Que Gälisch's Storm Titanic Partysong das jeder, der in den 90er Jahren gelebt hat, mit den Zehen wippen muss. Das Einzige, was ich kenne, das die Leute so zum Tanzen bringt wie dieser irische Klassiker, sind die Renditen, die in diesem Sommer in DeFi mit Kryptowährungen erzielt werden, und die 1.000-fachen Renditen, die Trader damit erzielen. Aber was ist Dezentrale Finanzwirtschaft und ist sie nur das neue Krypto-Schlagwort des Jahres 2020, oder wird sie die Finanz- und Kapitalmärkte, wie wir sie kennen, radikal verändern?

DeFi bezieht sich auf das Ökosystem, das für Produkte und Dienstleistungen entwickelt wird, die traditionell als Finanzprodukte und -dienstleistungen eingestuft werden, obwohl sie auf öffentlichen Blockchains basieren. Open-Source-Software nutzt die inhärent dezentrale Natur der Blockchain, z. B. auf Ethereum, um erlaubnisfreie, vermittlerlose und vertrauenslose Protokolle zu erstellen, die von:

- Geld-/Bankdienstleistungen (z. B. die Ausgabe von stabilen Kryptowährungen oder Vermögenswerten)

- P2P-Märkte für gepoolte Kredite und Anleihen

- Dezentrale Börsen, Liquiditätspools, Tokenisierung und mehr.

Die Vorteile von Smart Contracts ermöglichen es dezentralen Anwendungen (dApps) und Protokollen, diese Dienstleistungen ohne Zwischenhändler wie Zentralbanken, traditionelle Banken oder Finanzinstitute, wie wir sie gemeinhin kennen, anzubieten. Dies senkt die Einstiegshürden für Nutzer erheblich und beseitigt die meisten Betriebskosten, insbesondere die astronomischen Gemeinkosten von Finanzinstituten. Angesichts der Flexibilität und des Vertrauens, das DeFi bietet, ist es kein Wunder, dass es zum heißen Thema der Krypto-Sphäre im Jahr 2020 geworden ist, mit etwa $600M in DeFi Smart Contracts und Anwendungen zu Beginn des Jahres. Zum Zeitpunkt des Verfassens dieses Artikels ist diese Zahl auf fast $5B angestiegen, laut DeFi-Pulsmit $4B an Sperrungen seit Juni. Es gibt keine Anzeichen für eine Verlangsamung des DeFi!

Der Ansturm auf DeFi wird größtenteils von der P2P-Kreditvergabe vorangetrieben, wobei Protokolle wie Maker, der Emittent des beliebten DAI-Stablecoins, und Compound nahtlose Möglichkeiten zur Teilnahme an besicherten und dezentralen Kreditmärkten bieten. Der neue Liebling von DeFi, Uniswap, hat ein immenses Wachstum erlebt, da Liquiditätspools immer beliebter werden, und sogar Andreesen Horowitz hat sich daran beteiligt. Serie A von Uniswap. Die Kopplung solcher Plattformen hat zum Aufkommen von "Yield Farming" und "Liquidity Mining" geführt, die recht einfach beschrieben werden können, indem Krypto-Händler/-Inhaber ruhende Krypto-Vermögenswerte über diese Protokolle für nominale tägliche Renditen von einigen Basispunkten bis zu einigen Prozent in Betrieb nehmen (aber glauben Sie mir, es ist technisch viel komplexer als das). Das Konzept der "risikofreien Rendite" auf den Kapitalmärkten wurde praktisch auf den Kopf gestellt, während das Gegenparteirisiko auf den Kreditmärkten scheinbar aus der Gleichung gestrichen wurde. Oh je!

