Crypto Market Intelligence August 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

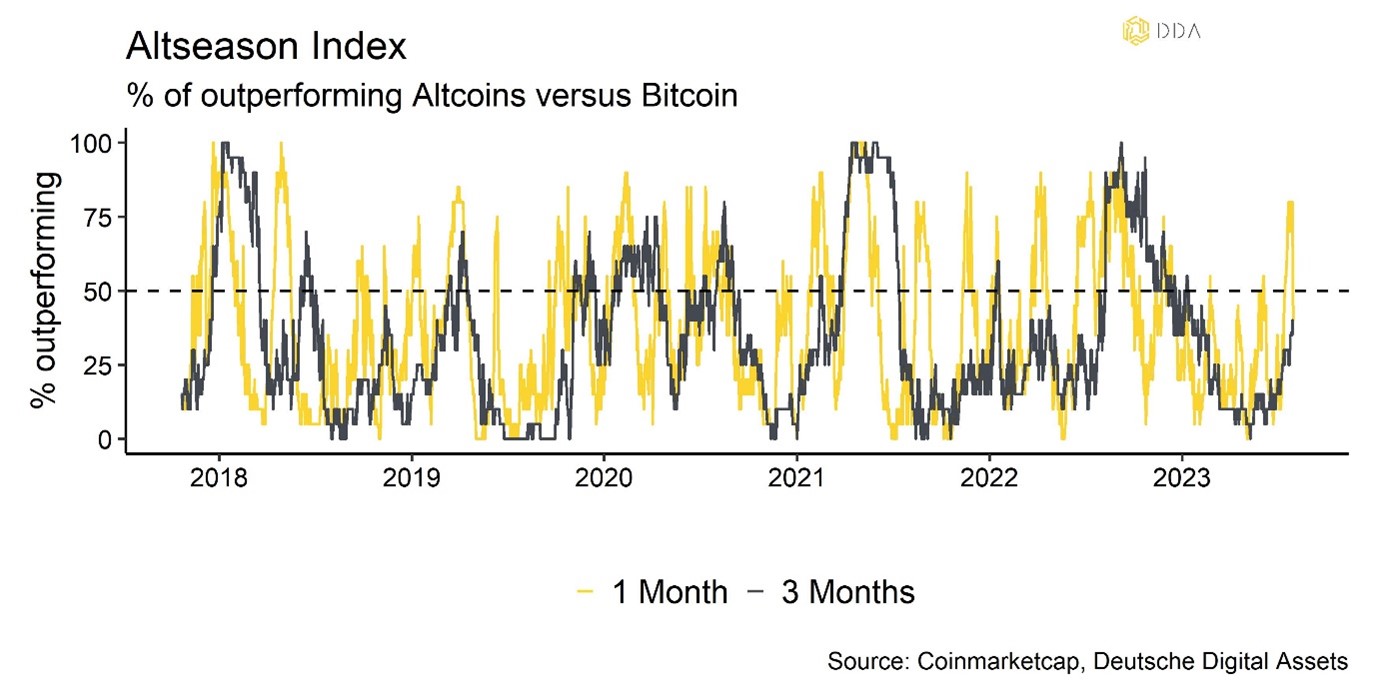

- Cryptoassets like Bitcoin and Ethereum paused in July after Blackrock-ETF hype in June, while the XRP ruling boosted altcoins significantly, leading to an 80% outperformance, but the crypto markets quieted in the summer with lower volumes and volatility.

- Falling inflation helps Bitcoin and Cryptoassets, but improved labor data and stretched sentiment in traditional financial markets may limit short-term gains.

- Limited short-term upside for BTC due to elevated sentiment, positioning, and weak on-chain activity, while altcoins have outperformed BTC, but market breadth has weakened compared to the beginning of the year.

Chart of the month

Kryptoasset Leistung

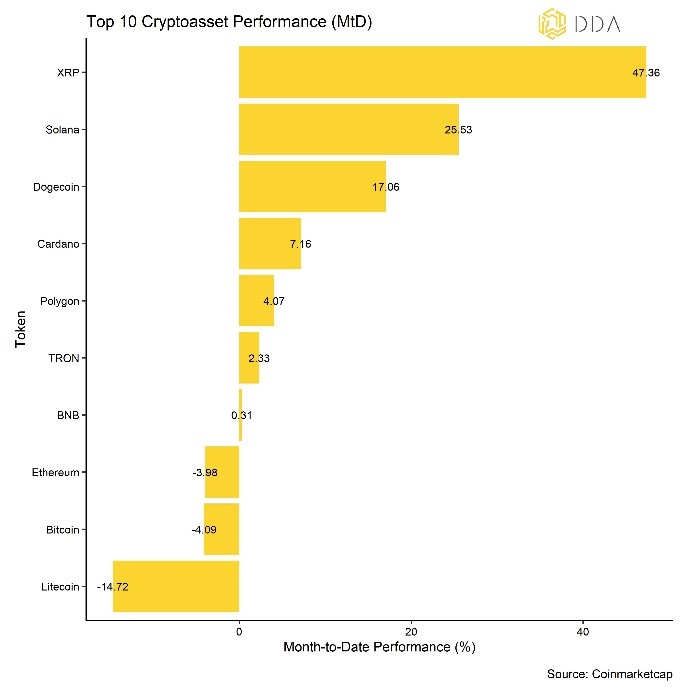

Cryptoassets overall posted a positive performance in July but with large performance divergences within the market. On the one hand, it appears as if Bitcoin and Ethereum took a breather after the Blackrock-ETF induced euphoria in June that led to exuberant sentiment and positioning within crypto markets.

On the other hand, a major positive catalyst for other altcoins was the US judge’s ruling that XRP’s parent company Ripple Labs Inc did not violate federal securities law by selling XRP tokens on public exchanges. This ruling was seen as a landmark legal victory for the cryptocurrency industry that sent the value of XRP and other altcoins soaring.

As a result, performance dispersion among cryptoassets has stayed at elevated levels in July. An increase in dispersion means that cryptoasset performances are increasingly driven by coin-specific factors in contrast to systematic factors.

However, July was also characterized by a rather calm market environment as implied volatilities for Bitcoin options reached an all-time low. It seems as though the crypto markets have entered the summer holiday season with lower transfer volumes and volatility. In fact, especially August and September are historically the months that exhibit the lowest monthly performances for Bitcoin as we have pointed out hier.

