Are sellers becoming exhausted?

Key Takeaways

- A classical prerequisite of a cycle bottom is what is called “seller exhaustion”

- Recent spending behavior by Bitcoin investors implies that selling pressure appears to be exhausted

- The current low readings of the Seller Exhaustion Constant imply significantly positive excess performances over the coming 12 months

One of the key concerns for investors is when cryptoasset markets and in particular Bitcoin prices will finally reach their bottom in this cycle.

Prerequisites of a cycle bottom are usually the following:

- Redistribution of coins from short- to long-term investors

- High degree of “pain” in the market in terms of realized and unrealized losses

- Reset of valuations: Coins that are generally trading below cost-basis

- Seller’s exhaustion

We have written extensively about the first 3 points in our latest DDA Crypto Espresso about Bottom Probabilities here.

But what about Seller’s Exhaustion?

Seller’s Exhaustion is usually described as an investment environment when sellers have capitulated, realized losses and the selling volume gradually fades out. There are many approaches to identify an environment like this such as:

- High ratio of put to call options

- Negative perpetual funding rates

- High amount of forced long futures liquidations

Most of these indicators focus on positioning especially in the derivatives markets. One-sided positioning is then often a sign of a local bottom as well. But there are also alternative approaches to measure the degree of seller’s exhaustion. One of these approaches was put forth by famous on-chain analyst David Puell and Ark Invest [1].

The idea is that capitulation, complacency, and a bottoming out of the price of bitcoin are linked to low volatility and high losses.

