Umkehrung der Überlastung des Bitcoin-Netzwerks, sinkender Stimmungsindex und die Kostenbasis von Kurzzeitbesitzern

DDA Krypto-Marktimpuls, 15. Mai 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

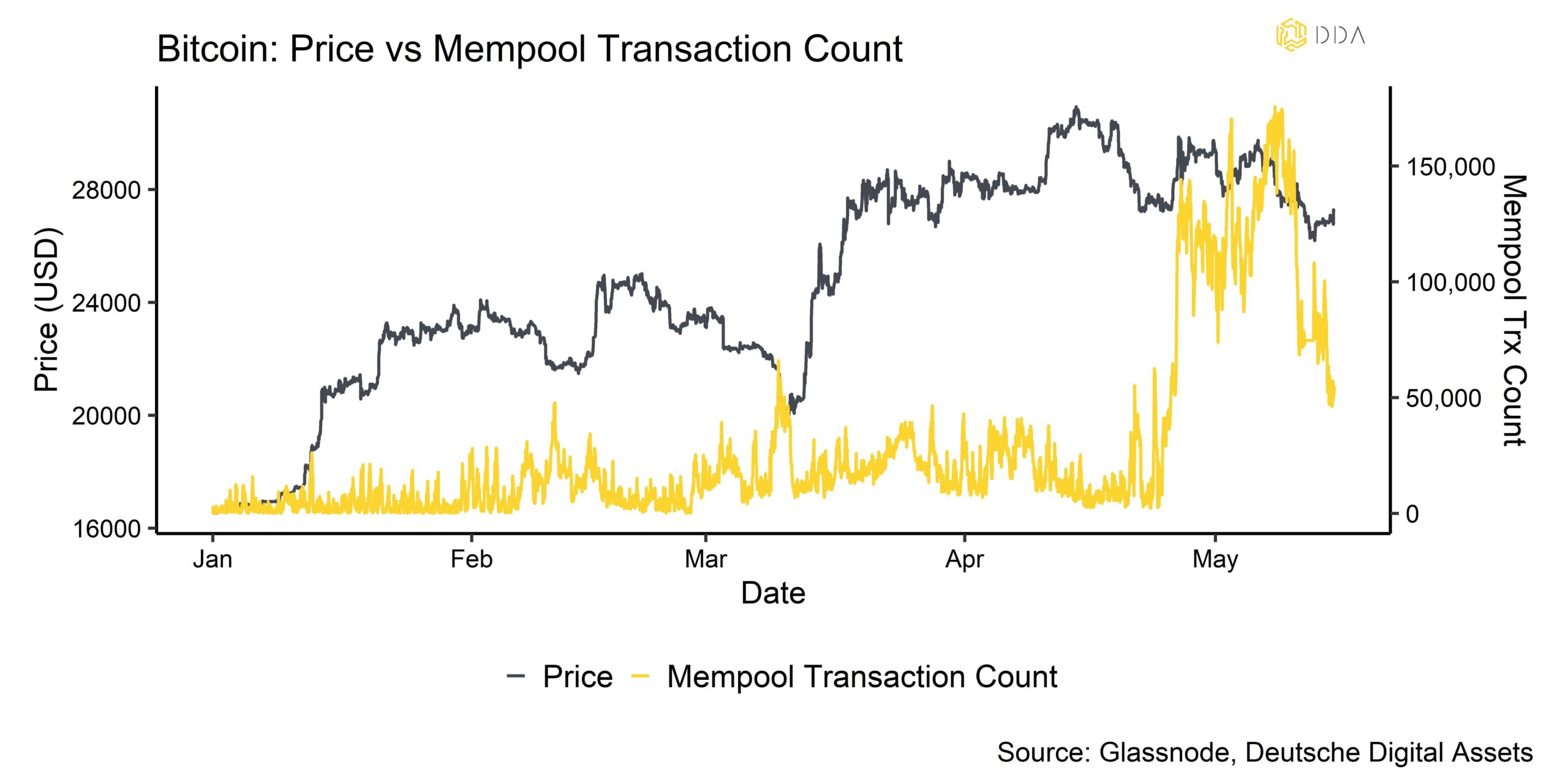

- Die Preise von Kryptowährungen standen in der vergangenen Woche aufgrund von Engpässen im Bitcoin-Netzwerk weiter unter Druck - dieser Trend scheint sich nun umgekehrt zu haben

- Unser hauseigener Crypto Sentiment Index ist in der letzten Woche gesunken und liegt nun leicht im negativen Bereich

- Ein "Flush-out" von "schwachen Händen" hat noch nicht stattgefunden, da die kurzfristige Kostenbasis der Inhaber bei etwa 25,2k USD für Bitcoin liegt.