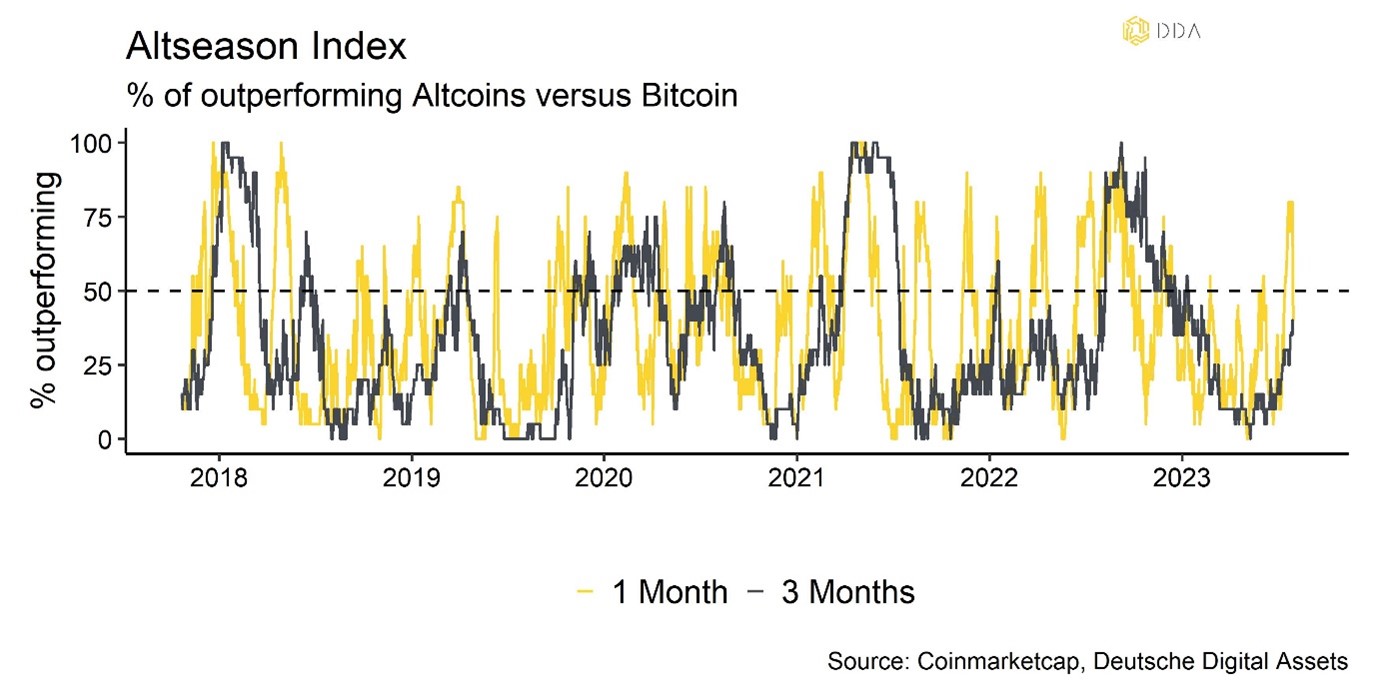

July was also characterized by an increase in altcoin outperformance vis-à-vis Bitcoin. In the month of July, 40% of our tracked altcoins managed to outperform Bitcoin. However, at some point, that percentage reached 80% on a monthly basis due to the XRP ruling. Seen from this perspective, it appears as if this ruling was also a catalyst for a wider “altseason”, i.e. a structural outperformance of altcoins vis-à-vis BTC (see also our Chart-of-the-Month).

In general, among the top 10 major cryptoassets, XRP, Solana, and Dogecoin have been the main outperformers.

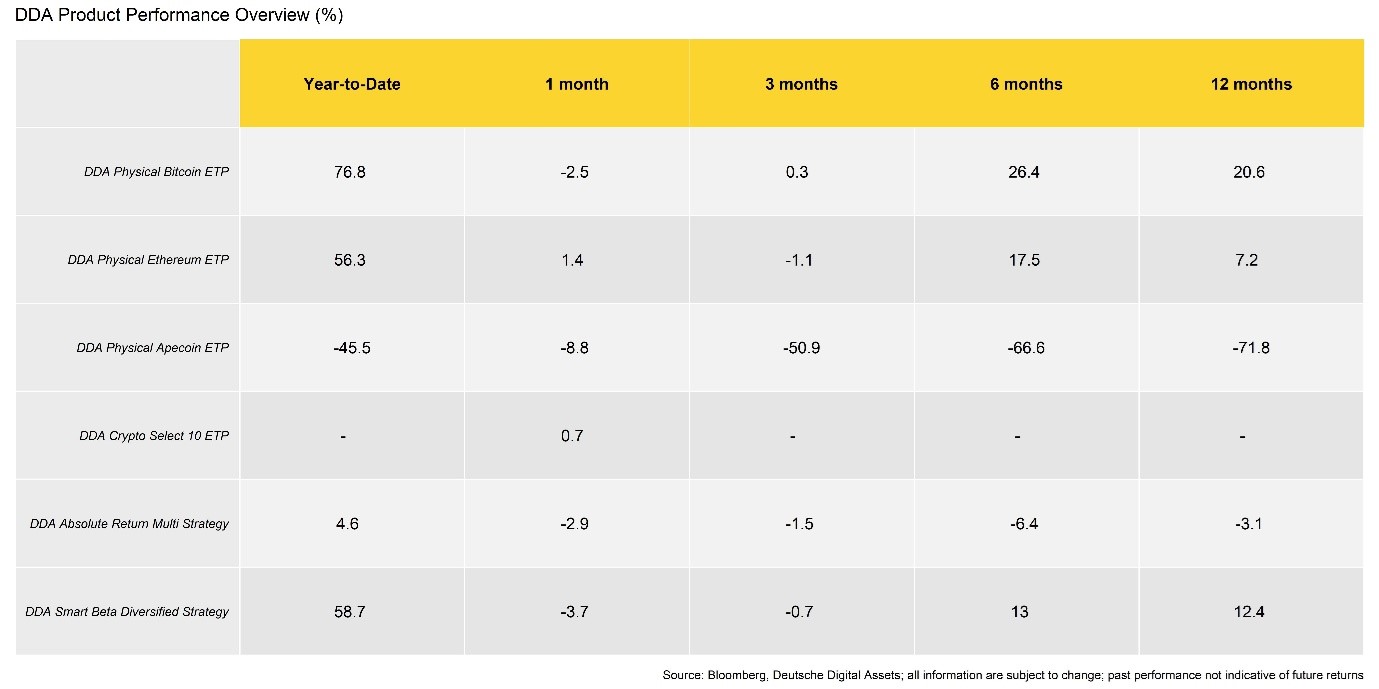

Likewise, our own passive DDA products have performed accordingly in July:

July was characterized by very low volatility overall, which is not a favorable environment for absolute return strategies, which suffered a little. The beta programme did better and slightly outperformed its benchmark thanks to the court ruling on XRP and the subsequent performance of certain altcoins.

