Is cryptocurrency at risk of being co-opted by the very institutions it was created to displace?

CryptoScout by Eleanor Haas, Partner of Iconic Holding, Chief Concept Navigator at The Calyx Group, Advisor to Astia Angels, and Director, Keiretsu Forum Mid-Atlantic

Bitcoin, the first cryptocurrency, was launched in 2009 as a rebel with a cause — bypass government currency controls and eliminate bank intermediaries from online transactions. Ten years later the very institutions cryptocurrency sought to bypass or eliminate are thinking about emulating selected Bitcoin capabilities for their own advantage. Is the disruptor about to be disrupted?

Digital Currencies on the Horizon

Bitcoin was founded to solve hyperinflation and the delays and costs of third party intermediaries in financial transactions by replacing fiat, or government-issued currency, with privately issued digital currencies. Ah, but there’s the catch. Anyone can create a digital currency. Anyone — even a central or commercial bank — and they seem to be planning to do just that. establishment-controlled digital currencies?

National Governments are Testing Their Own Digital Currencies

Digital currency is programmable code with no physical form. Like physical money, it can be used to buy and sell goods and services. It adds value by saving time and money; it makes transactions instantaneous — even smooths out cross border challenges of FX control and compliance from one jurisdiction to the other — and eliminates the cost of third party intermediaries.

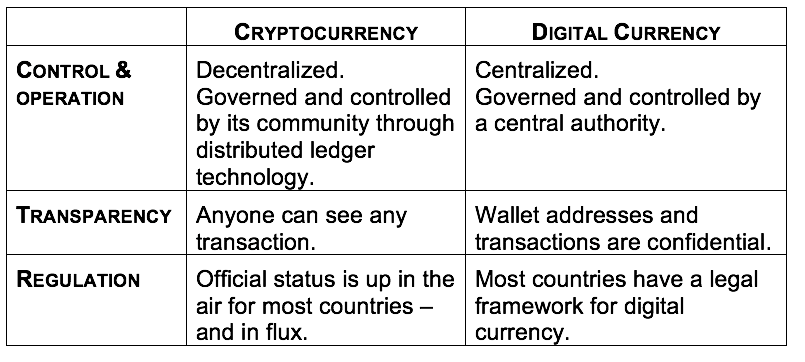

Cryptocurrency is a form of digital currency. (Another form is virtual currency, such as frequent flyer miles, coupons or reward points.) But they’re different:

Traditional money can be digital, and nations and their central banks are looking closely into the possibilities of central bank digital currency (CBDC). They have two reasons for this: the first, that greater efficiencies and cost-effectiveness can stoke economic growth. The second, the fear of seeing private control replace government control, a threat that last year’s Libra proposal makes all too tangible despite the near-universal backlash against Libra. Concerns of two kinds were expressed: (1) that any private currency would undermine national sovereignty and economic stability and (2) that Facebook, given its scandal-ridden track record, was hardly a trustworthy leader for such a responsibility.

Findings of a study IBM commissioned on the issue at the end of October confirm the reality of coming CBDCs: “Policy-makers at a number of central banks around the world are seriously considering developing and issuing a central bank digital currency (CBDC), with a consumer-ready CBDC likely to arrive in the next five years.”

The US has been locked in a regulatory quandary. US Deputy Secretary of the Treasury Justin Mnuchin argued at an annual banking conference in November that:

“Digital currencies at scale raise not only concrete questions about money laundering, monetary policy, and other topics, but also very abstract questions about self-government. Those engaged in digital currency markets should therefore expect that policymakers, in pursuing the public interest, will take a very hard look at these issues.”

Then came the coronavirus and the need for unprecedented government measures to cope with the economy. A digital dollar was mentioned by Congressional Democrats during negotiations for the third emergency bill, though scrapped from the final measure. Will it turn up in the next stimulus bill? That’s anyone’s guess. So far, however, any digital dollar would probably use traditional bank technology, not blockchain’s decentralized distributed ledger.

China, on the other hand, has taken the lead with the first real-world pilot of a digital yuan, designed to complement the paper yuan and to challenge the US dollar. Four major banks and major economic participants like China Telecom were scheduled to start a two-year test of digital currency payments by the end of 2019 under the auspices of its central bank, the People’s Bank of China (PBoC).

A few recent Cointelegraph headlines tell more of the story:

- Russia’s Central Bank Is Now Testing Real Asset-Pegged Stablecoins

- Sweden’s Central Bank to Partner with Accenture to Launch E-Krona.

- France to Test Its Central Bank Digital Currency in Q1 2020: Official

- Ghana Exploring Digitized National Currency, Says Central Bank Exec

Commercial Banks are Also Testing Their Own Currencies

JPMorgan Chase, the largest US bank, released a canary into the cryptocosm last February called the JPM Coin — a canary to test viability. It’s a digital coin, specifically a stable coin, backed by US dollars already held in JPMorgan Chase accounts. The purpose is to reduce cost, capital reserves and risk for institutional clients making payments to other clients.

When one client sends money to another using blockchain, the settlement time is eliminated because their JPM Coins are transferred and redeemed for the equivalent US dollars instantaneously.

Released as a prototype, JPM Coin survived to move on to the next stage in June, trialing the technology with customers. It’s a slow process. “The technology is very good, but it takes time in terms of licensing and approval. It must be explained,” said Umar Farooq, the investment bank’s head of digital treasury services and blockchain.

Another US bank, Signature Bank — less than 2% the size of JPMorgan Chase — already has a blockchain-based payment system in use by about 100 business customers. It was approved by NY State regulators and launched at the end of 2018. Customers reportedly use the system to send each other cryptocurrency payments in the millions of dollars a day. Signature also provides banking services to some cryptocurrency start-ups and other FinTech companies in Bermuda.

Key to both of these systems is the use of the stablecoin, a new class of cryptocurrencies that grew dramatically in variations and use during 2019. Its value is pegged to fiat currency or other assets in order to avoid the volatility inherent in other cryptocurrencies whose price is entirely market driven.

Are Establishment Currencies a Threat to Cryptocurrencies?

Will the disruptor be disrupted by the establishment? No way! Establishment currencies are merely media of exchange; cryptocurrencies are multipurpose. They were born not just as media of exchange but to power innovation — to be the fuel that blockchains rely on to incentivize the work of validating transactions. They have of course also become significant, if volatile, stores of value

To innovate is to compete with all that already is. And cryptocurrency has competed successfully for ten years. Prices may be volatile but the rebel fights on and multiplies. Bitcoin’s price at this writing is $9,732 (www.coinmarketcap.com). From a single cryptocurrency in 2009, 10 years later, we have 5,140 cryptocurrencies today. Cryptocurrency must be doing something right!

What’s happening as central and commercial banks explore digital currencies appears to be a step forward, not a step back — a first step towards adoption by establishment institutions of the “cryptochain” ecosystem — a first step towards adoption of the new technology and, more important, the new mindset. It’s a mindset willing to entertain the concept of what George Gilder describes as a new system of the world, “the set of ideas that unify a society’s technology, institutions and culture, and investors and entrepreneurs always have to have . . . of the world in which they operate.”

Gilder calls this new system of the world the cryptocosm, meaning an economy built on a network of organizations, systems, companies and individuals powered by blockchain technologies, where security and decentralization are primary features. Establishment currencies promise to be pathways to this brave new world!

# # #

This article is strictly for educational purposes and isn’t to be construed as financial advice.

CryptoScout by Eleanor Haas, Partner of Iconic Holding, Chief Concept Navigator at The Calyx Group, Advisor to Astia Angels, and Director, Keiretsu Forum Mid-Atlantic