Chart der Woche

Kryptoasset Leistung

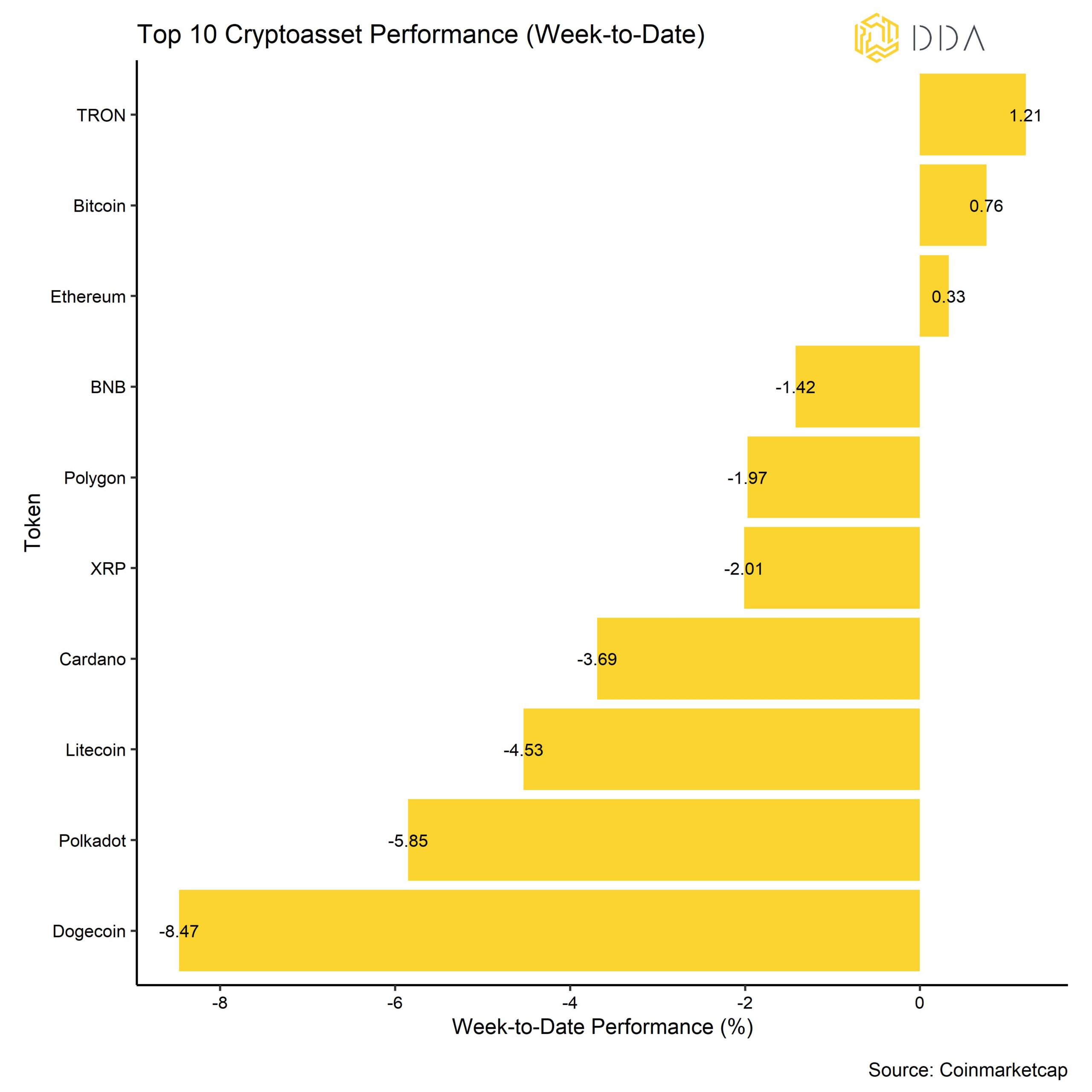

In der vergangenen Woche wurde die Performance von Kryptoassets vor allem durch die Überlastung der Bitcoin-Blockchain belastet, die auf eine hohe Anzahl von Zeichnungen für die Ausgabe von Token und eine große Anzahl von Transaktionen zurückzuführen ist. Infolgedessen waren Kryptoassets in der vergangenen Woche die größten Underperformer. Dieser Trend scheint sich in letzter Zeit wieder umgedreht zu haben.