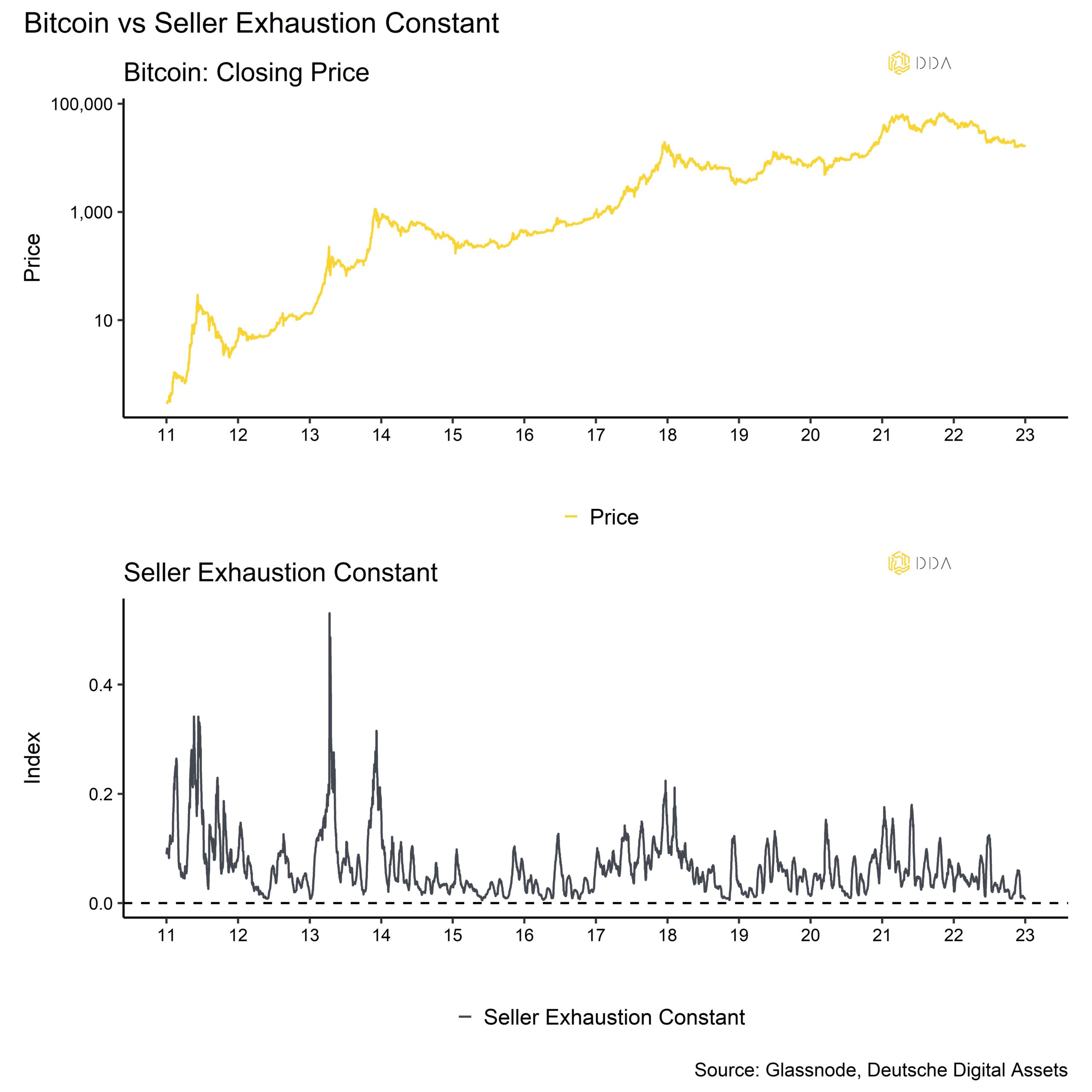

Volatility can help predict the future price movement of Bitcoin when combined with profit measures. The fraction of the entire circulating supply of Bitcoin that has generated profits divided by the volatility over the last 30 days is the Seller Exhaustion Constant, which is displayed below. This statistic assesses how closely the two variables line up.

Low volatility amid a high number of losses implies that selling volume is not affecting price significantly anymore – evidence that sellers have become “exhausted”.

Statistically speaking, low readings of the Seller Exhaustion Constant have indeed been indicative of above-average returns over a 12-months investment horizon in the past while high readings have been associated with below-average returns over a 12-months investment horizon.

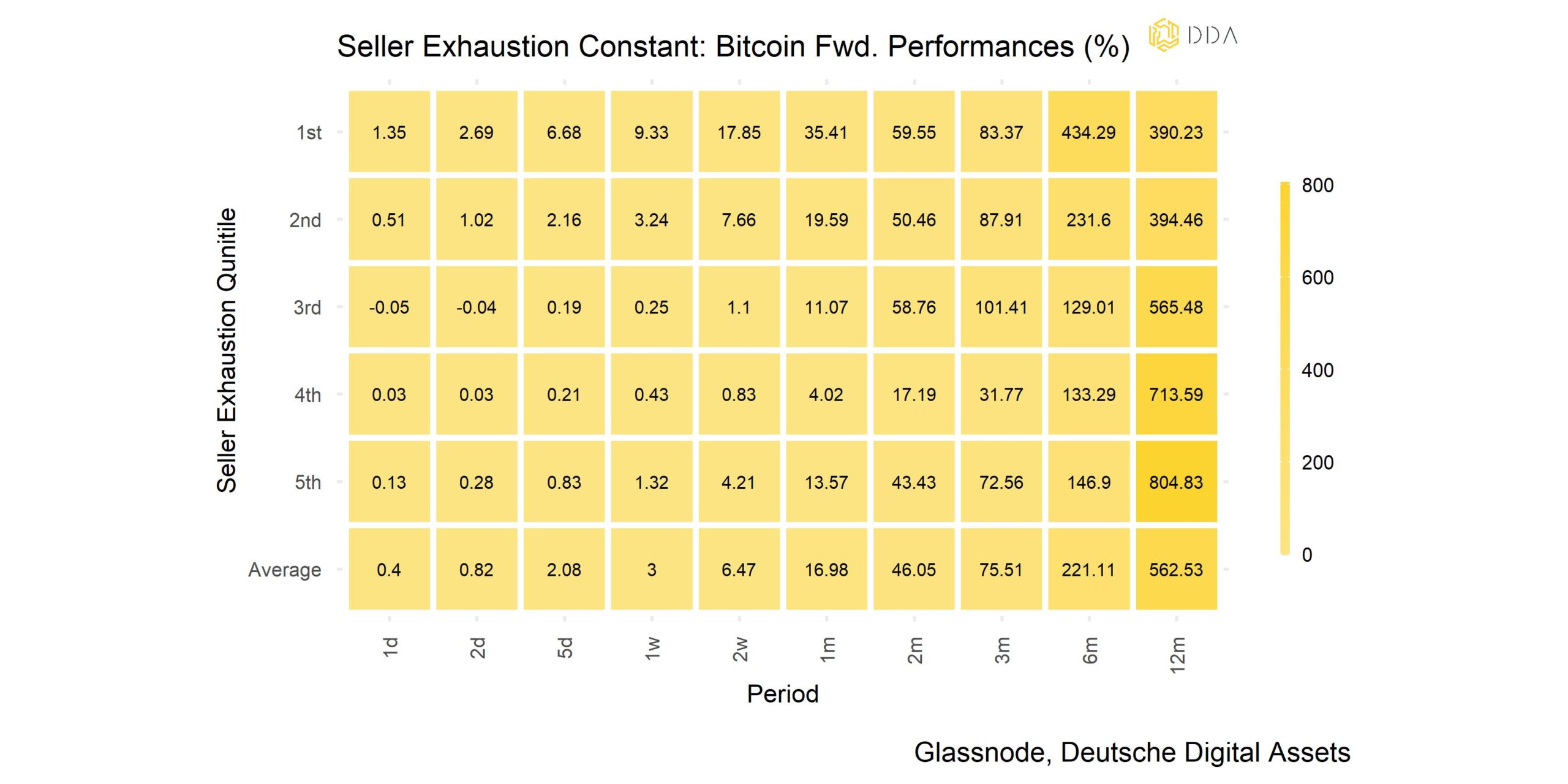

The following table shows the respective forward return for any given period conditional on a level of the Seller Exhaustion Constant. We have divided the Seller Exhaustion Constant levels into 5 equally sized quintiles with the 5th quintile showing the 20% lowest levels and 1st quintile showing the 20% highest levels:

