Wir leben in unglaublichen Zeiten. Die Weltgesundheitsorganisation (WHO) hat eine globale Pandemie über eine neues Coronavirus die eine Krankheit verursacht, die als COVID-19 die sich in mindestens 170 Ländern und Gebieten ausgebreitet hat und mehr als 114.000 Menschen und infizierten mehr als 1.800.000 Menschen, so die Weltmessgeräte.

Die Welt, wie wir sie kennen, kommt zum Stillstand und fast jeder Aspekt des Lebens eines jeden Menschen auf diesem Planeten ist davon betroffen.

In vielen Ländern auf der ganzen Welt ist der Betrieb eingestellt, d. h. alle "nicht lebensnotwendigen" Unternehmen müssen für eine bestimmte Zeit bzw. bis auf weiteres geschlossen bleiben. Weitere Informationen darüber, was als nicht lebenswichtig eingestuft wird, finden Sie in den folgenden Beispielen aus dem Vereinigten Königreich hier.

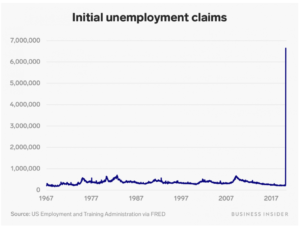

Das bedeutet, dass Unternehmen jeder Größenordnung in jedem Land, vom örtlichen Friseur bis hin zu riesigen Softwareunternehmen oder Produktionsbetrieben, einen massiven Tribut zahlen müssen, da die Mitarbeiter aufgefordert werden, zu bleiben und von zu Hause aus zu arbeiten. Die Arbeitslosigkeit ist weltweit in die Höhe geschnellt wie nie zuvor, und die globale Wirtschaft wird hart getroffen. Jedes Land und jeder Einzelne spürt den Schmerz.

Schaubild 1

Schaubild 1

Dieses Schaubild sollte die Dinge ins rechte Licht rücken, und wir stehen erst am Anfang. Ich erwarte, dass sich dieser Trend in den kommenden Wochen fortsetzen wird.

Lesen Sie den ausführlichen Artikel von Business Insider hieraber beachten Sie die folgende kurze Zusammenfassung.

- Wie das US-Arbeitsministerium am Donnerstag, den 9. April 2020, mitteilte, haben in der am Samstag zu Ende gegangenen Woche 6,3 Millionen Amerikaner einen Antrag auf Arbeitslosenversicherung gestellt - fast so viele wie in der Vorwoche.

- Das US-Arbeitsministerium berichtete am Donnerstag, den 2. April 2020, dass in der Woche, die am 28. März endete, 6,64 Millionen Amerikaner einen Antrag auf Arbeitslosenversicherung gestellt haben - mehr als doppelt so viele wie in der Vorwoche.

- Das US-Arbeitsministerium berichtete am Donnerstag, den 26. März, dass die Zahl der Anträge auf Arbeitslosenunterstützung in der Woche zum 21. März auf einen neuen Rekordwert von 3,28 Millionen gestiegen ist.

- Das sind fast 17 Millionen Menschen, die in nur drei Wochen Leistungen beantragen.

Länder auf der ganzen Welt bringen milliardenschwere Hilfspakete auf den Weg und pumpen insgesamt Billionen von Dollar in die Wirtschaft.

Die nachstehenden Angaben sollen Aufschluss über die Geschwindigkeit geben, mit der die Maßnahmen durchgeführt werden.

Woche ab dem 9. März 2020:

Montag war der "Schwarze Montag", der schlimmste Börsentag seit 2008.

Dienstag war Italiens erster Tag der vollständigen Abriegelung, und die Zahl der Covid19-Fälle wurde weltweit überschritten.

Mittwoch erklärt die WHO das Coronavirus zu einer Pandemie.

Donnerstag war der "Schwarze Donnerstag", der schlimmste Tag für Kryptowährungen und ein schrecklicher Tag für traditionelle Märkte, an dem die Fed $1,5T zu den Repo-Märkten hinzufügte.

Freitag rufen die USA den nationalen Notstand aus.

Samstag wird das erste fiskalische Konjunkturprogramm von Corona im US-Repräsentantenhaus verabschiedet.