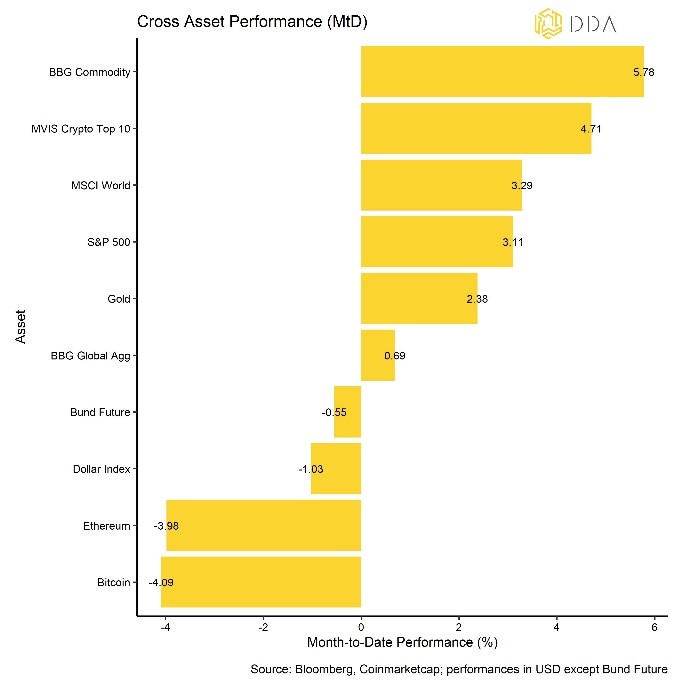

Traditional financial assets also performed positively in July as global equities continued to rally on the back of a weak Dollar despite ongoing monetary tightening and rate hikes by both the Fed and the ECB.

Bottom Line: Major cryptoassets such as Bitcoin and Ethereum took a breather in July after the Blackrock-ETF induced euphoria in June. In contrast, the XRP ruling sent the values of XRP and other altcoins soaring which overall contributed to a large performance dispersion in July. Altcoin outperformance also increased and even reached 80% at some point during the month of July. However, it seems as though the crypto markets have entered the summer holiday season with lower transfer volumes and volatility.

Macro & Markets Commentary

Markets have been pricing a turnaround in Fed monetary policy since October, when US inflation numbers peaked. In fact, the Fed did not deliver the proverbial “pivot” but markets “pivoted” anyway with the cyclical decline in inflation.

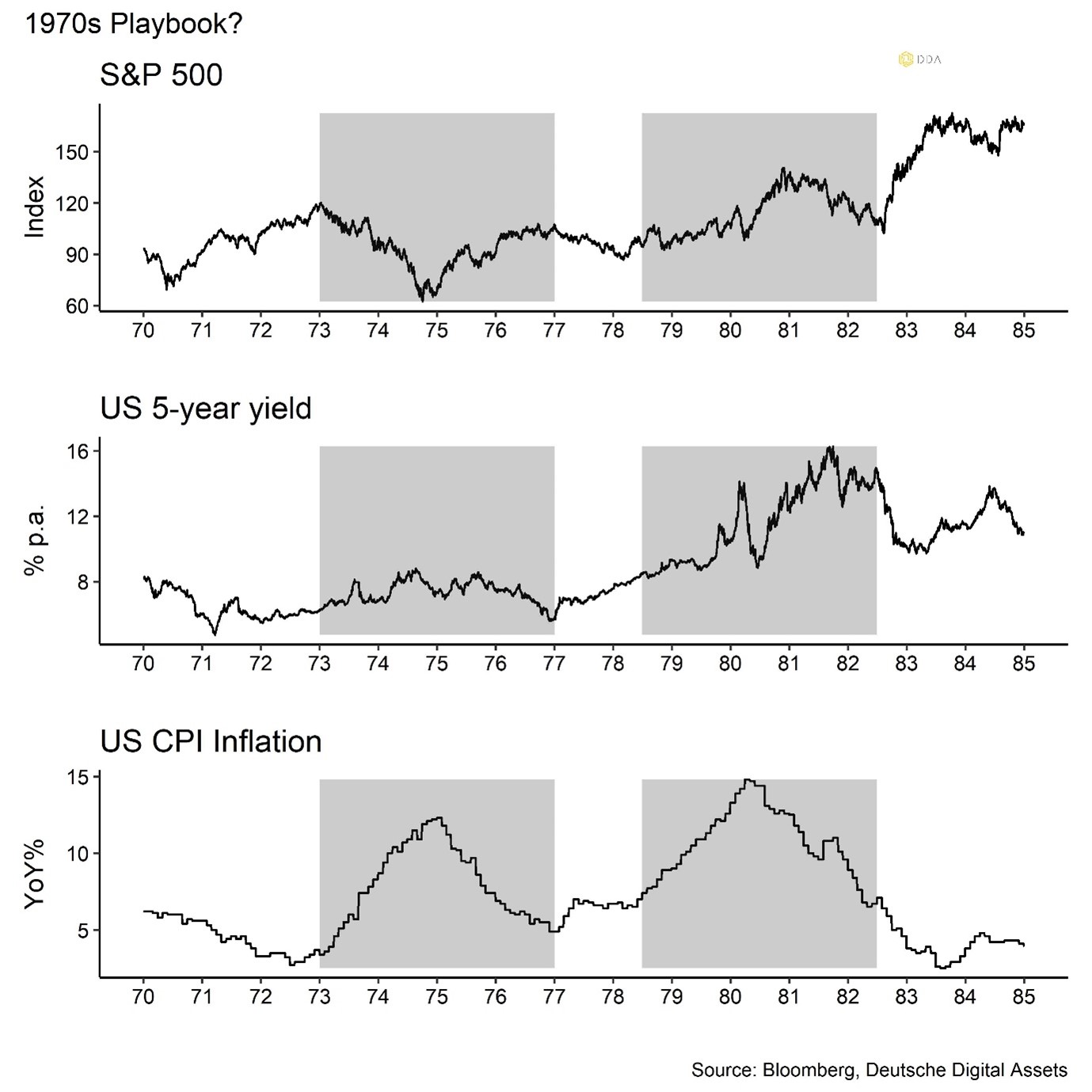

Traditional financial markets seem to be following a 1970s style playbook, when US equities continued to rallye (despite deteriorating earnings) with a fall in inflation numbers that limited a further rise in yields.

