context, BTC supply scarcity continues to intensify with the relative supply that has been inactive more than 2-years hitting a new all-time high of 56.6%.

Cryptoasset Derivatives

Last week, derivatives metrics mostly went sideways with not much activity.

For instance, open interest for both BTC perpetuals and futures went sideways. The same is true for ETH contracts. Besides, BTC perpetual and futures trading volumes continued to be comparatively low. BTC perpetual funding rates remained positive while the BTC 3-months futures basis rate continued to decrease last week. The BTC 3-months basis rate is currently at 3.6% p.a.

BTC options open interest increased only slightly last week as trading volumes remained comparatively low as well. The 25-delta skews across different expiries still imply a bias towards BTC put options, so there is still comparatively more demand for put than for call options at the moment.

Put-Call Volume Ratios for BTC are still elevated which is also emblematic for the current bearish sentiment in the market.

Short-term implied volatilities have mostly moved sideways last week while implied volatilities for expiries older than 1-month continued to grind higher.

Bottom Line

Last week, crypto assets posted another weak performance amid the anticipated liquidation of FTX’s remaining crypto asset holdings.

Our in-house Crypto Sentiment Index remains in bearish territory.

Overall bearish market sentiment still casts a shadow over the ETF-related euphoria.

About Deutsche Digital Assets

Deutsche Digital Assets is the trusted one-stop-shop for investors seeking exposure to crypto assets. We offer a menu of crypto investment products and solutions, ranging from passive to actively managed exposure, as well as financial product white-labeling services for asset managers.

We deliver excellence through familiar, trusted investment vehicles, providing investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption. DDA removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.