Laden Sie den vollständigen Bericht im PDF-Format herunter

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Der November war ein ziemlich harter Monat für Kryptoassets aufgrund des Zusammenbruchs einer der größten Krypto-Börsen FTX

- Unser intern der Indikator für die Geldpolitik hat sich in letzter Zeit deutlich abgeschwächt, da der Markt begonnen hat, eine moderatere Haltung der US-Geldpolitik einzupreisen - dies sollte ein makroökonomischer Rückenwind für Kryptoassets in der Zukunft sein

- Die Wahrscheinlichkeit einer Bitcoin-Bodenbildung ist in letzter Zeit auf der Grundlage des Random-Forest-Modells gestiegen, aber die Gesamtwahrscheinlichkeit bleibt relativ gering. Eine mögliche Kapitulation der Miner könnte die Preise kurzfristig weiter unter Druck setzen

Chart des Monats

Leistungsüberprüfung

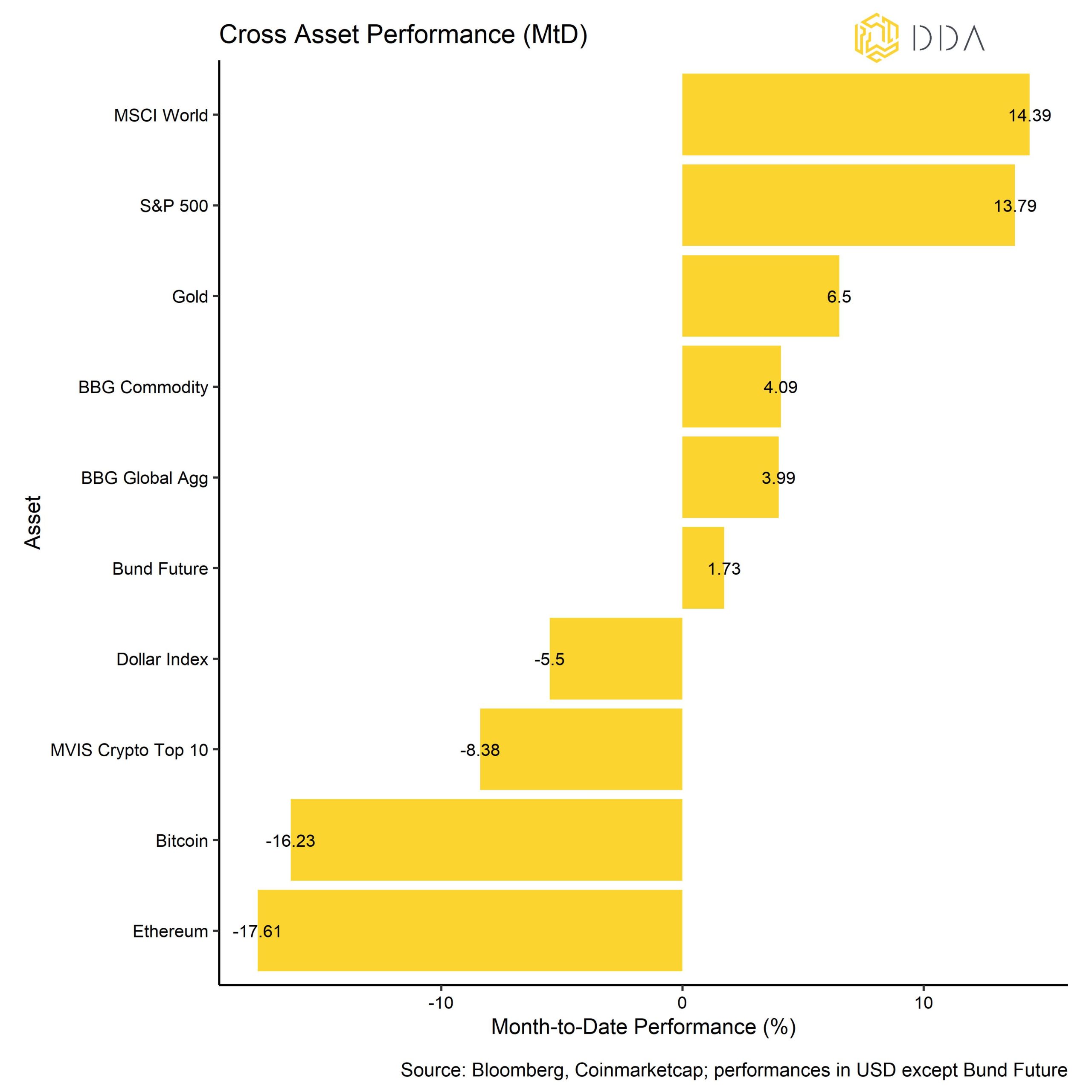

Der November war ein ziemlich harter Monat für Kryptoassets. Aufgrund des Zusammenbruchs der großen Kryptobörse FTX Anfang November stieg die Volatilität im Vergleich zur Oktoberflaute deutlich an.

Über die Hintergründe und Folgen des Zusammenbruchs von FTX haben wir ausführlicher berichtet hier und hier.

Kurz gesagt, FTX ging von der 4th größte Kryptobörse der Welt innerhalb einer einzigen Woche in Konkurs. Auch der Gründer und CEO von FTX, Sam Bankman-Fried, musste mit ansehen, wie sich sein Milliardenvermögen innerhalb weniger Tage in Luft auflöste.

Das Leben kann schnell gehen, besonders auf den Kryptomärkten. Ein Kollege von mir sagte nach der Woche des FTX-Einbruchs: "Es gibt Jahrzehnte, in denen nichts passiert, und es gibt Wochen, in denen Jahrzehnte passieren".

Glücklicherweise waren wir bei Deutsche Digital Assets weder bei FTX noch bei BlockFi engagiert und konnten diese Situation ohne finanzielle Verluste überstehen.

Der Zusammenbruch von FTX wird die Kryptomärkte sicherlich stärker ins Visier der Regulierungsbehörden rücken, obwohl der Zusammenbruch selbst mehr mit der traditionellen zentralisierten Kontrolle über Vermögenswerte zu tun hatte als mit der dezentralen Natur von Blockchains und der dezentralen Kontrolle über Vermögenswerte. Wenn überhaupt, dann hat der Zusammenbruch von FTX die Notwendigkeit einer stärkeren Dezentralisierung und einer echten Nutzung der Blockchain-Technologie hervorgehoben.

