Product details

| Type: | Exchange Traded Note (100% collateralized) |

| Exchanges | Börse Stuttgart |

| Trading Currency | EUR |

| Exchange Ticker | HELI |

| ISIN | DE000A4AHWT9 |

| WKN | A4AHWT |

| VALOR | n/a |

| Bloomberg | HELI GR |

Key facts

| As of Date | %DATE% |

| Base Currency | USD |

| First Trade Date | 20.12.2024 |

| Domicile | Liechtenstein |

| Net Asset Value (USD)** | %TOTAL_ASSETS% |

| Total Expense Ratio | 3.20% |

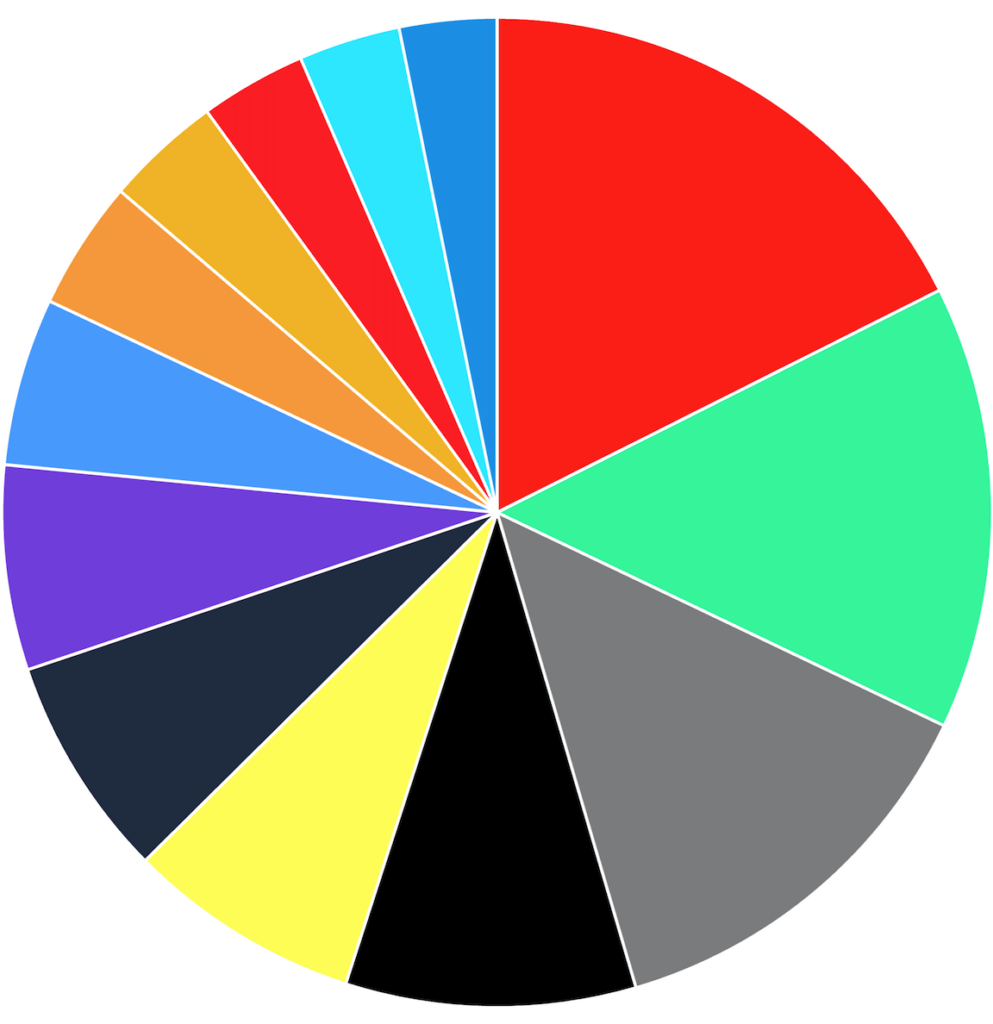

| Replication Method | Physically Backed by a basket of cryptocurrencies (100% collateralized) |

| Notes Outstanding** | %NOTES_OUTSTANDING% |

| UCITS Compliant | No |

| UCITS Eligible | Eligible* |

| Legal Form | Debt Security (100% collateralized) |

| Income | Accumulating |

| Rebalancing Frequency | Quarterly |

| Issuer | DDA ETP AG |

| Administrator | Trident Fund Services Ltd |

| Security Trustee | Griffin Trust AG |

| Custodians | Aplo SAS |

| Registered for sale | Austria, Belgium, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland |

Where to buy?

Add digital assets exposure to your portfolio using existing bank or brokerage accounts, or choose a new trading platform. DDA ETPs are listed on traditional exchanges and trade just like stocks or ETFs. As an investor in DDA ETPs you do not have the need or technical capability to manage crypto wallets or worry about tax implications.

The list above features some but certainly not all of the popular banks/brokerages. If you have difficulties accessing our products through your preferred bank/brokerage, please contact us by clicking on the button below. We will reach out to your bank/brokerage and try to make the products available to you.

Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

Core Documents

Other Documents

FAQs

Cryptocurrency exchange-traded products (ETPs) provide investors with access to cryptocurrencies via a traditional investment infrastructure. DDA ETPs physically-backed by cryptocurrencies enable investors to participate cost efficiently in the price development of a single digital asset or a basket of digital assets from their personal bank accounts - just as they experience investing in stocks, bonds or ETFs.

You can buy a DDA crypto ETPs through your bank or brokerage without setting up a crypto wallet.

The DDA ETPs are available on European stock exchanges, such as Deutsche Börse Xetra, Euronext Paris u0026 Amsterdam, SIX Swiss Exchange and Börse Stuttgart. For each exchange availability, please refer to the product-specific factsheet.

DDA ETPs are established investment structures that trade on traditional exchanges, mitigating the regulatory risk that exists when trading crypto outright on digital asset exchanges. Investors can invest in DDA ETPs with confidence, knowing that all stakeholders have been examined and trades are closely monitored to ensure all trading activities are aligned with regulatory requirements.

By purchasing bitcoin through an ETP, investors minimize the risk of losing their funds to due wallet mismanagement. DDA Bitcoin ETP is conveniently stored at specialized custodians such as BaFin-regulated Coinbase Germany GmbH or French AFM-regulated “Aplo SAS”. Investors do not require the technical expertise to manage several wallets and private keys.

So, there are a number of advantages to using DDA Bitcoin ETP for exposure to digital assets, including the fact that they are regulated, listed, liquid, available to retail investors, and don’t present issuer risk due to their collateralised nature. Find out more here.