Von Eleanor Haas, Blockchain/Krypto-Kolumnistin für Iconic Holding, Advisor Innovators und Astia Angels sowie Direktorin des Keiretsu Forum Mid-Atlantic.

"Umdrehen! Turn! Turn! (To Everything There is a Season)" Pete Seegers zeitloses Plädoyer für Frieden - basierend auf dem Alten Testament - drückt perfekt aus, was mit dem Blockchain-/Krypto-Raum zu geschehen scheint: ständige Veränderung. Jede neue Phase scheint ein gültiges Ziel zu sein. Dann dreht sich der Kreislauf wieder. Oh ja, und mit jeder Umdrehung erweitert sich der Raum um neue Arten von Möglichkeiten. Sind wir schon am Ziel? Wohl kaum! Aber es gibt zahlreiche Finanzierungsmöglichkeiten für den Start und das Wachstum neuer Blockchain-/Kryptounternehmen. Es liegt definitiv ein Gefühl von Krypto-Frühling in der Luft.

Crowdfunding

Der ICO, die erste öffentliche Finanzierung für Blockchain-/Krypto-Projekte, wurde durch eine Form des Crowdfunding ermöglicht, die ihrerseits durch den JOBS Act nur ein Jahr vor dem ersten ICO für die geschäftliche Nutzung gesetzlich festgelegt wurde. Beide stellen das traditionelle Fundraising auf den Kopf. Anstatt einige wenige schwer erreichbare Quellen um große Geldbeträge zur Finanzierung eines Unternehmens zu bitten, nutzen beide das Internet, um Tausende von Menschen zu erreichen und um kleinere Beträge zu bitten.

Crowdfunding half einigen frühen ICO-Kandidaten, die für den ICO selbst benötigten Mittel aufzubringen. Leider hat Crowdfunding, wie auch die ICO, durch mangelnde Transparenz und Rechenschaftspflicht sowie häufige Misserfolge an Vertrauen eingebüßt, auch wenn es einige Erfolge gab und es führende Vertreter der Branche gibt, die sich für eine Reform einsetzen. Einer von ihnen ist Ryan Feit, Gründer und CEO von SeedInvest, einer der ersten Crowdfunding-Plattformen. SeedInvest prüft die Bewerber mit einem umfassenden Due-Diligence-Verfahren, das die Einhaltung der SEC verlangt, und hat nur etwa 1% der sich bewerbenden Start-ups akzeptiert.

Jetzt hat Pledgecamp, das gerade einen STO abgeschlossen hat und im dritten Quartal an den Start gehen soll, die Blockchain-Technologie genutzt, um eine neue Crowdfunding-Plattform zu entwickeln, die das Vertrauen in diese Praxis wiederherstellen soll. Intelligente Verträge sind der Schlüssel dazu, da sie Transparenz ermöglichen, zusammen mit der Backer-Versicherung, die von den Projektgründern verlangt, dass sie Meilensteine vorschlagen, bevor Beiträge geleistet werden, und dann die Mittel nur dann freigibt, wenn die Unterstützer für die Erfüllung jedes Meilensteins stimmen.

Startups haben also eine Handvoll verlässlicher Crowdfunding-Websites und das Versprechen eines rekonstituierten Crowdfundings, um zu ihrem ICO zu gelangen.

Erste Token-Angebote (ITO)

"Ich veröffentlichte ein White Paper und eine Adresse, und Fremde schickten mir Geld. Auf diese Weise schuf ein in Seattle ansässiger Software-Ingenieur namens J.R. Willett im Jahr 2013 das erste ITO, eine Crowdfunding-Veranstaltung zur Generierung eines neuen Tokens, genannt Initial Coin Offering (ICO). Ethereum, die Blockchain-Plattform, die das ICO-Gateway werden sollte, wurde im folgenden Jahr geboren.

