5 key reasons to consider the DDA Bitcoin Macro ETP (BMAC) for bitcoin exposure

- Quantitative Access to Bitcoin: BMAC goes beyond static Bitcoin exposure. Through a quantitative model developed by DDA, the product shifts dynamically between BTC and USDC.

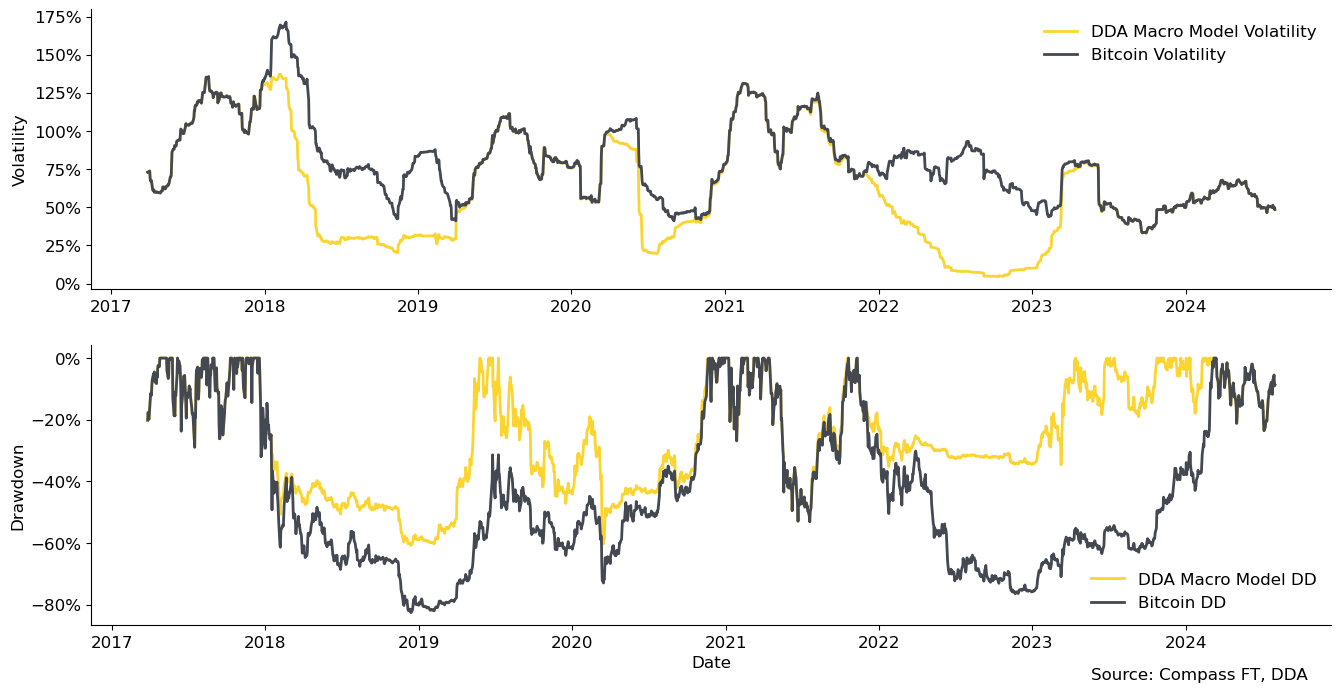

- 25%* reduced drawdowns: The product actively adjusts the exposure based on key macroeconomic factors, aiming to reduce drawdowns during major economic downtrends.

- 15%* lower volatility, higher Sharpe ratio: Historically, the index has shown lower volatility and an improved Sharpe ratio when compared to a pure Bitcoin exposure.

- Access through your bank or brokerage account: BMAC allows investors to access Bitcoin from their regular bank or brokerage accounts alongside other investments such as stocks, bonds, and other ETFs.

- Tax free after one year holding period (1): All DDA crypto ETPs can be tax-free for German private investors after a one-year holding period.