Positiv zu vermerken ist, dass der Zusammenbruch von FTX bisher zu verstärkten Bemühungen um mehr Transparenz unter den Kryptobörsen geführt hat, wie etwa die "Proof-of-Reserves"-Initiativen bei Binance, Kraken oder Gemini. Sie sind sicherlich ein Schritt in die richtige Richtung, obwohl diese Daten bereits öffentliche Informationen für On-Chain-Analysten waren. Was noch fehlt, sind Daten über die Verbindlichkeiten dieser Reserven.

Was die allgemeine Marktentwicklung anbelangt, so dominierte im November die Angst vor einer finanziellen Ansteckung die Marktstimmung, da der Markt versuchte, Unternehmen herauszufiltern, die möglicherweise in erheblichem Umfang mit FTX oder dessen Muttergesellschaft Alameda Research in Verbindung standen oder mit ihnen Geschäfte machten. Insbesondere größere Krypto-Lending-Unternehmen wie BlockFi (das später ebenfalls Konkurs anmeldete), Nexo und Genesis gerieten ins Visier des Marktes.

Infolgedessen markierten wir am 21. Dezember einen neuen Tiefststand des Bitcoin-Kurses auf Schlusskursbasis.st im November.

Die Marktstimmung hat sich erst kürzlich mit der Ankündigung eines potenziellen Fonds für notleidende Vermögenswerte durch den Börsenriesen Binance stabilisiert, der über ein potenzielles trockenes Pulver in Höhe von 1 Mrd. USD für notleidende Kryptounternehmen verfügt, möglicherweise sogar mehr.

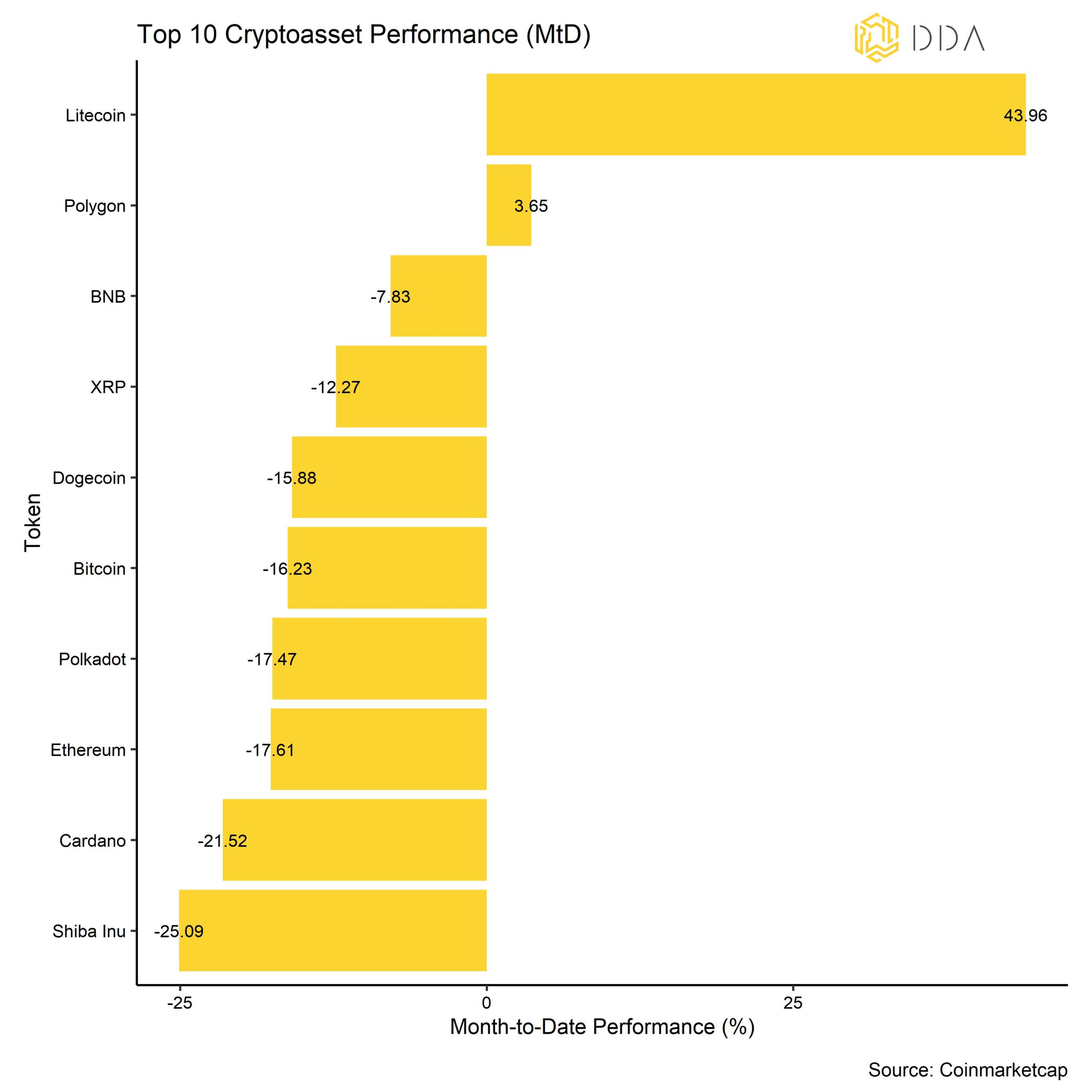

Unter den Top 10 der wichtigsten Kryptoassets waren Litecoin, Polygon und BNB die größten Outperformer. Litecoin-Tokens erholten sich aufgrund der erwarteten Halbierung im August 2023.

Die allgemeine Risikobereitschaft für Altcoins war relativ hoch, wenn man unseren internen Altseason-Index (siehe Anhang) betrachtet. 50% der wichtigsten Altcoins, die der Index abbildet, konnten sich im Laufe des Monats besser entwickeln als Bitcoin, trotz der durch FTX verursachten Verluste.