Sonntag die Fed setzt die Zinssätze auf 0% und druckt $700b aus dem Nichts, als ob es 2008 wäre.

Montag sagt die Fed, dass sie zusätzliche $500b an Repo-Finanzierung anbieten wird.

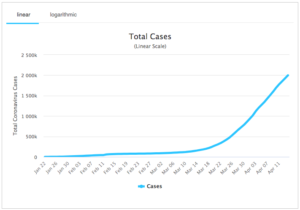

27. MärzWeltweit wurden mehr als 500.000 Fälle registriert, und die USA stehen an der Spitze der registrierten Fälle, und es sieht nicht so aus, als würde sich die Pandemie verlangsamen.

5. AprilWeltweit wurden 1,2 Millionen Fälle registriert.

April 12 Neel Kashkri von der FED warnt, Amerika müsse sich auf 18 Monate rollende Abschaltungen einstellen.

April 13 Weltweit wurden 1,8 Millionen Fälle registriert.

Das Schlimmste daran ist, dass die Kurve noch nicht abgeflacht ist, sondern dass die Geschwindigkeit, mit der sich das Virus weiter ausbreitet, alarmierend ist. Die Zahl der weltweiten Fälle hat sich innerhalb einer Woche ungefähr verdoppelt.

Ich persönlich glaube, dass dies auf die Untätigkeit der führenden Politiker der Welt zurückzuführen ist, aber wir sind nicht hier, um mit dem Finger auf andere zu zeigen, sondern um zu sehen, was getan werden kann, um dies zu stoppen.

Schaubild 2

Die Menschheit befindet sich jetzt auf unbekanntem Terrain, und offen gesagt hat noch niemand eine Pandemie dieses Ausmaßes erlebt oder sich auch nur vorstellen können. Wie bereits erwähnt, müssen alle, von Einzelpersonen bis hin zu den größten Regierungsstellen, Maßnahmen ergreifen, um die Situation in den Griff zu bekommen, aber wir haben kein Handbuch, wie das geschehen könnte.

Im Folgenden finden Sie einige Beispiele für die Schritte, die die Welt unternimmt.

Die Olympischen Spiele wurden verschoben, die NBA, die NFL und die weltweiten Sportligen sind bis auf Weiteres geschlossen.

Konjunkturpakete gibt es nur in den USA, unten finden Sie weitere Beispiele.

EZB stellt 750 Mrd. Euro als Konjunkturprogramm gegen das Coronavirus vor.

Singapur stellt $34 Mrd. Euro für die Bekämpfung des Coronavirus bereit.

Als die FED erkannte, dass die Senkung der Zinssätze und das Drucken von Billionen von Dollar nicht ausreichen würden, beschloss sie, noch drastischere Maßnahmen zu ergreifen und in einem kürzlich geführten Interview sagten, sie könnten unbegrenzter Erwerb von Vermögenswerten und "Es gibt eine unendliche Menge an Bargeld in der Federal Reserve".

Fluggesellschaften auf der ganzen Welt haben ihre gesamte Flotte stillgelegt oder operieren im einstelligen Prozentbereich.

Führende Analysten und Wirtschaftswissenschaftler warnen die Menschen und fordern sie auf "Bereitet euch auf die tiefste Rezession aller Zeiten vor".

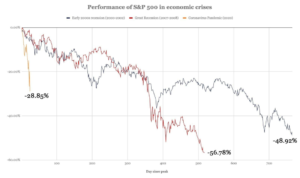

Ein Artikel von Zerohedge gibt einen detaillierten Einblick in die Zahlen des Geschehens auf dem Aktienmarkt. Ich verstehe, dass einige dies nicht als die zuverlässigste Nachrichtenquelle ansehen, aber alle Informationen können doppelt geprüft und bestätigt werden.

Um die Dinge ins rechte Licht zu rücken, sollten wir die Zahlen mit denen früherer Rezessionen vergleichen (siehe Abbildung).

Schaubild 3

Die COVID19-Pandemie hat die Weltmärkte in einem noch nie dagewesenen Ausmaß in den Abgrund gestürzt.