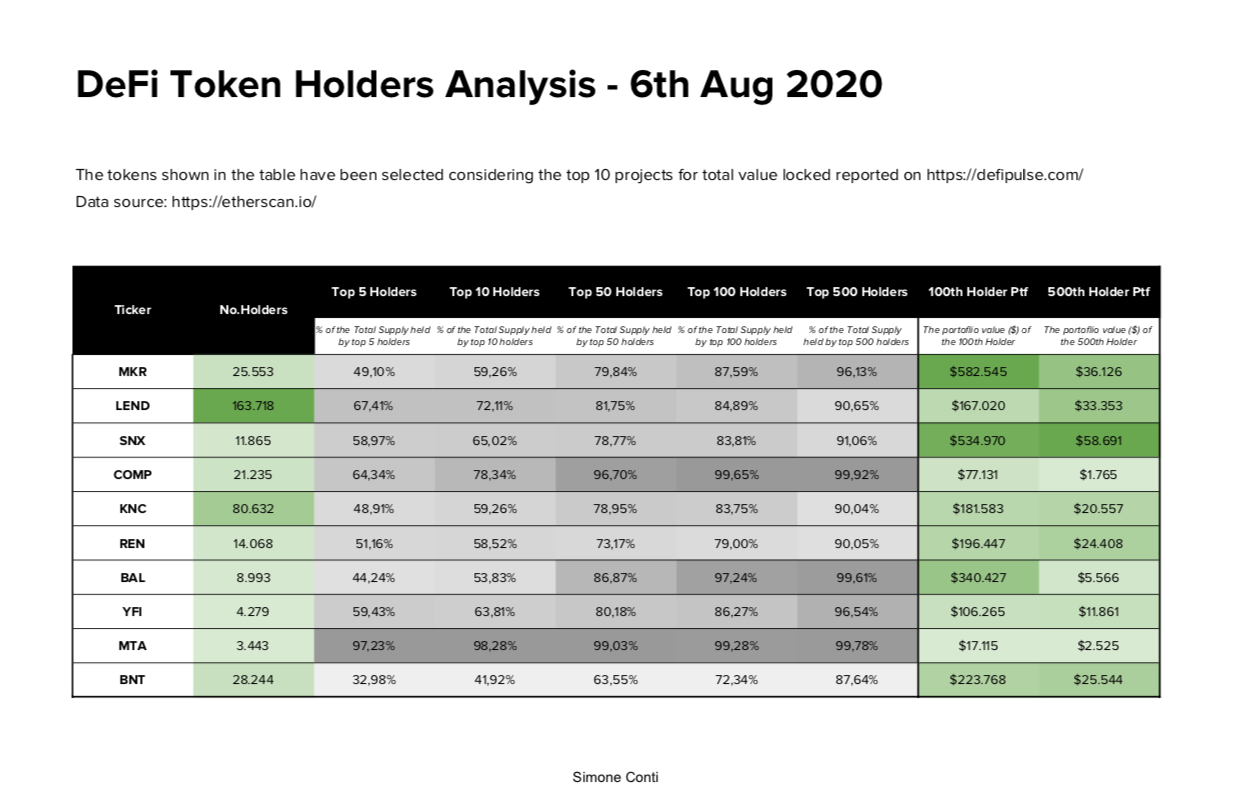

Das alles klingt zu schön, um wahr zu sein, oder? Nun, in vielerlei Hinsicht ist es das auch. Ähnlich wie ICOs im Jahr 2017, STOs im Jahr 2018 und IEOs im Jahr 2019 (erkennen Sie den Trend?), könnte sich "DeFi" im Jahr 2020 als nichts anderes als ein Schlagwort und eine Blase erweisen, die bald platzen wird. Eine kürzlich durchgeführte Studie hat ergeben, dass die meisten DeFi-Projekte stark auf einige wenige Personen konzentriert sind (siehe Bild unten), und Vitalik selbst hat die Sicherheit von DeFi Smart Contracts in Frage gestellt. Dies berührt nicht einmal ansatzweise die AML- und Compliance-Probleme, die auf vielen dieser Plattformen überwunden werden müssen, da die globalen Aufsichtsbehörden in der Regel dazu neigen, genehmigungsfreie Systeme, die Finanzdienstleistungen anbieten und zudem nicht lizenziert sind, nicht sehr wohlwollend zu betrachten. Der Bereich ist unbestreitbar jung, wie die Kryptowährung insgesamt, aber nicht ohne seinen Reiz und seine klaren Vorteile.

Was nicht außer Acht gelassen werden darf, ist, wie mächtig ein dezentraler Finanzmarkt sein kann, um benachteiligten Personen und Organisationen auf der ganzen Welt grundlegende Finanzdienstleistungen zu bieten. Die Ermöglichung von Finanzdienstleistungen und -produkten ohne Intermediäre ist der Kern des Geistes der Kryptowährung und sogar eine von Satoshis Inspirationen für Bitcoin selbst als eine Währung ohne Intermediäre. Bitcoin mag das erste DeFi-Protokoll gewesen sein, das es jedem erlaubte, seine eigene Bank zu sein, aber Unternehmer und Innovatoren in der DeFi-Branche gehen noch einen Schritt weiter und bauen Plattformen auf, die nicht nur die Bankgeschäfte der Nicht-Bankiers, sondern auch die Vermögensbildung dezentralisieren.

Die DeFi-Party fängt gerade erst an, und es gibt sogar irische Musik und Bier zum Mitklatschen! Iconic hat sogar seine Zehen nass gemacht, indem es die Liquidität zum ICNQ-Token auf Uniswap Wir blicken mit vorsichtigem, wenn auch großem Optimismus auf den DeFi-Bereich. Die Zukunft der Kapitalmärkte entsteht direkt vor unseren Augen, und es sieht immer mehr danach aus, dass sie dezentralisiert sein wird!

- Dr. Satoshi oder: Wie ich lernte, den (risikobereinigten) ROI zu verdoppeln und den Bitcoin zu lieben

- Der perfekte Sturm des Bitcoin

- Der Einfluss von Kryptowährungen auf die Sharpe Ratio traditioneller Anlagemodelle

_________

Haftungsausschluss

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.