Unser intern Der Crypto Dispersion Index bedeutet, dass die Wertentwicklung von Kryptowährungen in den letzten 30 Tagen hauptsächlich durch systematische Faktoren beeinflusst wurde. Ein niedriger Wert des Crypto Dispersion Index bedeutet, dass die durchschnittlichen paarweisen Korrelationen zwischen Altcoins und Bitcoin hoch sind, was bedeutet, dass Bitcoin und Altcoin meist in dieselbe Richtung handeln und von denselben Faktoren beeinflusst werden.

Unterm Strich: Der November war aufgrund des Zusammenbruchs einer der größten Krypto-Börsen FTX ein ziemlich harter Monat für Kryptoassets. Die Streuung zwischen den Kryptoassets war gering, aber die Hälfte der Altcoins konnte Bitcoin im letzten Monat übertreffen.

Kommentar zu Makro & Märkte

Während die Märkte für Kryptowährungen infolge des FTX-Zusammenbruchs unter enormem Druck standen, entwickelten sich die traditionellen Finanzmärkte recht gut. Der Hauptauslöser für eine Wiederbelebung der Risikobereitschaft im November war die Tatsache, dass die US-Inflationsdaten für Oktober unter den Konsenswerten lagen und darauf hindeuteten, dass die Inflationszahlen endlich ins Rollen kommen. Infolgedessen sanken die Renditen von US-Schatzpapieren und der Dollar verlor deutlich, da der Markt eine moderatere Haltung der US-Geldpolitik einpreist. Der Rückgang der Renditen und die Abwertung des Dollars lockerten die finanziellen Bedingungen und verhalfen den globalen Aktien im November zu einer kräftigen Erholung.

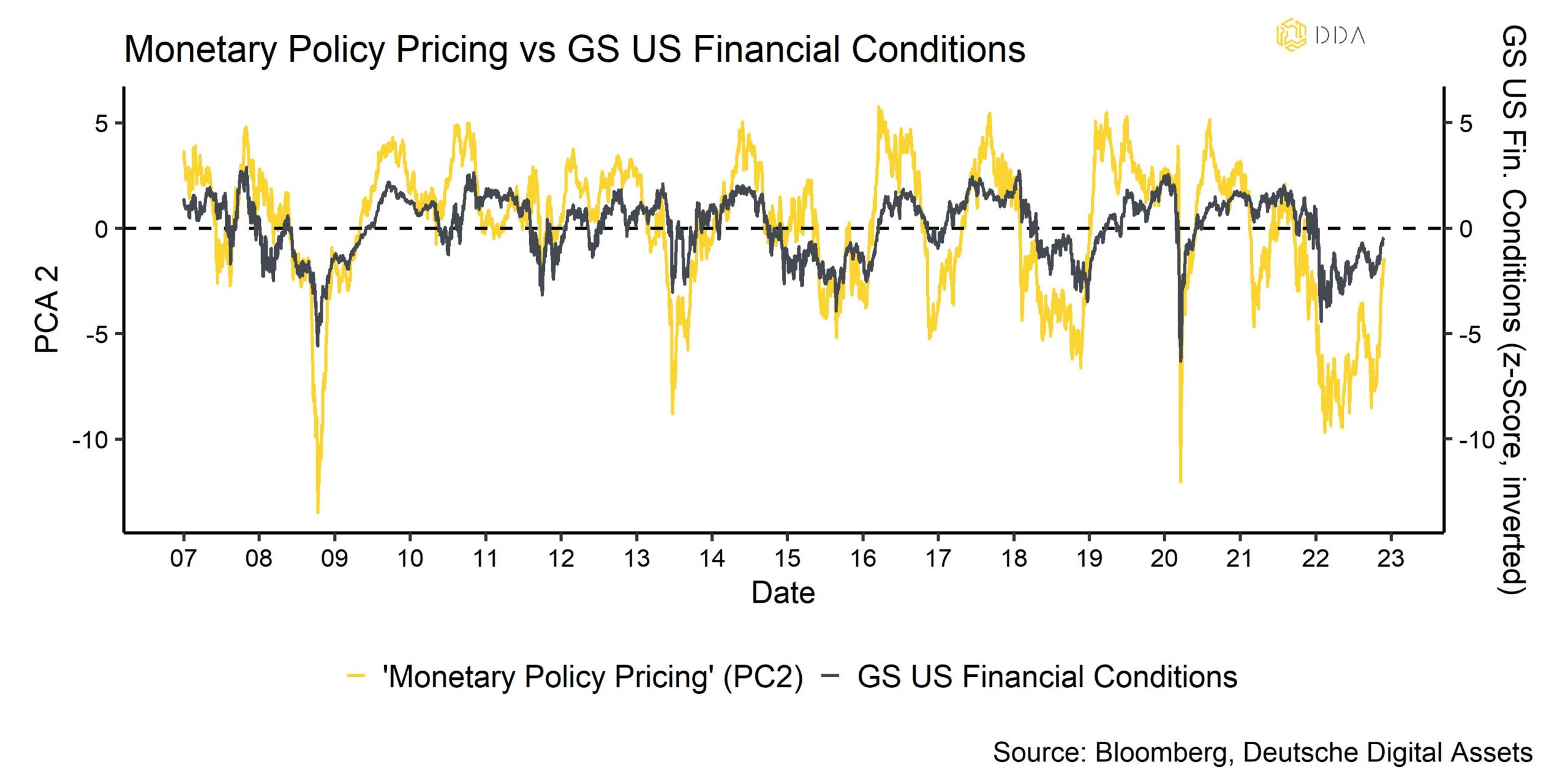

Dies zeigt sich auch in unserem intern Indikator für die Preisgestaltung der Geldpolitik, der von einem sehr niedrigen Niveau aus angestiegen ist und somit auf eine Lockerung der Geldpolitik hinweist, wie sie vom Markt bewertet wird.