Note that this inverse relationship between the stock market, on the one hand, and both yields and inflation, on the other hand, led almost to a “lost decade” in US equities between 1973 and 1982, when the S&P 500 did not make new highs (sustainably). The inflation-adjusted performance was clearly negative throughout that period.

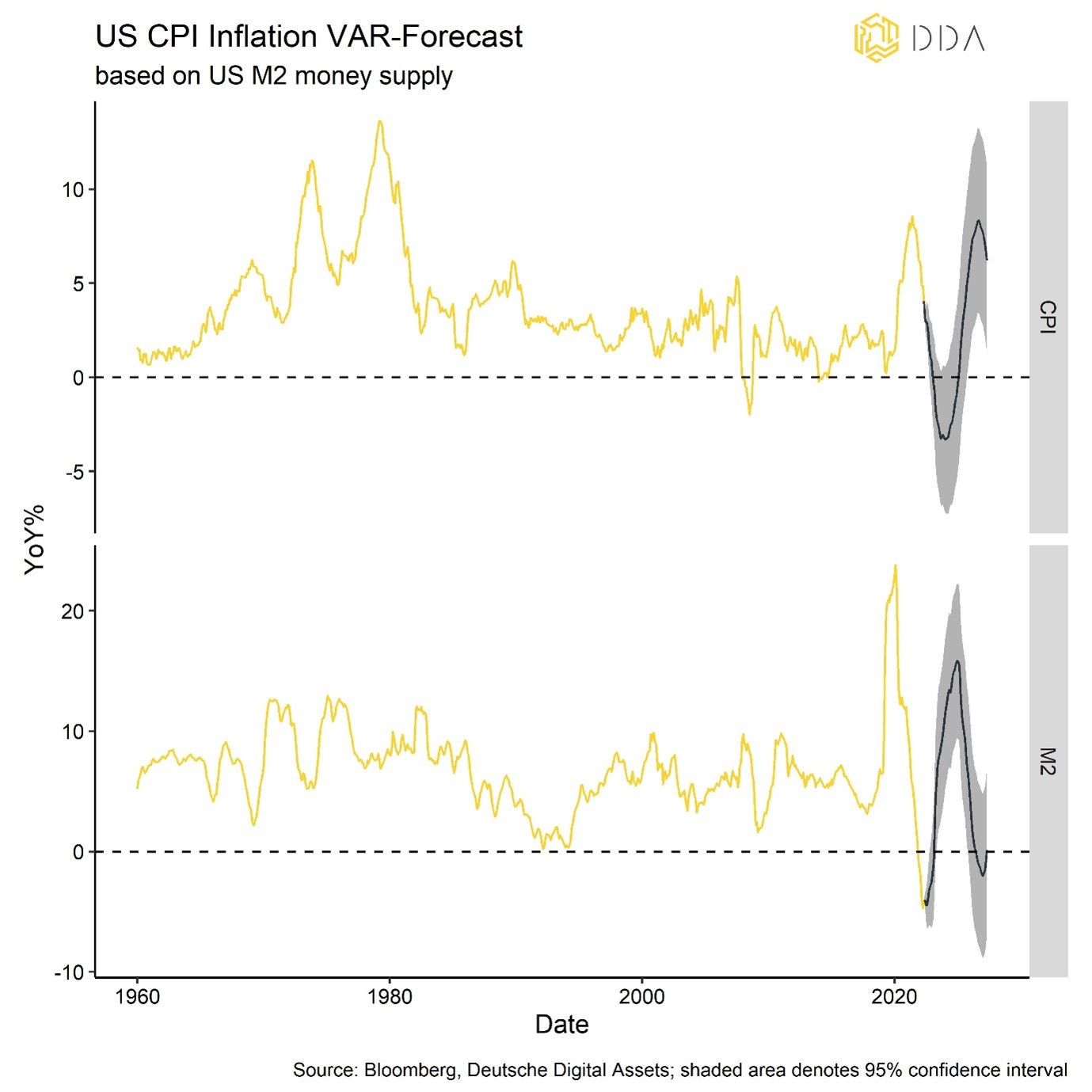

However, within the current environment, it is quite likely that US inflation numbers will continue to decline on account of the falling money supply growth that usually leads inflation by more than a year. In fact, our own forecast implies that there is high probability of deflation (i.e. negative inflation rates) in the US over the coming months.

In turn, financial markets could be supported by falling inflation readings and further downside in yields.