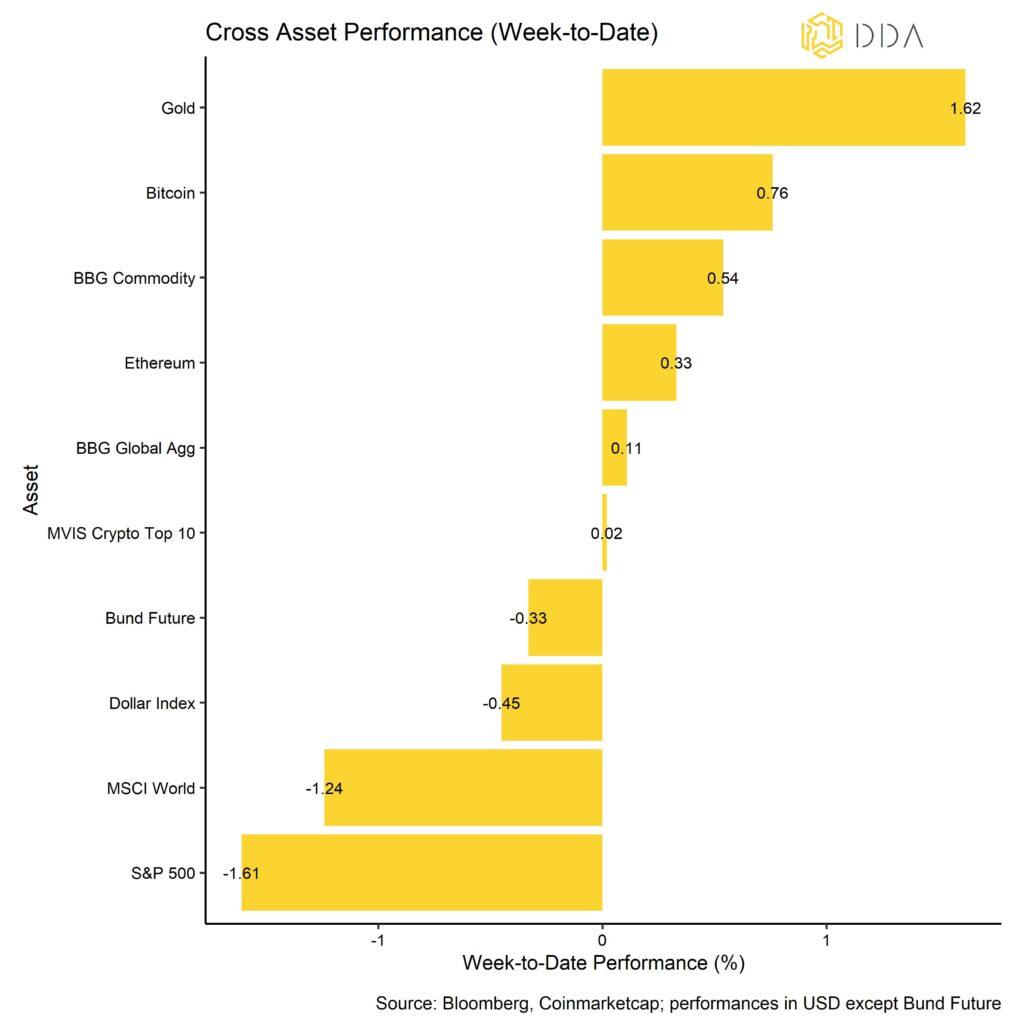

Im Vergleich dazu suchten die traditionellen Anleger die Sicherheit des US-Dollars und deutscher Bundesanleihen. Globale Aktien und Gold entwickelten sich in der vergangenen Woche negativ. In der Zwischenzeit lieferten wichtige Makrodaten wie der Verbraucherpreisindex und die Erstanträge auf Arbeitslosenunterstützung in den USA weitere Gründe für die Fed, eine Pause einzulegen, da die Inflation stärker als erwartet zurückgegangen ist und die Erstanträge auf Arbeitslosenunterstützung deutlich gestiegen sind.