Nach unseren Berechnungen bleibt die Geldpolitik auch für Bitcoin der dominierende Makrofaktor. Wie wir in unserem letzten Crypto Market Intelligence-Bericht im Oktober 2022 dargelegt haben, sind wir nach wie vor der Meinung, dass ein "Fed-Pivot", d.h. eine Umkehr der restriktiven Geldpolitik der Fed, die notwendige Makro-Bedingung für eine nachhaltige Stabilisierung der Bitcoin- und Kryptoasset-Märkte im Allgemeinen ist. Wir sind nach wie vor der Meinung, dass die jüngste Verbesserung des makroökonomischen Umfelds auch für Bitcoin und Kryptoassets im Allgemeinen ein Rückenwind sein wird. Der Zusammenbruch von FTX könnte die makroökonomische Verbesserung der letzten Zeit, insbesondere die starke Abwertung des Dollars, nur überlagert haben.

Tatsächlich schneidet Bitcoin historisch gesehen in einem schwachen Dollarumfeld am besten und in einem starken Dollarumfeld am schlechtesten ab.

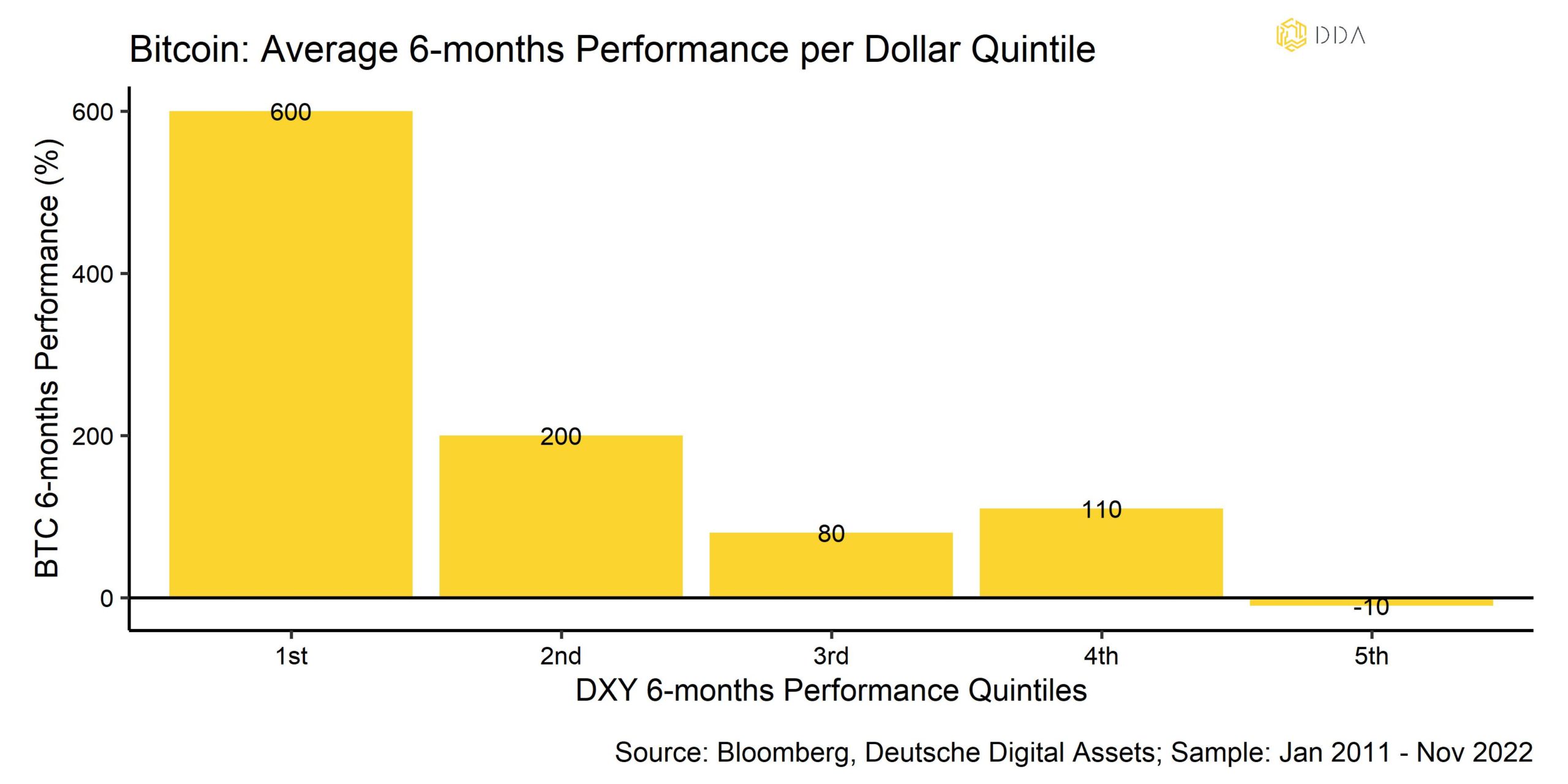

Die folgende Tabelle verdeutlicht diese empirische Beobachtung:

Die Tabelle zeigt die durchschnittliche 6-Monats-Performance von Bitcoin auf der Grundlage verschiedener Grade der 6-Monats-Performance des Dollar-Index (DXY). Die Quintile unterteilen die Stichprobe in 5 gleich große Unterstichproben. Die 1st Quintil repräsentiert die Unterstichprobe der 1/5 schwächsten Dollar-Performance (Dollar-Abwertungen) und die 5th Quintil repräsentiert die Unterstichprobe der 1/5 stärksten Dollar-Performance (Dollar-Aufwertungen).

Einerseits hat Bitcoin in den unteren 1/5 der Fälle, in denen der Dollar am stärksten abwertete, innerhalb von 6 Monaten durchschnittlich +600% zugelegt. Andererseits verzeichnete Bitcoin innerhalb von 6 Monaten eine durchschnittliche Performance von -10% in den oberen 1/5 der Fälle, in denen der Dollar am stärksten aufwertete.