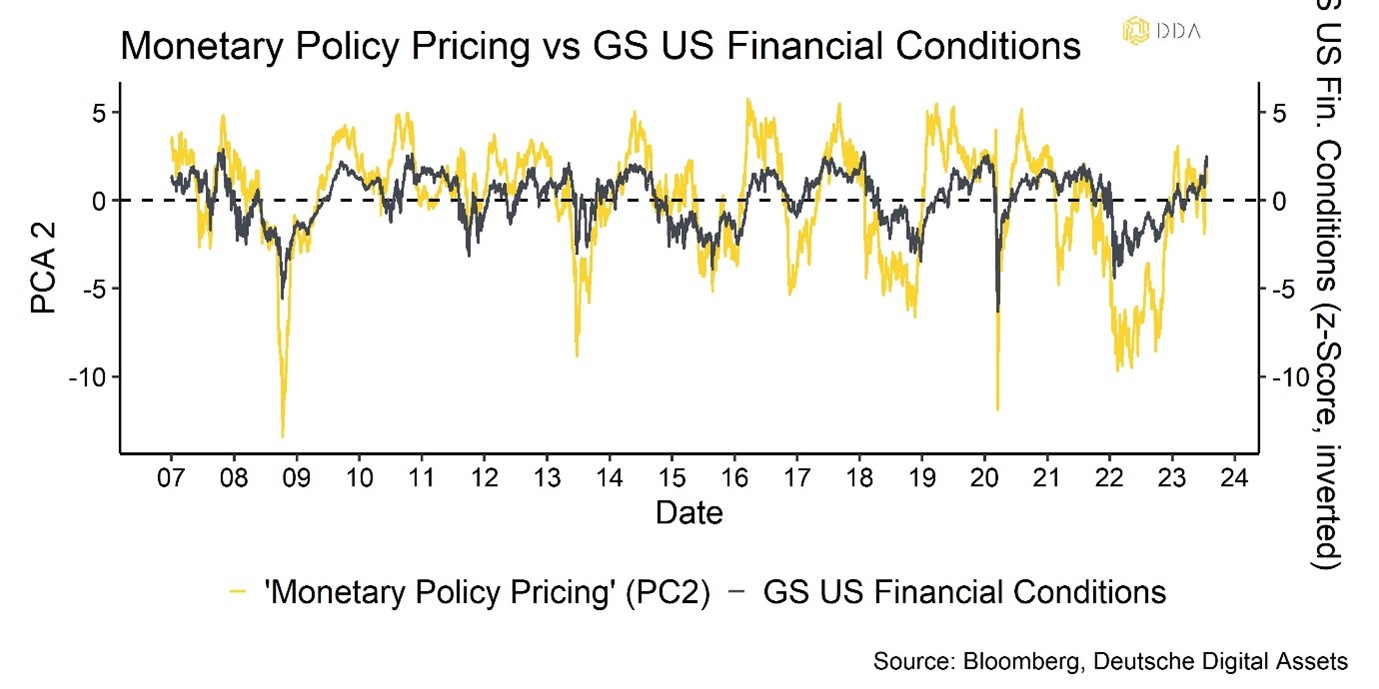

So far, the fall in inflation has led to a significant improvement in financial conditions (as measured by the GS US Financial Conditions Index) as well as monetary policy (as priced by financial markets) which has clearly provided a tailwind for both traditional financial markets and cryptoassets.

The risk, of course, is that monetary policy stays tight leading to a renewed tightening in overall financial conditions. The recent central bank actions by both the Fed and ECB who raised rates a further 25 bps point in that direction.

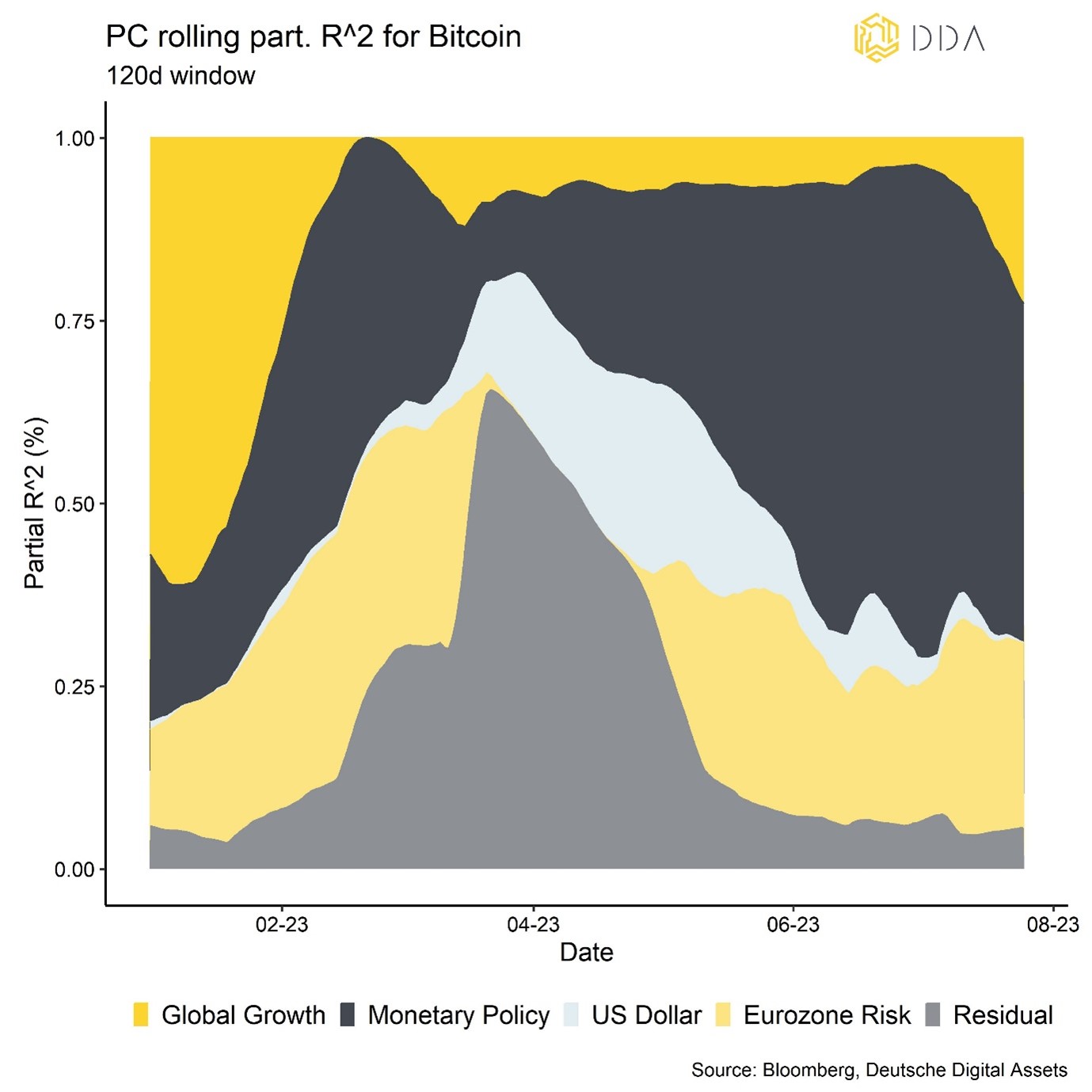

As far as Bitcoin and cryptoassets are concerned, monetary policy still appears to be the most dominant macro factor now. This can be seen in the following chart that shows the %-age of variation in the price of Bitcoin explained by different macro factors:

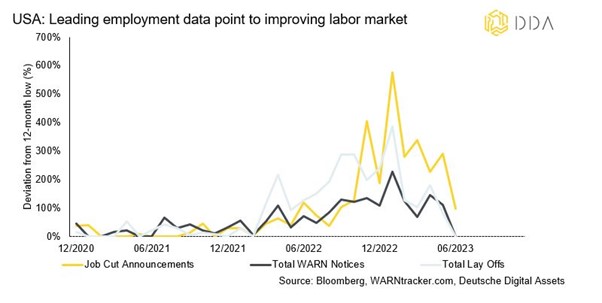

What is more is that leading job market indicators have significantly improved in the last months since January 2023 when US job cut announcements compiled by Challenger, Gray & Christmas appear to have peaked. This implies that yields could stay “higher for longer” despite the continuing fall in inflation rates.

Since January this year, alternative labour market data such as job cut announcements, layoffs as well as so-called WARN notices all have decreased. This appears to have been anticipated by financial markets already.