Unter den wichtigsten Kryptoassets waren TRON, Cardano und BNB die relativen Outperformer. Im Allgemeinen hat sich die Outperformance der Altcoins gegenüber Bitcoin in der letzten Woche verbessert, liegt aber immer noch unter 50% der Altcoins, die Bitcoin outperformen.

Krypto-Marktstimmung

Aufgrund des risikoarmen Umfelds bei den Kryptoassets ist unser hauseigener Krypto-Sentiment-Index in der vergangenen Woche gesunken. Nur 4 von 15 Indikatoren liegen über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche gab es große Umschwünge bei der Spent-Output-Profit-Ratio (STH-SOPR) des BTC-Kurzfristhalters und dem Global Hedge Fund Beta zu Bitcoin.

Der Crypto Fear & Greed Index ist leicht gesunken und bleibt heute Morgen im neutralen Bereich.

Die Leistungsstreuung zwischen den Kryptoassets hat in letzter Zeit zugenommen, da die Korrelationen zwischen den Kryptoassets abgenommen haben, was bedeutet, dass die Kryptoassets zunehmend nach coinspezifischen Faktoren gehandelt werden. Gleichzeitig hat die Outperformance der Altcoins in der letzten Woche weiter zugenommen, liegt aber immer noch unter 50% der Altcoins, die Bitcoin auf 1-Wochen- und 1-Monats-Basis outperformen.

Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt, wobei Altcoins eine bessere Performance als Bitcoin aufweisen. Eine breitere Outperformance von Altcoins ist in der Regel ein Zeichen für eine erhöhte Risikobereitschaft, und eine geringe Outperformance von Altcoins ist ein Anzeichen für ein eher vorsichtiges Marktumfeld.

Krypto Asset Flows

In der vergangenen Woche kam es erneut zu Netto-Fondsabflüssen aus Kryptoanlagen.

Insgesamt verzeichneten wir Netto-Fondsabflüsse in Höhe von -33,7 Mio. USD (Woche bis Freitag), wobei der größte Teil der Abflüsse aus Bitcoin-Fonds floss (-35,4 Mio. USD). Ethereum-Fonds verzeichneten nur geringe Nettoabflüsse von -1,7 Mio. USD. Dagegen verzeichneten sowohl Altcoin-Fonds ohne Ethereum als auch Basket & Thematic Cryptoasset-Fonds wieder einige Nettozuflüsse (+0,7 Mio. USD bzw. +2,8 Mio. USD).

Außerdem ist der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - wieder etwas gestiegen, was auf geringfügige Nettoabflüsse aus diesem Fondsvehikel schließen lässt.

In der Zwischenzeit hat sich das Beta der globalen Hedge-Fonds zu Bitcoin in den letzten 20 Handelstagen stark umgekehrt, ist aber weiterhin positiv, was bedeutet, dass die globalen Hedge-Fonds immer noch eine Long-Position zu Krypto-Assets haben.

On-Chain Tätigkeit

On-Chain-Metriken deuten darauf hin, dass sich der Grad der Überlastung der Bitcoin-Blockchain bereits abschwächt.

Die Anzahl der Transaktionen im Bitcoin-Mempool, d.h. derjenigen, die darauf warten, von den Minern validiert zu werden, ist von über 170.000 auf dem Höhepunkt der Überlastung am 23.05.08 auf etwa 51.000 Transaktionen zum Zeitpunkt der Erstellung dieses Artikels gesunken. Ebenso sind die durchschnittlichen Transaktionsgebühren von 45 USD pro Transaktion am 23.05.08 auf derzeit etwa 3,5 USD pro Transaktion gesunken.

Der hohe Grad der Überlastung war offenbar auf einen erheblichen Anstieg der Zahl der Einschreibungen aufgrund der Ausgabe von BRC-20-Tokens auf der Bitcoin-Blockchain zurückzuführen.

Das BRC-20-Protokoll wurde entwickelt, um die separate Übertragung von fungiblen Token auf der Blockchain zu ermöglichen. Ursprünglich wurde es entwickelt, um die Erstellung von nicht vertretbaren Bitcoin-Token (NFTs) zu erleichtern, indem Daten wie Fotos, Videos, Codes und Text in die Zeugenkomponente von BTC-Transaktionen eingebettet werden.