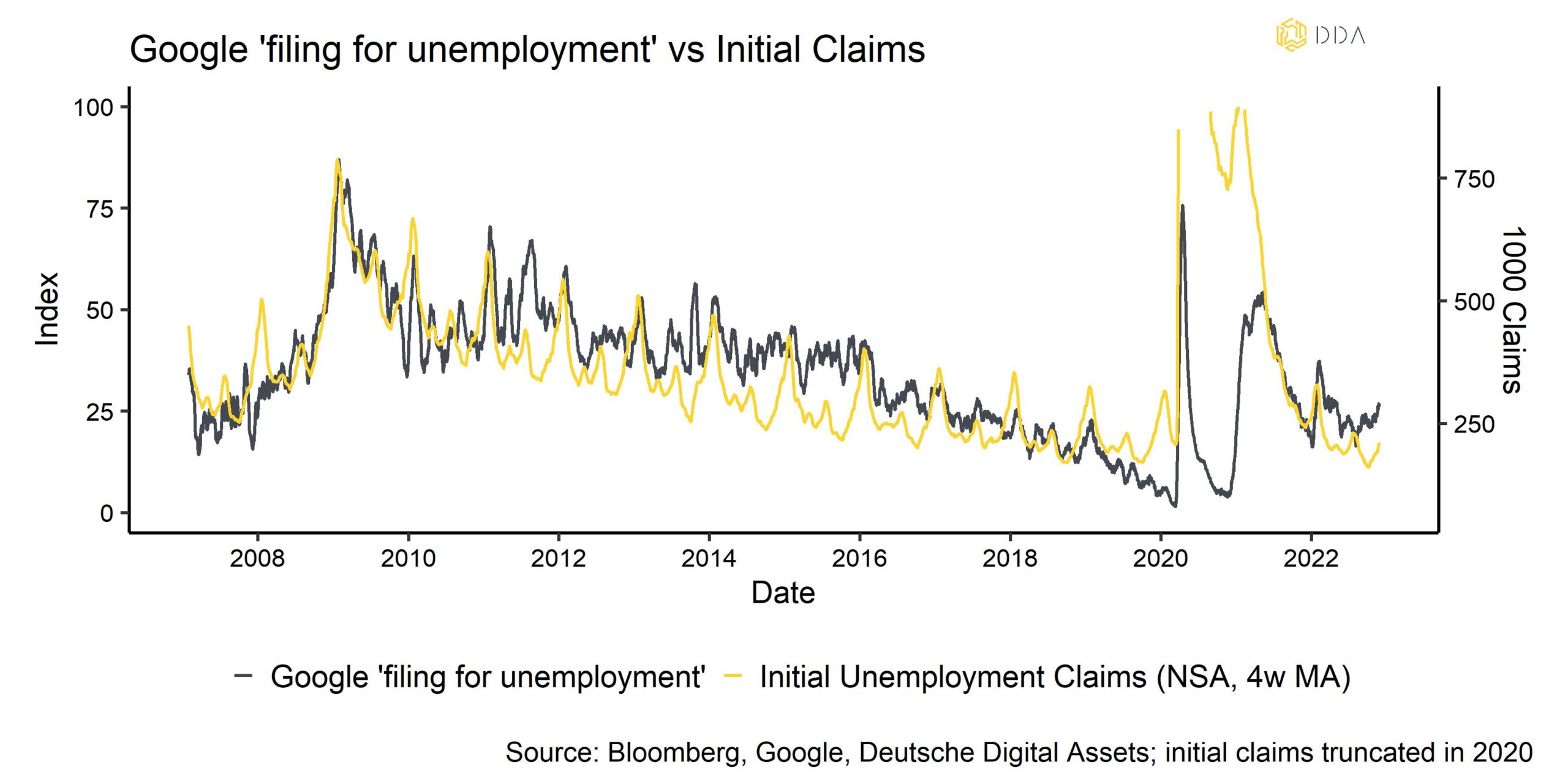

Obwohl die Inflationswerte in den USA in den kommenden Monaten wahrscheinlich weiter sinken werden, da sich die Indikatoren für die Lieferkette abschwächen und sich die Rohstoffpreise aufgrund der derzeitigen Konjunkturabschwächung entspannt haben, ist es nach wie vor ungewiss, ob es kurzfristig zu einem deutlichen Anstieg der Arbeitslosigkeit kommen wird. Der Grund, warum sich die Anleger auf die US-Beschäftigung konzentrieren, ist die Tatsache, dass ein schwächerer Arbeitsmarkt die Fed weiter unter Druck setzen könnte, eine moderatere geldpolitische Haltung einzunehmen und somit den Markt näher an den "Fed-Pivot" zu bringen.

Im November gab es bisher den größten Anstieg von Entlassungsankündigungen in diesem Jahr bei großen Technologieunternehmen wie Amazon oder Google, die beide den Abbau von jeweils rund 10000 Stellen angekündigt haben. Es bleibt abzuwarten, ob sich diese Entlassungsankündigungen insgesamt bereits in den Novemberdaten oder erst in späteren Veröffentlichungen niederschlagen.

Frühe Frühindikatoren für Anträge auf Arbeitslosenunterstützung wie Google-Suchanfragen nach "Anmeldung zur Arbeitslosigkeit" in den USA haben sich in letzter Zeit erholt, sind aber noch nicht wesentlich gestiegen.

Das Risiko für den Markt besteht also darin, dass die bevorstehende Veröffentlichung die erwartete Verlangsamung auf dem US-Arbeitsmarkt noch nicht bestätigt. Dies ist jedoch im Wesentlichen eine Frage des Timings, da die meisten Frühindikatoren bereits eindeutig auf eine Rezession in den USA mit hoher Wahrscheinlichkeit hindeuten und daher auch erhebliche Arbeitsplatzverluste sehr wahrscheinlich sind.

Unterm Strich:

Unser hauseigener Indikator für die Geldpolitik hat sich in letzter Zeit deutlich abgeschwächt, da der Markt begonnen hat, eine moderatere Haltung der US-Geldpolitik einzupreisen - dies sollte den Kryptoassets in Zukunft makroökonomischen Rückenwind verleihen. Der Rückgang der Renditen und die Abwertung des Dollars sollten Bitcoin unterstützen, da er historisch gesehen in einem schwachen Dollar-Umfeld am besten und in einem starken Dollar-Umfeld am schlechtesten abschneidet. Kurzfristig besteht das Risiko für den Markt darin, dass die bevorstehende Veröffentlichung der US-Arbeitsmarktdaten die erwartete Verlangsamung des US-Arbeitsmarktes noch nicht bestätigen wird.

On-Chain-Analytik

Ein Blick auf die On-Chain-Metriken zeigt, dass es im November zu erheblichen Störungen auf den Kryptoasset-Märkten kam.