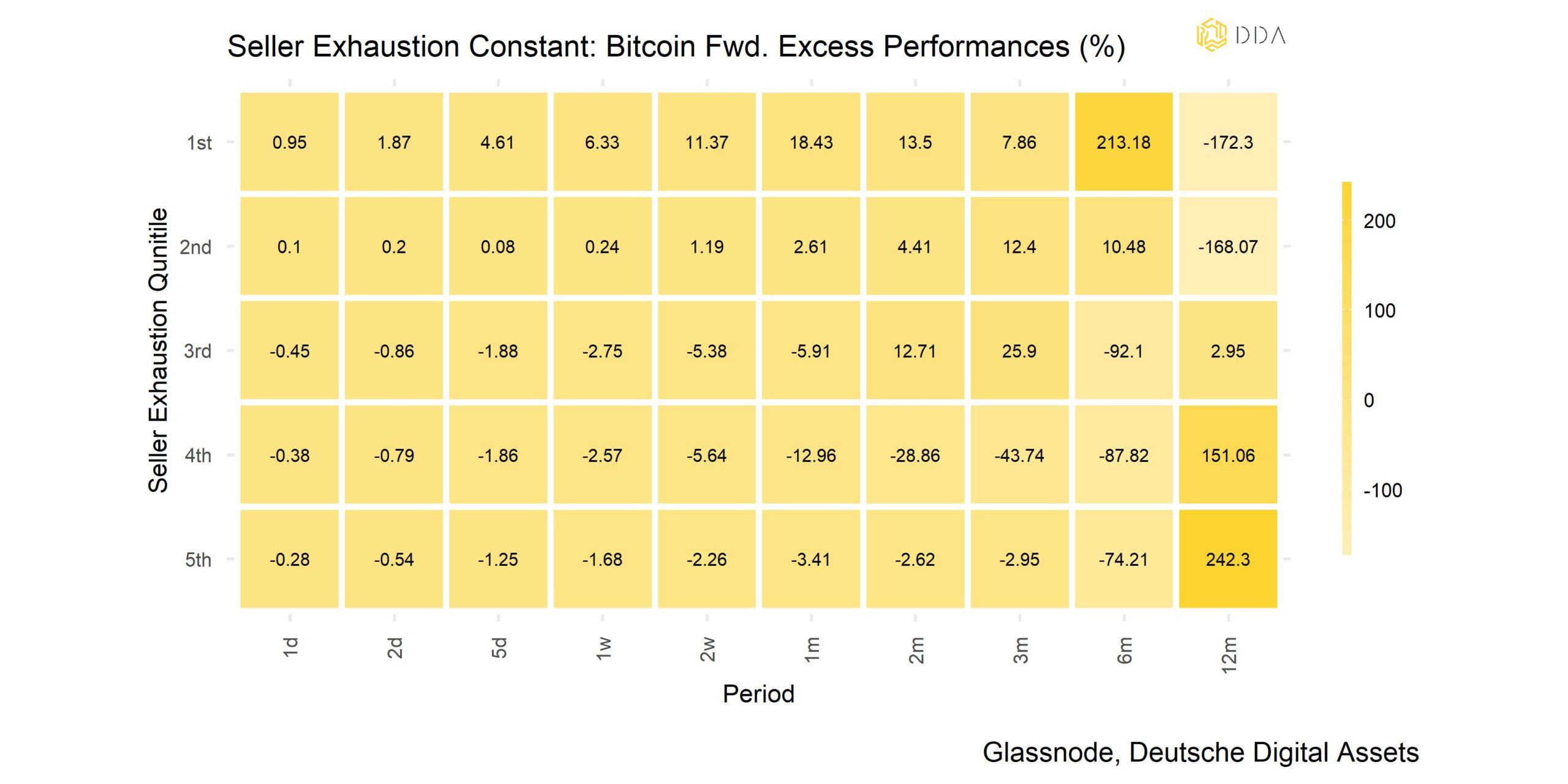

This is the corresponding excess performance (conditional performance minus average performance) table:

- The Seller Exhaustion Constant is currently in the 2% percentile and, thus, implies significantly positive excess performances over the coming 12 months.