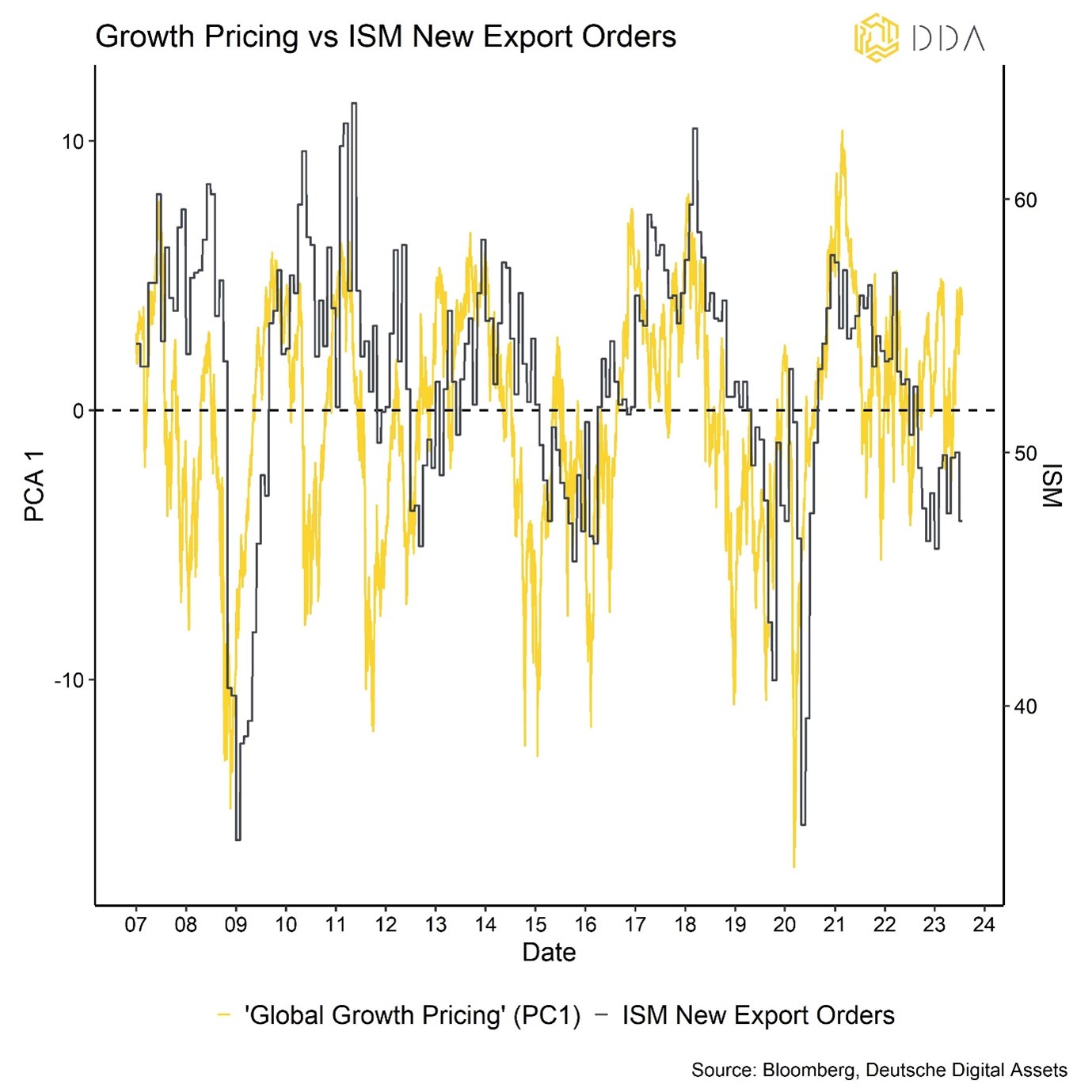

In fact, traditional financial markets appear to price a very sanguine macro growth outlook already judging by our own measure of global growth expectations priced into financial markets:

Moreover, traditional financial markets are already overextended in terms of positioning and retail sentiment. For instance, the NAAIM Exposure Index that represents the average exposure to US equity markets reported by its members already implies an allocation of 99.05% of its members – the highest level since November 2021. At the same time, retail investor bullish sentiment has reached the highest level since April 2021 according to data compiled by AAII.

Stretched positioning and sentiment in traditional financial assets is likely a limiting factor in the short term for cryptoassets as well.

One of the major reasons for the positive performance in traditional assets is the fact that economic data have significantly surprised to the upside in recent months. For instance, the Citi Economic Surprise Index for the US has reached the highest level since March 2021.

Let’s recap a little bit:

- Fall in inflation has led to an easing in financial conditions (as priced by financial markets) despite ongoing Fed tightening

- Risk: Renewed tightening in financial conditions

- Inflation will continue to fall based on money supply growth w/ rising probability of deflation

- Leading employment data point to an improvement in the labor market and economic data have generally surprised to the upside – “higher for longer” more likely

- Traditional financial markets are already pricing a sanguine macro growth outlook and equities appear to be stretched with respect to positioning and sentiment

Bottom Line: Falling inflation rates are likely going to continue to provide a tailwind for Bitcoin & Cryptoassets as it implies a less hawkish monetary policy. However, improvement in labor market data suggests “higher for longer” which could worsen financial conditions down the road again. Worsening financial conditions would be net negative for Bitcoin as well. Moreover, traditional financial markets already price a sanguine macro growth outlook and appear to be stretched in terms of sentiment and positioning. This could limit further upside in the short term.

On-Chain Analytics

It appears as if cryptoassets are somewhat “stuck in a rut” for the time being. The Blackrock ETF-induced rally has faded and the XRP-induced reduction in regulatory uncertainty was only short-lived so far. Besides, the summer months of July, August, and September usually exhibit below-average returns for Bitcoin as we have shown hier.

The market is clearly waiting for new catalysts while sentiment and positioning in the crypto markets still appear to be elevated as we have pointed out in our latest “Crypto Market Pulse” report (hier).

Apart from that, on-chain activity was generally quite low over the last weeks. For instance, the volume of transfers on the Bitcoin blockchain is currently close to multi-year lows. In addition, both exchange inflows and outflows sharply declined last month. Coins have been leaving exchanges on a net basis and balances have dropped to their lowest point since February 2018. But there is little doubt that the rate of change of these net outflows has slowed considerably.

Since short-term Bitcoin investors have a tendency to transmit more coins in losses to exchanges than gains, there appears to be some downward pressure at the present. More than 1% of short-term investors’ balances are currently being sent to exchanges in a single day, which is a sizable amount.