Da der Reiseverkehr und der Handel zum Erliegen kommen, sinkt die Nachfrage nach Öl erheblich, und der Ölpreis ist auf den niedrigsten Stand seit 20 Jahren gefallen, auf fast $20 pro Barrel.

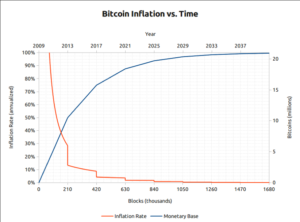

Das Bitcoin-Whitepaper ist ein Produkt der jüngsten globalen Rezession und wurde am 31. Oktober 2008 veröffentlicht, als die Welt die Finanzkrise durchlebte.

Die Wirtschaftskrise von 2008 wurde durch die unvollkommenen Mechanismen von QE (Quantitative Easing) und Zinssätzen nahe 0% gestützt, was eine der größten Zentralbankinterventionen in der Geschichte war und als Inspiration für Bitcoin diente.

Allein im Jahr 2008 haben die Regierungen ihre Basisgeldmenge um 41% erhöht. Seitdem haben die Zentralbanker die Menge an Basisgeld - Yen, USD, Euro, Yuan usw. - verdreifacht.

Das Drucken von Papiergeld funktionierte für die Banker in den 2010er Jahren. Währenddessen steckte Krypto noch in den Kinderschuhen.

Ich erwarte, dass die Rettungsmaßnahmen der Finanzkrise von 2008 im Vergleich zu dem, was uns in den nächsten Jahren bevorsteht, unbedeutend sein werden. Die Auswirkungen dessen, was wir derzeit erleben, werden erst in den kommenden Monaten zu spüren sein, wenn überhaupt.

Erlauben Sie mir, das näher auszuführen.

Seit 2013 hat Boeing mehr als $100 Milliarden ausgegeben, um seine eigenen Aktien zurückzukaufen und deren Wert zu steigern. Jetzt bittet das Unternehmen die US-Regierung um eine Rettungsaktion in Höhe von $60 Mrd., die Präsident Trump verständlicherweise befürwortet, um amerikanische Unternehmen und Arbeitsplätze zu retten. Dies geschieht, während Millionen von Amerikanern ihren Arbeitsplatz verlieren und auf Lebensmittelbanken zurückgreifen müssen.

Und das weniger als eine Woche, nachdem die USA den nationalen Notstand ausgerufen haben.

Schauen wir uns nun an, welche Schritte die FED in den letzten Wochen unternommen hat, und sehen wir, in welche Richtung wir uns bewegen? Sehen Sie irgendwelche Ähnlichkeiten? Ich glaube, dass es dieses Mal noch viel schlimmer sein wird, und um den Aktienmarkt zu stützen, werden die Regierungen zusätzlich zu den Krediten auch noch nationale Aktien kaufen.

Meine persönliche Vorhersage: Ich glaube, wir stehen erst am Anfang, und nach dem Börsenchaos wird es noch viel schlimmer werden, wenn der Markt für Anleihen und Unternehmensschulden zu implodieren beginnt, weil Entwicklungsländer und KMU ihre Kredite nicht mehr bedienen können. Es könnte sogar noch viele weitere Fälle ähnlich wie in Venezuela geben, wo Währungen innerhalb kürzester Zeit wertlos werden.

Der Grund dafür, dass andere starke Währungen in den letzten Wochen im Vergleich zum Dollar an Wert verloren haben, ist, dass es sich um eine Liquiditätskrise handelt. In Zeiten wie diesen strömen alle in den US-Dollar.

Was ich damit sagen will, ist, dass ich nicht glaube, dass viele Menschen das Ausmaß oder die Geschwindigkeit verstehen, mit der sich die Weltwirtschaft abwickelt, und die Auswirkungen, die dies auf das Leben aller haben wird. Es wird viel schlimmer sein als alles, was wir in der Geschichte erlebt haben. Ich möchte nicht so negativ und düster erscheinen, aber ich kann nicht genug betonen, wie dringend die Menschen handeln müssen.