Die wichtigsten Beobachtungen sind:

- Der Zusammenbruch von FTX stellt eines der größten Kapitulationsereignisse in der Geschichte von Bitcoin dar, mit über 21 Mrd. USD aggregierten realisierten Verlusten im November

- Der Markt wird immer noch unter der Kostenbasis gehandelt, die bei ~20,2k USD für Bitcoin und ~1370 USD für Ethereum liegt

- Unser hauseigener "Crypto Sentiment Index" ist auf den tiefsten Stand seit März 2020 abgestürzt

- Unsere hauseigene Metrik "BTC Composite Valuation" ist auf den untersten Wert von 20% der Beobachtungen gesunken

- Die BTC-Börsensalden sind im November deutlich gesunken, da vor allem Kleinanleger und sehr große Investoren die niedrigeren Preise genutzt haben, um stark zu akkumulieren

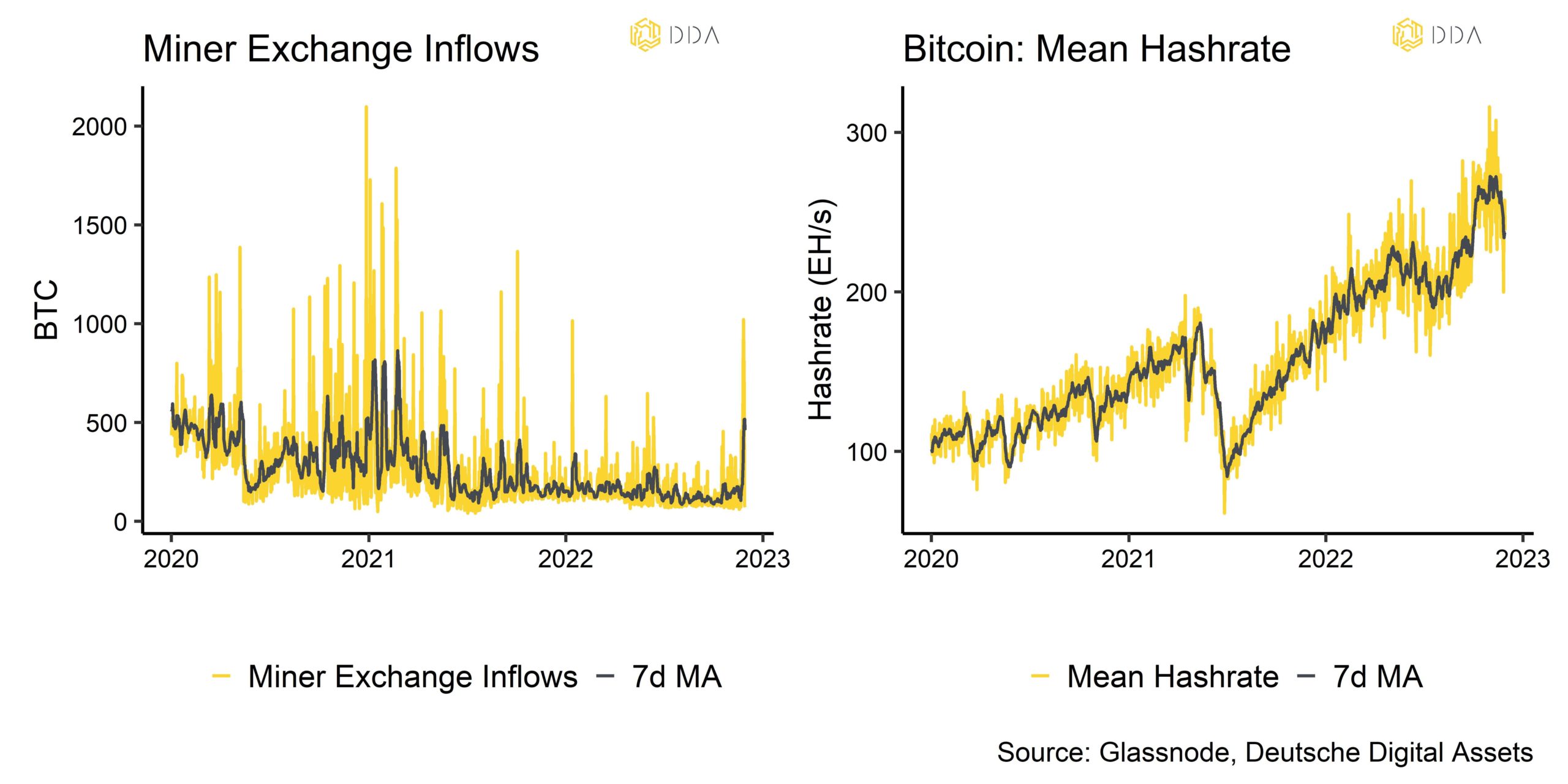

- Die niedrigen Preise setzen Bitcoin-Miner bereits unter Druck, ihre Reserven teilweise zu verkaufen und Mining-Rigs abzuschalten, was eine erhöhte Wahrscheinlichkeit der "Miner-Kapitulation" impliziert