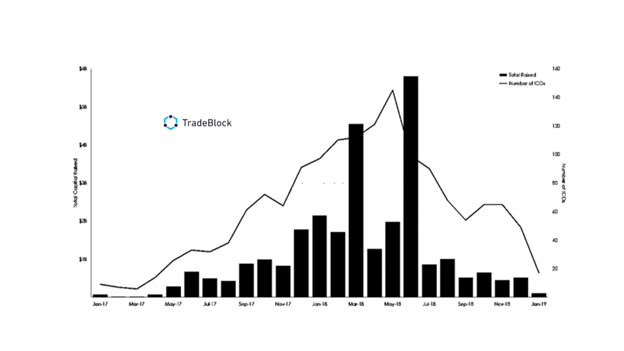

Dann kam der Überschwang, gefolgt von der Realität und, Ende 2018, der Krypto-Winter - zusammen mit ernsthafter regulatorischer Aufmerksamkeit. Aus gutem Grund: A Satis-Gruppe- beauftragt Studie festgestellt, dass 81% der ICOs Betrug waren. So geriet der ICO in Verruf, wobei die Statistiken für Q1 2019 sogar unter denen von Q4 2018 lagen, was die Anzahl der ICOs und die eingenommenen Dollars angeht; dennoch wurden laut ICOBench $902 Millionen eingenommen, und der durchschnittliche ICO nahm in Q1 2019 $2 Millionen mehr ein als in Q4 2018. Der ursprüngliche ITO ist also untergegangen, aber nicht ausgestiegen. Mehrere Websites veröffentlichen Kalender der kommenden und laufenden ICOs, darunter Coindesk.com.

Gleichzeitig wandelte sich das ICO in eine neue Form des ITO, das STO. Im April 2017, als sich die ICO in Richtung Überschwang bewegte, entstand das STO oder Security Token Offering - ein Krypto-Token, das im Sinne der SEC als handelbarer Vermögenswert - wie eine Aktie, eine Anleihe, eine Option usw. - gilt, d. h. den Howey-Test erfüllt und gesetzlich zur Einhaltung der SEC-Vorschriften verpflichtet ist. Die Einhaltung der Vorschriften bietet den Anlegern Schutz, schränkt aber auch den Umfang der Verkäufe über zugelassene Anleger hinaus ein.

Die regulatorische Unsicherheit hat die Verwendung von STOs erschwert. Am 3. April veröffentlichte die SEC neue regulatorische Leitlinien für Token-Emittenten Der Rahmen bietet weitere Klarheit, stellt aber klar, dass es sich um eine Richtlinie und nicht um eine Regel oder Vorschrift handelt. Anwälte für Sicherheitsfragen und die SEC arbeiten weiter an offenen Fragen. Forbes veröffentlichte kürzlich einen hilfreichen Artikel über "Wie man ein erfolgreiches Security Token Offering in Übereinstimmung mit den neuen SEC-Richtlinien durchführt".

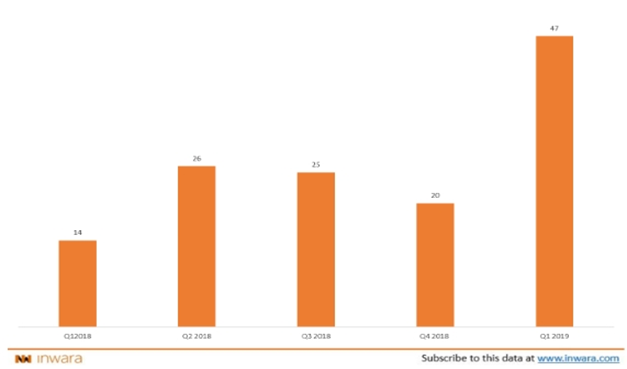

Die Zahl der STOs wuchs 2018 stark an und stieg im ersten Quartal 2019 im Vergleich zum vierten Quartal 2018 auf 130% an, so ein Bericht von InWara.

Die Begeisterung des Marktes für den Sicherheits-Token rührt zum Teil von den unbegrenzten Einsatzmöglichkeiten her, die er bietet, obwohl dies noch Neuland ist. Er kombiniert programmierbares Eigenkapital mit Krypto-Fundraising, globalem Zugang zu den Märkten rund um die Uhr, niedrigeren Gebühren (kein Zwischenhändler) und Zugang zu 2 Milliarden potenziellen Kunden ohne Bankverbindung.

Darüber hinaus werden Sicherheits-Token, die ihrerseits eine Erweiterung des Blockchain-/Kryptobereichs darstellen, die durch Kryptowährungen, gefolgt von Utility-Token und Smart Contracts, eingeleitet wurde, die Entwicklung einer neuen Infrastruktur erfordern: Marktplätze/Börsen, STOs, Depotbanken, Wallets usw. Es ist, als würde man eine Zwiebel von innen nach außen bauen!

Tokenisierung

Die Schaffung eines neuen Tokens bedeutet einen Anteil am Eigentum eines neuen handelbaren Vermögenswerts. Das ist die eine Seite der Medaille - kein Wortspiel beabsichtigt. Die andere Seite ist die Tokenisierung eines bestehenden Vermögenswerts, z. B. Immobilien, Gold, eine Kunstsammlung, geistiges Eigentum usw.