Diesmal hat die Welt jedoch bessere Optionen mit einer soliden Geldpolitik, für die sich jeder mit Internetzugang entscheiden kann, und das beginnt mit Bitcoin. Erlauben Sie mir, das noch einmal zu erläutern...

Nahezu 50% der Welt haben heute Zugang zum Internet.

~50 Millionen Menschen auf der ganzen Welt besitzen bereits Kryptowährungen.

Millionen weitere wissen davon, haben aber noch nicht den Schritt gewagt.

Weitere Milliarden werden es bald erfahren.

Im Jahr 2008 hatten sie keine Wahl, aber dieses Mal haben sie die Wahl.

Einige der Gründe für den astronomischen Anstieg des Bitcoin-Preises und seine Akzeptanz sind unten aufgeführt, und die Gründe, die ich glaube, dass er weiter wachsen wird.

- FIXED SUPPLY - es wird immer nur 21.000.000 Bitcoin (BTC) geben. Dies wurde im ursprünglichen Code des Produkts fest einkodiert

- Bitcoin ist das härteste Form des Geldes die jemals existiert hat und eine deflationäre Emissionsrate aufweist

- Sie ist vollständig dezentralisiert und wird nicht von einer Gruppe von Einzelpersonen oder einem Staat kontrolliert.

- Bitcoin ist erlaubnisfrei

- Bitcoin ist transparent und pseudonym

- Bitcoin ist grenzenlos

Und das Wichtigste: Bitcoin wird durch Mathematik und Code gesteuert.

Modernes Geld für moderne Zeiten.

Sie werden erleben, wie der Bitcoin erwachsen wird und sich der Krise stellt, für die er eigentlich konzipiert wurde.

Schließlich nähern wir uns schnell der Bitcoin-Halbierung, was bedeutet, dass die Menge der pro Block generierten "neuen Bitcoins" um 50% reduziert wird. Derzeit beträgt die Belohnung 12,5 Bitcoin pro Block. Ungefähr um den 14. Mai 2020 wird sie auf 6,25 Bitcoin pro Block sinken. Das Stock-to-Flow-Verhältnis von Bitcoin sinkt weiter und erhöht somit seinen Wert durch einfache ökonomische Gesetze.

Schaubild 4

Unten sehen Sie ein Bitcoin-Preisdiagramm mit eingezeichneten Halbwertszeiten. Viele glauben, dass der Preis pro Bitcoin deutlich steigen wird, wenn das Angebot sinkt und die Nachfrage steigt und sich ein Preisgleichgewicht einstellt.

Schaubild 5

Jeder, der die Kryptomärkte aufmerksam verfolgt, wird bemerkt haben, dass mit dem Absturz der traditionellen Märkte im März auch die Kryptomärkte abstürzten. Viele Leute verweisen darauf, dass die Aussage "Bitcoin ist ein unkorrelierter Vermögenswert" nicht mehr zutrifft. Ich stimme dem nicht zu, da die Stichprobengröße für dieses Ereignis zu klein ist und es sich um einen Flash-Crash handelte, der aufgrund von Panik an den Märkten auftrat. Seitdem hat sich Bitcoin deutlich besser erholt als jeder andere Markt und seinen Preis um ~100% gesteigert, was seine Nichtkorrelation weiter unter Beweis stellt. Ich erwarte, dass Bitcoin die traditionellen Märkte weiterhin übertreffen wird, da immer mehr Menschen auf der ganzen Welt Bitcoin und Kryptomärkte wählen, um ihre Wetten in den kommenden Monaten abzusichern.

Viele dieser Informationen, die ich vorgestellt habe, wurden bereits auf der ganzen Welt behandelt. Ich wollte sie alle an einem Ort zusammenfassen und Ihnen Fakten über die Pandemie, ihre Auswirkungen auf die Märkte und Bitcoin präsentieren, damit Sie sich selbst ein Urteil bilden können.

Alles, was ich sagen möchte, ist: Schnallt euch an. Wir werden bald genau herausfinden, woraus Bitcoin besteht.

Von Harsh Jani, Geschäftsentwicklung, Iconic Holding

# # #

Dieser Artikel dient ausschließlich zu Bildungszwecken und darf nicht als Finanzberatung verstanden werden.