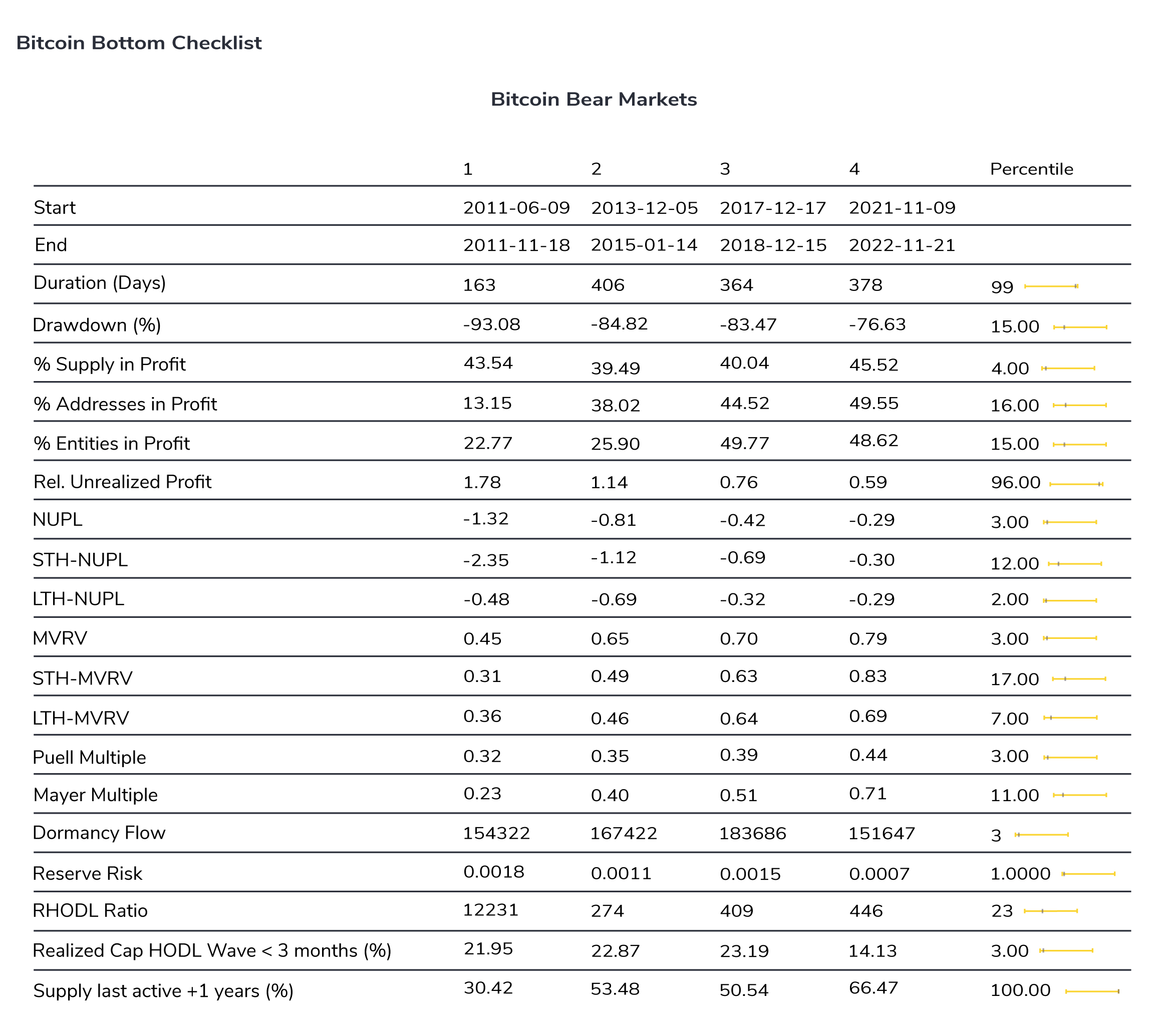

Alle oben genannten Beobachtungen deuten darauf hin, dass die Wahrscheinlichkeit einer zyklischen Bodenbildung infolge des FTX-Einbruchs deutlich gestiegen ist, da die kurzfristigen Investoren größtenteils aus dem Markt ausgestiegen sind und der Verkaufsdruck erschöpft zu sein scheint. Dies zeigt sich auch in der folgenden "Bitcoin Bottom Checkliste", in der viele Indikatoren bereits sehr niedrig/hoch sind, basierend auf ihren historischen Perzentilen.