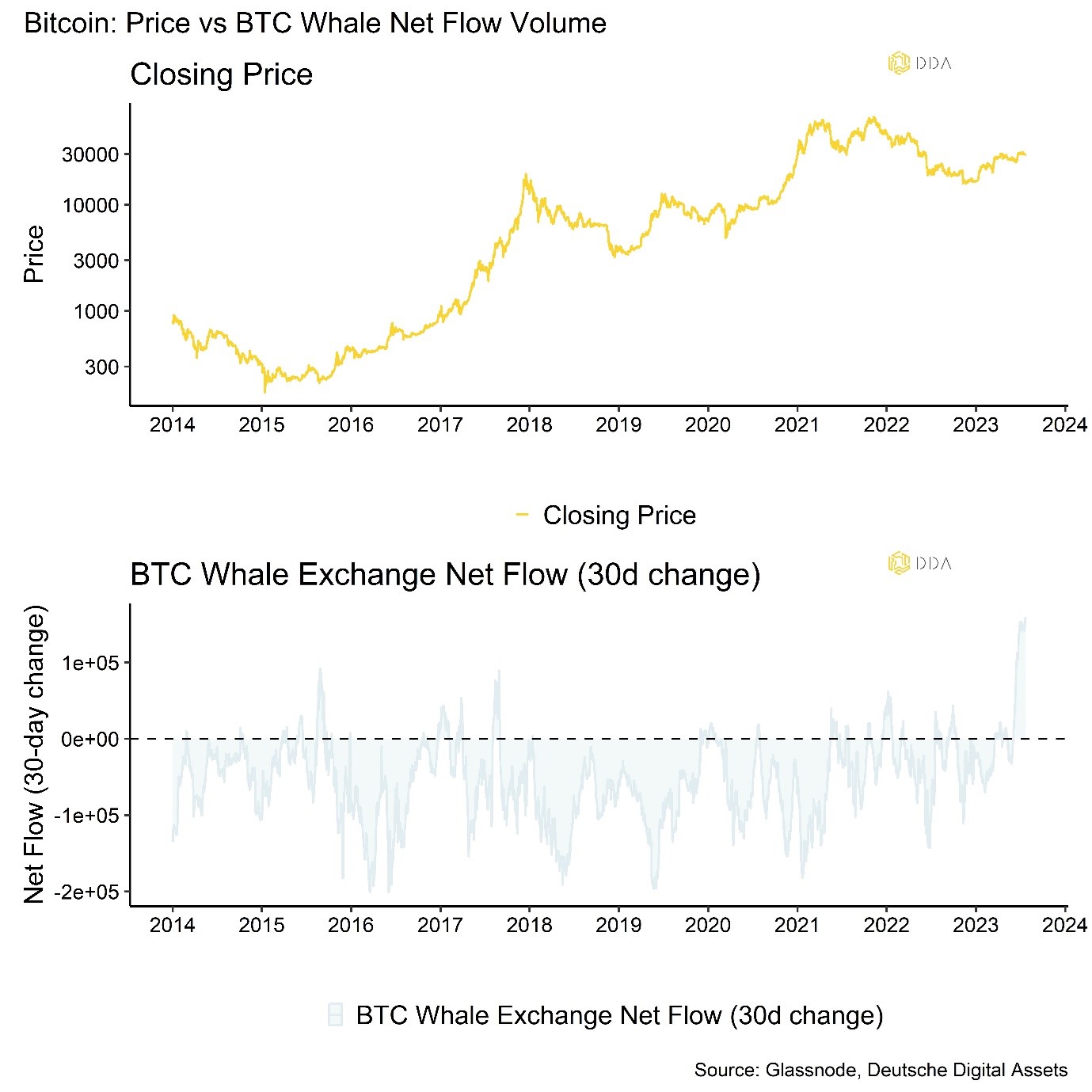

Such liquidations could be caused by a number of variables, such as general macroeconomic difficulties or even seasonal liquidity requirements because of the summer holiday season. Many of these short-term holders tend to be large wallets in excess of 1000 BTC (ie “whales).

The recent development in whale net exchange flows is somewhat of a concern for markets. The 1-month change in whale net exchange deposits has reached an all-time high recently. Although some on-chain analysts attribute this to short-term ‘wallet reshuffeling’, the amount of coins that has flown onto exchanges still represents potential selling pressure and therefore a downside risk.

On a positive note, long-term Bitcoin investors don’t seem to be selling off more of their holdings. More particular, only 0.0002% of long-term investors’ holdings are now being sent to exchanges. The majority of the coins sent in the first place are ones that have been profitable.