In the rapidly expanding universe of crypto exchange traded products, a vast array of Bitcoin ETPs have emerged to capture investor attention. Among these, the DDA Bitcoin Macro ETP stands out as a uniquely compelling choice. What sets this product apart, and what are the advantages compared to directly investing in Bitcoin?

DDA Bitcoin Macro ETP: Quantitative approach to Bitcoin investing

Crypto ETPs have emerged as a pivotal innovation in traditional finance by offering increased accessibility, enhanced security, and simplified tax processes for traditional investors marking a significant milestone in the integration of crypto assets into mainstream financial markets.

In a crowded market of Bitcoin investment options, the DDA Bitcoin Macro ETP stands out by offering a dynamic and data-driven approach to Bitcoin investing. Unlike traditional Bitcoin ETPs that simply track the price of Bitcoin, the DDA Bitcoin Macro ETP leverages advanced quantitative models and macroeconomic data to adjust its Bitcoin exposure. The strategy aims to provide investors with a more sophisticated and quantitative investment approach with the long-term objective to deliver the performance of Bitcoin with an improved risk-reward profile.

Data as of: 31/07/2024, past performance is no guarantee of future results.

The Rise of Crypto ETPs and the Challenge of Volatility

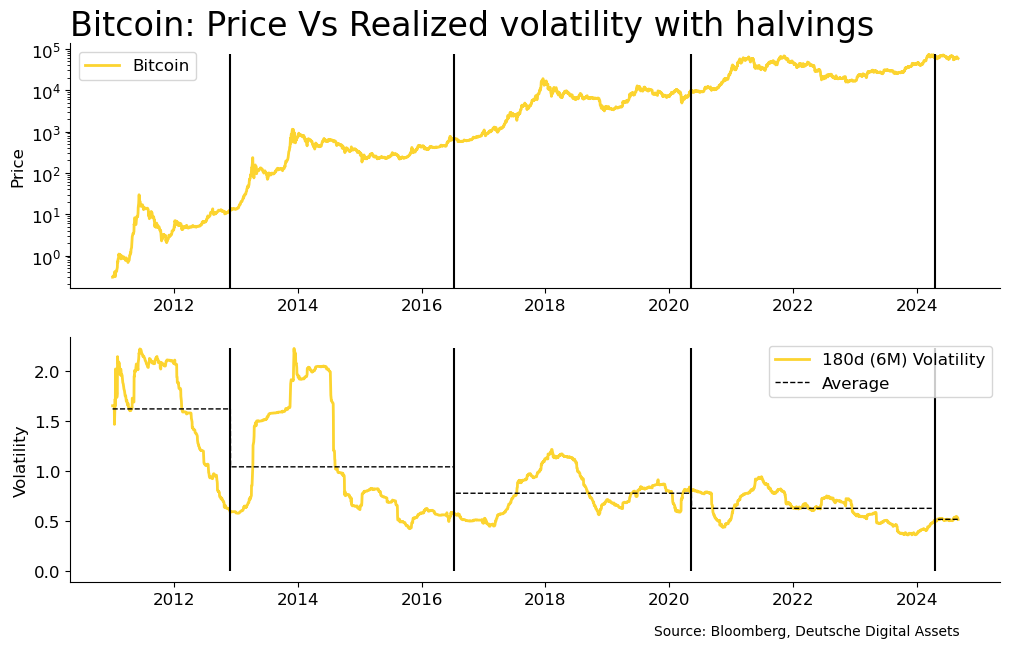

The global adoption of crypto ETPs has surged, reflecting growing interest from both institutions and retail investors. These products offer a convenient way to access the digital asset ecosystem, ranging from single-asset to basket-based strategies. However, the inherent volatility and the risk factors of cryptocurrencies remain a concern for traditional investors hindering its broader adoption as a component in portfolio construction, even if they tend to normalize more and more after each halving.

Data as of: 31/07/2024, past performance is no guarantee of future results.