Die Tokenisierung ermöglicht u.a. Liquidität. Dadurch wird Kapital frei, sofern es eine Nachfrage nach dem Token, eine vertrauenswürdige Börse für den Handel damit und einen akzeptablen Wechselkurs gibt. Das macht die Tokenisierung zu einer Cashflow-Wette! Wie hoch ist die Wahrscheinlichkeit einer Nachfrage? Wie hoch ist die Verfügbarkeit eines akzeptablen Wechselkurses? Zu welchem Preis wird der Token heute verkauft? Wenn die Sterne günstig stehen, können Sie mit Token neues Kapital generieren, so wie Sie es beim Verkauf von Aktien oder Anleihen tun würden.

Traditionelle Finanzierungsquellen

Ein besonders ermutigendes Zeichen für den Krypto-Frühling ist die wachsende Zahl traditioneller Geldgeber, die begonnen haben, in Blockchain/Krypto zu investieren.

Führende Acceleratoren haben mit der Aufnahme von Blockchain-/Krypto-Unternehmen begonnen - darunter der Entrepreneurs Roundtable Accelerator, 500 Startups und TechStars.

Kryptowährungen haben bereits 68% der globalen Millionäre angezogen, die bis 2022 investieren oder dies planen, so eine am 3. Mai veröffentlichte Umfrage von deVere-Gruppeein in Dubai ansässiges Finanzplanungs- und Beratungsunternehmen mit mehr als 80.000 Kunden in über 100 Ländern und einem beratenen Vermögen von über $1 Milliarde.

Mitglieder von Angel-Investor-Netzwerken wie dem Keiretsu Forum, dem größten der Welt, haben begonnen, Blockchain-/Krypto-Unternehmen als Präsentatoren zu akzeptieren. Die Tochtergesellschaft von Keiretsu Forum, Keiretsu Capital, hat sogar einen Blockchain-Dachfonds gegründet und einzelne Investoren dafür gewonnen.

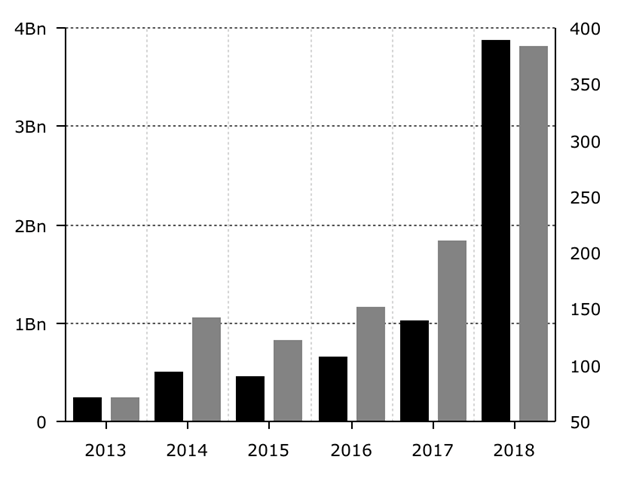

Risikokapitalfonds haben ihre Investitionen in Blockchain-/Kryptofirmen in den ersten drei Quartalen 2018 fast verdreifacht, so ein Bericht, der am 30. September 2018 von Diareinem Nachrichten- und Informationsdienst für digitale Währungen. Unter Berufung auf Daten von Pitchbook berichtete Diar, dass in diesem Zeitraum insgesamt $3,9 Milliarden an VC-Kapital in Blockchain-/Krypto-Unternehmen investiert wurden. Darüber hinaus stieg der durchschnittliche Wert jedes Deals um über $1 Million.

Andreessen Horowitz, eine der größten VC-Firmen und ein Vordenker der Branche, wurde von der Chance, die sie in Blockchain-/Krypto-Startups sehen, dazu getrieben, die VC-Struktur ganz zu verlassen, indem sie sich als RIA (Registered Investment Advisor) registrieren ließen. Als VCs waren sie durch ihre Kommanditistenverträge gezwungen, nicht mehr als 20% ihres Kapitals für nicht-traditionelle Investitions-"Experimente" zu verwenden. Darüber hinaus haben sie eine spezielle Krypto-Fonds im letzten Jahr, um Blockchain-/Krypto-Möglichkeiten aggressiver nutzen zu können.

Für spezifische Geldgeber sollten Sie sich die Liste ansehen, die kürzlich von The Bitcoin Pub, einer Gemeinschaft von Kryptowährungsenthusiasten, veröffentlicht wurde.170 VCs und Hedge-Fonds, die in Krypto- und Blockchain-Unternehmen investieren.

Schlussfolgerung

Um einen frühen Song von Alan J. Lerner ("Paint Your Wagon") zu paraphrasieren: Wohin gehen wir? Ich weiß es nicht. Where are we headin'? I ain't certain. Ich weiß nur, dass wir auf dem Weg sind!