Irgendwann in der letzten Woche erreichte die Marktkapitalisierung der auf der Bitcoin-Blockchain zirkulierenden BRC-20-Token eine Marktkapitalisierung von 1 Mrd. USD. Zu diesen Token gehören ORDI, PEPE oder MEME.

Zum Zeitpunkt der Erstellung dieses Artikels liegen die Neueinschreibungen in der Bitcoin-Blockchain immer noch bei über 300.000 pro Tag, was immer noch vergleichsweise hoch ist. Tatsächlich befindet sich auch unser interner Index der Bitcoin-Netzwerkaktivität in der Nähe seines Allzeithochs. Dies verschleiert jedoch einige größere Abweichungen bei den On-Chain-Daten. Während beispielsweise die Anzahl der Transaktionen in der letzten Woche ein neues Allzeithoch erreicht hat, ist die Anzahl der aktiven Adressen auf den niedrigsten Stand seit Juni 2021 gesunken. Regelmäßige Nutzer wurden offensichtlich durch die außergewöhnlich hohen Gebühren abgeschreckt und warteten darauf, dass die Überlastung verschwindet, was zu dem Rückgang der aktiven Adressen geführt haben muss.

Wie bereits erwähnt, haben sich diese Trends größtenteils wieder umgekehrt, da die Gebühren deutlich zurückgegangen sind.

Aus Sicht der Händler ist es noch nicht wirklich zu einem "Flush-out" der "schwachen Hände" gekommen, und die Marktstimmung hat sich nur leicht nach unten gedreht - die Kostenbasis für kurzfristige Anleger liegt bei etwa 25,2k USD, und kurzfristige Anleger haben erst vor kurzem damit begonnen, insgesamt Verluste hinzunehmen und ihre Positionen aufzugeben. Ein Durchbruch unter 25,2k USD könnte den Markt aus Sicht der Stimmung und der Positionierung wieder zurücksetzen und die Grundlage für neue Höchststände auf dem Weg dorthin bilden.

Gleichzeitig wurden die Ethereum On-Chain-Metriken nur geringfügig von diesen jüngsten Entwicklungen auf der Bitcoin-Blockchain beeinflusst. Die Anzahl der aktiven Adressen und Transaktionen ging nur leicht zurück. Der mittlere Transaktionsgaspreis hat sich ebenfalls erholt, ist aber immer noch weit von den Höchstständen entfernt, die während des letzten Zyklustops im November 2021 erreicht wurden.

Positiv zu vermerken ist, dass die Ethereum-Börsensalden in der vergangenen Woche weiter gesunken sind und sich nun auf dem niedrigsten Stand seit Juli 2016 befinden.

Krypto-Asset-Derivate

In der letzten Woche sind die impliziten Volatilitäten trotz der negativen Preisentwicklung weiter gesunken. Die implizite 1-Monats-Volatilität von Bitcoin ist wieder unter 50 gesunken. Der 1-Monats-25-Delta-Options-Skew wurde weiterhin zugunsten von Put-Optionen gehandelt, was auf eine negative Tendenz unter Bitcoin-Optionshändlern schließen lässt.

Die Perpetual Funding Rate hat sich nur leicht ins Negative gedreht, insbesondere am 23.05.08, was darauf hindeutet, dass die Trader von Perpetuals kurze Kontrakte gegenüber langen bevorzugen.

Während des jüngsten Preisrückgangs hat das offene Interesse an BTC sowohl bei Futures als auch bei unbefristeten Kontrakten weiter zugenommen, was darauf hindeutet, dass Händler ihre Short-Positionen in der Schwächephase prozyklisch erhöht haben. Dies könnte zu einem potenziellen Short-Squeeze führen, wenn der Markt wieder ins Plus dreht.

Unterm Strich

Die Preise von Kryptowährungen standen in der vergangenen Woche aufgrund von Engpässen im Bitcoin-Netzwerk weiterhin unter Druck - dieser Trend scheint sich jedoch umgekehrt zu haben.

Unser hauseigener Krypto-Sentiment-Index ist in der vergangenen Woche gesunken und liegt nun leicht im Minus.

Ein Flush-out der "schwachen Hände" hat noch nicht stattgefunden, da die kurzfristige Kostenbasis der Inhaber bei etwa 25,2k USD für Bitcoin liegt.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.