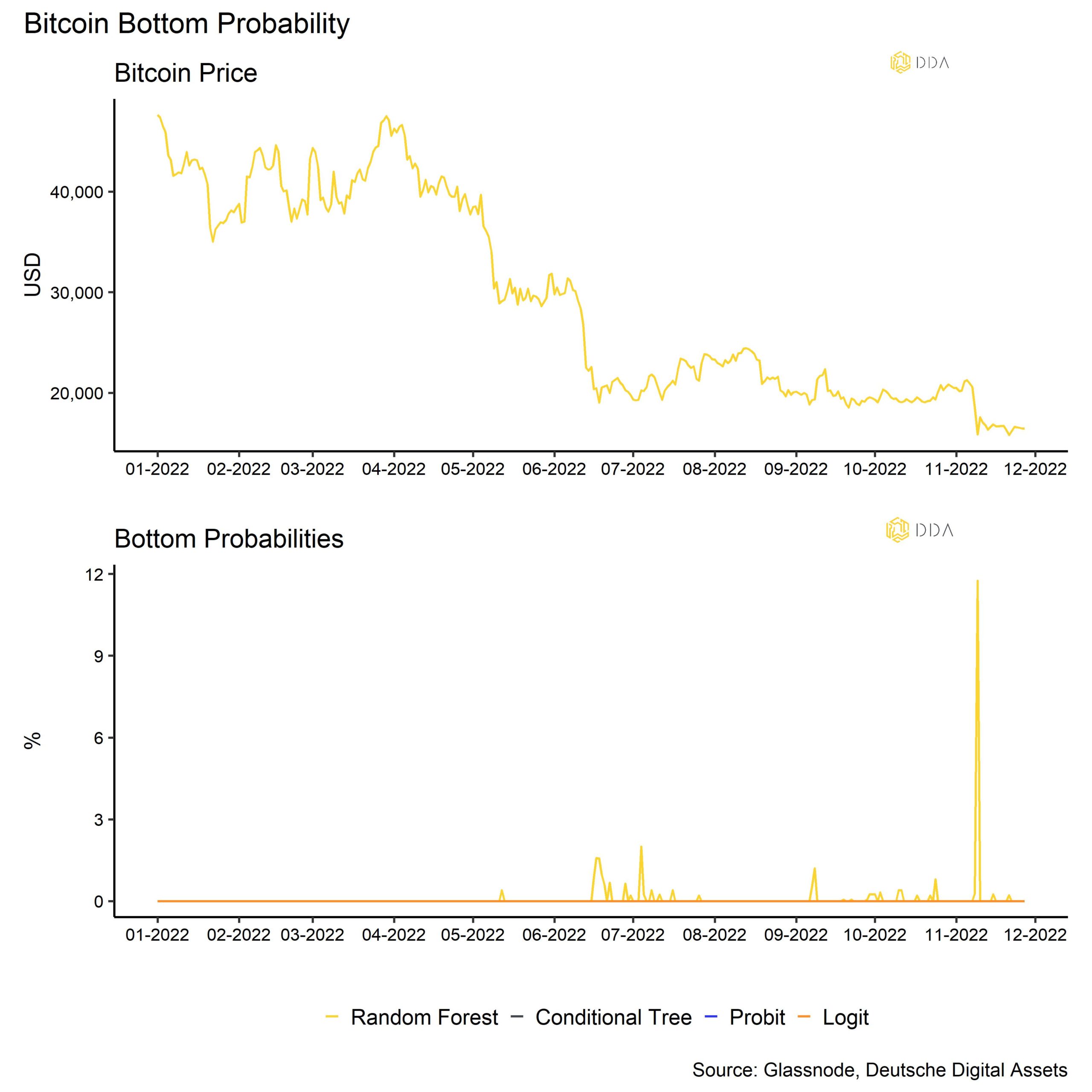

In der Tat ist unsere hauseigene Bitcoin-Bodenwahrscheinlichkeit genau an dem Tag in die Höhe geschnellt, als FTX zusammenbrach, was in unserem "Chart des Monats". Wir haben vor kurzem diese neue Metrik veröffentlicht hier.

Wir haben mehrere Bitcoin-On-Chain-Indikatoren kombiniert, um die Wahrscheinlichkeit eines zyklischen Tiefpunkts im Bitcoin-Kurs zu schätzen.

Die wichtigste Erkenntnis aus dieser Analyse ist, dass, obwohl die Wahrscheinlichkeit eines Bitcoin-Bodens in letzter Zeit basierend auf dem Random-Forest-Modell gestiegen ist, die Gesamtwahrscheinlichkeit relativ niedrig bleibt. Bitte beachten Sie, dass eine Wahrscheinlichkeit von 12% nicht bedeutet, dass eine Bodenbildung noch nicht stattgefunden hat. Es bedeutet nur, dass es statistisch gesehen eher unwahrscheinlich ist.

Dennoch könnte eine mögliche Kapitulation der Miner kurzfristig weiteren Abwärtsdruck auf die Preise ausüben. Wir haben erst kürzlich einen deutlichen Anstieg der Überweisungen von Bitcoin-Minern an Börsen beobachtet, was auf verstärkte Verkaufsaktivitäten von BTC-Minern hinweist. Diese Überweisungen der Miner waren die bisher höchsten im Jahr 2022.

Tatsächlich fressen die Bitcoin-Miner derzeit ihre Reserven auf und haben auch ihre Hash-Rate reduziert, da einige Mining-Aktivitäten angesichts der sehr niedrigen Preise unwirtschaftlich geworden sind. All diese Beobachtungen deuten auf eine erhöhte Wahrscheinlichkeit einer so genannten "Miner-Kapitulation" hin, die man normalerweise bei Markttiefs beobachtet. Die aktuellen Preise liegen unter dem aggregierten Break-Even-Preis für BTC-Miner, der bei 19,5.000 USD liegt. Der durchschnittliche BTC-Miner arbeitet also derzeit mit Verlust.

Tatsächlich fressen die Bitcoin-Miner derzeit ihre Reserven auf und haben auch ihre Hash-Rate reduziert, da einige Mining-Aktivitäten angesichts der sehr niedrigen Preise unwirtschaftlich geworden sind. All diese Beobachtungen deuten auf eine erhöhte Wahrscheinlichkeit einer so genannten "Miner-Kapitulation" hin, die man normalerweise bei Markttiefs beobachtet. Die aktuellen Preise liegen unter dem aggregierten Break-Even-Preis für BTC-Miner, der bei 19,5.000 USD liegt. Der durchschnittliche BTC-Miner arbeitet also derzeit mit Verlust.

Abgesehen davon ist das Ausmaß, in dem Kleinanleger diese niedrigeren Preise zur Akkumulation von Münzen genutzt haben, beeindruckend. Unser Akkumulationstrend-Score, bei dem der Anstieg des Guthabens in den Geldbörsen mit der jeweiligen Größe der Geldbörsen gewichtet wird, war bei Geldbörsenkohorten mit Guthaben zwischen 0,01 BTC und 10 BTC sowie über 100000 BTC besonders stark. Ebenso sind die Börsenguthaben im November stark zurückgegangen, was auf eine beträchtliche Akkumulation hindeutet, da diese Münzen von den Börsen in die kalte Lagerung überführt werden. Aus dieser Sicht ist die Menge des illiquiden Angebots auf ein neues Allzeithoch gestiegen, was normalerweise ein bullisches Signal ist. Nur 12% des gesamten Bitcoin-Angebots befinden sich derzeit in den Wallets der Börsen.

Unterm Strich: Die On-Chain-Metriken zeigen, dass es im November zu erheblichen Störungen auf den Kryptoasset-Märkten gekommen ist. Die Wahrscheinlichkeit einer Bitcoin-Bodenbildung hat sich in letzter Zeit auf der Grundlage des Random-Forest-Modells erhöht, aber die Gesamtwahrscheinlichkeit bleibt relativ gering. Eine mögliche Kapitulation der Miner könnte kurzfristig weiteren Abwärtsdruck auf die Preise ausüben. Der Grad der Akkumulation, insbesondere durch kleinere Wallet-Kohorten, war bei diesen niedrigen Preisen jedoch sehr stark.

Laden Sie den vollständigen Bericht mit Anhang hier herunter.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Aktuelle Nachrichten und Artikel

- Institutionelle Krypto-Annahme: Warum und wie Institutionen auf Krypto umsteigen

- Krypto-Portfolio-Zusammensetzung: Wie sich verschiedene Portfolios während der jüngsten Bullen- und Bärenmärkte entwickelt haben

- Wie man in Ethereum (ETH) investiert: Ein Leitfaden für professionelle Anleger

- Das Argument für aktiv verwaltete Anlagestrategien auf den Kryptomärkten

- Wie man in NFTs investiert: Ein Leitfaden für professionelle Anleger

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

Deutsche Digital Assets in der Presse

- ETF-Stream: Zahl der White-Label-Emittenten in Europa innerhalb einer Woche verdreifacht

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.