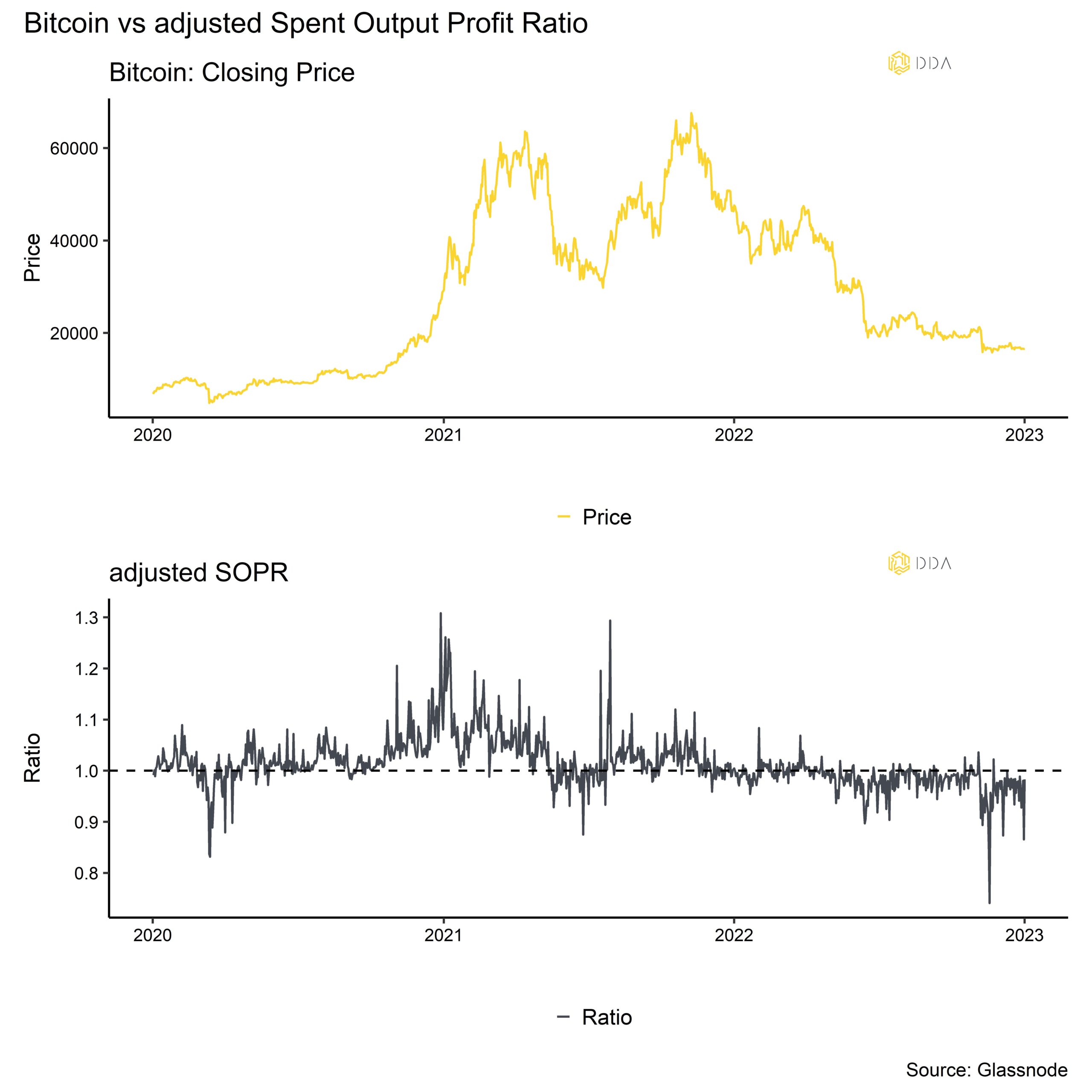

We have recently observed a significant volume of loss taking by investors as shown by the low spent-output-profit-ratio (SOPR):

The SOPR metric is calculated by dividing the realized value (in USD) divided by the value at creation (USD) of a spent output. Or simply: price sold / price paid.

A ratio below 1.0 implies that the spent coins are on average sold at a loss.

On the 31/12/2022, it was the second lowest reading of the SOPR metric in 2022. Despite that, the price has not reacted meaningfully which also supports the thesis that selling pressure appears to be exhausted.

We will continue to monitor these metrics going forward and highlight any upcoming salience.

As always, we hope that you will find these insights useful.

Stay humble and stack Sats,

André

Legal Disclaimer

The material and information contained in this article is for informational purposes only. Deutsche Digital Assets, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities. Performance is unpredictable. Past performance is hence not an indication of any future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Deutsche Digital Assets GmbH’s control. We believe all information contained herein is accurate, reliable and has been obtained from public sources. However, such information is presented “as is” without warranty of any kind.