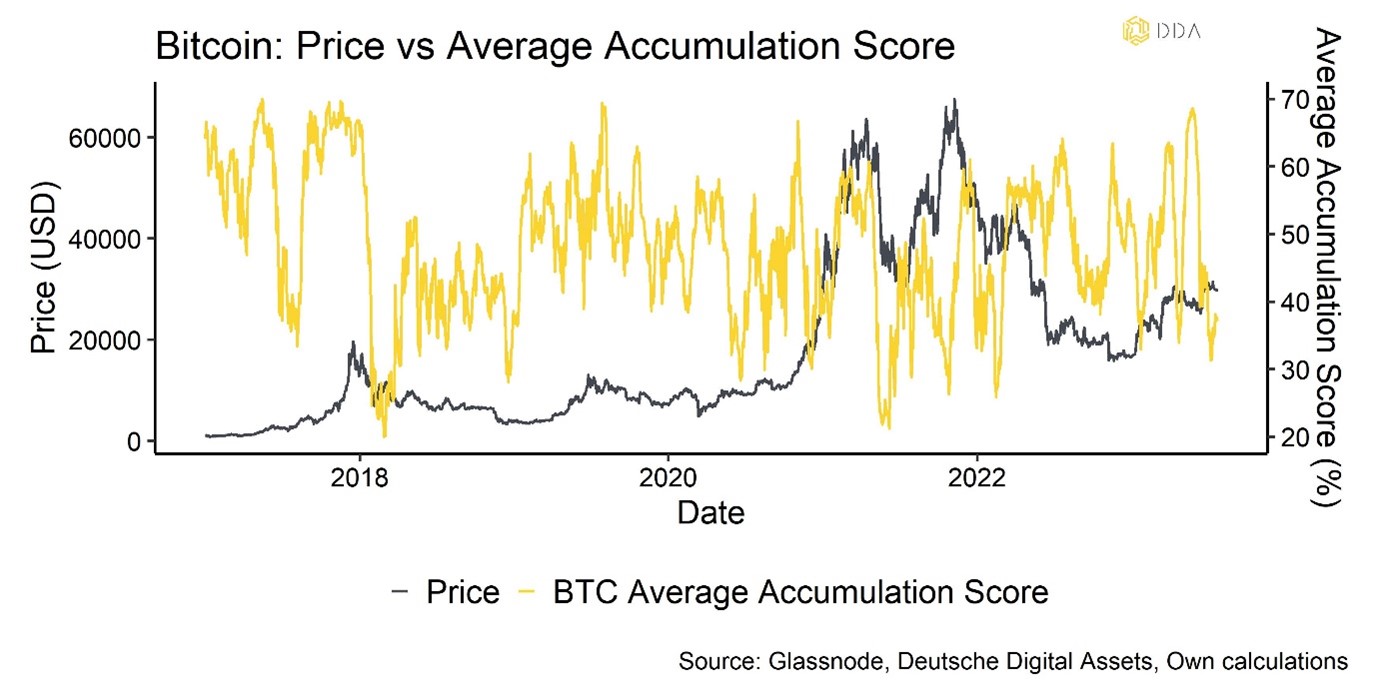

However, looking at transfer volumes by different wallet cohorts reveals that average accumulation score across all wallet cohorts has also declined significantly and remains at the lowest levels year-to-date.

These observations imply that further upside for BTC appears to be somewhat limited in the short-term because elevated sentiment, positioning and weak on-chain activity.

Meanwhile, XRP’s ruling appears to have served as a catalyst for a broad-based outperformance in altcoins vis-à-vis Bitcoin. On a monthly basis, 40% of our tracked altcoins managed to outperform BTC. However, at some point during last month, altcoin outperformance even reached 80% vis-à-vis BTC.

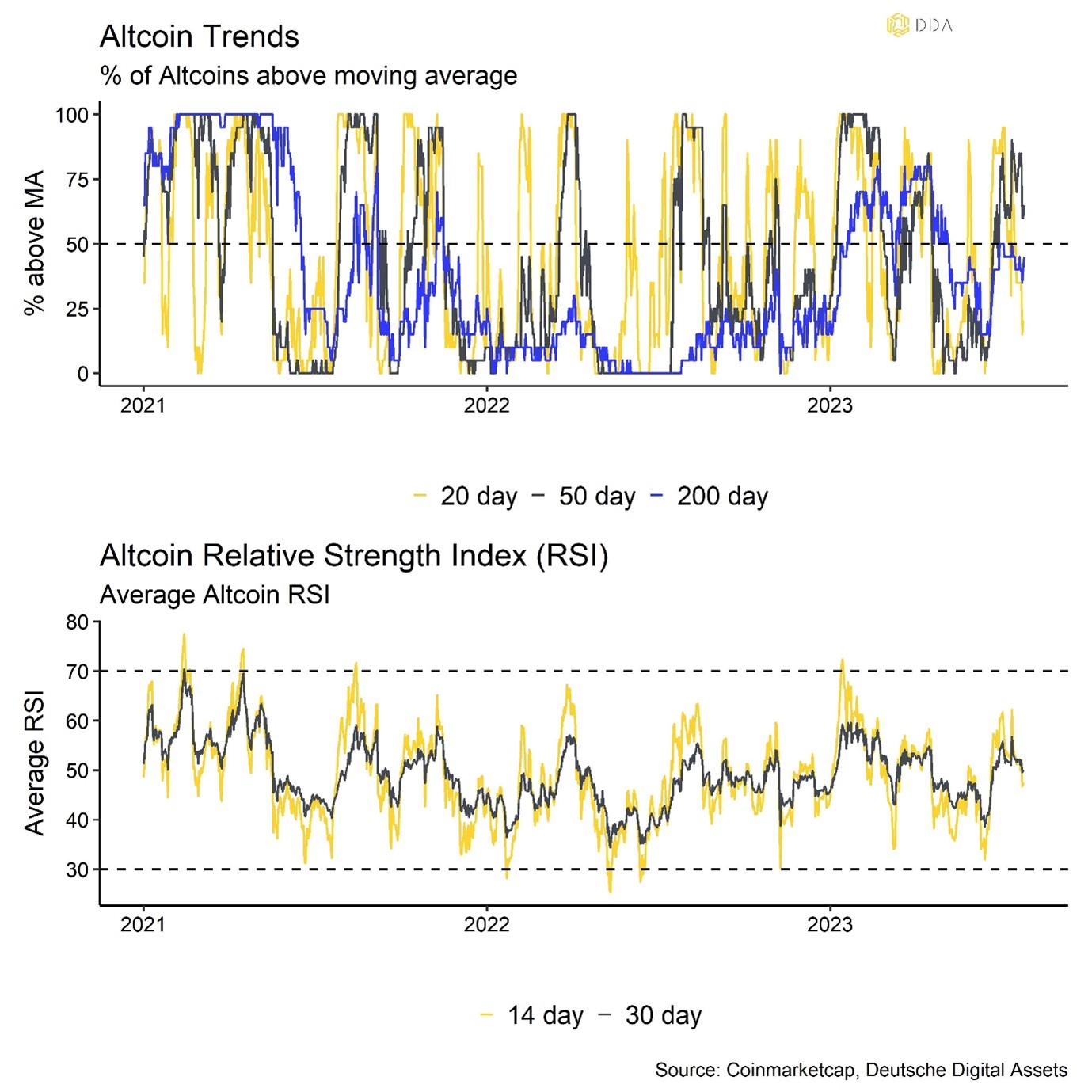

In general, that being said, market breadth for altcoins seems to be deteriorating from the high breadth levels we have seen at the beginning of the year.

The majority of our tracked set of altcoins is below their respective 200-day moving average, i.e. is currently in a general downtrend. Moreover, only 1/5 of tracked altcoins is currently above their short-term 20-day moving average.

In general, altcoin outperformance goes hand in hand with an increase in crypto dispersion, i.e. Bitcoin and altcoins are generally trading up during “altseason” with altcoins outperforming Bitcoin. Broader altcoin outperformance is usually a sign of increasing risk appetite and broader altcoin underperformance a sign of increasing risk aversion.

Thus, the above mentioned metrics could be sign that overall market risk appetite within cryptoasset markets is still rather cautious.

Bottom Line: These observations imply that further upside for BTC appears to be somewhat limited in the short-term because of elevated sentiment, positioning and weak on-chain activity. Altcoins managed to outperform Bitcoin lately but market breadth has clearly weakened compared to the beginning of the year.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.