Introducing DDA Bitcoin Macro ETP: A Macro Approach to Bitcoin Investing

Deutsche Digital Assets (DDA) addressed this challenge with the launch of the world’s first Bitcoin ETP based on macroeconomic factors – the DDA Bitcoin Macro ETP (BMAC). Through extensive research and in-depth analysis, DDA has identified that ca. 83% of Bitcoin’s price movements can be attributed to the four main macroeconomic factors. These four factors are sensitive to: global economic growth, monetary policy, US Dollar strength, and Eurozone risk. The ETP is physically backed by the underlying (BTC and/or USDC) and tracks the price of the DDA Bitcoin Macro Allocation Index (“DDAMACRO”) calculated by Compass FT.

BMAC: 5 key reasons to consider the DDA Bitcoin Macro ETP (BMAC) for bitcoin exposure

- Quantitative Access to Bitcoin: BMAC goes beyond static Bitcoin exposure. Through a quantitative model developed by DDA, the product shifts dynamically between BTC and USDC.

- 25 percent* reduced drawdowns: The product actively adjusts the exposure based on key macroeconomic factors, aiming to reduce drawdowns during major economic downtrends.

- 15 percent* lower volatility, higher Sharpe ratio: Historically, the index has shown lower volatility and an improved Sharpe ratio when compared to a pure Bitcoin exposure.

- Access through your bank or brokerage account: BMAC allows investors to access Bitcoin from their regular bank or brokerage accounts alongside other investments such as stocks, bonds, and other ETFs.

- Tax free after one year holding period (1): All DDA crypto ETPs can be tax-free for German private investors after a one-year holding period.

Data: 01/01/2017-31/07/2024

| DDAMACRO 1Y | BTC 1Y | DDAMACRO 3Y | BTC 3Y | DDAMACRO ITD | BTC ITD | |

| Ann Perf | 125.62% | 125.72% | 55.55% | 18.76% | 104.54% | 72.98% |

| Volatility | 45.92% | 45.94% | 41.52% | 55.63% | 60.81% | 70.96% |

| Sharpe | 2.75 | 2.75 | 1.34 | 0.34 | 1.72 | 1.03 |

| Max DD | -23.56% | -23.56% | -35.18% | -76.42% | -60.73% | -82.56% |

Data as of: 31/07/2024, past performance is no guarantee of future results.

BMAC: A new Paradigm in Bitcoin investing

Similar to the way ETFs revolutionized access to traditional asset classes, the DDA Bitcoin Macro ETP represents a major shift for Bitcoin investing. BMAC empowers traditional investors to participate in the potential of Bitcoin while trying to reduce its drawdowns through a quantitative model.

| Name | DDA Bitcoin Macro ETP |

| ISIN | DE000A3G9SE0 |

| WKN | A3G9SE |

| Exchange Ticker | BMAC |

| TER | 0.00% * |

| Inception Date | 18.06.2024 |

| Product Structure | ETP – Physisch besichert |

About Deutsche Digital Assets

Established in 2017, Deutsche Digital Assets GmbH (DDA) is a German crypto and digital asset manager that serves as a trusted gateway for investors seeking exposure to crypto assets. DDA, through various subsidiaries, offers a menu of crypto investment products and solutions, ranging from passive to actively managed, as well as financial product white-labeling services for asset managers. By leveraging traditional financial products, DDA provides investors with familiar access to a range of crypto asset ETPs and quantitative strategies, making crypto and digital asset acquisition as easy as buying a stock. For more information, please visit https://deutschedigitalassets.com/.

Legal Disclaimer

This is a marketing communication. The material and information contained in this article is for informational purposes only.

Important Notices:

This article represents solely a non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129(Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG). It does not constitute an offer of securities for sale in the United States and the securities referred to in this notice may not be offered or sold in the United States absent registration or an exemption from registration.

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.

Risk Considerations

The price of an investment in a DDA ETP may go up or down and the investor may not get back the amount invested.

The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance.

You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of deciding to invest in the securities.

The prospectus of each ETP product is available at https://deutschedigitalassets.com/products/etp/